Who Is Eligible For Tax Relief On Pension Contributions You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself It

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the Workers are usually eligible for tax relief if they re under the age of 75 if they re 75 years or older they aren t eligible and fit under one of the following categories they have UK earnings that are subject to income tax for the tax year they re resident in the UK at some time during the tax year

Who Is Eligible For Tax Relief On Pension Contributions

Who Is Eligible For Tax Relief On Pension Contributions

https://www.goodingaccounts.co.uk/app/uploads/2022/07/bench-g836200001_1920.jpg

Low Pension Coverage Affecting Contribution Growth The Vaultz News

https://thevaultznews.com/wp-content/uploads/2021/01/2E676220-D00F-4452-8335-5536A80F76D3.jpeg

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

For most people the amount of tax relief they can have on their pension contributions is limited to 100 of their relevant UK earnings that are chargeable to income tax for the tax year there is If you are UK resident and under 75 you will be eligible for tax relief on contributions into your pension In order to get full tax relief the amount you can pay into your pension is restricted to the higher of 3 600 gross 2 880 net

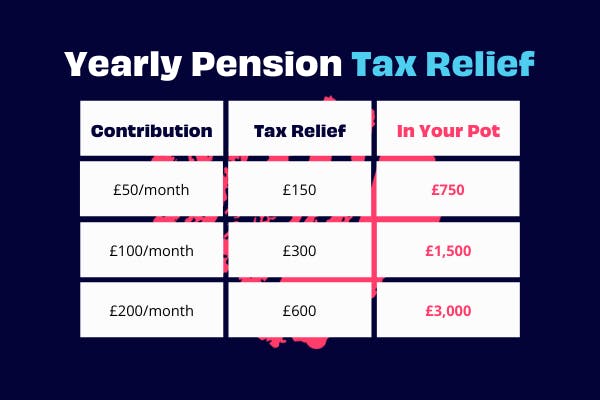

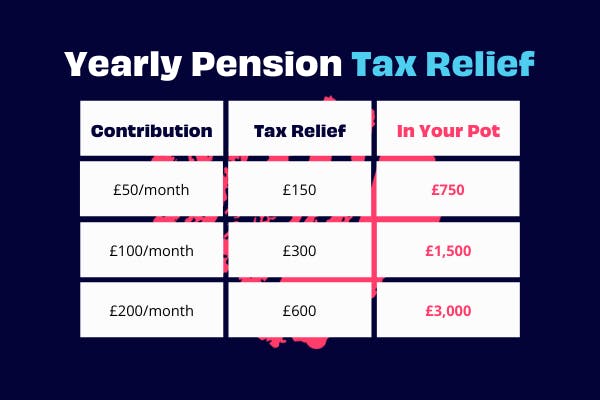

You can claim tax relief on your Self Assessment return for contributions you make towards registered pension schemes From HM Revenue Customs Published 12 May 2016 Get Your tax relief depends on how much you pay in and the highest rate of income tax you pay in a tax year For example for every 100 you put into your personal pension you ll get 25 tax relief giving a total contribution of 125 This is because basic rate tax in the UK is currently 20 and 20 of 125 25

Download Who Is Eligible For Tax Relief On Pension Contributions

More picture related to Who Is Eligible For Tax Relief On Pension Contributions

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

https://smallbizaccounts.co.uk/wp-content/uploads/2020/03/shutterstock_1387425773-scaled.jpg

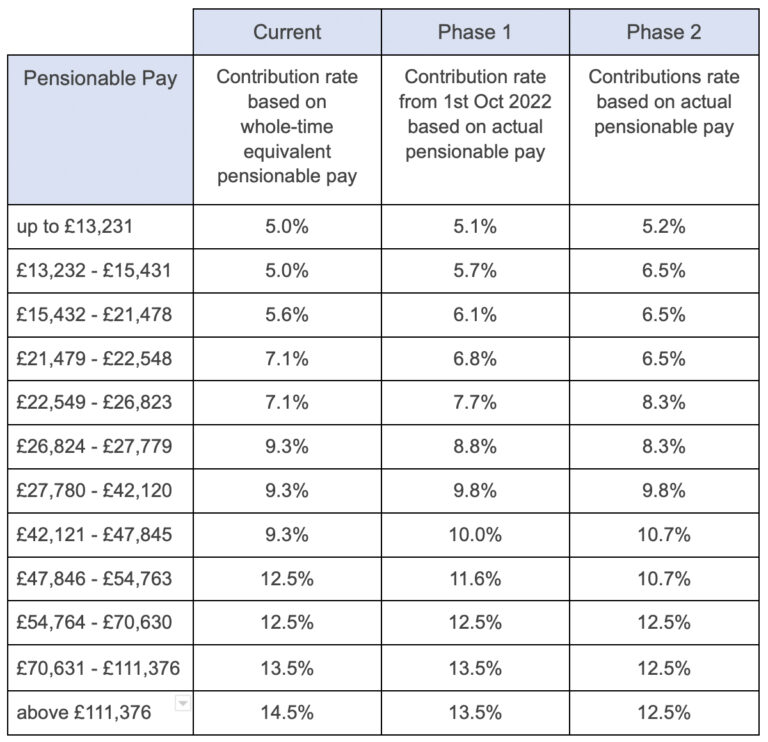

Changes In NHS Pension Contributions Are You A Winner Or Loser

https://www.legalandmedical.co.uk/wp-content/uploads/2022/07/Pensionable-pay1-768x742.jpg

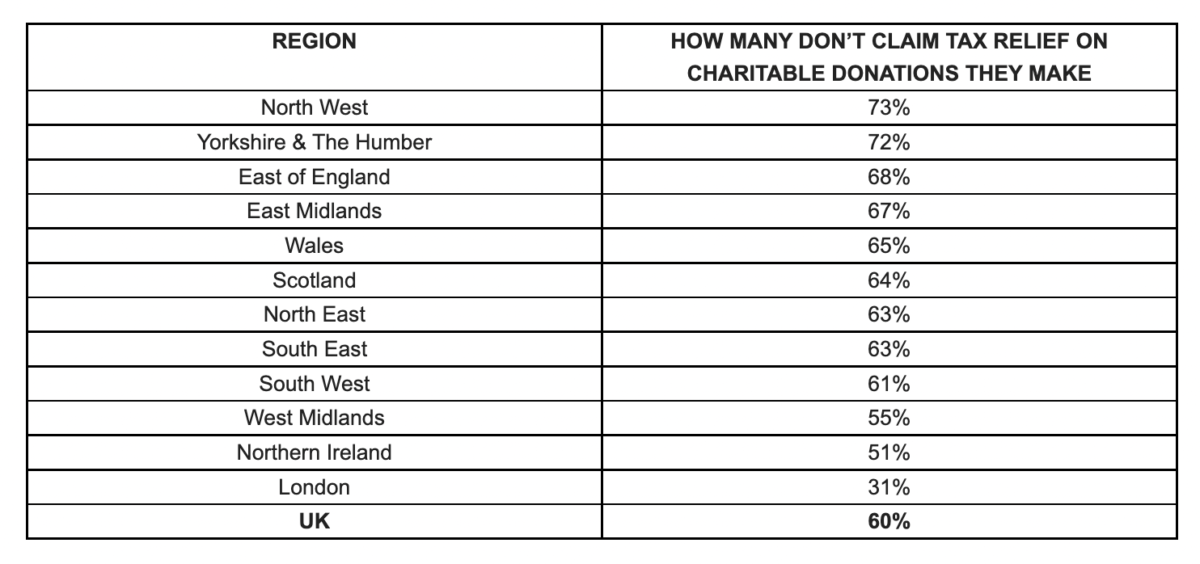

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

The basic rate of tax relief is 20 This means for every 1 of a worker s contribution we ll claim 20p from the government If the worker s contribution is 5 and they re eligible for tax relief then their actual contribution will be made Tax relief on employer pension contributions When are contributions to a registered pension scheme by an employer allowable as a deduction in computing trade profits Like any business expense to be an allowable deduction against profits pension contributions have to be made wholly and exclusively for the purposes of the business

26 March 2024 6 min read How much can a company or employer pay into a pension plan Key facts Company and employer contributions are not restricted however they must satisfy the wholly and exclusively requirement to receive tax relief Company and employer contributions count towards the annual allowance If you pay a higher rate of tax and are contributing to a pension you are entitled to extra relief and you need to claim Here we explain how When you pay into your pension the government

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

https://www.gov.uk/tax-on-your-private-pension/pension-tax-relief

You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself It

https://www.moneyhelper.org.uk/en/pensions-and...

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

Self Employed Pension Tax Relief Explained Penfold Pension

Personal Tax Relief 2022 L Co Accountants

Maximise Tax Relief For 2020 Via Pension Contributions

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

A Consultation On Pensions Tax Relief Provisio Wealth

A Consultation On Pensions Tax Relief Provisio Wealth

What Is Pension Tax Relief Moneybox Save And Invest

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

Pension Tax Relief On Pension Contributions Freetrade

Who Is Eligible For Tax Relief On Pension Contributions - Your tax relief depends on how much you pay in and the highest rate of income tax you pay in a tax year For example for every 100 you put into your personal pension you ll get 25 tax relief giving a total contribution of 125 This is because basic rate tax in the UK is currently 20 and 20 of 125 25