Where Do You Mail Past Due Tax Returns Search by state and form number the mailing address to file paper individual tax returns and payments Also find mailing addresses for other returns including corporation partnership tax exempt government entity and other returns

If you live Use this address if you are not enclosing a payment Use this address if you are enclosing a payment A foreign country U S possession or territory or use an APO or FPO address or file Form 2555 or 4563 or are a dual status alien Department of the Treasury Internal Revenue Service Austin TX 73301 0215 USA The address you ll send your prior year tax return to will depend on what state you live in Below are five separate addresses on where to send a late tax return to Please note that if you received a notice from the IRS with an alternate address you should use that one Tax tips for filing a late tax return

Where Do You Mail Past Due Tax Returns

Where Do You Mail Past Due Tax Returns

https://www.irs.com/wp-content/uploads/2018/11/get_copy_past_tax_return_copies_previous_year_transcript_irs.jpg

How Do I Send My Federal Tax Return By Mail YouTube

https://i.ytimg.com/vi/GOFMI9ReiBU/maxresdefault.jpg

How To Deal With A Past Due Tax Return Account Abilities LLC

https://accountabilitiesllc.com/wp-content/uploads/2022/02/Tax-Plan-1021-image-1.jpg

Back taxes are taxes that are delinquent or overdue typically from previous years The IRS begins to charge penalties and interest on late or unpaid taxes the day after the tax filing deadline If you qualified for federal tax credits or refunds in the past but didn t file tax returns you may be able to collect the money by filing back taxes However the IRS only allows you to claim refunds and tax credits within three years of

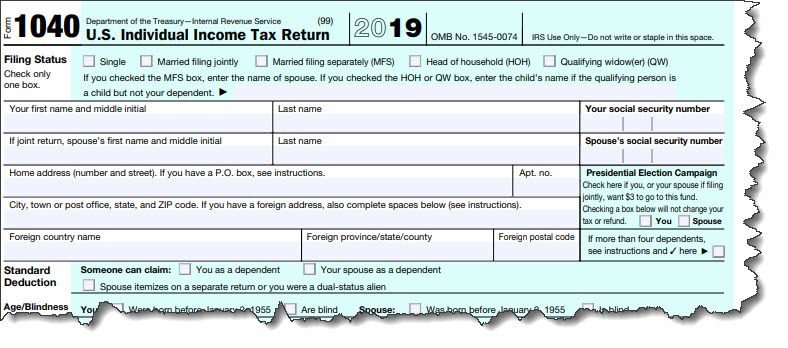

See also IRS s reminder about 2018 tax returns with refunds For 2018 tax returns the RSED window closes April 18 2022 for most taxpayers Filing past due tax returns Filing past due federal tax returns is important for reasons other than just the potential for losing out on a credit or refund Those include A past due tax return requires the same information as a regular tax return Make sure you have any W 2s and 1099s you received during the year in which your back taxes were due

Download Where Do You Mail Past Due Tax Returns

More picture related to Where Do You Mail Past Due Tax Returns

How To Write A Past Due Invoice Email Templates Samples Inside

https://yamm.com/blog/content/images/2022/04/Past-Due-Invoice-Email-Template--2-.png

How To Check For Federal Tax Return Wastereality13

https://komonews.com/resources/media/e9ab4034-7c84-4ebd-b93e-812b3e65a760-jumbo1x1_TWYLASCHECKWEB.jpg?1562118783075

Barbara Johnson Blog How To File Past Due Taxes and Never Be Late Again

https://assets-blog.fundera.com/assets/wp-content/uploads/2018/04/17141135/how-to-file-past-due-taxes-2.jpg

Can you file taxes from previous years If you didn t file a federal income tax return for the last few years you might wonder if you re still responsible for filing those late returns The answer is yes in most cases But if you didn t meet the filing requirements you don t need to file a prior year s tax return Just verify that you mail your return by the federal tax return deadline on April 15 2024 Don t forget to double check the postage rates to avoid penalties for filing a late return

When it comes to filing past due tax returns you generally have two options e filing or mailing E filing is the electronic filing of your tax returns which has become popular due to its speed convenience and security Get federal tax forms for current and prior years Get the current filing year s forms instructions and publications for free from the IRS Download them from IRS gov Order online and have them delivered by U S mail Order by

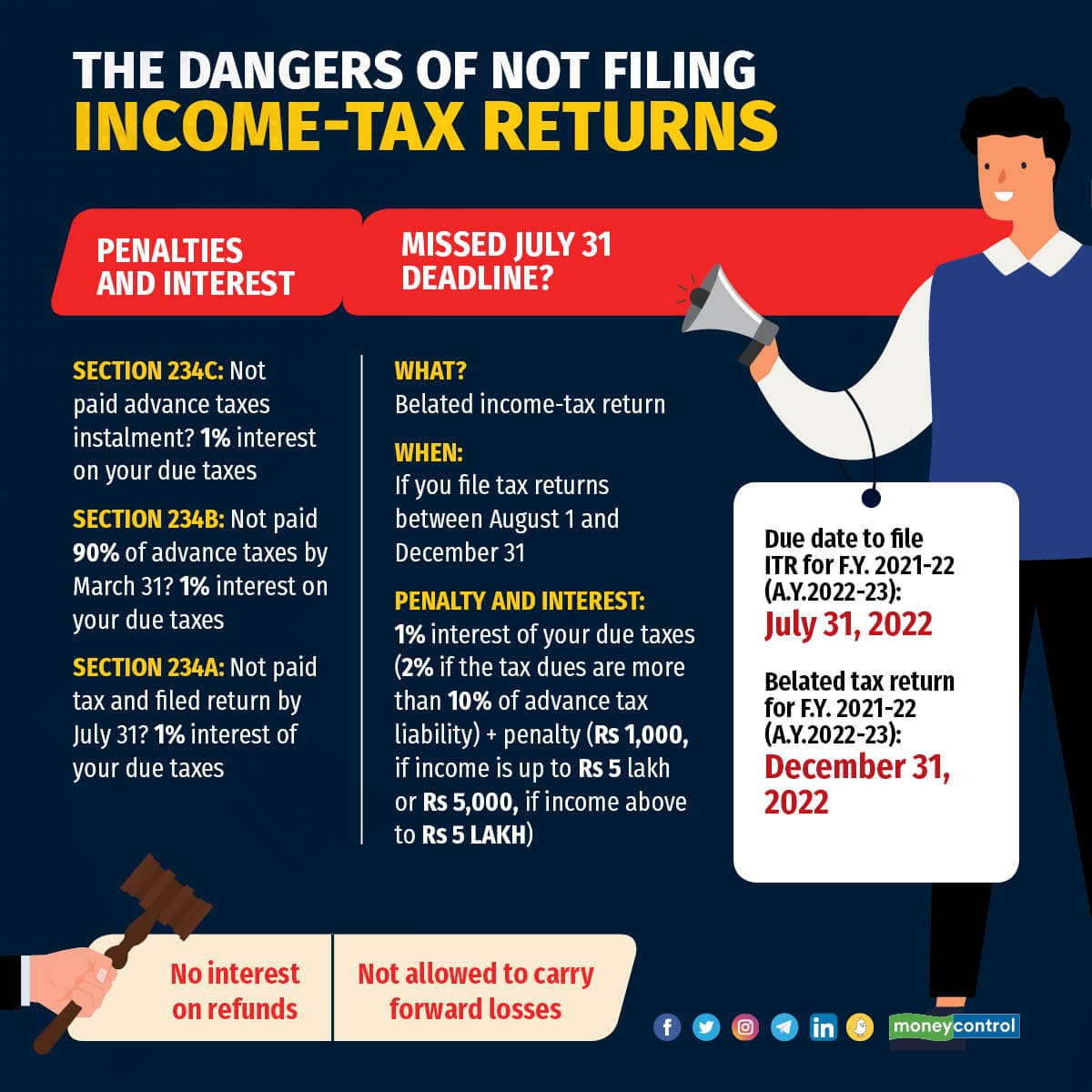

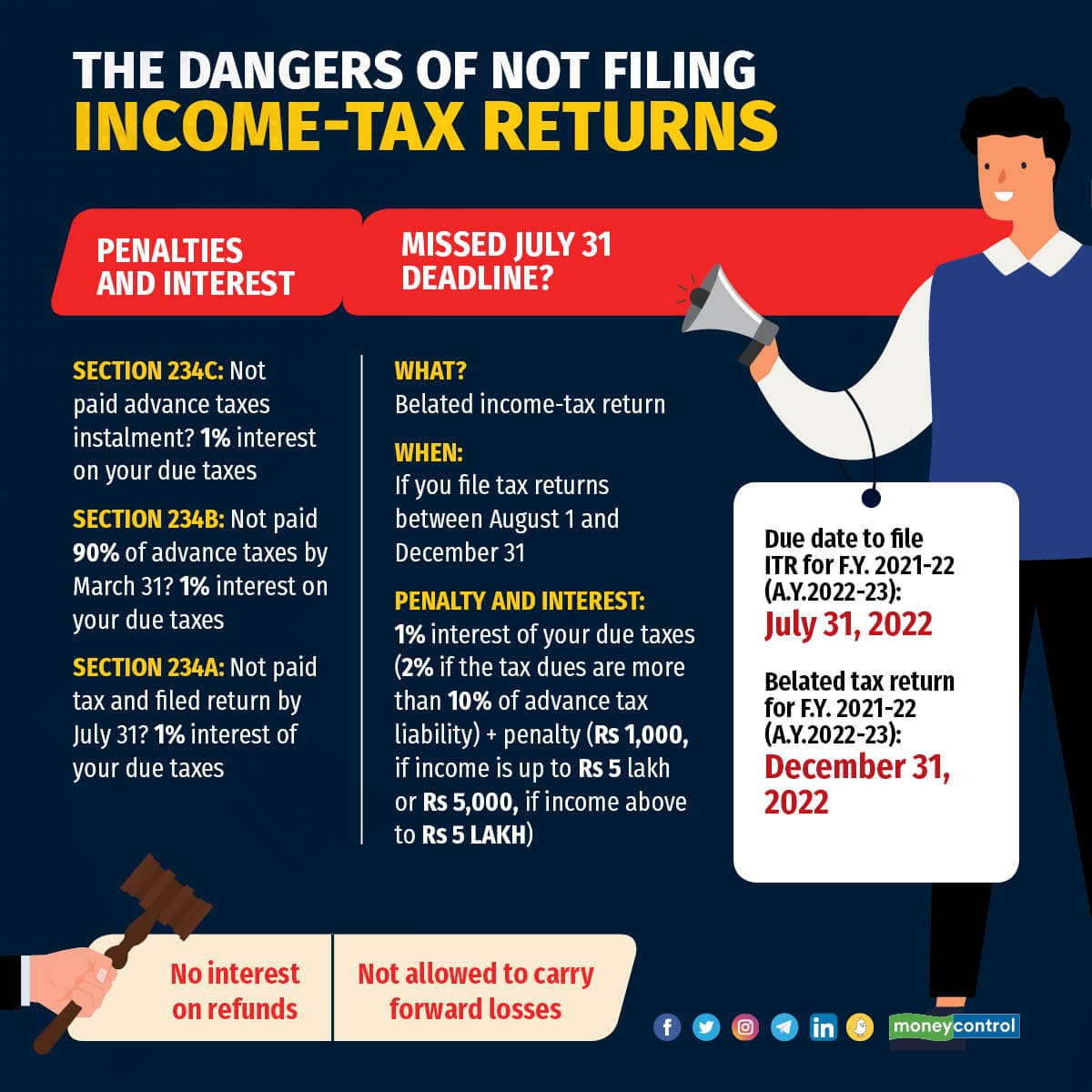

I T Return Filing Interest Penalties On The Cards If Failed To File Returns By July 31

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

How Do I File Returns For Back Taxes TurboTax Tax Tips Videos Filing Past Due Tax Returns

https://protocolor.com/6f0a2d1f/https/01e497/digitalasset.intuit.com/IMAGE/A7DQDj5mb/filebacktaxreturn_INF14505.jpg

https://www.irs.gov/filing/where-to-file-paper-tax...

Search by state and form number the mailing address to file paper individual tax returns and payments Also find mailing addresses for other returns including corporation partnership tax exempt government entity and other returns

https://www.irs.gov/filing/where-to-file-addresses...

If you live Use this address if you are not enclosing a payment Use this address if you are enclosing a payment A foreign country U S possession or territory or use an APO or FPO address or file Form 2555 or 4563 or are a dual status alien Department of the Treasury Internal Revenue Service Austin TX 73301 0215 USA

How To File Past Due Tax Returns Optima Tax Relief

I T Return Filing Interest Penalties On The Cards If Failed To File Returns By July 31

Are You Afraid To File Past due Tax Returns Do You Think That If You File The IRS Might Find

Mailing Your Tax Return USPS

Past Due Invoice Email Samples SemiOffice Com

All About Past Due Tax Returns Daphne Fairhope AL

All About Past Due Tax Returns Daphne Fairhope AL

/past_due_invoice_letter_after_45_days.png)

How To Write A Past Due Invoice Reminder Templates

Where Should I Mail My Federal Tax Return Deadline Approaches

Why You Should File Your Due Tax Returns Now

Where Do You Mail Past Due Tax Returns - Resources Taxpayer Rights Related Content What do I need to know If you must file a paper tax return consider sending it by certified mail with a return receipt This will be your proof of the date you mailed your tax return and when the IRS received it You may also use certain private delivery services designated by the IRS