What Tax Credits Can I Claim Ireland What are tax credits Tax credits reduce the amount of tax you pay What are tax reliefs Tax reliefs reduce the amount of income that you pay tax on The tax credits and reliefs you are entitled to depend on your personal circumstances

Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that apply to your circumstances Housing tax credits and reliefs You can claim tax relief on some housing expenses and income Find out more There are a number of tax credits and reliefs available to those in employment Working from home and tax relief You may be able to claim tax relief on the additional costs of working from home including electricity heat and broadband Separation divorce and income tax credits and reliefs

What Tax Credits Can I Claim Ireland

What Tax Credits Can I Claim Ireland

http://www.robertsnathan.com/wp-content/uploads/2015/10/RD-edit.jpg

Why Are Northern Ireland Businesses Lagging Behind When It Comes To

https://www.irishnews.com/picturesarchive/irishnews/irishnews/2018/02/15/094615144-8c2ee64d-4554-4fcc-acdf-bc15fca70026.jpg

Tax Credits

http://thismatter.com/money/tax/images/form-1040-page-2.gif

All PAYE taxpayers are entitled to a tax credit known as the Employee Tax Credit formerly known as the PAYE tax credit This is worth 1 875 in 2024 1 775 in 2023 If you are married and taxed under joint assessment then you and your spouse may both claim an Employee Tax Credit The amount of relief you receive depends on the rate of tax you pay The tax reliefs you can claim depend on your personal situation You can find many of the reliefs in the Personal tax credits reliefs and exemption section For example Rent a Room Relief is in Land and property Transborder Worker s Relief is in Income and employment

In Ireland tax credits reduce the amount of Irish income tax that a taxpayer pays in a given year A few tax credits are granted automatically while others can be claimed either by simple notification to Revenue or by completing a form The maximum amount you can claim is 7 000 per person per course which gives a tax credit of 1 400 However no tax credit is allowed for the first 3 000 of fees for full time courses and the first 1 500 for part time courses This is know as the disregard amount

Download What Tax Credits Can I Claim Ireland

More picture related to What Tax Credits Can I Claim Ireland

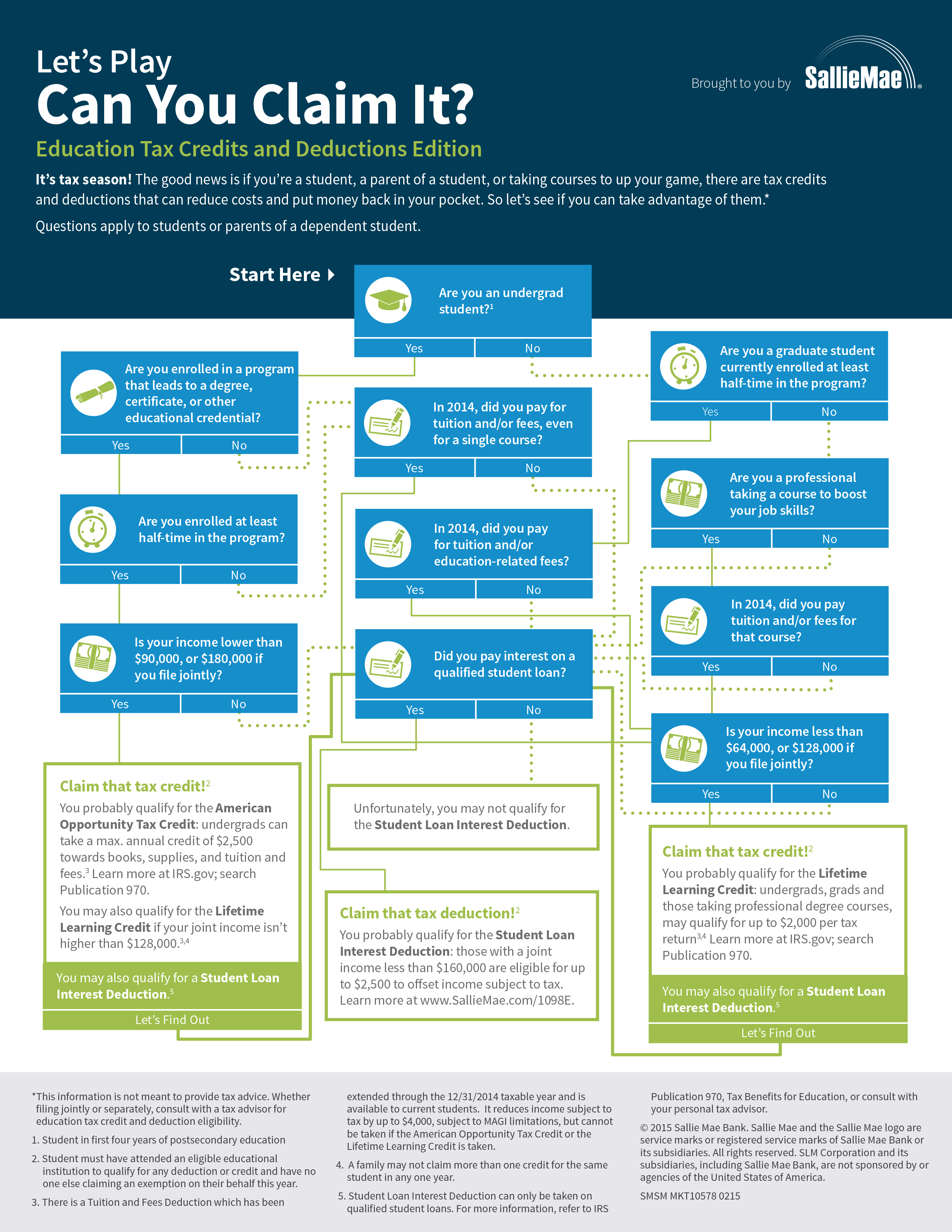

Education Tax Credits And Deductions Can You Claim It

http://www.madammoney.com/wp-content/uploads/2015/03/TaxTipsVisualCorpComm_FNL.jpg

What Tax Credits Can I Qualify For This Year A Guide NerdWallet

https://i.pinimg.com/originals/24/10/6b/24106bf9c3f9610bf73860debc576e9a.png

What Tax Credits Can I Claim In Canada Accounting Professionals In

https://naickercpa.ca/wp-content/uploads/2019/09/shutterstock_520623100-1.jpg

Tax credits reduce the amount of tax you pay There is more information about how tax credits work in Calculating your Income Tax Revenue will give you a Personal Tax Credit if you are resident in Ireland You may be able to claim additional tax credits depending on your personal circumstances Simply fill out our 60 second application form today New Customers Apply here Existing Customers Apply For Additional Rebate The government offers a range of tax credits that will reduce the amount of tax you have to pay Here are some of the tax credits you can currently claim

Widowed Parent Tax Credit All tax credits are in the Tax rates bands and reliefs chart The amounts of each tax credit for this year and the previous four years are also in these charts You can use myAccount to claim additional tax credits for 2024 by selecting the icon Manage your tax 2024 Irish Tax Rebates help thousands of people in Ireland every year to claim tax back 3 out of every 4 people are eligible for tax back and the average tax rebate is 1 100 Apply Online today to begin the tax back process

The Complete List Of Tax Credits For Individuals

https://1.bp.blogspot.com/-B5mx7WwZLfU/XkNu_a2Yc3I/AAAAAAAAAVI/92Bi9aK3Zck3yvveRPIUlVsZCGZHNQNlgCEwYBhgL/s1600/TaX%2BCredits%2B%25281%2529.png

These Tax Credits Can Mean A Refund For Individual Taxpayers

https://cljgives.org/wp-content/uploads/2018/01/20180131-MM00000131-itaxes-e1517453186990-1024x635.png

https://www.citizensinformation.ie/en/money-and...

What are tax credits Tax credits reduce the amount of tax you pay What are tax reliefs Tax reliefs reduce the amount of income that you pay tax on The tax credits and reliefs you are entitled to depend on your personal circumstances

https://www.citizensinformation.ie/en/money-and...

Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that apply to your circumstances Housing tax credits and reliefs You can claim tax relief on some housing expenses and income Find out more

Tax Credits What Are The Tax Credits I Can Qualify For

The Complete List Of Tax Credits For Individuals

What Tax Credits Can I Expect In 2023

What Tax Credits Can I Qualify For This Year Bankrate

Mark Zuckerberg Has Addressed Metaverse Memes Unifyhubgh

Investment Glossary Income Tax Credit Armstrong Advisory Group

Investment Glossary Income Tax Credit Armstrong Advisory Group

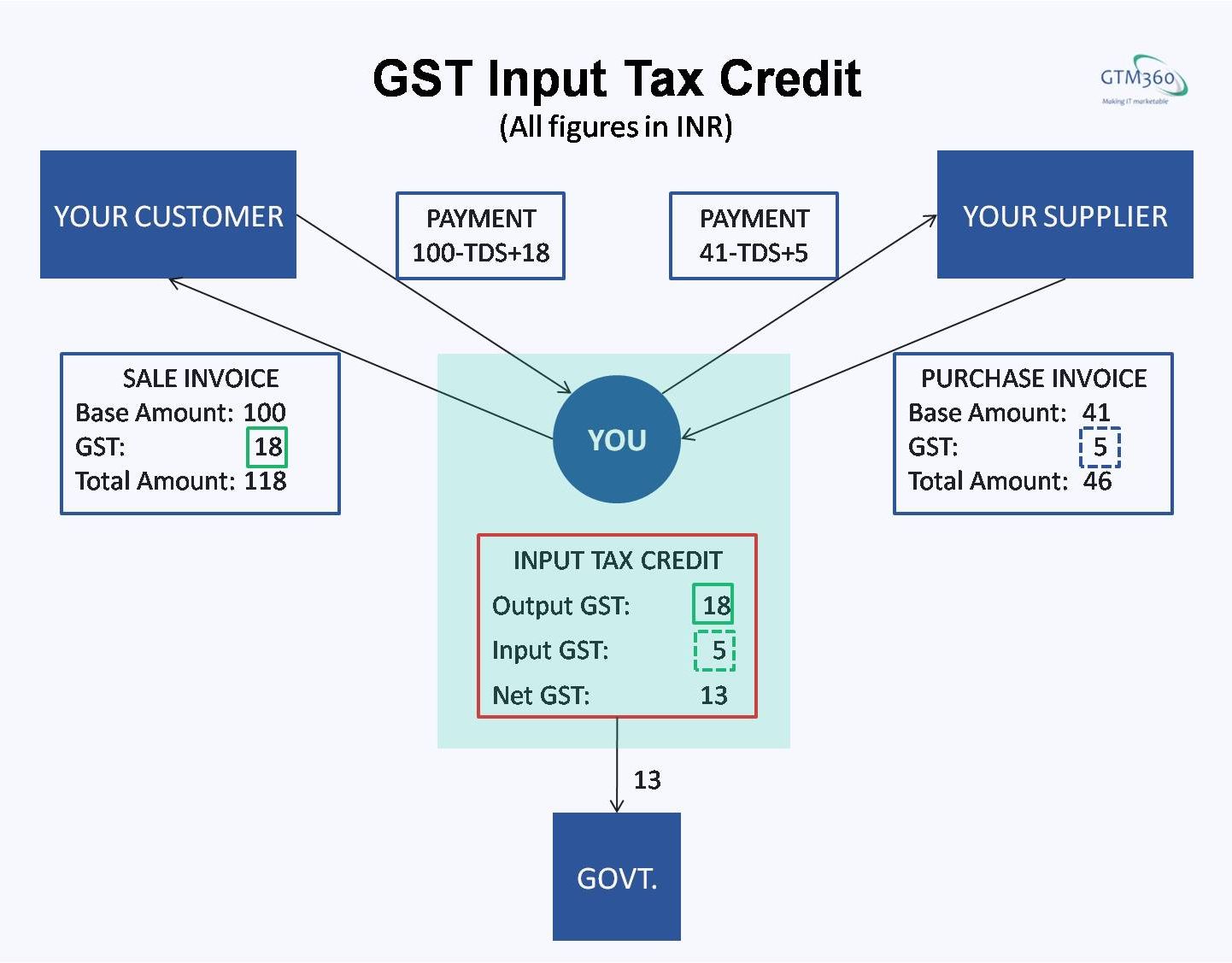

GST For Normies Part 2 Talk Of Many Things

What Tax Credits Can Do For Low income Families CSMonitor

What Tax Credits Can I Qualify For Lavish Green

What Tax Credits Can I Claim Ireland - The amount of relief you receive depends on the rate of tax you pay The tax reliefs you can claim depend on your personal situation You can find many of the reliefs in the Personal tax credits reliefs and exemption section For example Rent a Room Relief is in Land and property Transborder Worker s Relief is in Income and employment