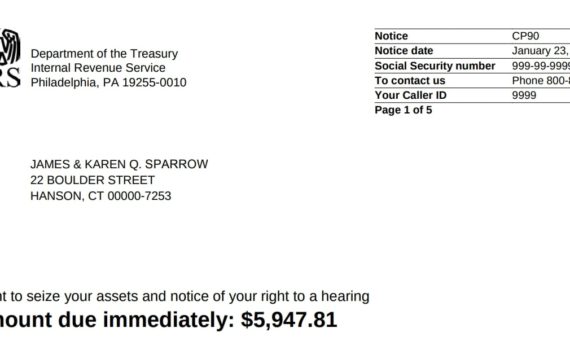

What Would The Irs Be Sending Me Certified Mail There are several other notices that the IRS will send by certified mail such as the CP91 for example if the IRS intends to garnish your Social Security benefits but these are the five most common You can find your notice or letter number in the upper right hand corner of the piece of ail the IRS sent you

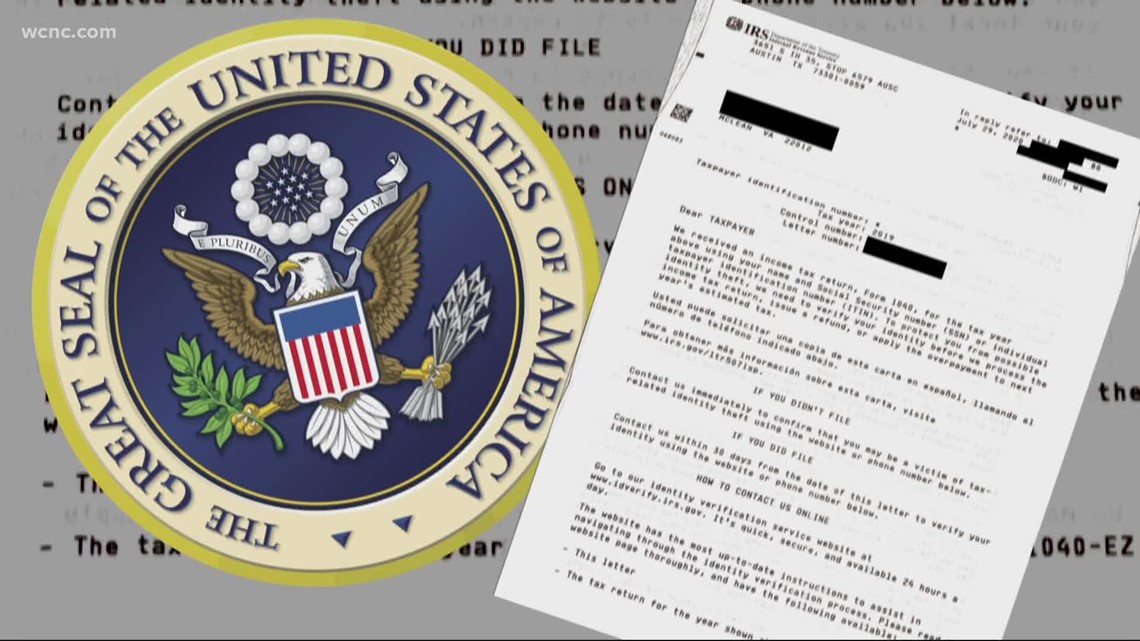

The IRS mails letters or notices to taxpayers for a variety of reasons including if They have a balance due They are due a larger or smaller refund The agency has a question about their tax return They need to verify identity The agency needs additional information The agency changed their tax return The IRS sends notices and letters for the following reasons You have a balance due You are due a larger or smaller refund We have a question about your tax return We need to verify your identity We need additional information We changed your return We need to notify you of delays in processing your return Next steps Read

What Would The Irs Be Sending Me Certified Mail

What Would The Irs Be Sending Me Certified Mail

https://postalocity.com/wp-content/uploads/2021/06/dreamstime_m_207225491-scaled.jpg

IRS Certified Mail Understanding Your Letter And Responding

https://trp.tax/wp-content/uploads/2021/09/irscertifiedmail.jpg

IRS Letter 5071C Sample 1 Irs Taxes Irs Lettering

https://i.pinimg.com/originals/9f/6b/b6/9f6bb6b05fd4f40c3c1f1f260d1f5377.png

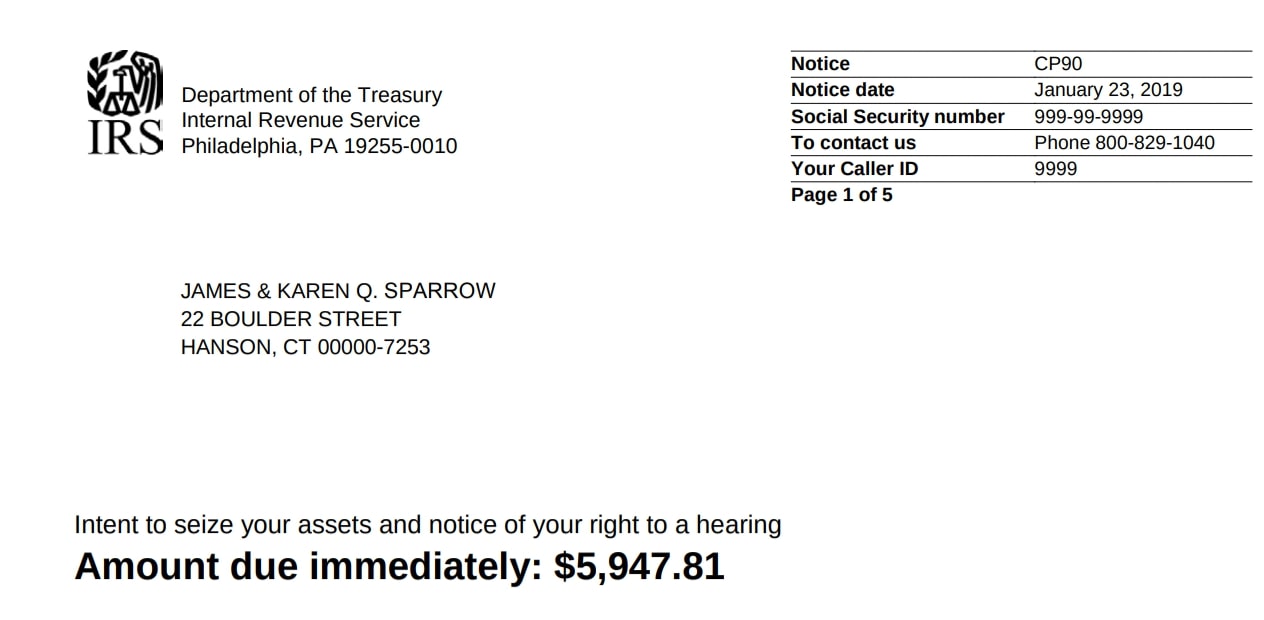

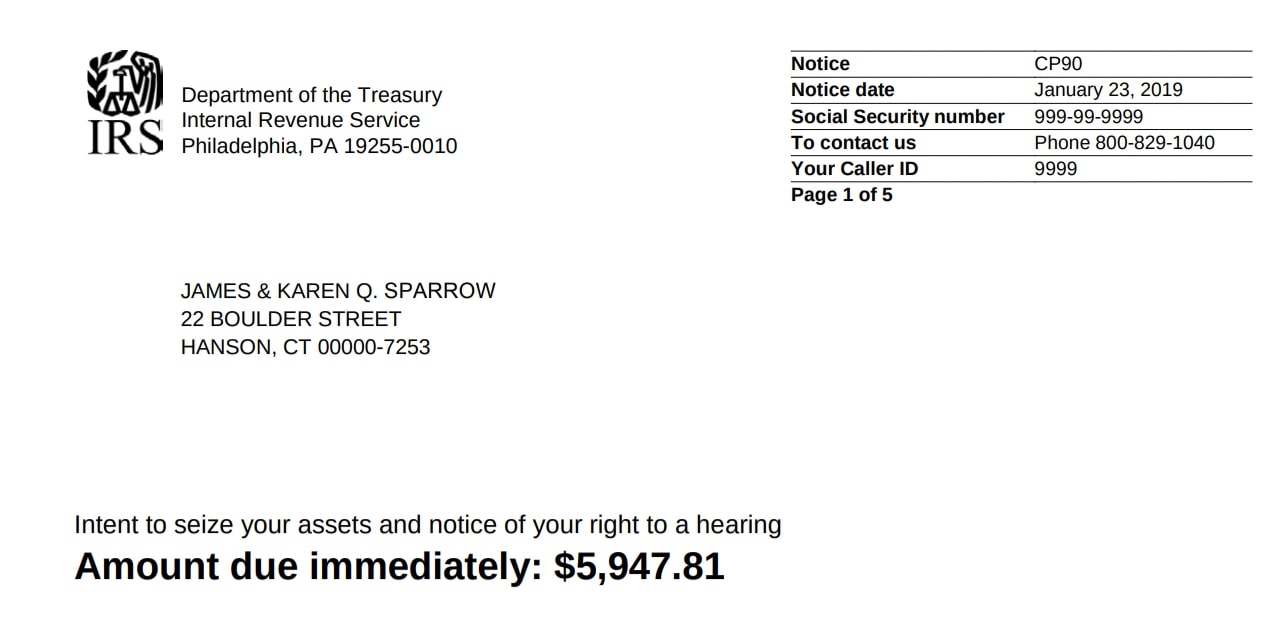

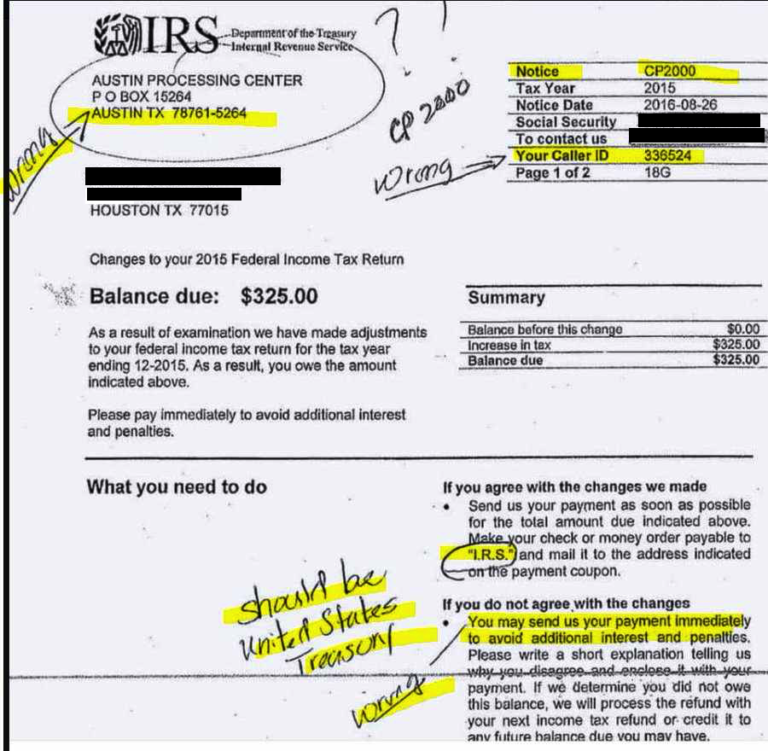

Here are a few of the reasons why you might receive a certified letter from the IRS There s a balance due on your IRS tax account Your IRS tax refund needs to change smaller or larger The IRS needs to verify your identity The IRS has a question about your tax return The IRS needs additional information from you Official Communication When the IRS sends a certified letter it means that the information in the letter is significant and requires your attention It could be related to matters like tax audits overdue tax payments or other issues that require your response or action

IRS Certified Mail Letters Reasons and Responses Under certain conditions the IRS will send letters through the post office via certified mail A specific set of circumstances will require the IRS to notify you of an action or event through certified mail Then based on the date of the letter you will have a certain amount of time to The IRS will send a copy of the Notice of Federal Tax Lien to the taxpayer visa certified mail so they can confirm for their own records it was received by the Taxpayer Notice Audit and Examination

Download What Would The Irs Be Sending Me Certified Mail

More picture related to What Would The Irs Be Sending Me Certified Mail

Why Would The IRS Send A Certified Letter To Begin

https://taxsharkinc.com/wp-content/uploads/2022/03/mailman-deliverying-certified-IRS-letter-copy.webp

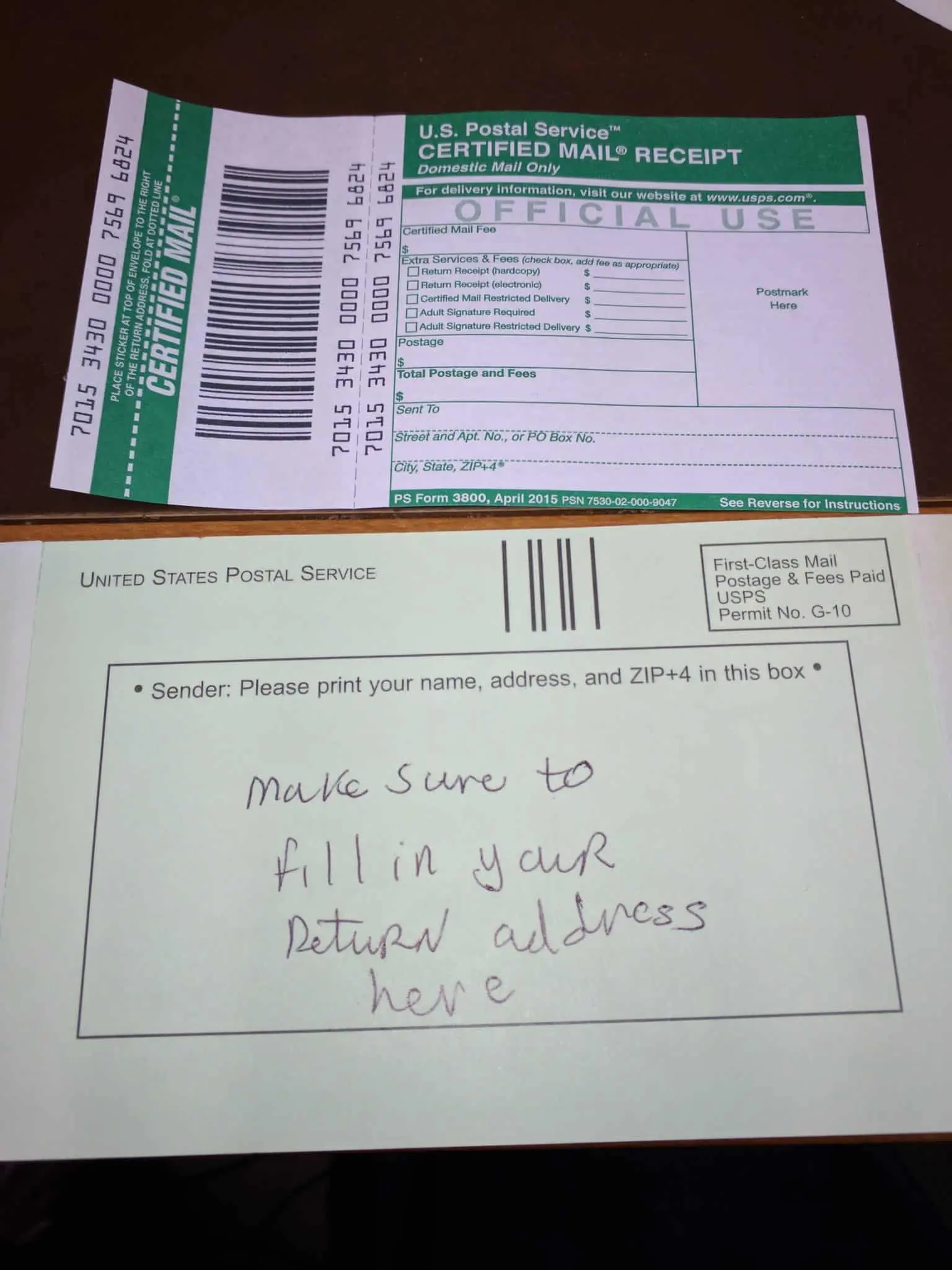

Certified Return Receipt Mail Old School Workers Comp Life Saver

https://cutcompcosts.com/wp-content/uploads/2017/12/Certified-Return-Receipt-Example.jpg

Everything You Need To Know About USPS Certified Mail Certified Mail

https://cml-ckeditor.s3.amazonaws.com/Electronic Delivery Confirmation.png

The central reason for the IRS sending certified letters is to serve as proof or start of the clock on a time sensitive issue These certified letters may be sent in conjunction with other notices that outline the issue in additional detail or request more information or payment from you Getting a letter from the IRS could seem scary at first glance but it may not impact you financially As we just stated above it could be as simple as a receipt for one of your stimulus payments So keep calm carefully read through the letter and understand why the IRS is contacting you

Some IRS notices are sent via certified mail such as the Notice of Intent to Levy while others are mailed via regular post like changes made to your tax return Read all IRS letters and notices you receive both certified The IRS then issued a notice of determination by certified mail The reason the IRS certified mails this determination letter is because the IRS is statutorily required to send it by registered or certified mail and after the date of mailing you have 90 days to protest this determination by filing a petition to Tax Court after which the IRS

Irs Certified Mail Archives Tax Resolution Professionals A

https://trp.tax/wp-content/uploads/2021/09/irscertifiedmail-570x350.jpg

/GettyImages-200370614-001-56de29d25f9b5854a9f63ad1.jpg)

Where To Mail Tax Documents To The IRS

https://fthmb.tqn.com/Z7NjihcQqWCTaQNrggBdOhky2Pk=/768x0/filters:no_upscale()/GettyImages-200370614-001-56de29d25f9b5854a9f63ad1.jpg

https://choicetaxrelief.com/irs/certified-mail

There are several other notices that the IRS will send by certified mail such as the CP91 for example if the IRS intends to garnish your Social Security benefits but these are the five most common You can find your notice or letter number in the upper right hand corner of the piece of ail the IRS sent you

https://www.irs.gov/newsroom/dos-and-donts-for...

The IRS mails letters or notices to taxpayers for a variety of reasons including if They have a balance due They are due a larger or smaller refund The agency has a question about their tax return They need to verify identity The agency needs additional information The agency changed their tax return

How To Email A Resume Insurance And Education

Irs Certified Mail Archives Tax Resolution Professionals A

IRS Notices B S U J H T A X COM

The IRS Sent Me Certified Mail To Seize My Property Now What Boxelder

Warning From The IRS Be Aware Of These New Phishing Emails

Beware IRS Certified Letter Or NYS Tax Notice 7 FAQs

Beware IRS Certified Letter Or NYS Tax Notice 7 FAQs

If You Got A Letter From The IRS In The Mail Here s What To Do Wcnc

Why Did The IRS Send Me A Certified Letter YouTube

Beware Fake IRS Letter Scam The Big Picture

What Would The Irs Be Sending Me Certified Mail - Generally speaking the IRS sending you an IRS certified mail document is to show the IRS has attempted to give you notice of whatever tax debt issue the IRS wants to address with you