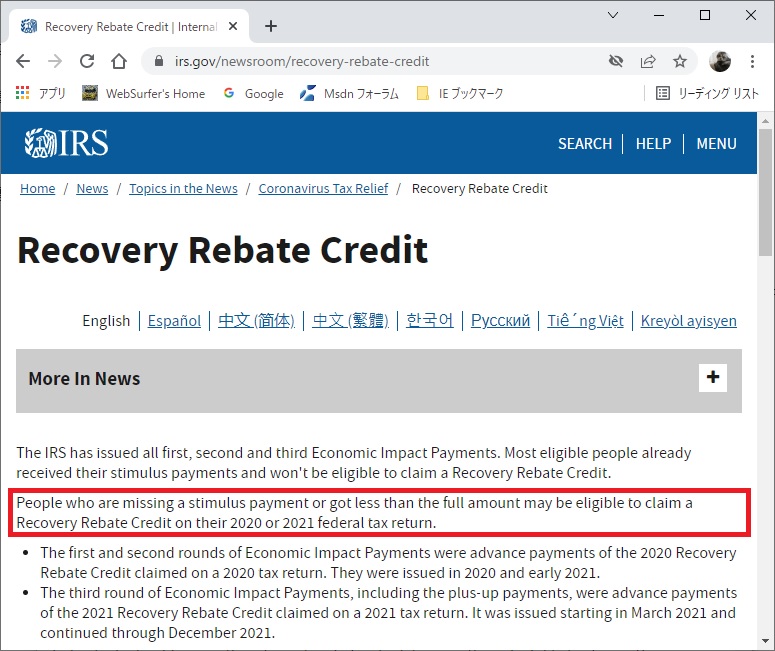

Who Is Eligible For The Irs Recovery Rebate Credit Verkko 20 jouluk 2022 nbsp 0183 32 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They

Verkko 8 helmik 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments were based on 2018 or 2019 tax year information Verkko 10 jouluk 2021 nbsp 0183 32 A12 An individual who died in 2020 or in 2021 and did not receive the full amount of the first or second Economic Impact Payment may be eligible for the 2020 Recovery Rebate Credit if the individual met the eligibility requirements An individual who died prior to January 1 2020 does not qualify for the Recovery Rebate Credit

Who Is Eligible For The Irs Recovery Rebate Credit

Who Is Eligible For The Irs Recovery Rebate Credit

https://www.taxdefensenetwork.com/wp-content/uploads/2021/02/recovery-rebate-compressed.jpg

IRS FAQs For 2021 Recovery Rebate Credit VEB CPA

https://vebcpa.com/wp-content/uploads/2022/01/01_2022_tax_refund.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

Verkko 13 tammik 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund Verkko 17 marrask 2023 nbsp 0183 32 Generally to claim the 2020 Recovery Rebate Credit a person must Have been a U S citizen or U S resident alien in 2020 Not have been a dependent of another taxpayer for 2020 Have a Social Security number issued before the due date of the tax return that is valid for employment in the United States

Verkko 1 jouluk 2022 nbsp 0183 32 Were no longer claimed as a dependent in 2020 If you weren t claimed as a dependent in 2020 you might be eligible for the tax credit Check the eligibility criteria to see if you qualify Then calculate the amount of the credit using tax software such as TurboTax or the 2020 tax forms Verkko 17 elok 2022 nbsp 0183 32 Once eligible you could qualify for a full or partial Recovery Rebate Credit on your 2020 and or 2021 returns if any of the following applied You were eligible for payment but did not receive one

Download Who Is Eligible For The Irs Recovery Rebate Credit

More picture related to Who Is Eligible For The Irs Recovery Rebate Credit

Recovery Startup Businesses Are Eligible For Employee Retention Tax

https://www.holbrookmanter.com/wp-content/uploads/2021/08/tax-credit-scaled.jpg

The Recovery Rebate Credit Calculator MollieAilie

https://www.irstaxapp.com/wp-content/uploads/2021/01/irs-update-stimulus-1024x475.png

The Recovery Rebate Credit Calculator MollieAilie

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

Verkko IRS information letters about Economic Impact Payments and the Recovery Rebate Credit All third Economic Impact Payments issued parents of children born in 2021 guardians and other eligible people who did not receive all of their third round EIPs can claim up to 1 400 per person through the 2021 Recovery Rebate Credit Verkko 12 lokak 2022 nbsp 0183 32 You re generally eligible to claim the recovery rebate credit if in 2021 you Were a U S citizen or U S resident alien

Verkko You may be able to take this credit only if You are eligible but were not issued an EIP 1 an EIP 2 or neither an EIP 1 or EIP 2 or Your EIP 1 was less than 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 or Verkko You gained a qualifying dependent You can claim the Recovery Rebate Credit for any qualifying child born adopted or placed into foster care with you in 2021

Irs Recovery Rebate Credit Number IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-number-irsyaqu.jpg?fit=980%2C653&ssl=1

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

https://www.irs.gov/newsroom/recovery-rebate-credit

Verkko 20 jouluk 2022 nbsp 0183 32 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Verkko 8 helmik 2021 nbsp 0183 32 People who are eligible and either didn t receive any Economic Impact Payments or received less than the full amounts must file a 2020 tax return to claim a Recovery Rebate Credit even if they don t usually file Economic Impact Payments were based on 2018 or 2019 tax year information

Track Your Recovery Rebate With This Worksheet Style Worksheets

Irs Recovery Rebate Credit Number IRSYAQU Recovery Rebate

What Is The IRS Recovery Rebate Credit And Who Qualifies Maui Now

IRS Provides FAQs Regarding The Recovery Rebate Credit YouTube

Where Is The Recovery Rebate Credit On My Tax Return Recovery Rebate

Who Is Eligible For A Recovery Rebate Credit Printable Rebate Form

Who Is Eligible For A Recovery Rebate Credit Printable Rebate Form

The Recovery Rebate Credit Calculator ShauntelRaya

Eligibility For Recovery Rebate Credit Ft Myers Naples Markham Norton

IRS 2

Who Is Eligible For The Irs Recovery Rebate Credit - Verkko 29 tammik 2022 nbsp 0183 32 A A A The IRS issued all third round Economic Impact Payments by Dec 31 The Recovery Rebate Credit makes it possible for any eligible individual who did not receive all Economic Impact