Who Is Eligible For Tax Return In Jamaica Persons are required to file annual income tax return for 2022 and declare estimated income for 2023 TAXTIP2 APPLY INCOME TAX THRESHOLD RELATED TO THE

ANNUAL RETURN OF INCOME AND TAX PAYABLE ORGANIZATIONS BODIES COPORATE SPECIAL ECONZOMIC ZONES Who files This form is to used by a Filing an income tax return is a must for many Jamaican residents Jamaica taxes its residents on their worldwide income from all sources and uses a self

Who Is Eligible For Tax Return In Jamaica

Who Is Eligible For Tax Return In Jamaica

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/medicare-eligibility.png

Frequently Asked Questions On The CARES Act Spartan Echo

https://nsuspartanecho.files.wordpress.com/2020/04/rcs_official_photo_2016_optimized-1.jpg

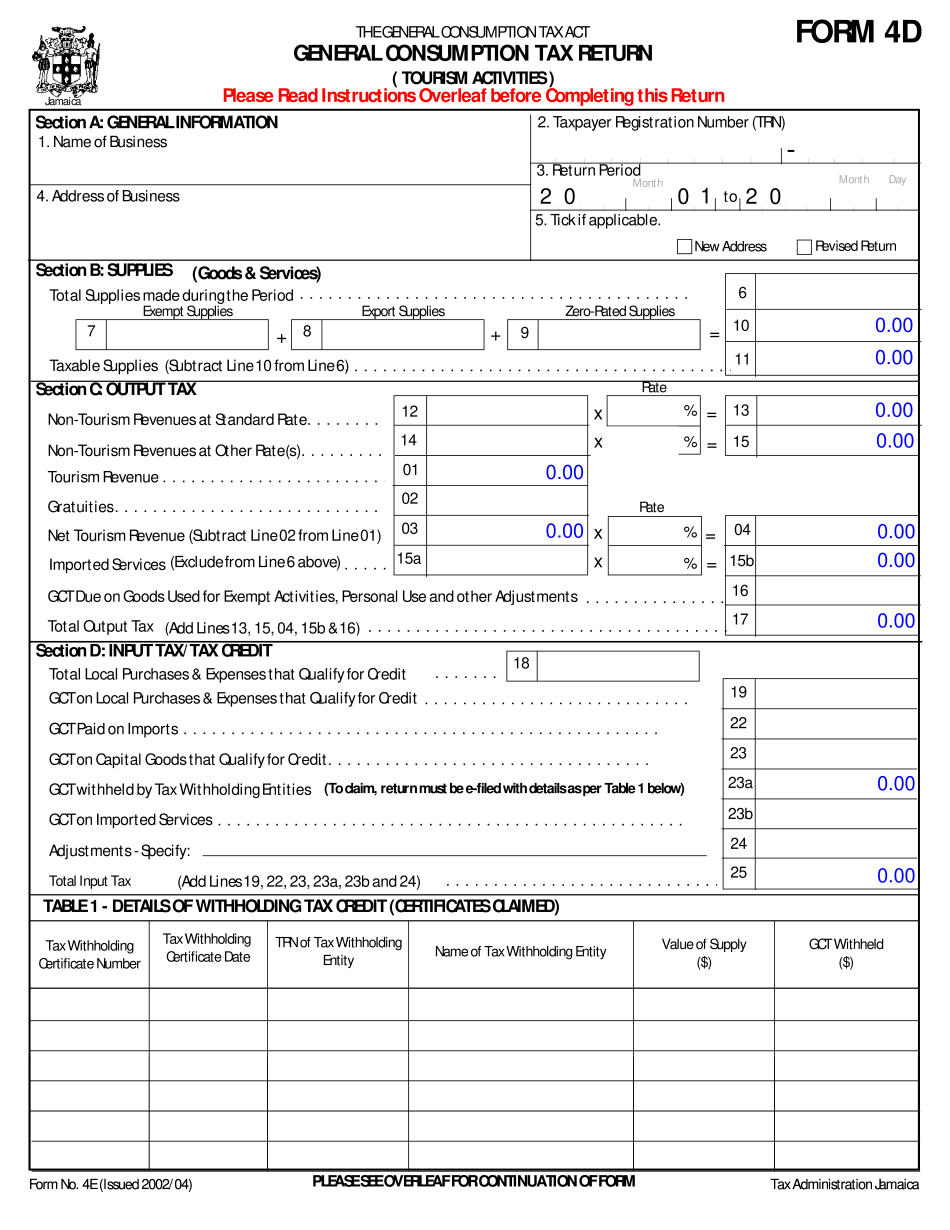

Create Fillable Jamaica Consumption Tax Return Form With Us Fastly

https://www.pdffiller.com/preview/16/973/16973700/big.png

Expats in Jamaica may be eligible for certain tax breaks and credits and they are required to file a tax return annually Following tax exit procedures is important to ensure that Individuals are generally liable to income tax at the rate of 25 on their chargeable income not exceeding 6 million Jamaican dollars JMD per annum less an

In April 2024 the threshold for personal income tax will be increased to J 1 700 088 from J 1 500 096 and a tax credit will be given to Jamaicans earning less Jamaica s Tax Administration TAJ recently announced the opening of the tax season including that the due date is 15 March 2023 for filing annual tax returns for

Download Who Is Eligible For Tax Return In Jamaica

More picture related to Who Is Eligible For Tax Return In Jamaica

Who Is Eligible For The 450 Cost of living Payment In South Australia

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA11kQ7o.img?w=1920&h=1080&m=4&q=91

Who Is Eligible For The 300 Child Tax Credit

https://www.childtaxrelief.com/img/00528dcd17f7d72316c4323e68a51972.jpg?09

VA Mortgage Loans VA Mortgage Loans For Poor Credit VA Loan Lenders

https://203krehabnow.com/wp-content/uploads/2020/12/shutterstock_1124855249-scaled.jpg

The Jamaican Tax Administration Jan 22 announced the March 15 deadline for businesses and individuals to file 2023 income tax returns The announcement It s that time of year when companies company directors self employed persons and employed persons who earn additional income should be in high gear to

Interest paid by a resident person to a non resident individual is subject to WHT of 25 unless a lower rate of withholding is applicable by virtue of tax treaty protection In Jamaica individuals are considered tax residents if they meet certain criteria outlined by the country s tax laws Being a tax resident means that you are required to pay taxes

Eligibility MACPAC

https://www.macpac.gov/wp-content/uploads/2022/05/PIE-CHART-Share-of-Dually-Eligible-Population-by-Medicaid-Eligibility-Pathways.png

How To Apply Bank Of America Credit Card

https://progressforamerica.org/wp-content/uploads/2022/06/Add-a-subheading.jpg

https://www.jamaicatax.gov.jm/documents/10194/...

Persons are required to file annual income tax return for 2022 and declare estimated income for 2023 TAXTIP2 APPLY INCOME TAX THRESHOLD RELATED TO THE

https://www.jamaicatax.gov.jm/income-tax1

ANNUAL RETURN OF INCOME AND TAX PAYABLE ORGANIZATIONS BODIES COPORATE SPECIAL ECONZOMIC ZONES Who files This form is to used by a

Who Is Eligible For Tax Return In Jamaica QATAX

Eligibility MACPAC

What Is The Medi Cal Income Limit For 2022 INVOMERT

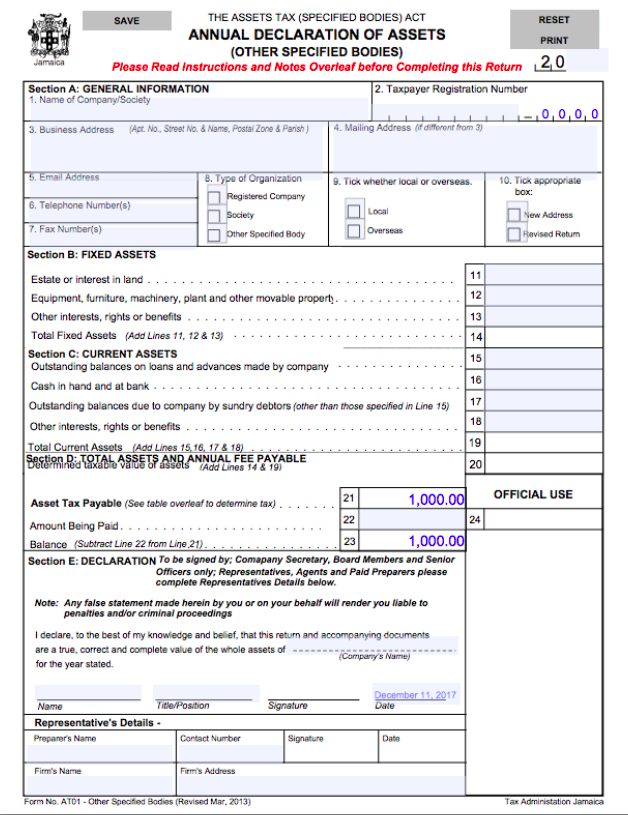

Form AT01 Asset Tax Forms Declaration Of Assets HeadOffice Jamaica

2022 Education Tax Credits Are You Eligible

Who Is Eligible For Tax Return In Jamaica QATAX

Who Is Eligible For Tax Return In Jamaica QATAX

Who Is Eligible For VA Benefits The 2 Critical Factors Revealed

Who Is Eligible For Tax Return In Jamaica QATAX

Your Tax Refund Is The Key To Homeownership

Who Is Eligible For Tax Return In Jamaica - Pay As You Earn PAYE workers whose income now exceed the previous tax threshold of 592 800 but who earn up to 796 536 are to receive a refund from their