Who Is Eligible For Homestead Exemption In Illinois Web Vor einem Tag nbsp 0183 32 The homeowner s exemption is available only for your primary residence A primary residence can be a Single family home Condominium or Co op Once you receive the homeowner s exemption you should automatically receive this exemption on your tax bill in future tax years Senior citizen homestead exemptions

Web 5 Sept 2019 nbsp 0183 32 Under the Illinois homestead exemption a homeowner can exempt up to 15 000 of equity in their property provided that it is suitably covered by the exemption For married couples filing bankruptcy jointly it is possible to double the exemption amount and protect up to 30 000 of equity in a home Web 5 Aug 2020 nbsp 0183 32 Homeowners who are 65 or older with total household income of 65 000 or less and who meet other qualifications may be eligible for the Senior Citizens Assessment Freeze Homestead Exemption The year a senior qualifies for this exemption their home s assessed value is frozen and will not increase as long as the homeowner

Who Is Eligible For Homestead Exemption In Illinois

Who Is Eligible For Homestead Exemption In Illinois

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

https://res.cloudinary.com/agiliti/image/upload/v1669104038/texas-homestead-exemption-form-section-1.webp

Web In Illinois homestead exemptions are typically subtracted from a property s value called the equalized assessed value EAV before the tax bill is calculated 5 The first homestead exemptions the Senior Citizens Homestead Exemption Homestead Improvement Exemption and General Web 9 Feb 2012 nbsp 0183 32 Writer Bio Illinois has general and group specific property tax homestead exemptions such as seniors disabled individuals and veterans that work to reduce your overall yearly property tax bill Another homestead exemption may also protect your home during either Chapter 7 or Chapter 13 bankruptcy

Web 18 Jan 2022 nbsp 0183 32 The Illinois homestead exemption allows homeowners to exempt up to 15 000 of equity 30 000 for married couples from collection attempts from creditors potentially preventing the seizure foreclosure and sale of their home The Illinois Homestead Exemption Web Following the Illinois Property Tax Code this exemption lowers the equalized assessed value of the property by 8 000 These changes will be reflective for 2023 payable in 2024 Qualifications Property ownership and primary residency on the property as of January 1 st of the tax year seeking the exemption Only one property can receive this exemption

Download Who Is Eligible For Homestead Exemption In Illinois

More picture related to Who Is Eligible For Homestead Exemption In Illinois

Bought A Home In Florida In 2021 File For Your Homestead Exemption By

https://sandbergteam.com/wp-content/uploads/2022/01/Homestead-Exemption-Header-2022-1024x630.png

What Is A Homestead Exemption And Do You Qualify WalletGenius

https://cdn2.system1.com/eyJidWNrZXQiOiJvbS1wdWItc3RvcmFnZSIsImtleSI6IndhbGxldGdlbml1cy93cC1jb250ZW50L3VwbG9hZHMvMjAyMS8xMi9zaHV0dGVyc3RvY2tfMjAzNjk2OTAwMy5qcGciLCJlZGl0cyI6eyJ3ZWJwIjp7InF1YWxpdHkiOjQwfX19

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Web 19 Feb 2019 nbsp 0183 32 In order to apply the homestead exemption you must meet residency requirements i e you must have lived in the property as a home for a certain amount of time and be the legal owner of the property with your name listed on the deed Web 20 Juni 2016 nbsp 0183 32 Illinois homestead laws allow people to claim as much as 15 000 worth of property or 30 000 if jointly owned as a homestead Illinois Homestead Statutes Unlike laws in many other states Florida homestead laws don t state a maximum acreage that may be designated Indeed with Florida s homestead exemption you can protect the

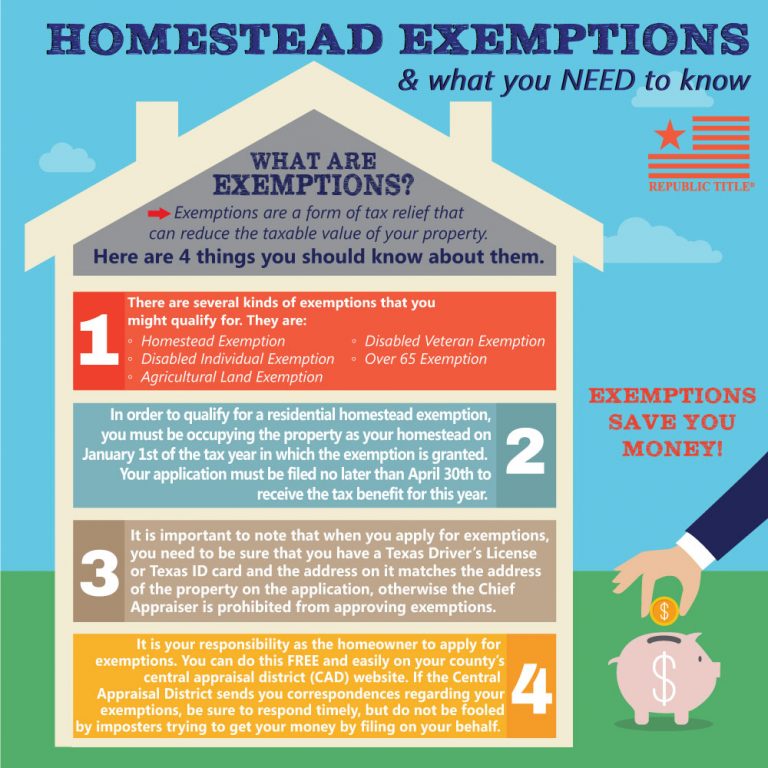

Web 6 Dez 2021 nbsp 0183 32 Not everyone is eligible for a homestead tax exemption in some states only certain people qualify like senior citizens surviving spouses of veterans or people with a disability Some states don t offer a homestead tax exemption at all though similar property tax credits may exist Web 9 Dez 2023 nbsp 0183 32 Understand how this exemption can reduce your property tax burden learn about the eligibility criteria and the straightforward process to apply Discover the different exemption types available including those for general homeowners seniors veterans and persons with disabilities

Homestead Reminder Shayla Twit

https://www.sarasotarealestatesold.com/wp-content/uploads/2021/12/GaY66es9TaScia2JjL6t_DONT-Forget.png

What Is The Illinois Homestead Exemption DebtStoppers

https://www.debtstoppers.com/wp-content/themes/debtstoppers-atlanta-012015/img/what-is-the-homestead-exemption.jpg

https://www.illinoislegalaid.org/legal-information/what-property-tax...

Web Vor einem Tag nbsp 0183 32 The homeowner s exemption is available only for your primary residence A primary residence can be a Single family home Condominium or Co op Once you receive the homeowner s exemption you should automatically receive this exemption on your tax bill in future tax years Senior citizen homestead exemptions

https://www.gundersonfirm.com/illinois-homestead-exemption-faqs

Web 5 Sept 2019 nbsp 0183 32 Under the Illinois homestead exemption a homeowner can exempt up to 15 000 of equity in their property provided that it is suitably covered by the exemption For married couples filing bankruptcy jointly it is possible to double the exemption amount and protect up to 30 000 of equity in a home

Homestead Exemption Information

Homestead Reminder Shayla Twit

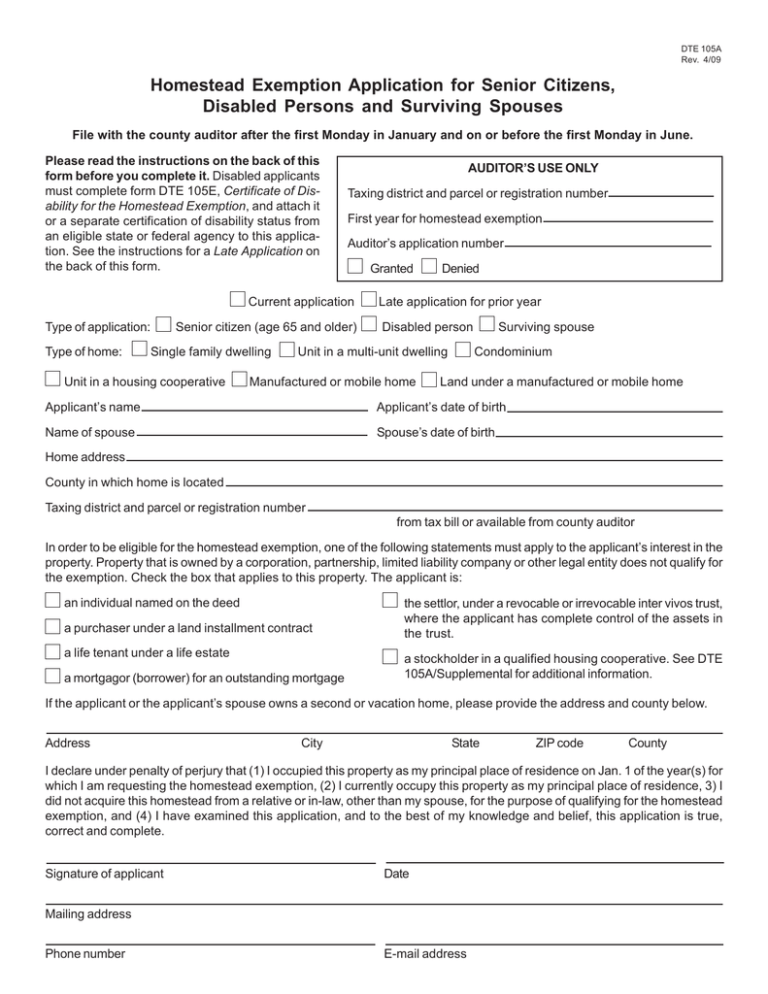

Homestead Exemption Application For Senior Citizens Disabled Persons

Florida Homestead Exemption Application Guide Who Is Eligible

How To File For Homestead Exemption In Florida

Texas Homestead Tax Exemption

Texas Homestead Tax Exemption

Homestead Exemption Mojgan JJ Panah

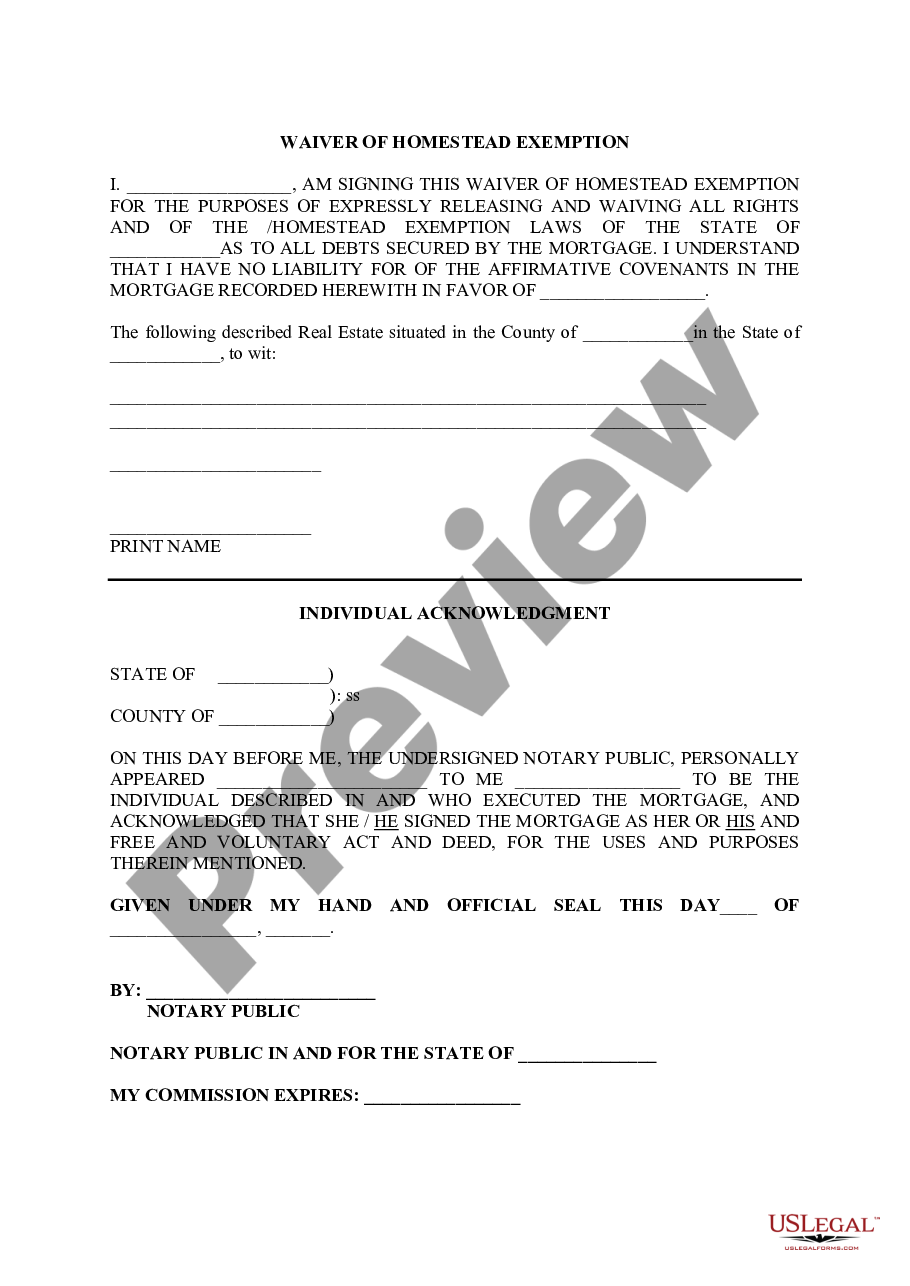

Joliet Illinois Waiver Of Homestead Exemption US Legal Forms

How To File Homestead Exemption Denton County YouTube

Who Is Eligible For Homestead Exemption In Illinois - Web In Illinois homestead exemptions are typically subtracted from a property s value called the equalized assessed value EAV before the tax bill is calculated 5 The first homestead exemptions the Senior Citizens Homestead Exemption Homestead Improvement Exemption and General