When Can You Claim Eis Loss Relief Web If a beneficiary inherits EIS shares can they claim loss relief if they have fallen in value Spouses A spouse who received the EIS shares prior to the death of the original owner should be able to claim loss Executors The executor of an estate may be able to offset the loss net of income

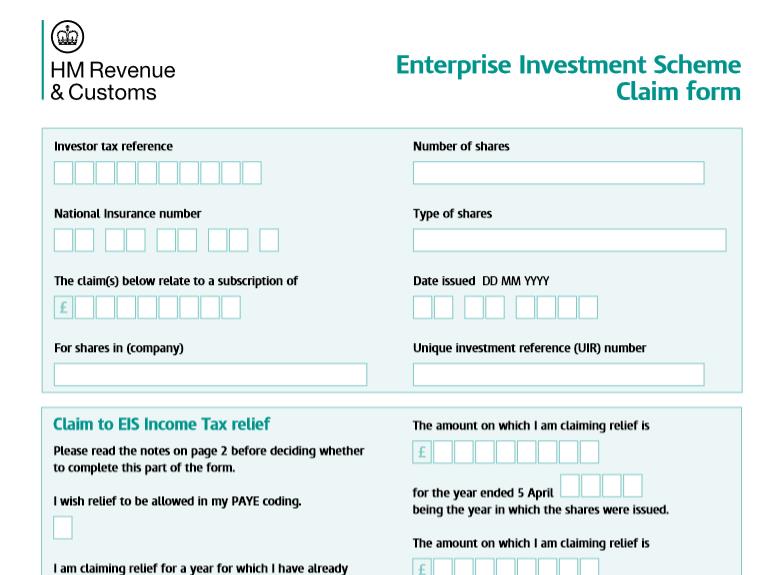

Web 22 Mai 2018 nbsp 0183 32 So if you submitted your tax return on 31 January 2022 and included a claim with that tax return you could specify an earlier time from 6 April 2019 to 30 January 2022 The EIS3 certificate issued must be kept safe as HMRC may request that the original be sent in as evidence for the claim Web Updated 6 April 2023 This helpsheet explains how to make 2 different types of claim a negligible value claim allows you to treat an asset as being disposed of even though you still own it

When Can You Claim Eis Loss Relief

When Can You Claim Eis Loss Relief

https://media-exp1.licdn.com/dms/image/C4D12AQGhc3WRbd6Qsg/article-cover_image-shrink_720_1280/0/1606376467198?e=2147483647&v=beta&t=nN9S5eLzwgFRwKwdT2UUv_Q2T_11B19Y0LOxezKPSPc

How Do I Claim An EIS Loss Relief On My Taxes KBC

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2020/12/How-Do-I-Claim-An-EIS-Loss-Relief-On-My-Taxes.jpg

How To Claim EIS Relief On Your EIS Fund Investments MMC

https://mmc.vc/wp-content/uploads/2023/12/HomePage-Header.jpg

Web 25 Sept 2023 nbsp 0183 32 Investors can indeed claim loss relief on a failed Seed Enterprise Investment Scheme or an Enterprise Investment Scheme investment in the UK by following these steps Confirm the Qualification Ensure that Web how can i claim tax relief on eis losses If you have made an EIS investment which is sold at a loss or is liquidated you may be able to claim tax relief on losses To qualify for relief the value of an investment at sale must have fallen below the net cost

Web If you want to set the loss against your income you must claim Loss Relief within 1 year from the 31 January following the tax year in which the loss was made What are the main rules Web For investments in a portfolio of EIS qualifying companies it should be possible to claim loss relief for individual holdings sold at an effective loss even if the overall portfolio performance is positive If a beneficiary inherits EIS shares they cannot claim loss relief if the investment falls in value

Download When Can You Claim Eis Loss Relief

More picture related to When Can You Claim Eis Loss Relief

Claiming EIS Tax Relief For Investors Sleek

https://sleek.com/uk/wp-content/uploads/sites/6/2023/01/how-to-claim-eis-tax-relief.png

Here s How To Claim EIS Tax Reliefs This Tax Year

https://www.syndicateroom.com/images/EIS3-claim-form.jpg

How To Claim Eis Client Is Claiming Eis Relief And Has Given Me Form

https://s.w-x.co/de-Eis_See_Einbruch.jpg

Web An Octopus guide A guide to EIS loss relief For UK investors only This guide does not offer investment or tax advice We recommend investors seek professional advice Key investment risks of Enterprise Investment Schemes EIS This guide provides additional information on loss relief one of the unique tax benefits associated with EIS investments Web 29 Aug 2023 nbsp 0183 32 You can claim loss relief on an SEIS or EIS qualifying investment when submitting your self assessment tax return for the year you incurred the loss or the year after For example if you made the loss in the 2022 23 yax year you would need to claim by 31st January 2025

Web When is the best time to claim loss relief If you are an individual claimant you must file a claim for loss relief on SEIS or EIS related shares also known as Share Loss Relief on or before the first anniversary of the usual self assessment filing date for the year of the loss How to claim loss relief Web 8 M 228 rz 2023 nbsp 0183 32 When you make your loss claim you can pick to deduct the loss from your taxable income at any of the below points The year the loss occurred The year before the loss occurred Both years if you don t have sufficient taxable income in a single year If the loss is offset against CGT you can claim The year the loss occurred

What Is Socso EIS Sep 21 2021 Johor Bahru JB Malaysia Taman

https://cdn1.npcdn.net/image/1632194135c80cb8bad9af7336dac2c3245f7cfb20.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

The Downing Guide To Claiming EIS Loss Relief IFA Magazine

https://ifamagazine.com/wp-content/uploads/2020/06/money-loss-620x375.jpg

https://octopusinvestments.com/resources/guides/eis-loss-relief

Web If a beneficiary inherits EIS shares can they claim loss relief if they have fallen in value Spouses A spouse who received the EIS shares prior to the death of the original owner should be able to claim loss Executors The executor of an estate may be able to offset the loss net of income

https://www.growthcapitalventures.co.uk/insights/blog/eis-loss-relief...

Web 22 Mai 2018 nbsp 0183 32 So if you submitted your tax return on 31 January 2022 and included a claim with that tax return you could specify an earlier time from 6 April 2019 to 30 January 2022 The EIS3 certificate issued must be kept safe as HMRC may request that the original be sent in as evidence for the claim

When Can I Claim EIS Tax Relief Capital Gains Tax CGT Deferral

What Is Socso EIS Sep 21 2021 Johor Bahru JB Malaysia Taman

EIS Loss Relief How To Claim EIS Loss Relief

EIS Loss Relief What It Is And How To Claim It GCV

SEIS EIS Loss Relief In Insolvency And Liquidation Real Business Rescue

YOUR GUIDE TO EIS LOSS RELIEF Oxford Capital

YOUR GUIDE TO EIS LOSS RELIEF Oxford Capital

How To Claim EIS Loss Relief EMV Capital

How And When To Claim Benefit Capital

How Do I Claim EIS Loss Relief TaxScouts

When Can You Claim Eis Loss Relief - Web For investments in a portfolio of EIS qualifying companies it should be possible to claim loss relief for individual holdings sold at an effective loss even if the overall portfolio performance is positive If a beneficiary inherits EIS shares they cannot claim loss relief if the investment falls in value