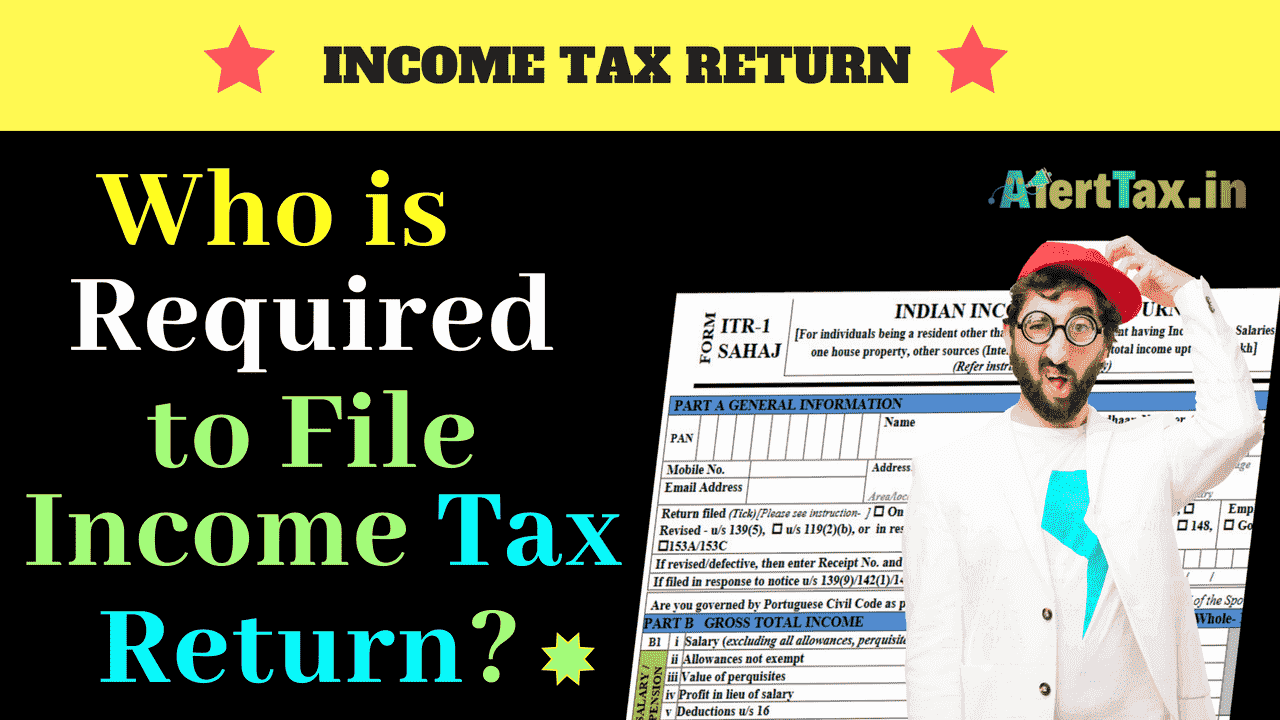

Who Is Eligible For Income Tax Return Who is exempted from filing ITR If they fulfill certain requirements outlined in the Income Tax Act of 1961 super elderly persons 75 years of age and above will no longer be

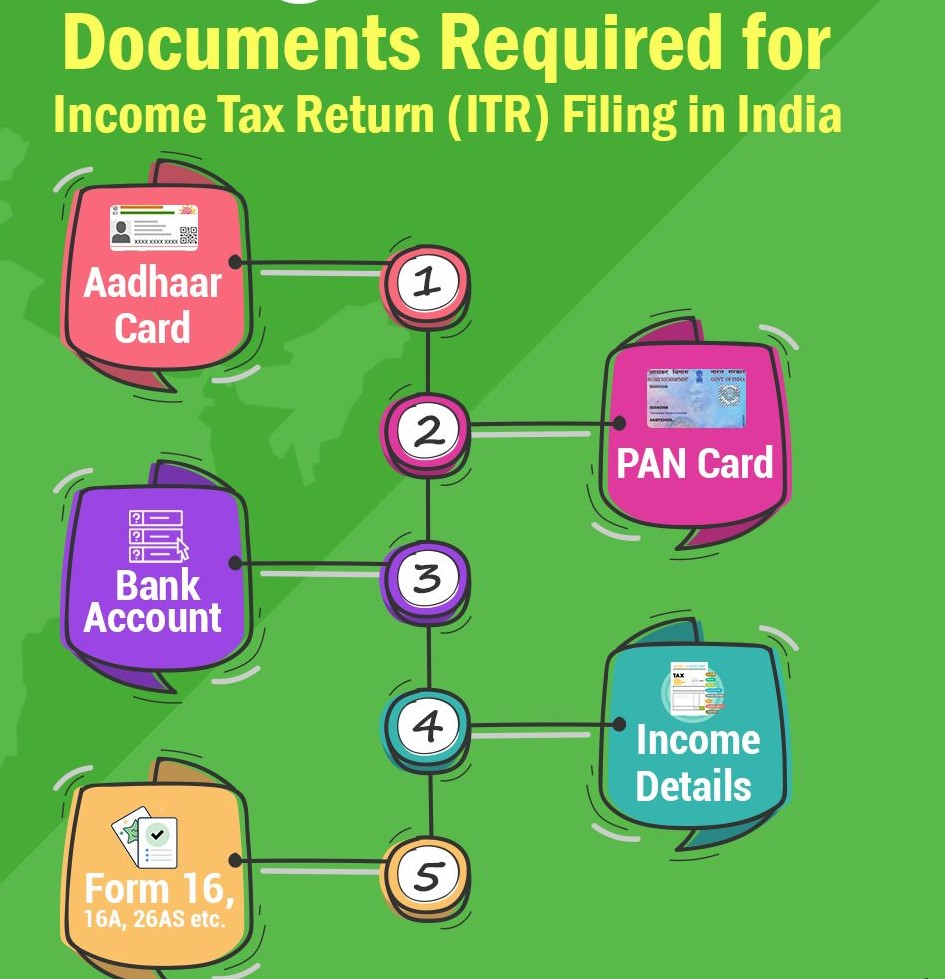

Income tax eligibility refers to the criteria determine whether an individual is liable to file Income Tax Return In India individuals Hindu Undivided Families HUFs and other entities are As per the Income Tax Act of India individuals are required to file an ITR only if their annual income exceeds the basic exemption limit However there are certain conditions

Who Is Eligible For Income Tax Return

Who Is Eligible For Income Tax Return

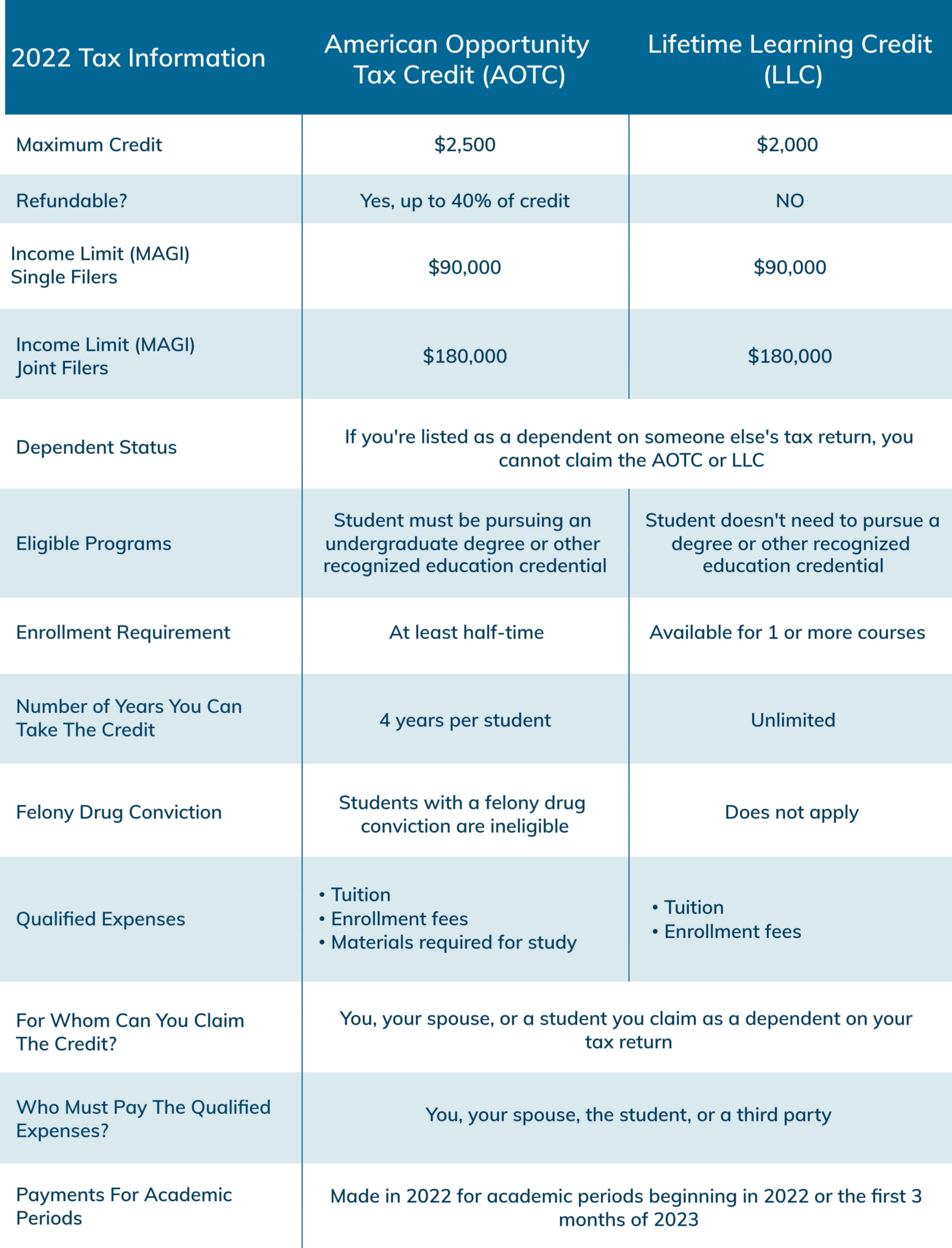

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

ITR Income Tax Return E verification To Complete Filing Process All

https://static.tnn.in/thumb/msid-93580108,imgsize-100,width-1280,height-720,resizemode-75/93580108.jpg

ITR Filing Do Not Claim Fake Deductions Lessons For ITR Refund 2023

https://mnpartners.in/media/posts/175/Income-Tax-Notice-India-2.jpg

If you re under 18 years old a minor special rules apply to income you earn and you may pay tax at a higher rate Income Tax Return ITR is a form in which the taxpayers file information about their income earned and tax applicable to the income tax department The department has

ITR 4 is the Income Tax Return form for taxpayers who opt for a presumptive income scheme under Section 44AD Section 44ADA and Section 44AE of the Income tax Act 1961 However if the turnover of the business Who should file a tax return including tax obligations for Canadian residents newcomers non residents and deemed residents those who live outside of Canada temporarily and how to file

Download Who Is Eligible For Income Tax Return

More picture related to Who Is Eligible For Income Tax Return

Income Tax Return Changes For 2017 And Benefits To Salaried And Business

https://2.bp.blogspot.com/-Yta7KbnGdS0/V5GOdQmvnpI/AAAAAAAALQA/UCyC1y5G0dQAUjGanNF4rFdtEuNuzx9bwCLcB/s1600/IncomeTaxReturn-uptra.png

State Individual Income Tax Rates And Brackets Tax Foundation

https://files.taxfoundation.org/20210216163839/2021-state-income-tax-rates.-2021-state-individual-income-tax-rates.-States-with-no-income-tax.-2021-top-state-marginal-individual-income-tax-rates.png

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/income-tax-filing-form-number.jpg

Tax returns for low income trusts that cease in the 2024 to 2025 tax year The March 2024 Trusts and Estates Newsletter described the introduction of a tax free de Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to

Federal programs Old Age Security OAS Guaranteed Income Supplement GIS and Spouse s AllowanceIf you are age 65 or older and have lived in Canada for 10 or more Not all salaried individuals can file their tax returns using ITR 1 form If one had conducted certain transactions in FY 2022 23 AY 2023 24 they might be ineligible to use

ABC Of Tax Lets Learn The Basics Everything About E filing Made Easier

https://www.gconnect.in/gc22/wp-content/uploads/2022/07/e-filing-income-tax-return-1067x800.jpg

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjgH5E3CzzJ-EczNDbw-wI_pL5VZC0SNmhsDQowAPaGKZ6vduNsvxSJgeHlrZQtukMAJ5XecqFbniw9tA-_vkdXcMzNSddLdSt_vXTyfHJpqrXqGUqYaoF0gOS4P268HUqM2FEsnkUirI00ycY1vH7KW4JJO-KNdRmEld1-DcyaNNeA0HqXHo7AIBxH-w/s950/income tax return due date 2023-24 (1).png

https://www.livemint.com/money/personal-finance/...

Who is exempted from filing ITR If they fulfill certain requirements outlined in the Income Tax Act of 1961 super elderly persons 75 years of age and above will no longer be

https://tax2win.in/tax-tools/itr-eligibility-checker

Income tax eligibility refers to the criteria determine whether an individual is liable to file Income Tax Return In India individuals Hindu Undivided Families HUFs and other entities are

ITR Filing Due Dates For Financial Year 2022 23

ABC Of Tax Lets Learn The Basics Everything About E filing Made Easier

Who Should File Income Tax Return A Y 2023 24

Income Tax Statement Form 2 Free Templates In PDF Word Excel Download

Last minute Income Tax Saving Options Ebizfiling

CBDT Notifies ITR Forms And Income Tax Return Acknowledgement For AY

CBDT Notifies ITR Forms And Income Tax Return Acknowledgement For AY

Online File Income Tax Returns Rajput Jain Associates

Find Your WHY 2 Easy Ways To Discover Your Life s Purpose

6 Benefits Of Tax Return Services Melbourne Registered Tax Agent

Who Is Eligible For Income Tax Return - ITR 4 is the Income Tax Return form for taxpayers who opt for a presumptive income scheme under Section 44AD Section 44ADA and Section 44AE of the Income tax Act 1961 However if the turnover of the business