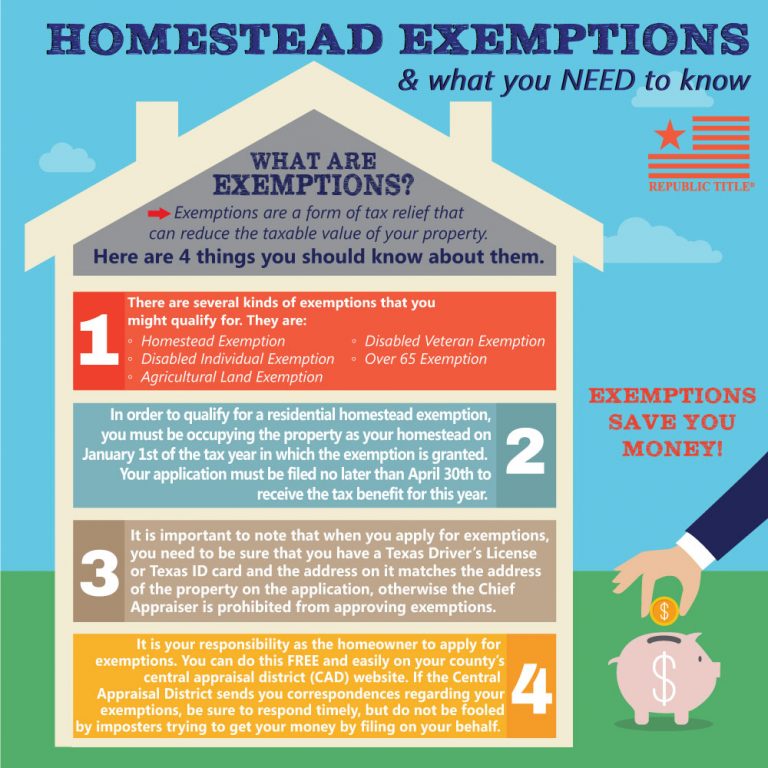

Who Qualifies For Homestead Tax Exemption Generally a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence as of January 1 of the taxable year O C G A 48 5 40 LGS Homestead Application for Homestead Exemption To be granted a homestead exemption

An individual with a disability An older adult A veteran A law enforcement official or first responder with a disability Some homestead exemptions are based on a flat reduction of all of the To qualify for a homestead exemption a homeowner must occupy the property as their principal residence The qualifications may vary by local jurisdiction but typically the owner must reside in the home for a portion of the tax year

Who Qualifies For Homestead Tax Exemption

Who Qualifies For Homestead Tax Exemption

https://www.cutmytaxes.com/wp-content/uploads/2021/02/Oconnor-Property-Tax-Exemptions-What-you-need-to-know-1.jpg

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Homestead Exemption

https://townandparish.com/wp-content/uploads/2021/07/homestead-home-loan-finance-finances-money-exempted-business-property-economy-credit-financial_t20_RJA1Kk.jpg

A homestead exemption is a provision that helps certain taxpayers reduce their property taxes and protect the homestead from creditors following the declaration of bankruptcy or death of a spouse The exemption lowers the taxable value of a property by a certain amount This is done based on a graduated scale Who qualifies for a homestead exemption Each state and even each county can make its own rules about who qualifies for a homestead exemption and how much it is In most cases people with permanent and total disability veterans seniors people 65 and older and the surviving spouses of veterans can qualify if they have

Who Qualifies for the Homestead Exemption Homestead exemption laws are state enacted laws so the specific requirements can vary The most common requirement is that the home must be your primary residence But keep in mind the exemption will usually extend to the spouse or surviving heirs of the property owner as If you own your primary residence you are eligible for the Homestead Exemption on your Real Estate Tax The Homestead Exemption reduces the taxable portion of your property s assessed value With this exemption the property s assessed value is reduced by 80 000

Download Who Qualifies For Homestead Tax Exemption

More picture related to Who Qualifies For Homestead Tax Exemption

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

Homestead Tax Exemption

http://www.bocaexpert.com/uploads/agent-21/bigstock-Taxes-Word-91547726.jpg

2019 2021 Form TX HCAD 11 13 Fill Online Printable Fillable Blank

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/2019-2021-form-tx-hcad-11-13-fill-online-printable-fillable-blank-20.png

According to the Texas Comptroller here Appraisal notices will start being mailed to property owners within the next several weeks The general deadline for filing an exemption application is As a property owner you must live in a primary residence in your state and may have to meet other criteria such as having a low income or disability Other states provide homestead exemptions to veterans of the military Homestead Exemption From Property Taxes

1 00 Applying for a homestead tax program is the most effective way for homeowners to create tax savings Your state and local government may offer this program in the form of a property A homestead valued at 400 000 taxed at 1 is eligible for an exemption of 50 000 The property s taxable value will be 350 000 and the tax bill 3 500 Without the exemption the property tax bill would be 4 000

How To File For Florida Homestead Exemption Smart Title

https://smart-title.com/wp-content/uploads/2021/01/0121-homestead-blog-banner-d1.jpg

Homestead Tax Exemption For Seniors Adams County Iowa

https://adamscounty.iowa.gov/images/news/homestead_tax_exemption_for_seniors_93413.png

https://dor.georgia.gov/property-tax-homestead-exemptions

Generally a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their legal residence as of January 1 of the taxable year O C G A 48 5 40 LGS Homestead Application for Homestead Exemption To be granted a homestead exemption

https://www.investopedia.com/terms/h/homestead-exemption.asp

An individual with a disability An older adult A veteran A law enforcement official or first responder with a disability Some homestead exemptions are based on a flat reduction of all of the

Texas Homestead Tax Exemption

How To File For Florida Homestead Exemption Smart Title

Homestead Exemption

Homestead Exemption Mojgan JJ Panah

Homestead Exemptions Reminder Due January 1 April 30

How To File For Florida Homestead Exemption Tutorial Pics

How To File For Florida Homestead Exemption Tutorial Pics

Texas Homestead Tax Exemption Cedar Park Texas Living

Fillable Original Application For Homestead And Related Tax Exemptions

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Who Qualifies For Homestead Tax Exemption - Translation Open All Do I as a homeowner get a tax break from property taxes Do all homes qualify for residence homestead exemptions What is a residence homestead What residence homestead exemptions are available How do I get a general 40 000 residence homestead exemption What is the deadline for filing a residence