Who Is Considered A Non Resident Of Canada For Tax Purposes You may be considered a deemed non resident of Canada if you have residential ties in a country that Canada has a tax treaty with and you are considered to be a resident of that

This guide is for you if you were a non resident of Canada or a deemed non resident of Canada for all of 2023 Generally you were a non resident of Canada in 2023 if you You ll generally be considered an emigrant for income tax purposes that is a non resident if you fulfill both of the following conditions You leave Canada to live

Who Is Considered A Non Resident Of Canada For Tax Purposes

Who Is Considered A Non Resident Of Canada For Tax Purposes

https://cardinalpointwealth.com/wp-content/uploads/2022/02/iStock-1270111816.jpg

Departure Tax Becoming A Non Resident Of Canada Spectrum Lawyers

https://spectrumlawyers.ca/wp-content/uploads/2020/11/post-banner-new-02-768x261.jpg

I Am A Non Resident And I Own A Rental Property In Canada Grant

http://grantcga.com/wp-content/uploads/2019/01/non-resident-rax-1024x640.jpg

If you are a deemed resident of Canada and also establish residential ties in a country with which Canada has a tax treaty and that you are considered to be a resident of that You may be a deemed non resident of Canada for tax purposes if you were a resident of Canada in the year and under a tax treaty you were considered to be a resident of

An individual who is resident in Canada during a tax year is subject to Canadian income tax on his or her worldwide income from all sources Generally a non resident individual is To evaluate if you re a Canadian resident or not for tax purposes the CRA considers your Canadian residential ties including Owning or leasing a home in Canada for a long term A spouse or

Download Who Is Considered A Non Resident Of Canada For Tax Purposes

More picture related to Who Is Considered A Non Resident Of Canada For Tax Purposes

Tax Residency Factors That Decide Weather You Are A Resident Or

https://www.rkbaccounting.ca/wp-content/uploads/2022/01/resident-of-Canada.jpg

Tax Residency Factors That Decide Weather You Are A Resident Or

https://www.rkbaccounting.ca/wp-content/uploads/2022/01/resident-of-Canada-2-1024x445.jpg

Tax Obligations As A Non Resident Of Canada

https://www.nbgcpa.ca/wp-content/uploads/2022/07/Non-resident-taxes-1024x683.jpg

Deemed non residents and maybe dual citizens could be deemed or factual residents of Canada who have established residential ties with another You are responsible for deducting and remitting non resident tax if you are a Canadian resident who pays or credits certain types of income to a non resident of Canada an

Non resident of Canada An individual who does not meet the criteria to be considered a tax resident of Canada Non residents are generally taxed only on income earned from Individuals are considered residents of Canada for tax purposes when they live and have enough residential ties in Canada An individual is generally considered a resident for

Who Is Non Residents In India SC Bhagat Co

https://scbc.co/blog/wp-content/uploads/2021/09/Gradient106-750x420.png

Who Is A Non resident Indian

https://www.welcomenri.com/NRIs_Planning_FAQs/img/non-resident.jpg

https://www.canada.ca/en/revenue-agency/services...

You may be considered a deemed non resident of Canada if you have residential ties in a country that Canada has a tax treaty with and you are considered to be a resident of that

https://www.canada.ca/en/revenue-agency/services/...

This guide is for you if you were a non resident of Canada or a deemed non resident of Canada for all of 2023 Generally you were a non resident of Canada in 2023 if you

Common USA Tax Forms Explained How To Enter Them On Your Canadian Tax

Who Is Non Residents In India SC Bhagat Co

Are You A Tax Resident Of Canada Personal Tax Advisors

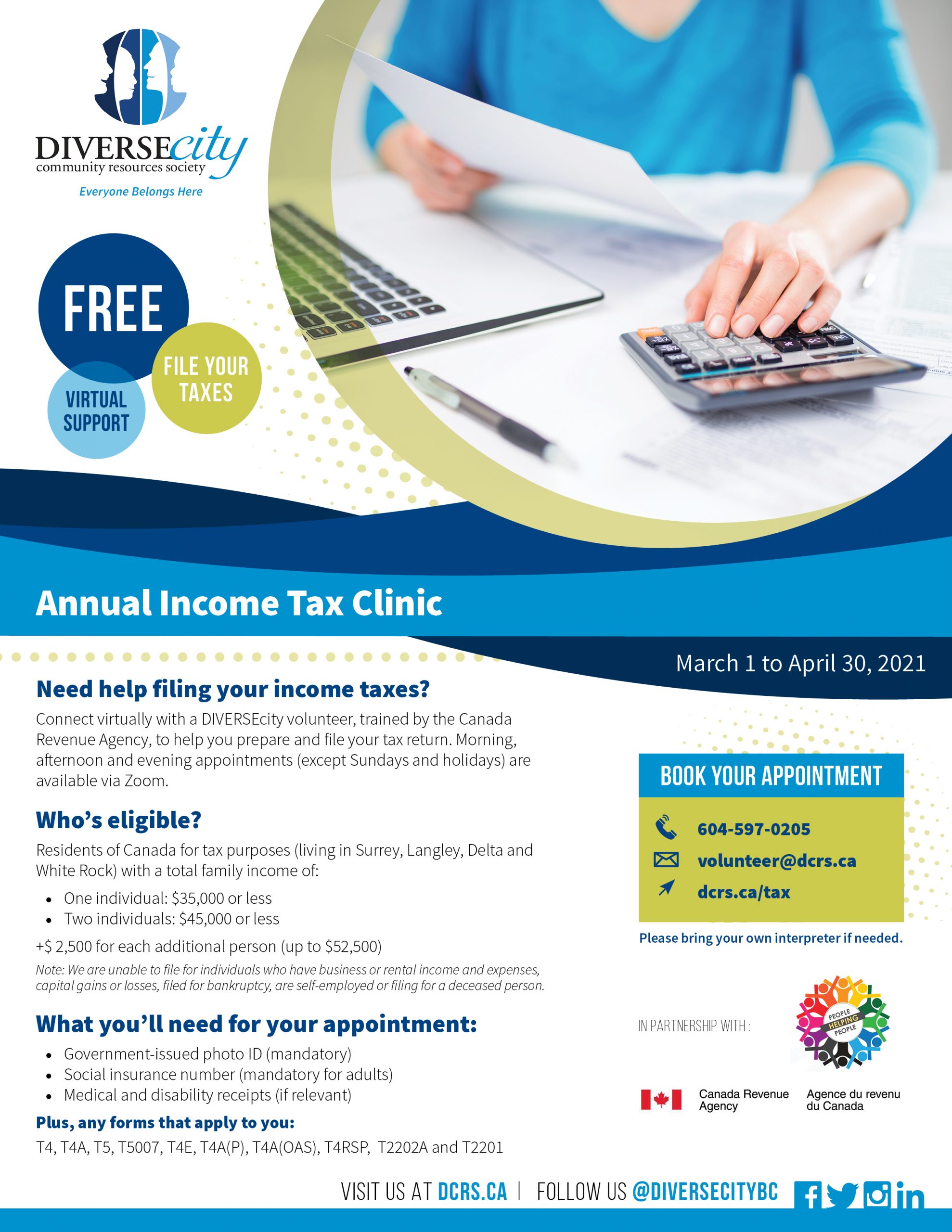

Annual Income Tax Clinic DIVERSEcity Community Resources Society

Taxes For Canadian Non Residents The Ultimate Guide

Ministry Of Finance Announces Cabinet Decision On Determination Of Non

Ministry Of Finance Announces Cabinet Decision On Determination Of Non

Non Resident Withholding Tax RKB Accounting Tax Services

Non Resident Withholding Tax In Canada

Non Resident Taxes Canada Property Management In Toronto

Who Is Considered A Non Resident Of Canada For Tax Purposes - If you are a deemed resident of Canada and also establish residential ties in a country with which Canada has a tax treaty and that you are considered to be a resident of that