Who Can Claim Vat Refund In Uk This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can claim a refund of VAT incurred abroad

The VAT refund scheme can be used to reclaim VAT if you re registered as a business outside the UK and bought the goods or services to use in your business HMRC released new guidance for UK and Isle of Man businesses who wish to claim an EU VAT refund as well as for non UK businesses who wish to claim a VAT refund in the UK The guidance moves on to explain how each VAT refund scheme works

Who Can Claim Vat Refund In Uk

Who Can Claim Vat Refund In Uk

https://www.claimcompass.eu/blog/content/images/2020/05/How-to-Claim-a-VAT-Refund.png

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

https://selectitaly.com/blog/wp-content/uploads/2016/03/D_D_Italia-VAT-Refund-1024x677.jpg

All non established companies that need a VAT refund for goods and services purchased in the UK can request their VAT refund under the rules set out by the 13th Directive EU companies claiming back British value added tax for goods and services will have to use a specific form UK businesses can potentially reclaim VAT incurred in the EU since 1 January 2021 The window for reclaiming EU VAT for earlier periods closed on 31 March 2021 Following the end of the transitional period the UK must now use the existing processes for non EU businesses

UK businesses which are not required to register for VAT in the European Union and who have incurred VAT in connection with their activities in an EU country are entitled to deduct that VAT This deduction is made by means of a Can EU citizens claim a VAT refund in the UK 15 Mar 7 56 pm If you are a European Union EU citizen and you re planning on travelling to the UK you may be wondering if you ll need to pay value added tax VAT on the goods you plan on buying there

Download Who Can Claim Vat Refund In Uk

More picture related to Who Can Claim Vat Refund In Uk

Tax Free Refund Guide For Non EU Residents MILAN Welcome City Guide

https://milan.welcomemagazine.it/wp-content/uploads/2018/04/Vat_refund_milan.jpg

Value Added Tax VAT Refund

https://www.triptipedia.com/tip/img/bU3jmlExN.jpg

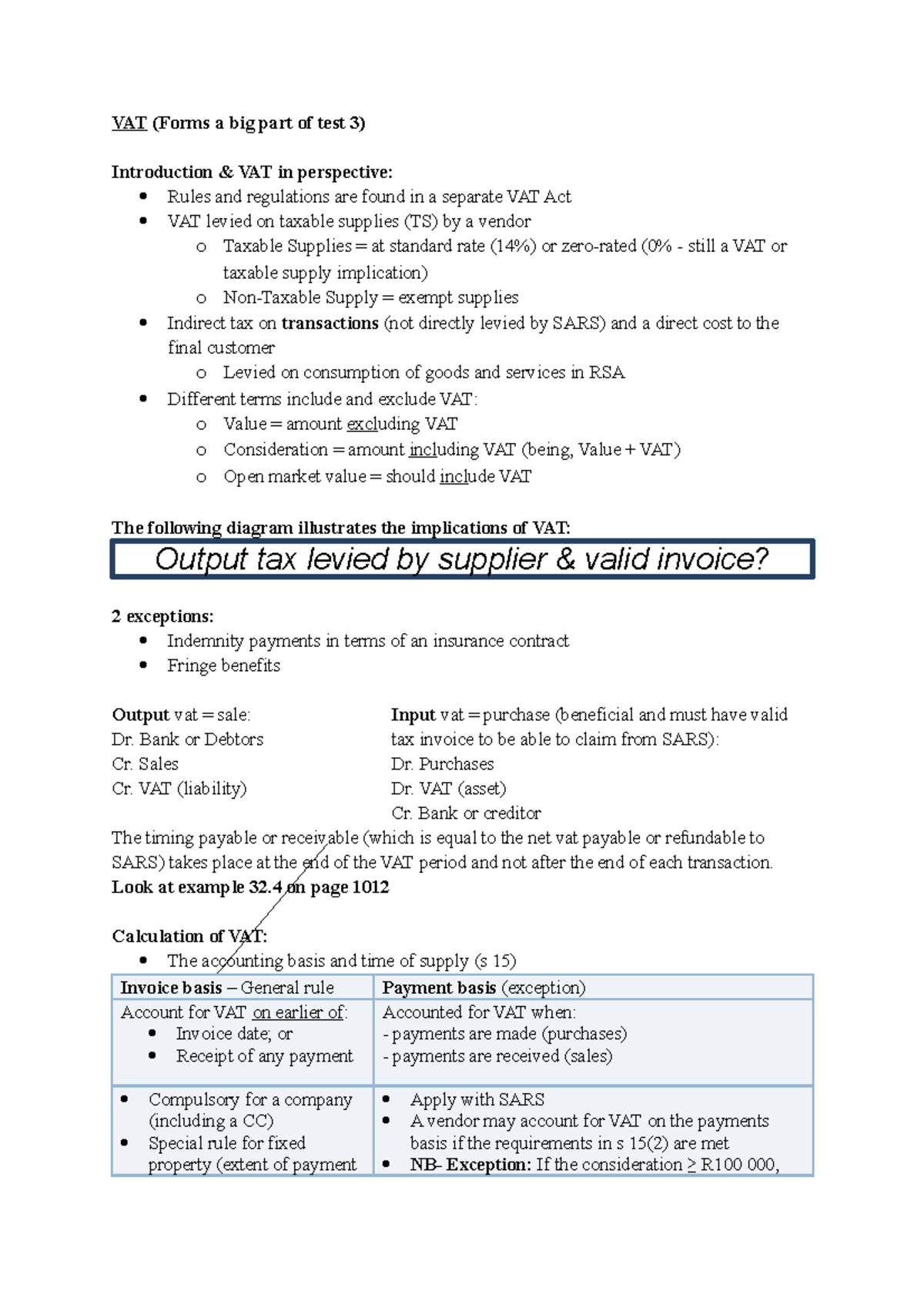

Chapter 32 VAT VAT Forms A Big Part Of Test 3 Introduction VAT

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/56d1c7e8adaa2c40ba44b2f7c004c705/thumb_1200_1698.png

For UK businesses Value Added Tax VAT can be reclaimed on a variety of business related expenses provided that certain conditions are met The general rule is that businesses can claim VAT back on goods or services if they have been used exclusively for business purposes Who can claim back VAT Only VAT registered businesses can claim back VAT Every business with a turnover of 90 000 must register but you can register voluntarily if your turnover is below this level Once registered you ll have to charge VAT on the goods and services you sell but you can also claim it back on the expenses your

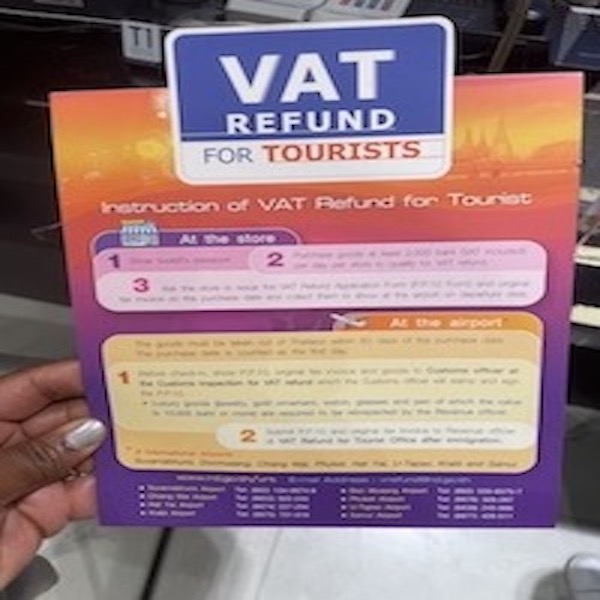

Fortunately HM Revenue and Customs the UK tax man has provided a useful guide for claiming VAT refunds under the VAT Refund Scheme Australian Business Traveller s top tips for the refund process include As a visitor to the EU who is returning home or going on to another non EU country you may be eligible to buy goods free of VAT in special shops Who is a visitor A visitor is any person who permanently or habitually lives in a country outside the EU

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

How To Get A VAT Refund In The UK With An App London Tips Travel

https://i.pinimg.com/736x/c5/28/1c/c5281c867db2558527372a69fc2ab8b4.jpg

https://www.gov.uk/guidance/refunds-of-uk-vat-for...

This notice explains how businesses established outside of the UK can reclaim VAT incurred in the UK It also explains that UK and Isle of Man businesses can claim a refund of VAT incurred abroad

https://www.gov.uk/guidance/vat-refunds-for-non-eu...

The VAT refund scheme can be used to reclaim VAT if you re registered as a business outside the UK and bought the goods or services to use in your business

How To Claim VAT Refund In UAE For Tourists A Comprehensive Guide By

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

How To Claim VAT Refund An EU Guide

How To Claim Your VAT Refund Tax Refund

How To Claim Your VAT Refund In UAE A Guide For Tourists UAE Expatriates

How To Claim Vat Refund In Uk 2023 Updated

How To Claim Vat Refund In Uk 2023 Updated

VAT Refund Claim Guide For Businesses In UAE Ridzeal

Why Businesses Are Allowed To Claim VAT Back Online Accounting Guide

VAT Refund FastVAT

Who Can Claim Vat Refund In Uk - UK businesses which are not required to register for VAT in the European Union and who have incurred VAT in connection with their activities in an EU country are entitled to deduct that VAT This deduction is made by means of a