Where To Show Interest On Housing Loan In Itr 1 Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to

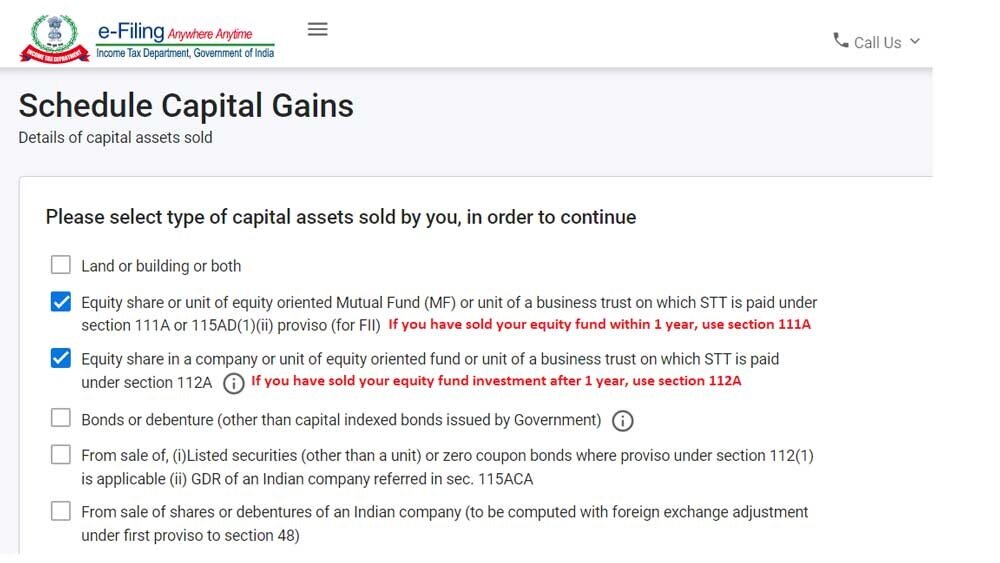

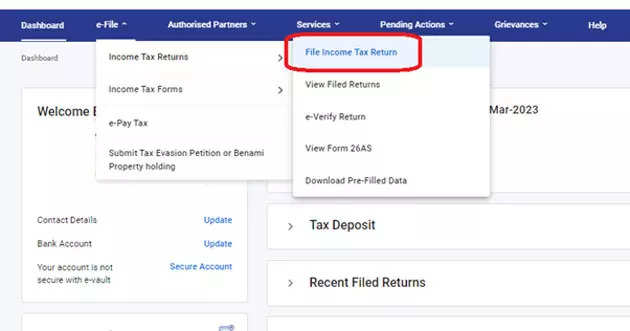

This service enables individual taxpayers to file ITR 1 either online through the e Filing portal or by accessing the offline excel and html utility This user manual covers the So let s understand where to Show Housing loan Interest in ITR 1 As we have already understood there are three sections Section 24 Section 80EE section 80EEA which allow the taxpayer to

Where To Show Interest On Housing Loan In Itr 1

Where To Show Interest On Housing Loan In Itr 1

https://financialcontrol.in/wp-content/uploads/2020/02/section-24-of-income-tax-act.jpg

How To Show Interest On A Home Loan In An Income Tax Return

http://instafiling.com/wp-content/uploads/2023/03/Topic-40-how-to-show-interest-on-home-loan-in-income-tax-return.png

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

https://carajput.com/art_imgs/can-hra-and-home-loan-benefits-be-claimed-when-itr-is-filing.jpg

Step 1 Fill in all your details name address Aadhar number etc Step 2 Under the head Salaries enter your chargeable income Be sure to check Form 16 ITR 1 can be filed by a Resident Individual whose Total income does not exceed 50 lakh during the FY Income is from salary one house property family pension income

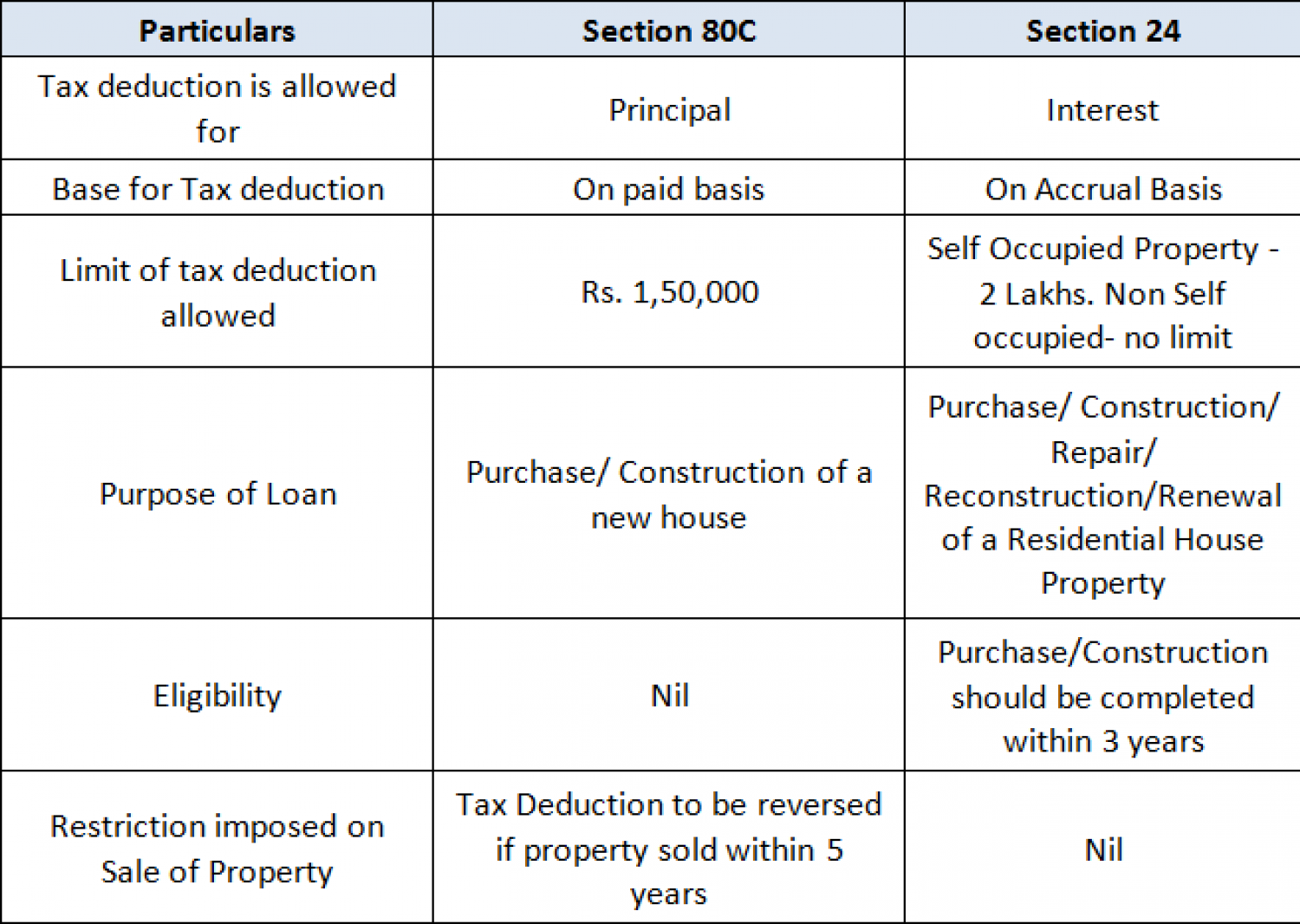

You can claim deductions for both the interest on a home loan and principal repayment under Section 80C of the Income Tax Act by submitting the required documents to your If you are a salaried individual with a total income below Rs 50 lakh then you might be eligible to file the simpler ITR 1 form abbreviated as Sahaj This form does not

Download Where To Show Interest On Housing Loan In Itr 1

More picture related to Where To Show Interest On Housing Loan In Itr 1

How To Fill Home Loan In Income Tax Return ITR Home Loan Tax

https://i.ytimg.com/vi/XErtiMJKxS4/maxresdefault.jpg

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

https://life.futuregenerali.in/media/suwdjtal/tax-saving-on-interest-paid-on-house-loan.jpg

Claim Home Loan Tax Benefits HRA Together For ITR Filing Telangana Today

https://cdn.telanganatoday.com/wp-content/uploads/2022/07/Claim-Home-Loan-Tax-Benefits-HRA-together-for-ITR-filing.jpg

How to fill home loan Interest and Capital in ITR Portal How to Claim Tax Benefits on Home Loans Rakibhusain tech s SurgeonThe new e filing portal www By following the necessary steps such as gathering required documents informing your employer calculating income from house property and claiming

Each co owner can claim the deduction for housing loan interest Tax Benefits on Rental Income Taxpayers having a rental income can claim the following Details of house property rental income interest on housing loan will be pre filled basis the Form 16 if declared to the employer last year s filed return of

5 Top 5 Points For

https://1.bp.blogspot.com/-bQzJ_9n04UY/YFS_OTB-aHI/AAAAAAAAAvQ/3E6y-HGxQQEbem4S8_Q1XeZiEQX16a_WwCNcBGAsYHQ/s980/housing-loan.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

https://cleartax.in/s/deductions-under-section24...

Interest on home loan If you have taken a loan for the acquisition construction or repair of the property you can claim the interest paid on the loan up to

https://www.incometax.gov.in/iec/foportal/help/how-to-file-itr1-form-sahaj

This service enables individual taxpayers to file ITR 1 either online through the e Filing portal or by accessing the offline excel and html utility This user manual covers the

How To Effectively Declare Housing Loan Interest In Your ITR

5 Top 5 Points For

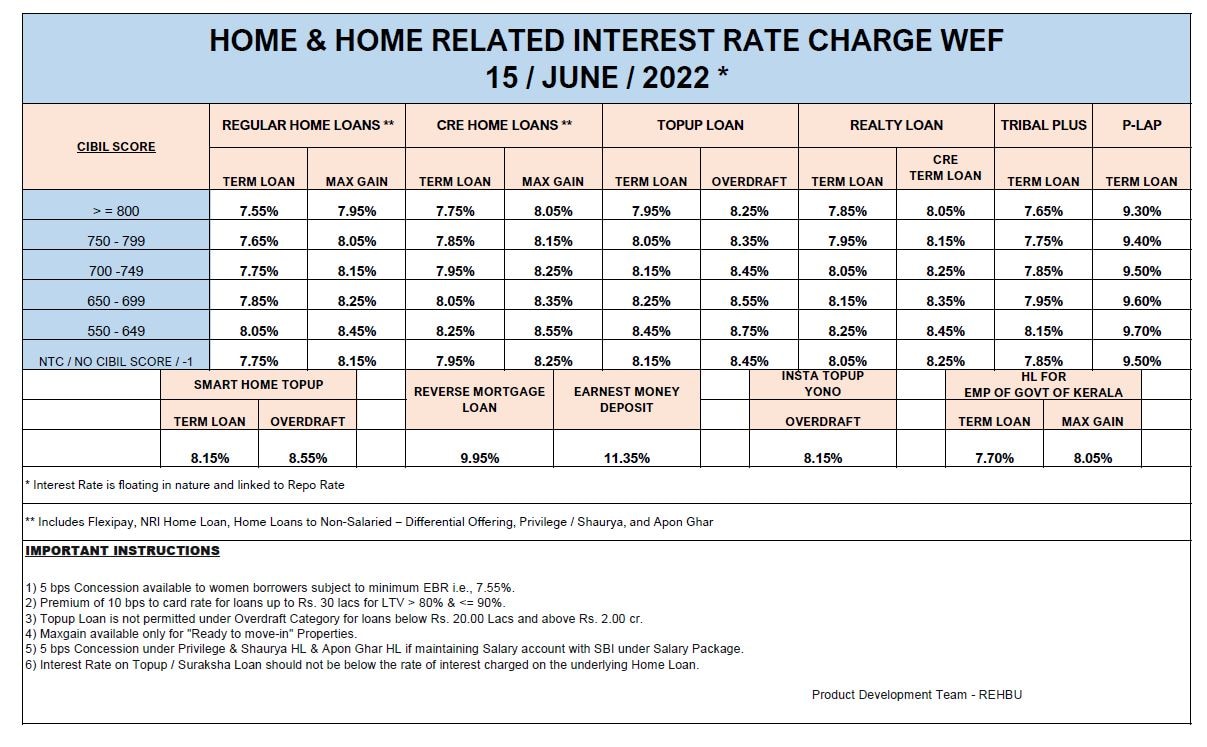

How Does The Interest Rate Of Your Housing Loan Works Fortune My

How To Show Equity Mutual Fund Investments In ITR Value Research

How To File ITR 1 For FY 2022 23 With Salary Income From House

How Much Home Loan Can I Get From Sbi Lupon gov ph

How Much Home Loan Can I Get From Sbi Lupon gov ph

Deduction Of Interest On Housing Loan In Case Of Co ownership

How To Calculate Interest On Housing Loan For Income Tax Haiper

Is It Essential To File ITR To Avail Home Loan HDFC Sales Blog

Where To Show Interest On Housing Loan In Itr 1 - If you are a salaried individual with a total income below Rs 50 lakh then you might be eligible to file the simpler ITR 1 form abbreviated as Sahaj This form does not