Where Do Ca Gas Taxes Go With a measure to repeal California s recently enacted gas taxes and registration fees heading to the November ballot many

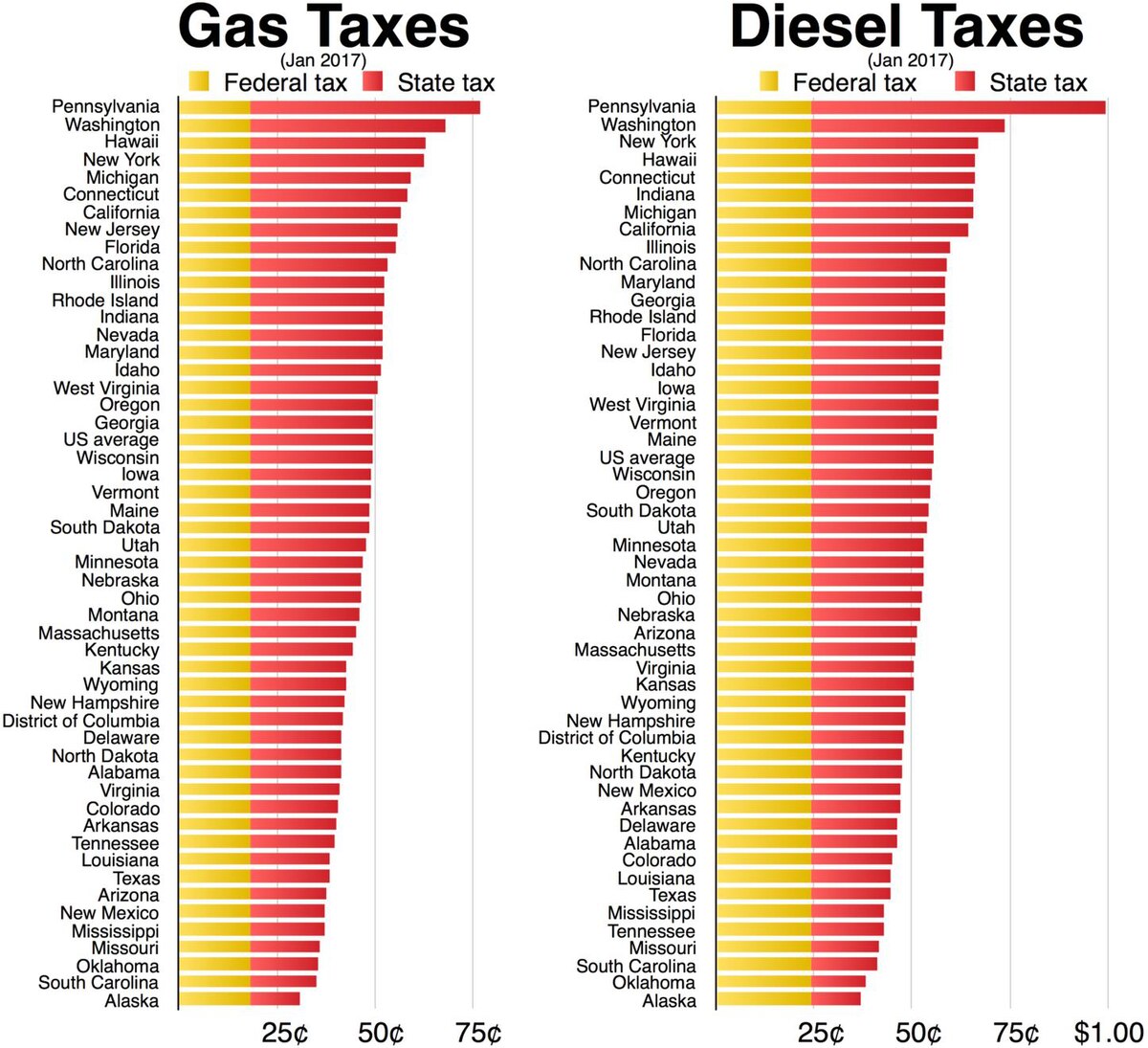

For every gallon of gas in California we pay 54 cents in state excise tax among the highest in the nation 18 4 cents in federal excise tax 23 cents for California s cap and trade As a large majority of California state residents are impacted by the gas taxes and registration fees imposed at the state and federal level it is only natural to question

Where Do Ca Gas Taxes Go

Where Do Ca Gas Taxes Go

https://cdn.howmuch.net/articles/133_Gas-Tax-per-Gallon-b125.jpg

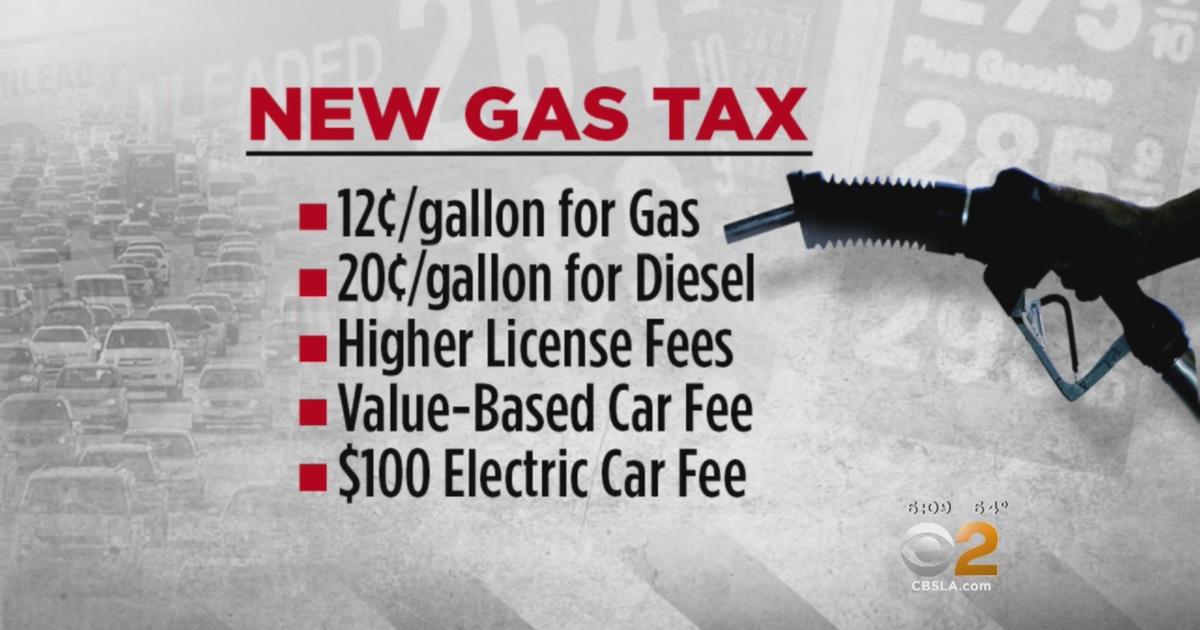

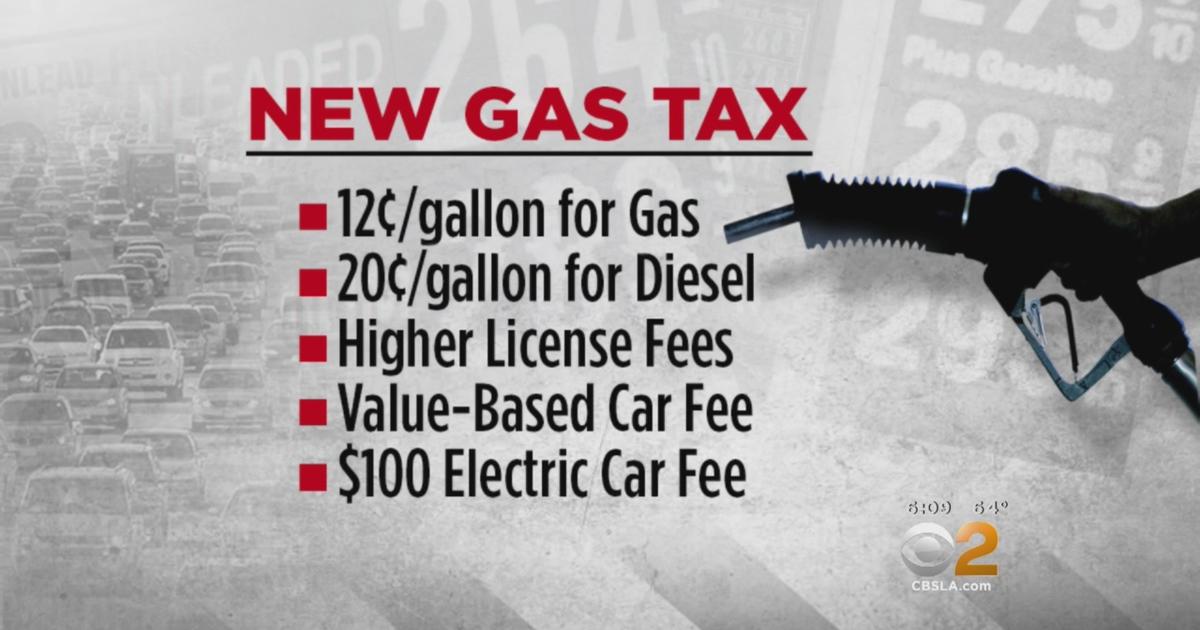

California Gas Tax Increase Kicks Off Wednesday CBS Los Angeles

https://assets2.cbsnewsstatic.com/hub/i/r/2017/10/31/71cbbc24-c4dc-43c5-a5bd-866f1c3e58db/thumbnail/1200x630/d39467e2e3ea237cf8a06a7508cd7d06/ba0d90edfa1348d78b9541b0d2a2679f.jpg

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

https://files.taxfoundation.org/20220202142849/2022-sales-taxes-including-2022-sales-tax-rates-2022-state-and-local-sales-tax-rates-1200x1033.png

Readers had questions about California s gas rebate payments including whether it matters how many cars you have and why it s based on 2020 tax returns We ve answered some here In addition to the excise tax California motorists pay a federal fuel tax of 18 4 cents per gallon and state costs for the low carbon fuel standard the cap and trade

California pumps out the highest state gas tax rate of 77 9 cents per gallon cpg followed by Illinois 66 5 cpg and Pennsylvania 62 2 cpg The lowest state gas California s gasoline excise tax will increase by 2 cents a gallon starting July 1 but one local lawmaker is asking the state to stop the increase

Download Where Do Ca Gas Taxes Go

More picture related to Where Do Ca Gas Taxes Go

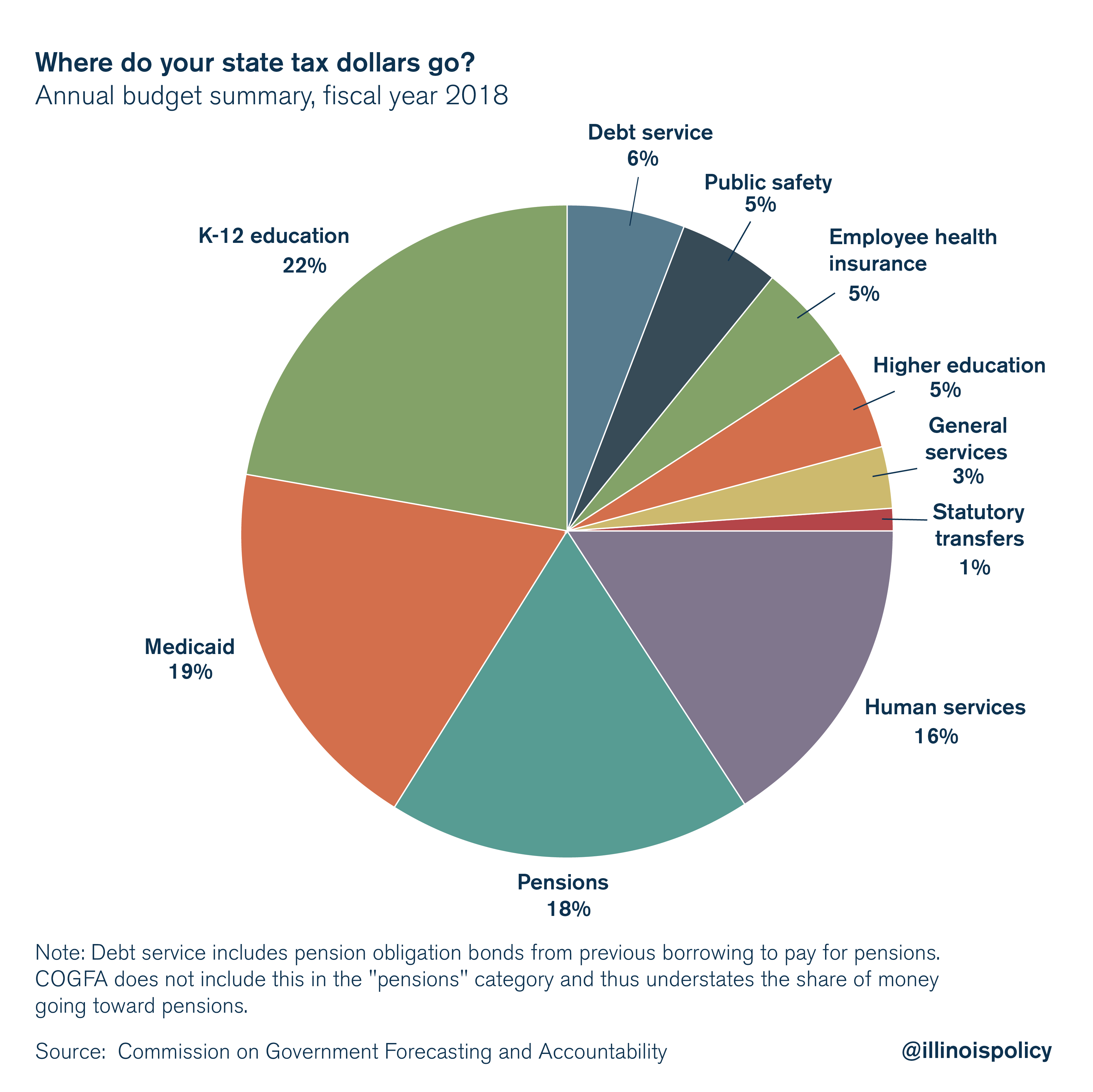

Tax Day Where Do Illinoisans State Tax Dollars Go

https://files.illinoispolicy.org/wp-content/uploads/2018/04/Where-the-money-went-01-1.png

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Five Myths About Gas Taxes The Washington Post

https://www.washingtonpost.com/rf/image_1484w/2010-2019/WashingtonPost/2014/12/19/Outlook/Images/206159080-740.jpg?t=20170517

Where will all this gas tax money go The state says most of it goes to fixing roads repairing potholes rebuilding bridges and to improve public transportation California s excise taxes on gasoline come to 50 5 cents per gallon That includes 12 7 cents per gallon from the controversial Senate Bill 1 that became law to

Gov Gavin Newsom and leaders of the California Legislature have agreed to provide more than 9 billion in refunds to taxpayers to offset high gas prices and For California gas prices are topping in the 7 00 range in some areas To help lighten the financial burden of the recent surge for Californians Governor Newsom

Proposed Law Would Hurt Georgia School Systems Revenue Sowega Live

http://sowegalive.com/wp-content/uploads/2015/02/Gas-Taxes-Apr-2014.png

Fuel Taxes In The United States Wikipedia

https://upload.wikimedia.org/wikipedia/commons/thumb/a/a8/Gas_and_Diesel_taxes.pdf/page1-1200px-Gas_and_Diesel_taxes.pdf.jpg

https://www. mercurynews.com /201…

With a measure to repeal California s recently enacted gas taxes and registration fees heading to the November ballot many

https://www. cbs8.com /article/traffic/g…

For every gallon of gas in California we pay 54 cents in state excise tax among the highest in the nation 18 4 cents in federal excise tax 23 cents for California s cap and trade

Where Do Your Tax Dollars Go NetCredit Blog

Proposed Law Would Hurt Georgia School Systems Revenue Sowega Live

How High Are Gas Taxes In Your State Laura Strashny

Map How High Are Gas Taxes In Your State Vox

Illinois Gas Taxes To Increase Again Next Week

Post News California With The Highest Gas Taxes In The Nation

Post News California With The Highest Gas Taxes In The Nation

PA Ranks The Highest For State Imposed Gas Taxes NewtownPANow

Study Shows Illinois Has The 2nd Highest Gas Taxes In America

Gas Prices Us Map Oil s Well That Ends Well Gas Prices

Where Do Ca Gas Taxes Go - California s gasoline excise tax will increase by 2 cents a gallon starting July 1 but one local lawmaker is asking the state to stop the increase