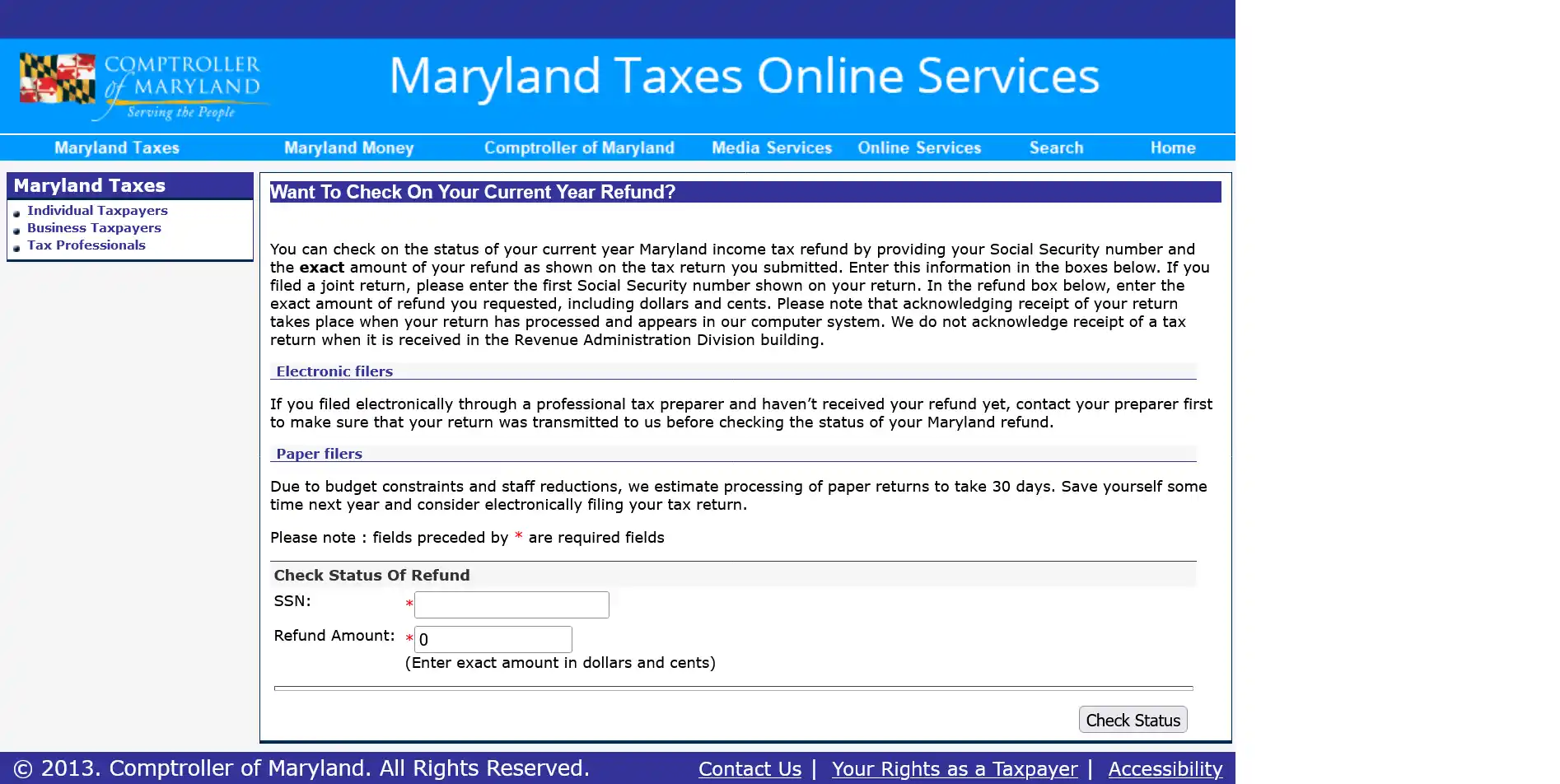

When Can I Expect My Maryland Tax Refund 2022 Want To Check On Your Current Year Refund You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of

Wait at least 10 days from acceptance of your return before calling Taxpayer Services Division at 1 800 638 2937 toll free or 410 260 7980 The state will ask you to enter the exact amount How can I check on my income tax refund You can check the status of your refund online or by calling 410 260 7701 from Central Maryland or 1 800 218 8160 from elsewhere Whether

When Can I Expect My Maryland Tax Refund 2022

When Can I Expect My Maryland Tax Refund 2022

https://savingtoinvest.com/wp-content/uploads/2022/02/PAth-act.jpg?is-pending-load=1

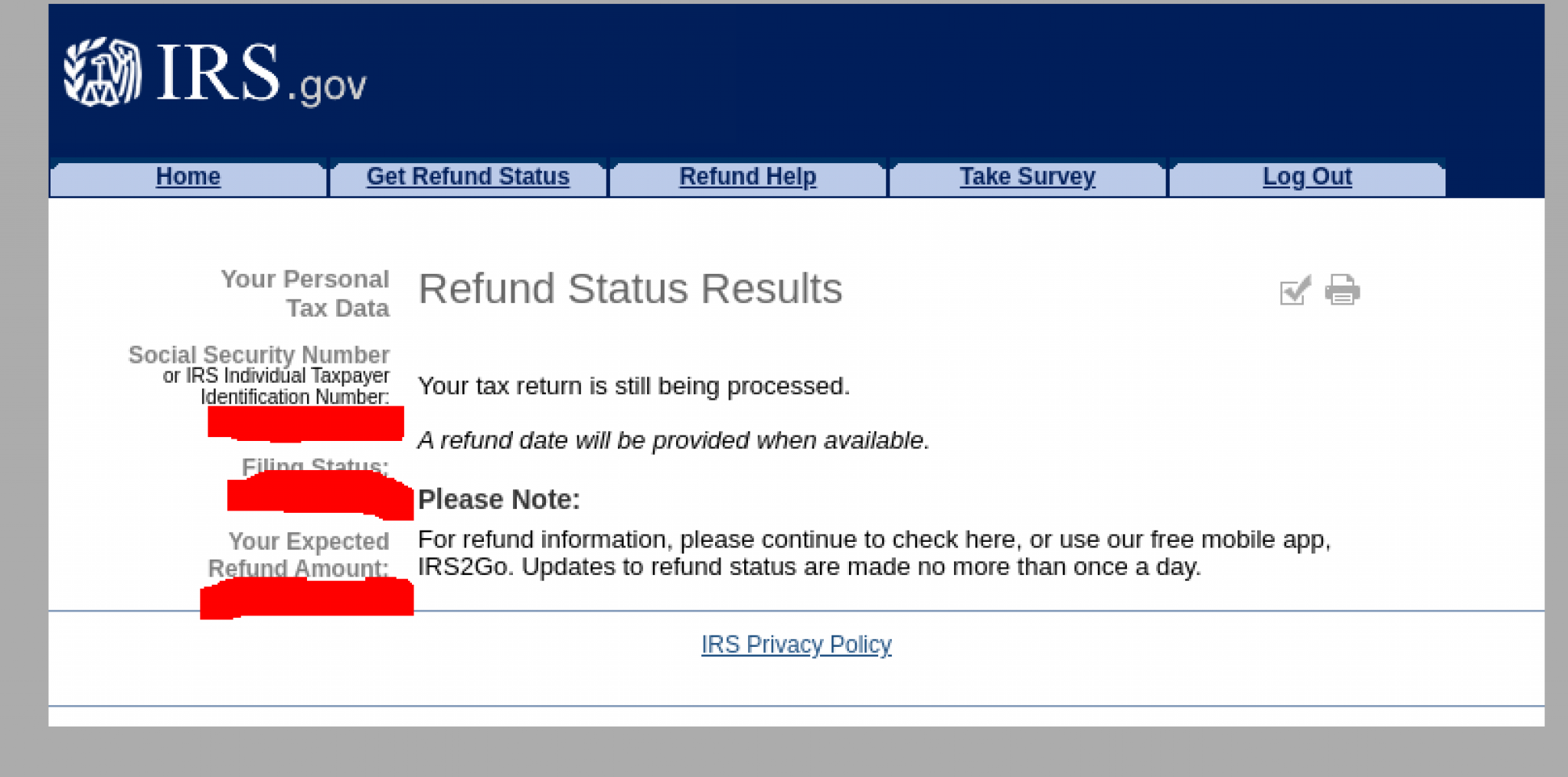

Latest Updates On IRS Where s My Refund Check Status 2022 EEFRI

https://eefri.org/wp-content/uploads/2022/11/IRS-wheres-My-Refund-2048x1015.png

2022 Taxes Due Deadlines Refunds Extensions And Credits This Year

https://www.gannett-cdn.com/presto/2022/01/24/PDTF/ebc18e00-bb66-42ae-8ed3-7a38c04013e9-taxreturn.jpg

Here are some instruction for tracking your Maryland refund Individual taxpayers can check the status of their refund by visiting the Comptroller of Maryland website or by calling the automated refund inquiry Discrepancies can trigger delays or additional verification Specifying the tax year helps the system locate the correct filing period Double check these details against your tax

The Maryland tax refund process begins when a taxpayer submits their return Electronic filings are typically processed within two to three weeks due to automated systems Maryland taxpayers can generally expect to receive their tax refunds within 30 days of filing their tax returns assuming they have filed electronically However several factors can affect the

Download When Can I Expect My Maryland Tax Refund 2022

More picture related to When Can I Expect My Maryland Tax Refund 2022

Top 9 Tax Refund Schedule 2022 Chart 2022

https://assets-global.website-files.com/600089199ba28edd49ed9587/61e9dc516117a41cd6798851_2021 Tax Schedule%402x.png

When Can I Expect My 2019 Income Tax Refund Tax Management

https://www.managedtaxes.com/wp-content/uploads/2019/01/When-Can-I-Expect-My-2019-Income-Tax-Refund_.png

Estimated Income Tax Refund Dates In 2022 When Can You Expect To

https://theeastcountygazette.com/wp-content/uploads/2022/01/Featured-Image-Templet-2022-01-06T173643.084.png

How fast can I get my Maryland tax refund E filers who select direct deposit can get their refund within several days Paper filers can expect approximately 30 days for their return to be processed The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may

Individual taxpayers can check the status of their refund by going to the Comptroller of Maryland website and clicking on Where s My Refund under Frequently Visited Links or by calling the 2024 Business Income Tax Forms Business Tax Forms 2024 Income Tax Forms 2024 Instruction Booklets CRA 500 500 2D 500CRW 500D 500DM 500E 500E 2D 500UP 500UP 2D

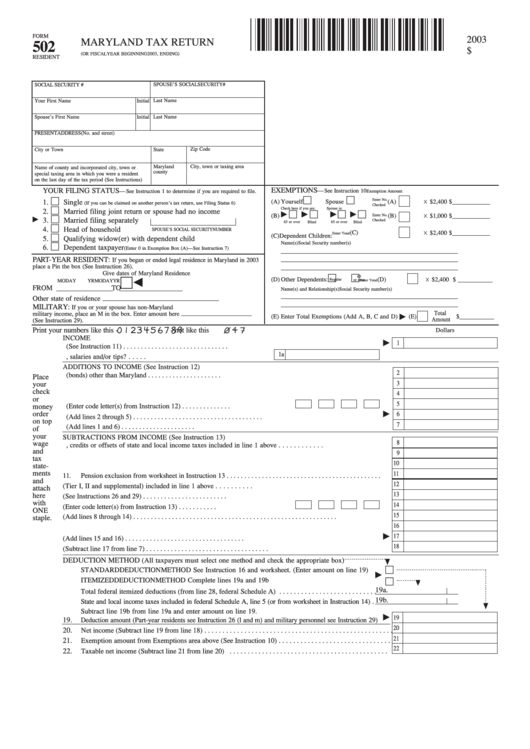

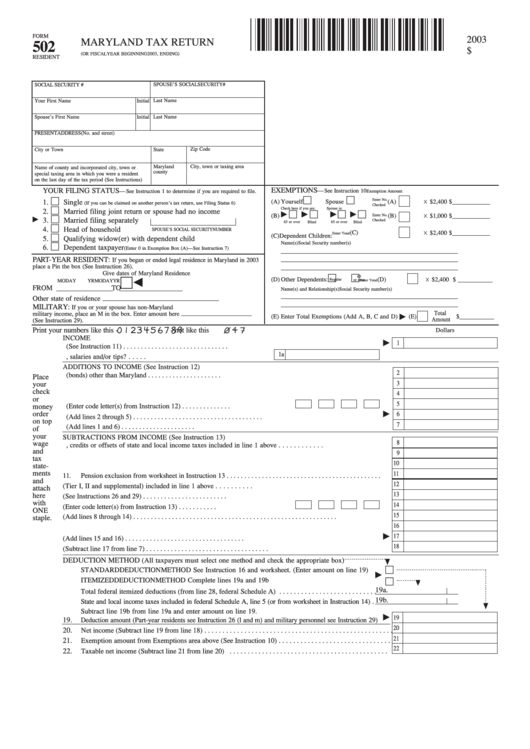

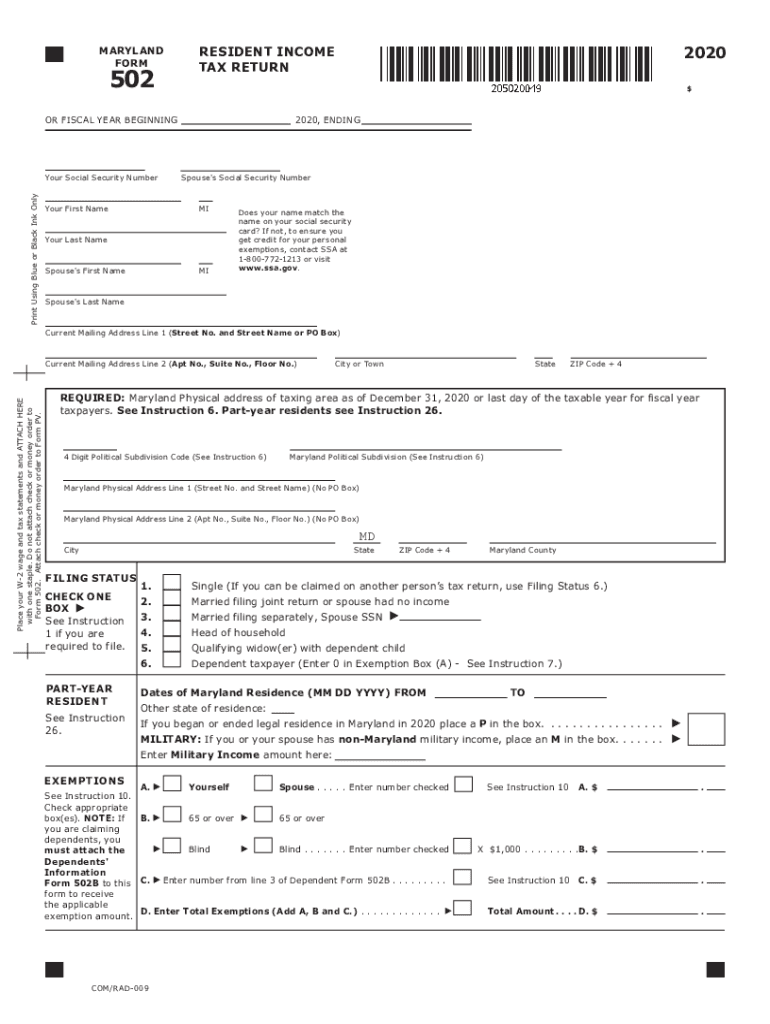

Blank Fillable Maryland Tax Return 502 Fillable Form 2023

https://fillableforms.net/wp-content/uploads/2022/07/blank-fillable-maryland-tax-return-502.png

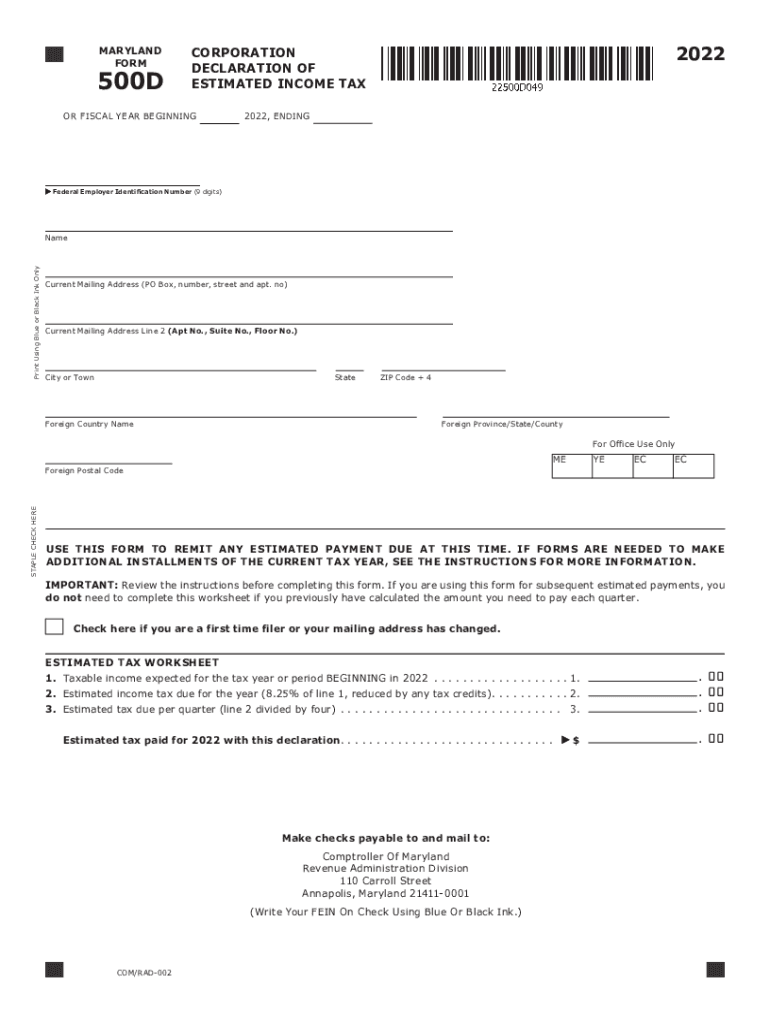

Md Estimated Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/995/585995555/large.png

https://interactive.marylandtaxes.gov › INDIV › refund...

Want To Check On Your Current Year Refund You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of

https://ttlc.intuit.com › turbotax-support › en-us › ...

Wait at least 10 days from acceptance of your return before calling Taxpayer Services Division at 1 800 638 2937 toll free or 410 260 7980 The state will ask you to enter the exact amount

Irs Form Release Date 2023 Printable Forms Free Online

Blank Fillable Maryland Tax Return 502 Fillable Form 2023

Md 502 Instructions 2018 Fill Out And Sign Printable PDF Template

List Of Tax Refund Calendar 2022 Ideas Blank November 2022 Calendar

Ga State Refund Cycle Chart 2023 Printable Forms Free Online

The 8 Most Common 2019 Tax Return Questions Answered By Experts The

The 8 Most Common 2019 Tax Return Questions Answered By Experts The

2022 IRS TAX REFUND UPDATE Refunds Approved IRS DIRECT DEPOSIT DATE

Check Your Maryland Tax Refund Status Maryland Tax Refund Online

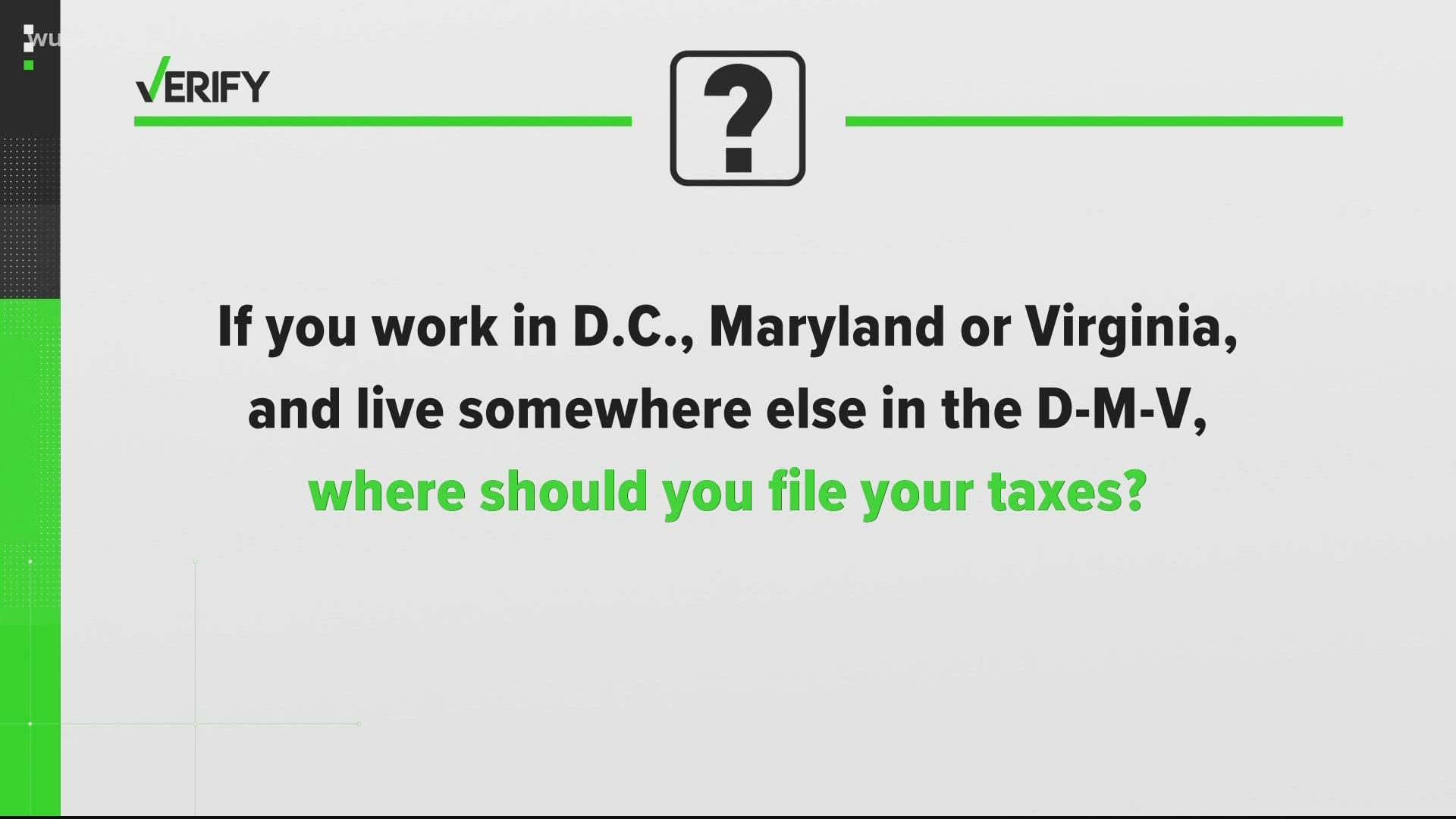

Tax Season 2022 Last Day To File And Where To File In The DMV Wusa9

When Can I Expect My Maryland Tax Refund 2022 - When Can You Expect Your Refund The timing of your Maryland tax refund depends on how you file If you file electronically e file you can generally expect to receive