Which Itr Form For Salaried Employees A salaried individual can file his her income tax return either using ITR 1 or ITR 2 form Both forms have differences and which form is applicable to an individual depends on all the sources of the salaried individual s income

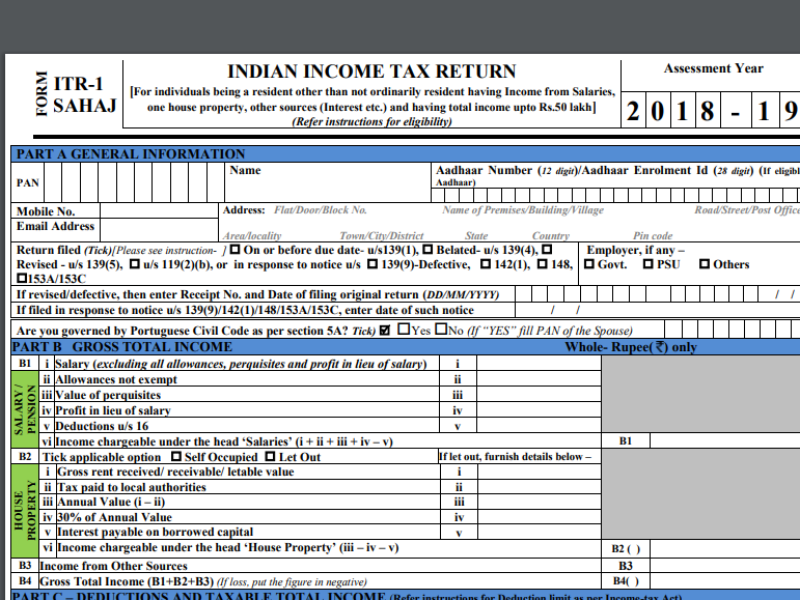

Learn about different types of income tax returns ITR for salaried employees ITR 1 ITR 2 ITR 3 and ITR 4 Understand which form suits your income structure best Salaried resident individuals having a maximum income of Rs 50 lakh within a financial year need to choose the ITR 1 form while filing their returns Here are the criteria that

Which Itr Form For Salaried Employees

Which Itr Form For Salaried Employees

https://www.hindustantimes.com/ht-img/img/2023/06/27/1600x900/itr_1687864356896_1687864357103.jpg

Types Of ITR Form And ITR Form Applicability CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/03/type-of-ITR.jpg

ITR Form For Salaried Employees File Your Returns Easily Taxbuddy

https://static.wixstatic.com/media/f120be_5f7f69302d974840ae16a00faa007efc~mv2.png/v1/fill/w_1000,h_668,al_c,q_90,usm_0.66_1.00_0.01/f120be_5f7f69302d974840ae16a00faa007efc~mv2.png

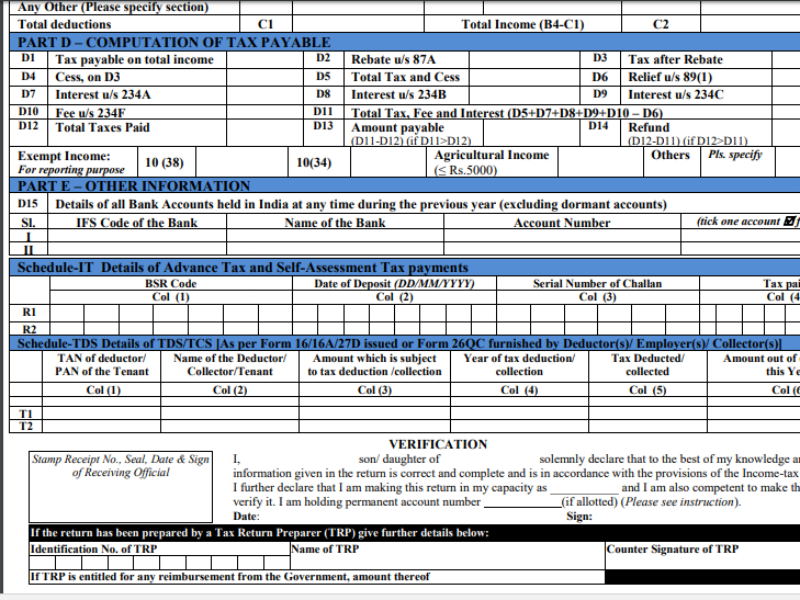

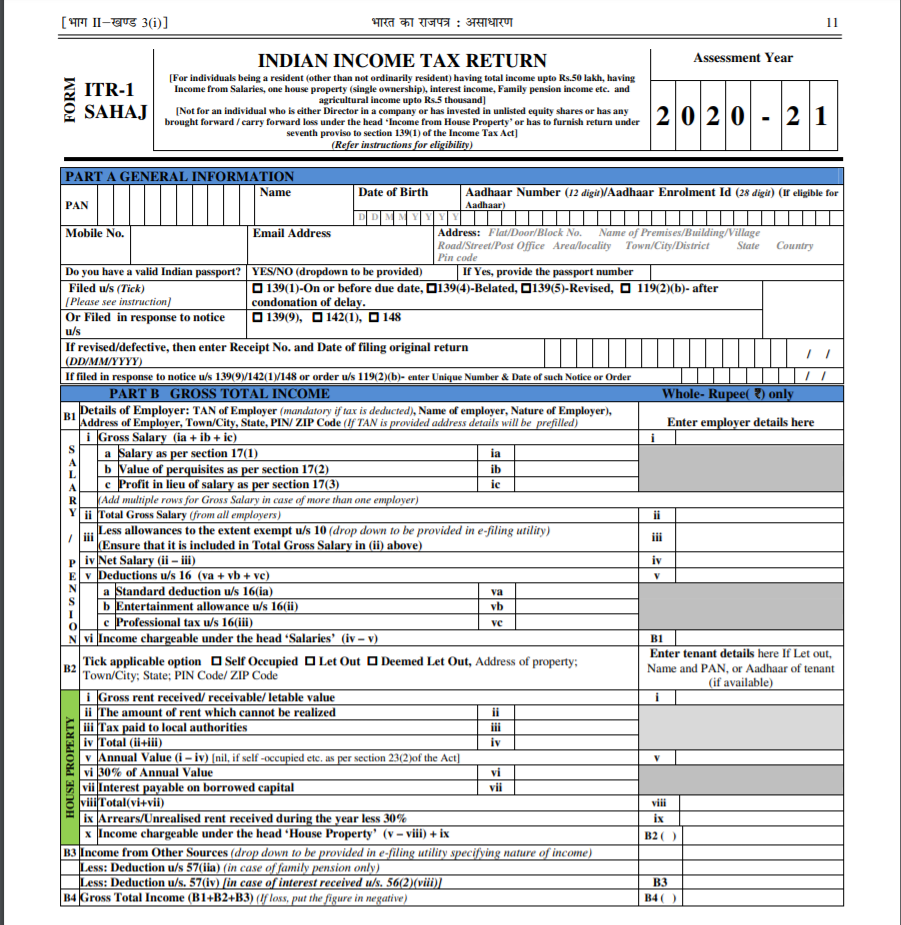

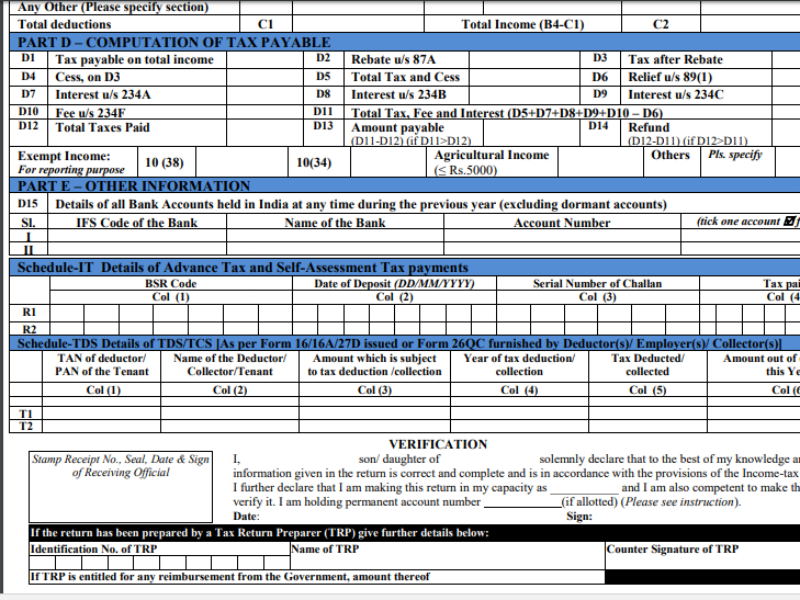

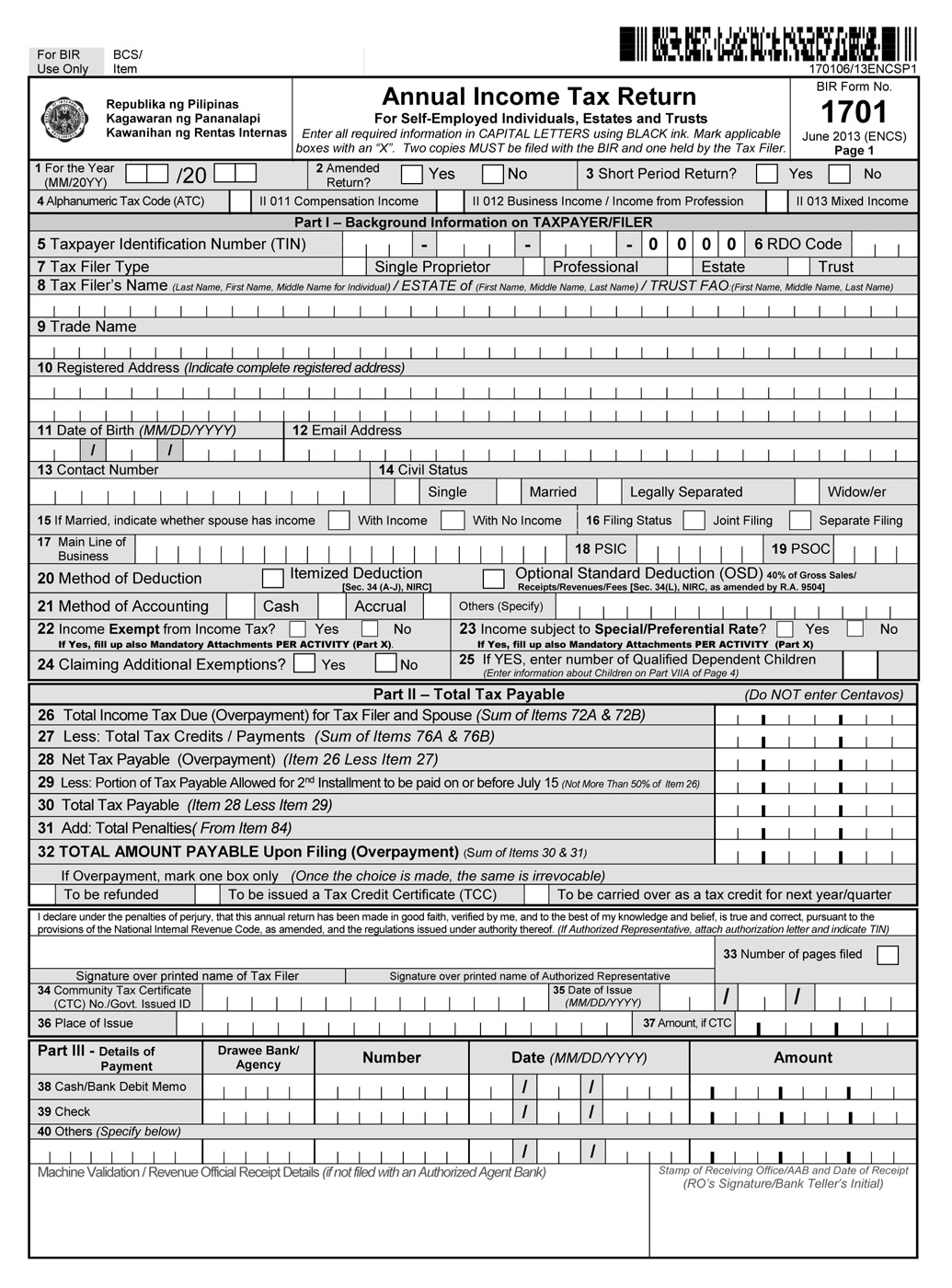

Which ITR form is applicable for salaried employees ITR 1 ITR 1 for salaried employees also known as SAHAJ is a simplified tax form designed for resident individuals whose total income doesn t exceed INR 50 lakh For self employed individuals one must fill in either ITR 3 or ITR 4 form Which ITR form to fill in for NRI Non Resident Indians must fill in ITR 2 or ITR 3 to file their ITR returns

ITR form for salaried Beginning in AY 2024 25 the new tax regime will be the default choice Each year you will need to choose between the old and new tax regimes for that specific Assessment year Failing to meet the ITR Once you have all your documents in order and tally the details with Form 26AS and Annual Information Statement AIS you can start the process of filing your returns Step one is to select the

Download Which Itr Form For Salaried Employees

More picture related to Which Itr Form For Salaried Employees

How To File ITR 1 Form Online For Salaried Employees In Easy Way YouTube

https://i.ytimg.com/vi/U3cUTqC6LTA/maxresdefault.jpg

Itr Form For Salaried Which ITR Form Should A Salaried Person Use To

https://bigbayouyouth.com/dea33788/https/414ba3/img.etimg.com/thumb/width-1200,height-900,imgsize-485050,resizemode-75,msid-93129124/wealth/tax/which-itr-form-should-a-salaried-person-use-to-file-income-tax-return.jpg

ITR Form For Salaried Employees

https://media.licdn.com/dms/image/D4D12AQHqXems7K6M3A/article-cover_image-shrink_720_1280/0/1679561313394?e=2147483647&v=beta&t=bYTjd2DfEjfnHk_nb-pwgyhNl7zogyr88K-hhLt04WQ

Filing your ITR as a salaried employee in India for AY 2024 25 not only requires careful consideration of the old and new tax regimes but also accurate completion of the ITR Which form is used for filing ITR by a salaried employee A salaried employee receives a fixed amount of income from an employer for providing services under a contract of employment

Yes ITR filing is mandatory for salaried individuals under the following conditions If a salaried individual s total income in the year is more than the basic exemption limit If Salaried individuals can file income tax returns ITR using the forms ITR 1 or ITR 2 ITR 1 applies to individual resident taxpayers with a total income of up to Rs 50 lakhs

New Itr Forms For Salaried Employee 2023 Employeeform

https://www.employeeform.net/wp-content/uploads/2022/07/itr-filing-2018-19-a-step-by-step-guide-on-how-to-file-online-return-1.png

ITR 1 Sahaj Form For Salaried Individuals Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2020/05/Sample-ITR-1-Sahaj.png

https://economictimes.indiatimes.com › w…

A salaried individual can file his her income tax return either using ITR 1 or ITR 2 form Both forms have differences and which form is applicable to an individual depends on all the sources of the salaried individual s income

https://taxguru.in › income-tax › types-income-tax...

Learn about different types of income tax returns ITR for salaried employees ITR 1 ITR 2 ITR 3 and ITR 4 Understand which form suits your income structure best

Definition Meaning Of ITR Forms Tax2win

New Itr Forms For Salaried Employee 2023 Employeeform

Salaried Employees ITR Filing Benefits Alankit

Itr Form For Self Employed Employment Form

Which ITR Should I File Types Of ITR Forms Which One Should You File

How To File Income Tax Return ITR Online For Salaried Employees

How To File Income Tax Return ITR Online For Salaried Employees

New Itr Forms For Salaried Employee 2023 Employeeform

How To File ITR 1 For Salaried Person Employee Form 16 Step by Step

Alliance Tax Experts Confused About Which ITR Form To Use Heres The Help

Which Itr Form For Salaried Employees - For self employed individuals one must fill in either ITR 3 or ITR 4 form Which ITR form to fill in for NRI Non Resident Indians must fill in ITR 2 or ITR 3 to file their ITR returns