Who Is Eligible For Home Heating Credit Verkko You may qualify for a home heating credit if all of the following apply You own or were contracted to pay rent and occupied a Michigan homestead You were NOT a full time student who was claimed as a dependent on another person s return You did NOT live in college or university operated housing for the entire year

Verkko 23 maalisk 2023 nbsp 0183 32 Household energy Collection Find energy grants for your home Help to Heat Find out if your property is eligible for Help to Heat funding From Department for Energy Security and Net Verkko Energy gov Who can claim the home energy credits The home energy credits are designed to be of most benefit to residents who make improvements or upgrades to the homes they live in but each has slightly different

Who Is Eligible For Home Heating Credit

.jpg)

Who Is Eligible For Home Heating Credit

https://www.nmcaa.net/media/news37/nmcaa-home-heating-credit-ad-n-express-(5-1-3-98-in).jpg

Home Heating Credit Heintzelman Accounting Services

https://hasgr.com/wp-content/uploads/2021/10/Home-Heating-Credit-Blog-1080x675.png

Gov Whitmer Announces More Than 178 600 Michigan Households Are

https://theflintcouriernews.com/wp-content/uploads/2021/09/home-heating-credit-3.jpg

Verkko 15 jouluk 2023 nbsp 0183 32 Who is eligible to claim the credits and how much can they lower your tax burden What is a tax credit A tax credit according to the IRS is a dollar for dollar amount taxpayers claim Verkko 28 elok 2023 nbsp 0183 32 Who Qualifies You may claim the residential clean energy credit for improvements to your main home whether you own or rent it Your main home is generally where you live most of the time The credit applies to new or existing homes located in the United States

Verkko 22 jouluk 2022 nbsp 0183 32 The rules vary by credit Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or renovation of an existing home and not for a newly constructed home Verkko A home heating credit is a financial assistance program designed to help eligible individuals and families with their heating costs during the colder months It s like a warm hug for your wallet Now you might be wondering how this credit works

Download Who Is Eligible For Home Heating Credit

More picture related to Who Is Eligible For Home Heating Credit

The Home Heating Credit Is Available Now Metro Community

https://metrocommunitydevelopment.com/wp-content/uploads/2022/09/p71LFtAo.png

Home Heating Credit For Michigan Homeowners Renters Apply By

https://www.caajlh.org/wp-content/uploads/2022/09/Home-Heating-Credit-Couple.jpg

Home Heating Credit Form 2022 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/95/11095777/large.png

Verkko 4 toukok 2023 nbsp 0183 32 Taxpayers who make energy improvements to a residence may be eligible for expanded home energy tax credits What taxpayers need to know Taxpayers can claim the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit for the year the qualifying expenditures are made Verkko 25 maalisk 2019 nbsp 0183 32 A person who is a full time student at a school community college or college or university and who is claimed as a dependent by another person is NOT eligible to claim the home heating credit MCL 206 527a 11 A claimant has to calculate the Total Household Resources available on MI 1040CR 7 which includes

Verkko 9 tammik 2024 nbsp 0183 32 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on Verkko What home improvements are eligible for the Energy Efficient Home Improvement Credit and how much is the credit added December 22 2022 A1 The following energy efficient home improvements are eligible for the Energy Efficient Home Improvement Credit

288 000 Michigan Residents To Receive Additional Home Heating Credit

https://misoap.org/wp-content/uploads/sites/5/2019/09/cash-collection-currency-47344-800x566.jpg

Michigan Residents Can Now Apply For Home Heating Credit 95 3 MNC

https://www.953mnc.com/wp-content/uploads/2021/03/Michigan-Department-of-Treasury-2048x1025.jpg

.jpg?w=186)

https://www.michigan.gov/taxes/questions/iit/accordion/heating/home...

Verkko You may qualify for a home heating credit if all of the following apply You own or were contracted to pay rent and occupied a Michigan homestead You were NOT a full time student who was claimed as a dependent on another person s return You did NOT live in college or university operated housing for the entire year

https://www.gov.uk/.../find-energy-grants-for-you-home-help-to-heat

Verkko 23 maalisk 2023 nbsp 0183 32 Household energy Collection Find energy grants for your home Help to Heat Find out if your property is eligible for Help to Heat funding From Department for Energy Security and Net

Home Heating Credit Information Pocketsense

288 000 Michigan Residents To Receive Additional Home Heating Credit

See If You Qualify For Michigan s Home Heating Credit

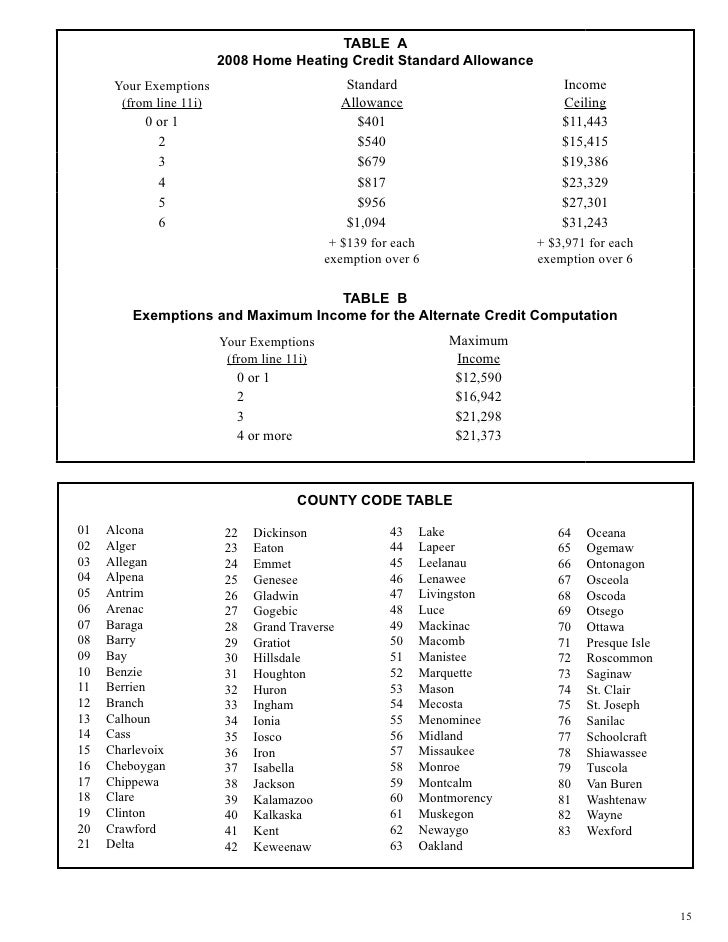

Home Heating Credit Claim Instruction Book

Home Heating Credit Claim Instruction Book

High Heating Bills Apply For The Home Heating Credit Metro Community

High Heating Bills Apply For The Home Heating Credit Metro Community

Fillable Online Printable 2020 Michigan Form 4976 Home Heating Credit

Home Heating Credit Claim Instruction Book

MI 1040CR 7 Michigan Home Heating Credit Claim 2019 CEDAM

Who Is Eligible For Home Heating Credit - Verkko 15 jouluk 2023 nbsp 0183 32 Who is eligible to claim the credits and how much can they lower your tax burden What is a tax credit A tax credit according to the IRS is a dollar for dollar amount taxpayers claim