What Was The Recovery Rebate Credit Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

What Was the Recovery Rebate Credit The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

What Was The Recovery Rebate Credit

What Was The Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/01-Three-Checkpoints-When-The-IRS-Will-Determine-And-Issue-2021-Recovery-Rebates.png

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

Recovery Rebate Credit Line 30 Form 1040 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

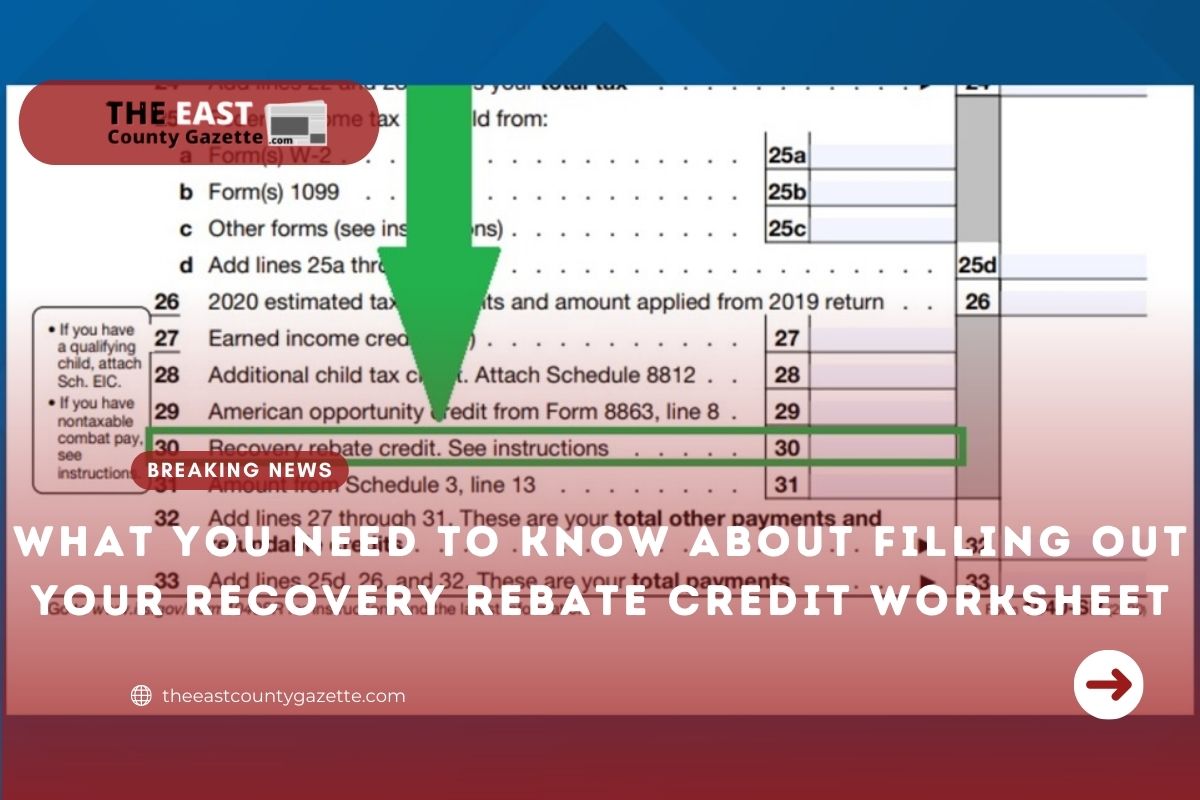

The recovery rebate credit is considered a refundable credit meaning it can reduce the amount of taxes you owe or generate a refund to you The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if Your EIP 2 was less than 600 1 200 if married filing jointly plus 600 for each qualifying child you had in 2020

If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to make up the difference

Download What Was The Recovery Rebate Credit

More picture related to What Was The Recovery Rebate Credit

The Recovery Rebate Credit YouTube

https://i.ytimg.com/vi/wSilRYLy8L0/maxresdefault.jpg

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Two EIPs EIP1 and EIP2 were issued to eligible taxpayers during 2020 and early 2021 These EIPs were advanced payments of the Recovery Rebate Credit RRC a refundable credit claimed on the 2020 Individual Tax Return How do I get these EIPs if I didn t receive them or got an incorrect amount Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent What is the Recovery Rebate Credit The Recovery Rebate Credit makes it possible for any eligible individual who did not receive an Economic Impact Payment also known as an EIP or stimulus payment to claim the missing amount on the following tax return

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/le-cdn.hibuwebsites.com/6795e9d01eed4352a64d15f170ad49ae/dms3rep/multi/opt/Recovery+Rebate2020-1920w.jpeg

What Is Recovery Rebate Tax Credit For 2020 All About AOTAX COM

https://www.aotax.com/wp-content/uploads/2021/02/What-is-Recovery-Rebate-Tax-Credit-for-2020-all-about-1-1080x675.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate...

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

https://www.investopedia.com/recovery-rebate-credit-5090493

What Was the Recovery Rebate Credit The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible

What You Need To Know About Filling Out Your Recovery Rebate Credit

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit Calculator EireneIgnacy

Eligibility For Recovery Rebate Credit Ft Myers Naples Markham Norton

Recovery Rebate Credit 2023

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

What Is The Recovery Rebate Credit And Do You Qualify The

Recovery Rebate Credit Santa Barbara Tax Products Group

2020 Recovery Rebate Credits Bayshore CPA s P A

What Was The Recovery Rebate Credit - The Recovery Rebate Credit RRC is a refundable federal tax credit that is available to filers who were eligible for the third stimulus but did not receive the correct amount they were due Here s what you need to know about it