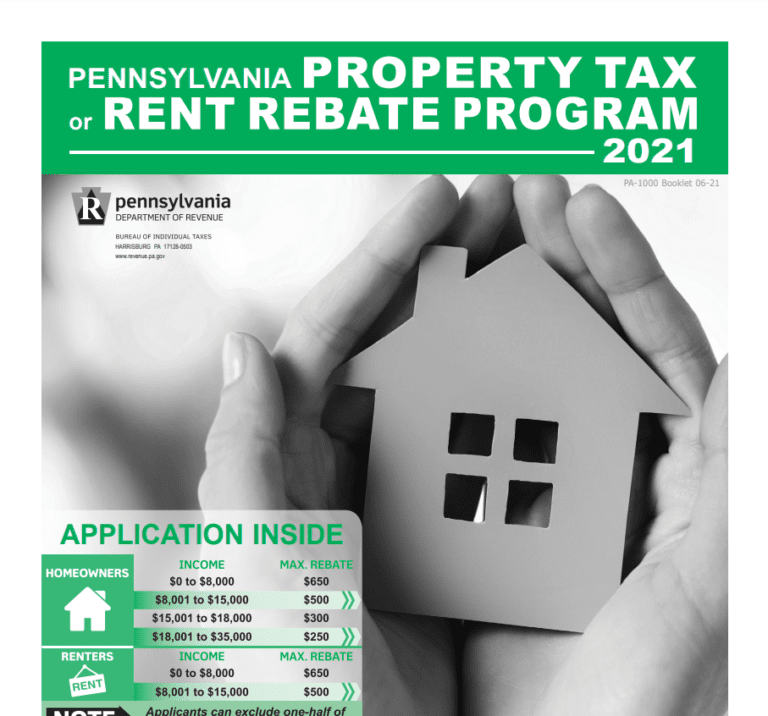

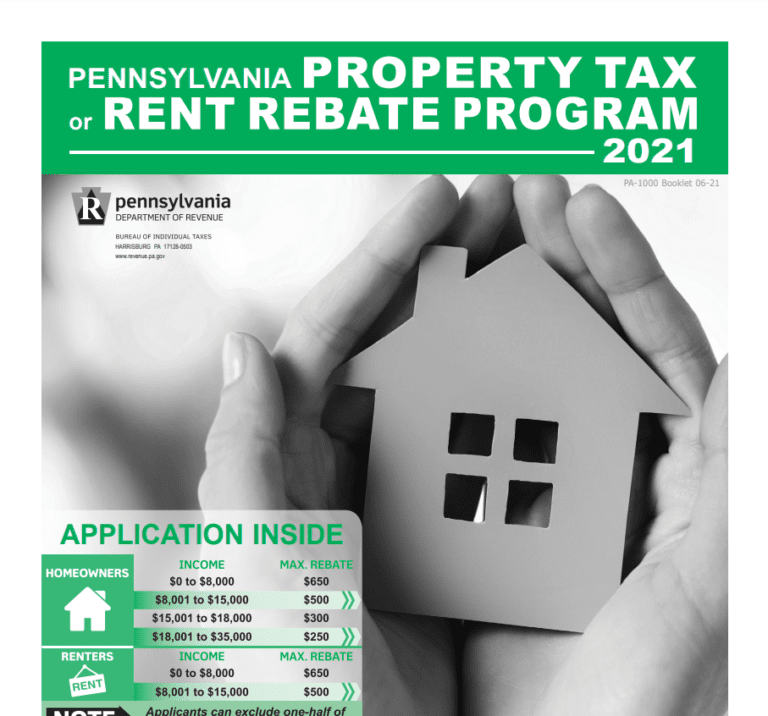

Who Qualifies For Rent Rebate In Pa Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental property You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer

Qualify for a property tax or rent rebate At the same time many of the 430 000 claimants who previously qualified under the program s prior guidelines will see their rebates increase Here are the specific changes that will be in effect as eligible Pennsylvanians apply for rebates on property taxes or rent paid in 2023 Harrisburg PA In order to ensure as many Pennsylvanians receive the relief they are entitled to the deadline for older adults and Pennsylvanians with disabilities to apply for rebates on rent and property taxes paid in 2023 has been extended from June 30 to December 31 2024 Governor Josh Shapiro announced today Eligible applicants

Who Qualifies For Rent Rebate In Pa

Who Qualifies For Rent Rebate In Pa

https://www.pennlive.com/resizer/9__l3v8PgaVRb7vyfHFdyNzfxkM=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OPZBRT6KQNA2DBHYBAEUKDMWK4.png

Eligibility For Pennsylvania Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/form-pa-1000-download-fillable-pdf-or-fill-online-property-tax-or-rent-44.png?resize=796%2C1024&ssl=1

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

The program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and adults with disabilities The rebates range from 380 to 1 000 based on income Who Qualifies for a Pennsylvania Rent Rebate Pennsylvanians who don t qualify for a property tax rent rebate this year may qualify in the near future more on that below

For more information about eligibility and how to apply for the Property Tax Rent Rebate Program Pennsylvania residents can visit the Department of Revenue s website or call 1 888 222 9190 Applications can be submitted online with If you re 65 or older or receive disability benefits and paid rent or property taxes last year you qualify if you meet the income requirements The income limit is 35 000 per household for

Download Who Qualifies For Rent Rebate In Pa

More picture related to Who Qualifies For Rent Rebate In Pa

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

Pa Rent Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-792x1024.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Eligible applicants of the Property Tax Rent Rebate PTRR program are encouraged to file their rebate applications online by visiting mypath pa gov This online filing option makes it simple to submit the PTRR application and the supporting documentation needed to verify each applicant s eligibility The Pennsylvania Property Tax Rent Rebate program opened Jan 16 2024 It s free to apply for the rebate You may be able to get back up to 1 000 on property taxes or rent paid in 2023 Eligibility Pennsylvania residents must meet the age guidelines at least one of the following 65 and older Widows and widowers age 50 and older

The rebate program benefits eligible Pennsylvanians age 65 and older widows and widowers age 50 and older and people with disabilities age 18 and older Rebates must be applied for every year as they are based on annual income and property taxes or rent paid during the prior year There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Application For Rent Rebate Eligibility And Required Documents Rent

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Application-For-Rent-Rebate.jpg?resize=983%2C800&ssl=1

https://revenue-pa.custhelp.com/app/answers/detail/a_id/181

Renters must make certain their landlords were required to pay property taxes or has made a payment in lieu of tax payments on the rental property You are eligible for a Property Tax Rent Rebate if you meet the requirements in each of the three categories below Category 1 Type of Filer

https://www.revenue.pa.gov/FormsandPublications/...

Qualify for a property tax or rent rebate At the same time many of the 430 000 claimants who previously qualified under the program s prior guidelines will see their rebates increase Here are the specific changes that will be in effect as eligible Pennsylvanians apply for rebates on property taxes or rent paid in 2023

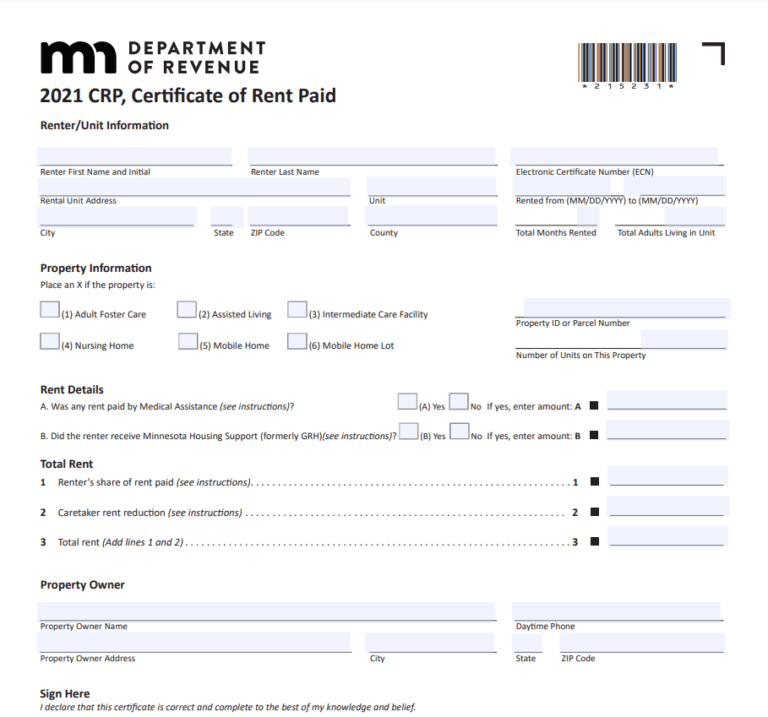

Renters Printable Rebate Form

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Who Do I Call About My Rent Rebate In PA YouTube

Renters Rebate 2021 Printable Rebate Form

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

Where To Mail Pa Property Tax Rebate Form Amended Printable Rebate Form

Rent Rebate Form Missouri Printable Rebate Form

Form For Renters Rebate RentersRebate

PA Property Tax Rent Rebate Applications Now Available

Who Qualifies For Rent Rebate In Pa - Who Qualifies for a Pennsylvania Rent Rebate Pennsylvanians who don t qualify for a property tax rent rebate this year may qualify in the near future more on that below