Which States Have Property Tax Exemptions For Seniors Property tax exemptions for seniors based on age and income thresholds Alabama Complete property tax exemption for seniors aged 65 and above Alaska Property tax

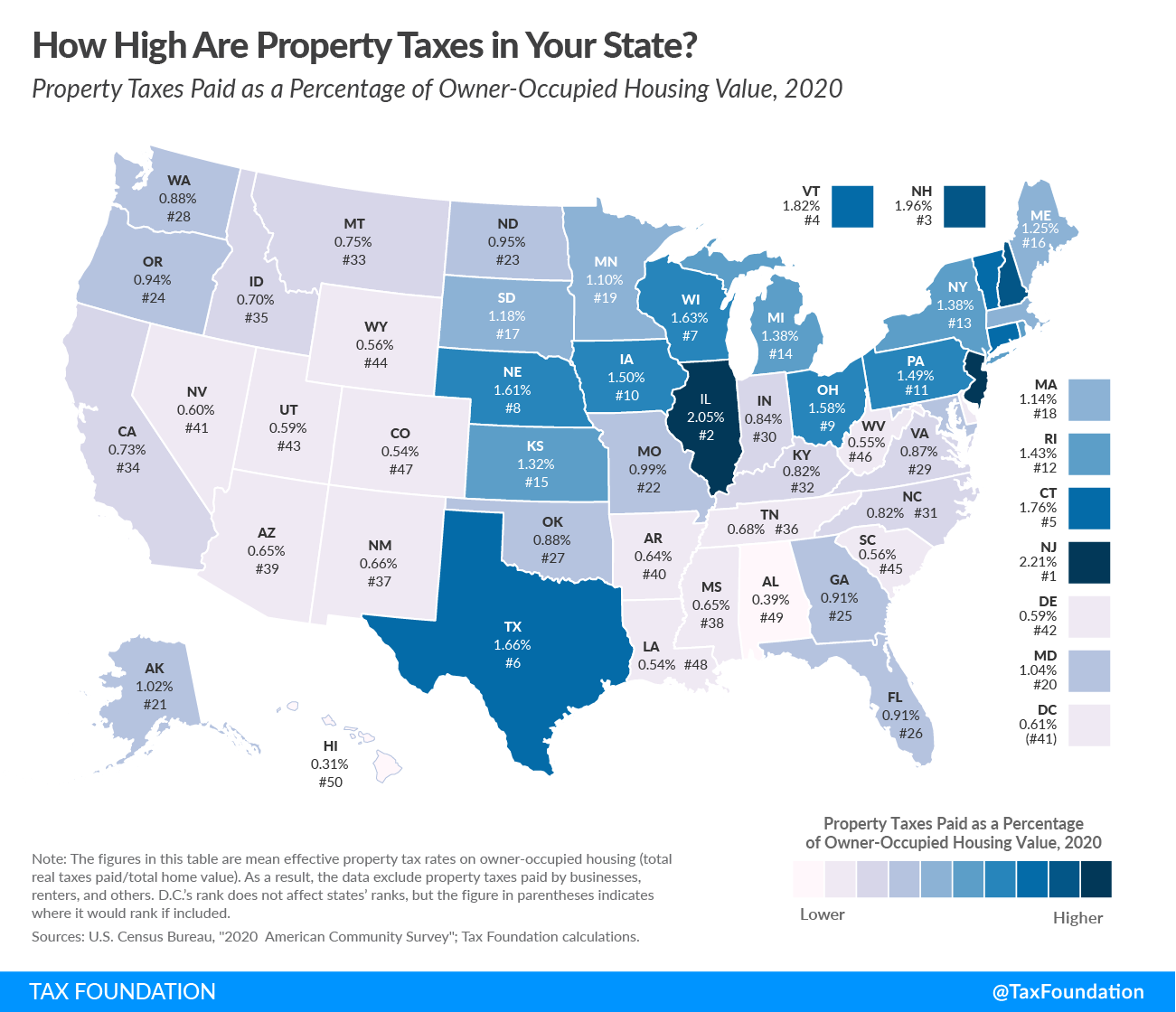

Retirement income tax breaks start at age 55 and increase at age 65 Flat 4 63 income tax rate Average property tax 607 per 100 000 of assessed value 2 States offer property tax breaks to seniors in a variety of ways but the three most common methods are property tax deferral programs circuit breaker programs and homestead exemption or credit programs

Which States Have Property Tax Exemptions For Seniors

Which States Have Property Tax Exemptions For Seniors

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption1.jpg

Understanding Property Tax Exemptions For Seniors In Missouri Sunset R

https://s3.amazonaws.com/gotchastream/images/1840911544/large-the-concept-of-financial-dependence-on-borrowed-funds-mortgage-debts-the-house-will-be-pulled-by.jpg

Guide To Property Tax In Arlington TX 2022 Four 19 Properties

https://cdn.carrot.com/uploads/sites/42864/2022/06/Property-Tax-Exemptions-for-Seniors-and-the-Disabled-People.jpg

More than half of the states now have laws that reduce what older homeowners owe in property taxes New Jersey and Iowa are joining other states that In this article Skip to What is a property tax exemption for seniors How property tax exemptions work How to qualify for a senior tax exemption How to claim

Written by Geoff Williams As a senior citizen you probably will end up paying property taxes for as long as you are a homeowner However depending on the Examples of senior property tax breaks by state To give you a general idea of what s out there here s a list of six states senior property tax relief options Arizona Seniors can get a

Download Which States Have Property Tax Exemptions For Seniors

More picture related to Which States Have Property Tax Exemptions For Seniors

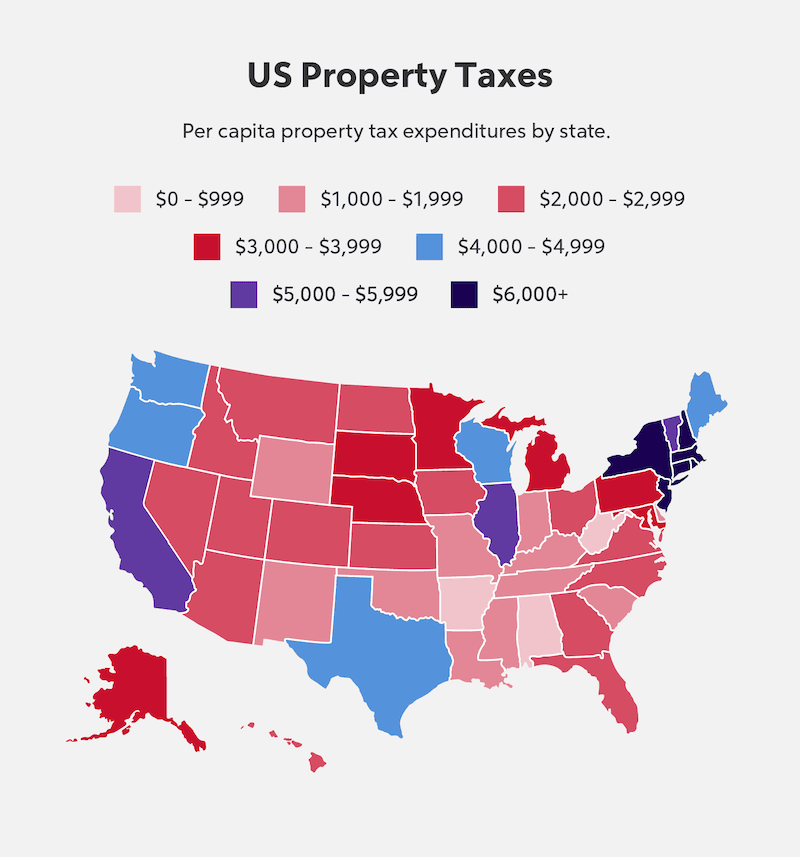

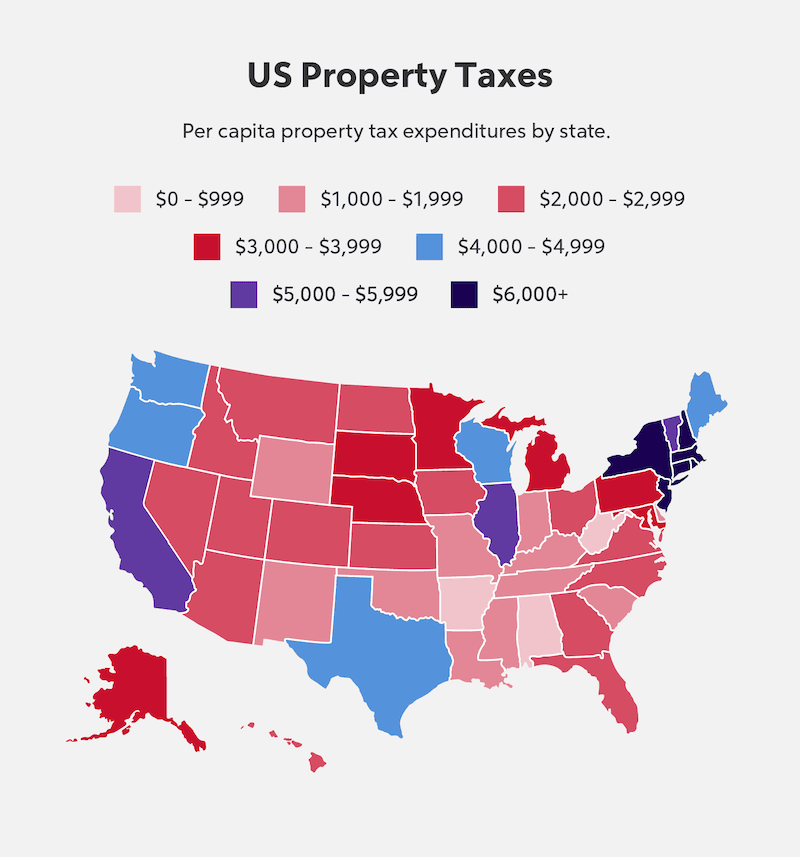

Thinking About Moving These States Have The Lowest Property Taxes

https://s.yimg.com/ny/api/res/1.2/KIn0MJiYkqOV1PvLUtV.RQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MA--/https://media.zenfs.com/en-US/gobankingrates_644/bc13aa3e1c6cbf6964cc8c0a9d0bbfc3

Your Guide To Property Tax Exemptions For Seniors In Texas Dallas

https://www.dallasfortworthseniorliving.com/wp-content/uploads/2020/12/mortgage-fee-2-1237668-640x640-1-500x500.jpg

Qualifying Trusts For Property Tax Homestead Exemption Sprouse

https://www.sprouselaw.com/wp-content/uploads/2022/05/BAC-Tax-Home-Exemption-2022.5.png

States With Property Tax Exemptions for Older People Numerous states and cities give a special nod to older adults when it comes to property taxes but some are more generous than others New York One example of a senior citizen property tax relief program is the Senior Citizen Property Tax Exemption in New York This program provides eligible seniors with a partial

Alabama is the only state with no property taxes for seniors All other states charge senior citizens property taxes However there are some states that offer property tax At a Glance Most states offer disabled Veterans property tax exemptions which can save thousands each year depending on the location and the Veteran s disability rating Within

Property Tax By State From Lowest To Highest Rocket Homes

https://www.rockomni.com/glc/assets/Rocket Homes/ArticleImages/2023 Images/Property Tax By State/Wf-US-Property-Taxes-Infographic-copy.png?im=1&imwidth=2048

Tax Exemptions Know Your Taxes

https://knowyourtaxes.org/wp-content/uploads/2021/04/exemptions-768x858.jpg

https://greatsenioryears.com/states-with-no-property-tax-for-seniors

Property tax exemptions for seniors based on age and income thresholds Alabama Complete property tax exemption for seniors aged 65 and above Alaska Property tax

https://www.seniorliving.org/finance/state-taxes-seniors

Retirement income tax breaks start at age 55 and increase at age 65 Flat 4 63 income tax rate Average property tax 607 per 100 000 of assessed value 2

Texas Property Tax Exemptions For Seniors Lower Your Taxes

Property Tax By State From Lowest To Highest Rocket Homes

Hecht Group Property Tax Exemptions For Seniors

Tax Exemption Form For Veterans ExemptForm

What Is A Property Tax Exemption For Seniors And How To Get One

PropertyTax Exemptions In Jamestown At 37 Percent Higher Than 30

PropertyTax Exemptions In Jamestown At 37 Percent Higher Than 30

Hecht Group Property Tax Exemptions For Seniors

Jefferson County Property Tax Exemption Form ExemptForm

Property Taxes By State County Median Property Tax Bills

Which States Have Property Tax Exemptions For Seniors - More than half of the states now have laws that reduce what older homeowners owe in property taxes New Jersey and Iowa are joining other states that