Who Is An Eligible Dependent For Tax Purposes Canada Line 30400 Amount for an eligible dependant You may be able to claim the amount for an eligible dependant if at any time in the year you supported an eligible dependant

If you re a single parent you may be able to claim one of your children under 18 years of age or one deemed a dependant due to mental or physical impairment Who is an eligible dependent for tax purposes You can claim the dependent tax credit for one of these people Spousal tax credit If your spouse s net income is less than 13 808 the basic personal

Who Is An Eligible Dependent For Tax Purposes Canada

Who Is An Eligible Dependent For Tax Purposes Canada

https://www.taxtips.ca/filing/eligible-dependant-tax-credit.jpg

Should I Claim My College Student As A Dependent

https://media.marketrealist.com/brand-img/vQ8aqfcRK/2160x1131/income-tax-g1f627ca891280-1646796165352.jpg

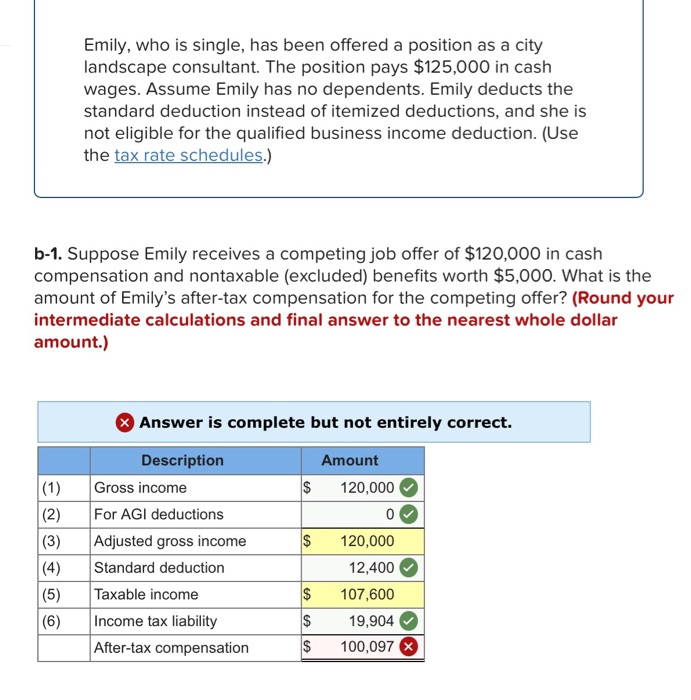

Solved Emily Who Is Single Has Been Offered A Position As Chegg

https://media.cheggcdn.com/study/10b/10bce9a6-e304-4c0f-b33e-0cf217ccb57b/image.png

The definition of dependant for this credit is different than for the Eligible Dependant Amount credit In this case the dependant must be Your child grandchild Can you claim an amount for an eligible dependant Were you single divorced separated or widowed and supporting a dependant who lived with you in a home that you

You supported a dependant in 2023 and You lived with the dependant in most cases in Canada in a home you maintained You can t claim this amount for a person that only Claim the eligible dependant credit to reduce your taxable income and save money on taxes Learn who can claim this credit what types of dependants are eligible

Download Who Is An Eligible Dependent For Tax Purposes Canada

More picture related to Who Is An Eligible Dependent For Tax Purposes Canada

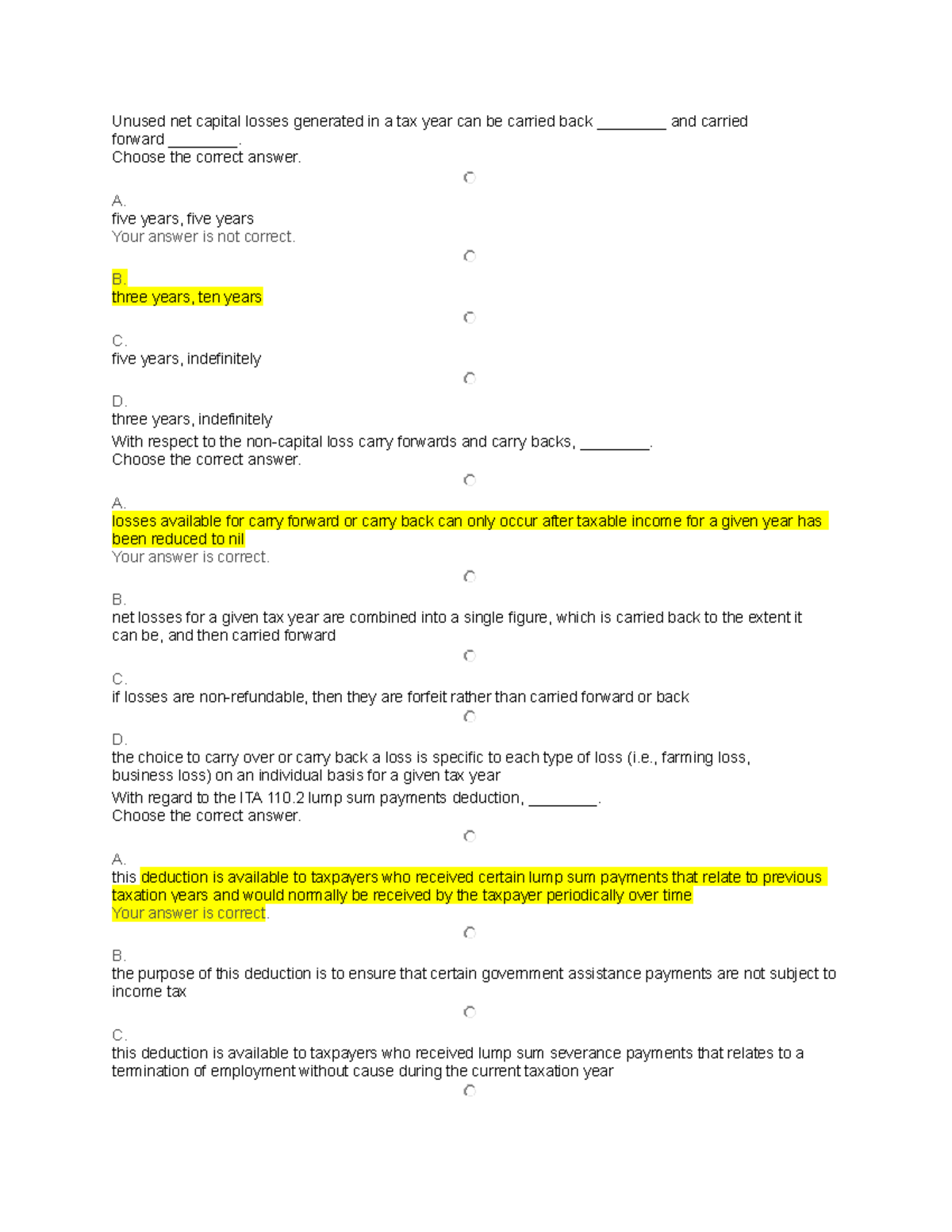

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

How To File Taxes For An LLC With No Income Step By Step Business

https://stepbystepbusiness.com/wp-content/uploads/2021/11/How-to-File-Taxes-for-an-LLC-with-No-Income-1-1024x612.jpg

What Is An Eligible Dependent YouTube

https://i.ytimg.com/vi/a6ZhZqM-gpM/maxresdefault.jpg

If your child is over 18 and has a disability or infirmity you can either claim the amount for an eligible dependant if you re single or the caregiver amount if you re An individual may claim under certain circumstances the amount for an eligible dependant equivalent to spouse tax credit for a dependent child or other

Most Canadians know that spouses and children qualify as dependants with the CRA Canada Revenue Agency Did you know however that under certain Eligible dependant with an impairment in physical or mental functions If the eligible dependant is and dependent on you because of an impairment in physical or mental

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Claiming Dependents On Taxes In Canada Who Is Eligible

https://www.olympiabenefits.com/hubfs/Vega/Blog Pages/Tax/Claiming dependents on taxes in Canada.png

https://www.canada.ca/.../line-30400-amount-eligible-dependant.html

Line 30400 Amount for an eligible dependant You may be able to claim the amount for an eligible dependant if at any time in the year you supported an eligible dependant

https://turbotax.intuit.ca/tips/who-are-considered-dependants-5145

If you re a single parent you may be able to claim one of your children under 18 years of age or one deemed a dependant due to mental or physical impairment

Are You A Tax Resident Of Canada Personal Tax Advisors

2022 Education Tax Credits Are You Eligible

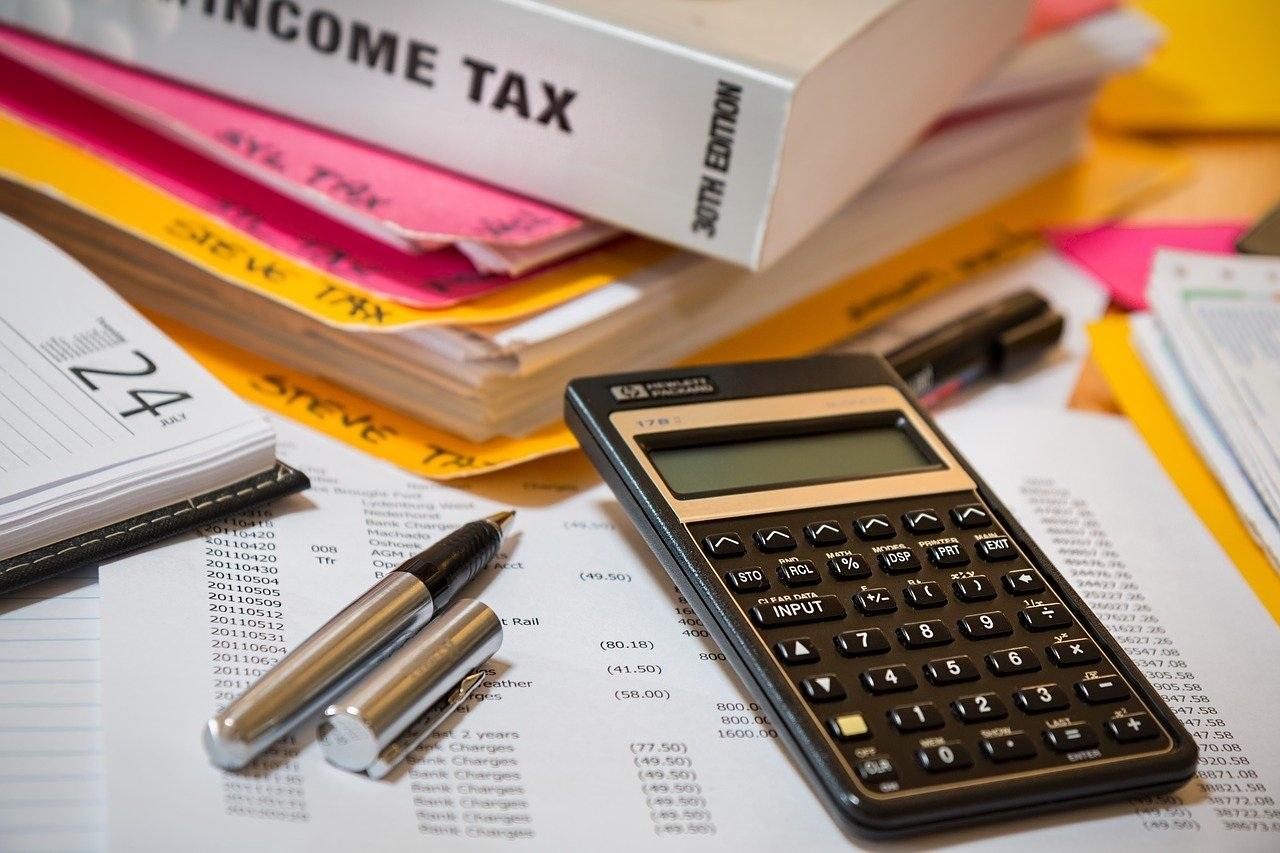

Tax Return Time

Tax Services Business

Is Taking Home Loan A Good Idea For Tax Exemption Leia Aqui Is It

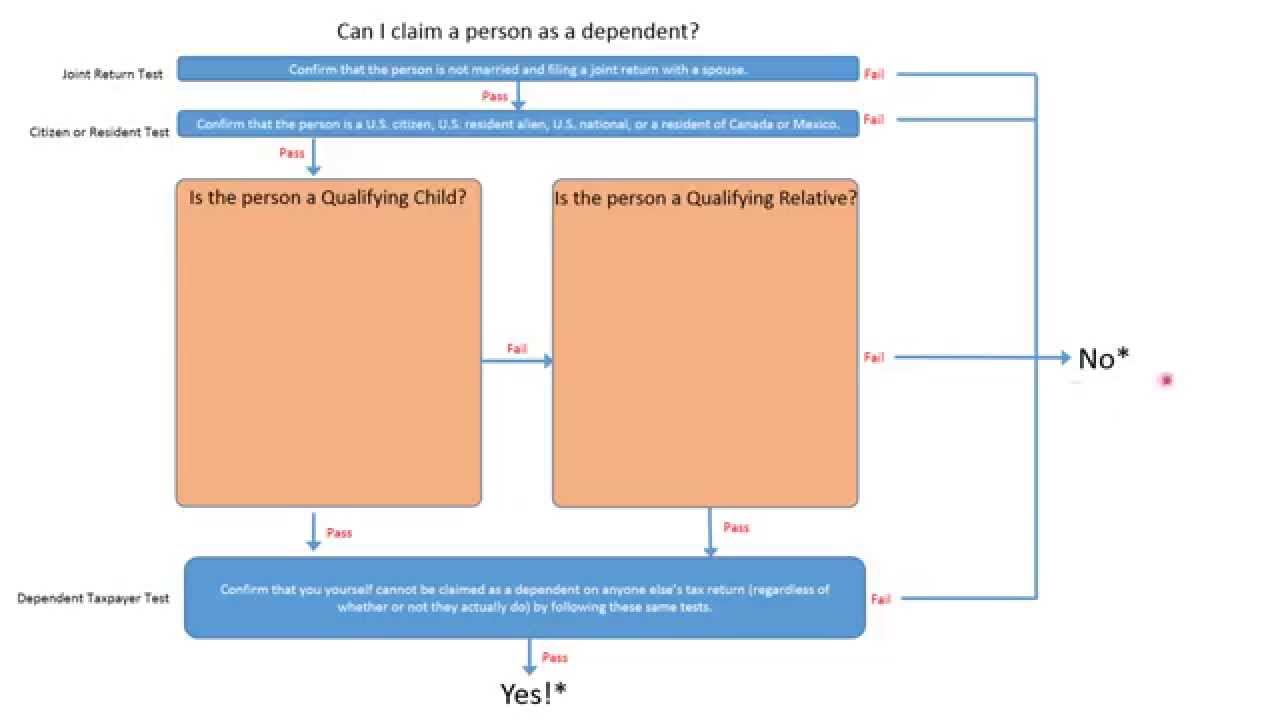

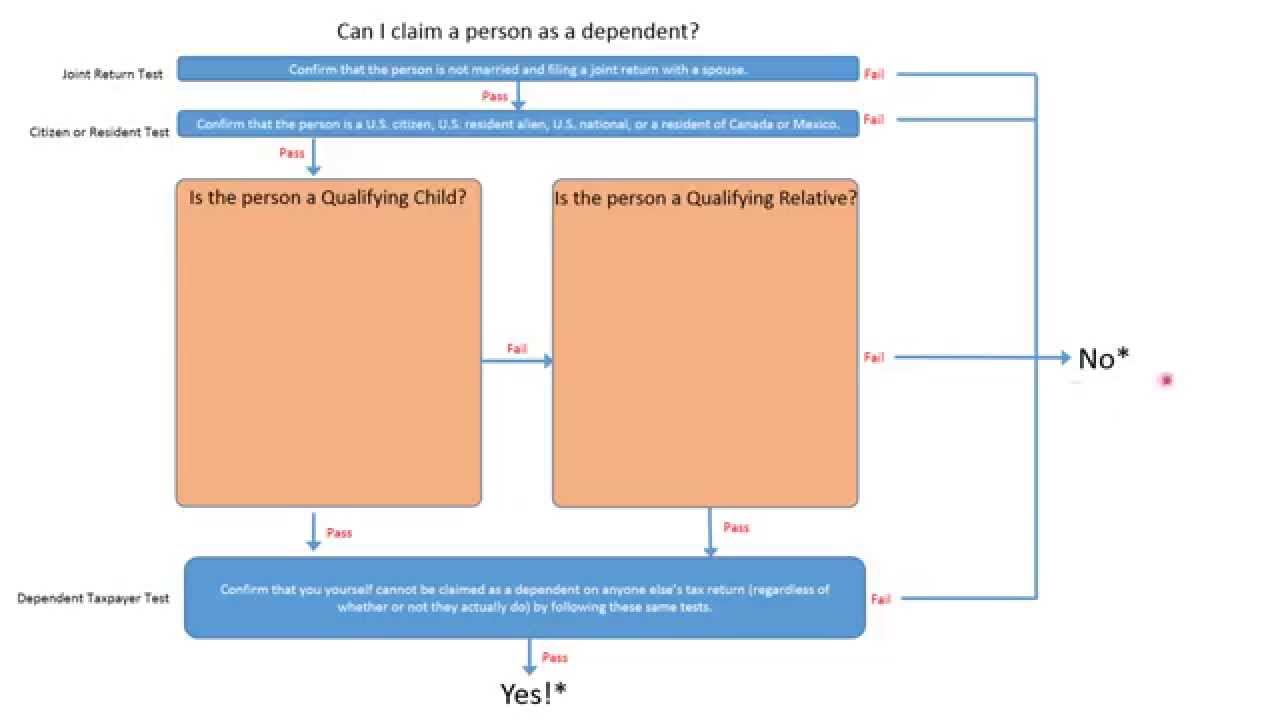

Who Can I Claim As A Dependent On My Tax Return A Flow Chart YouTube

Who Can I Claim As A Dependent On My Tax Return A Flow Chart YouTube

How To Find Your Transaction History On Binance For Taxes Moment Of

Tax Both Dependant Parent Head Of Household

Can I Claim My Girlfriend Or Boyfriend As A Dependent Me As A

Who Is An Eligible Dependent For Tax Purposes Canada - Claiming eligible deductions for Having a Dependent is one of the tax credits offered by the Canada Revenue Agency CRA which allows Canadian taxpayers to lower their taxes