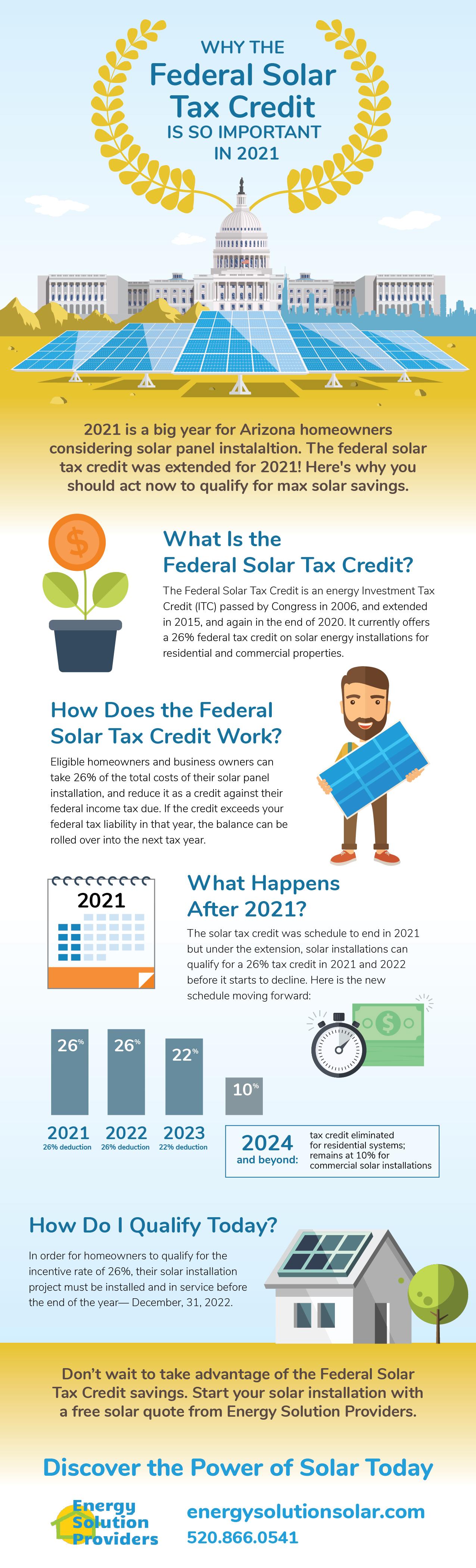

Who Qualifies For The Solar Tax Credit Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

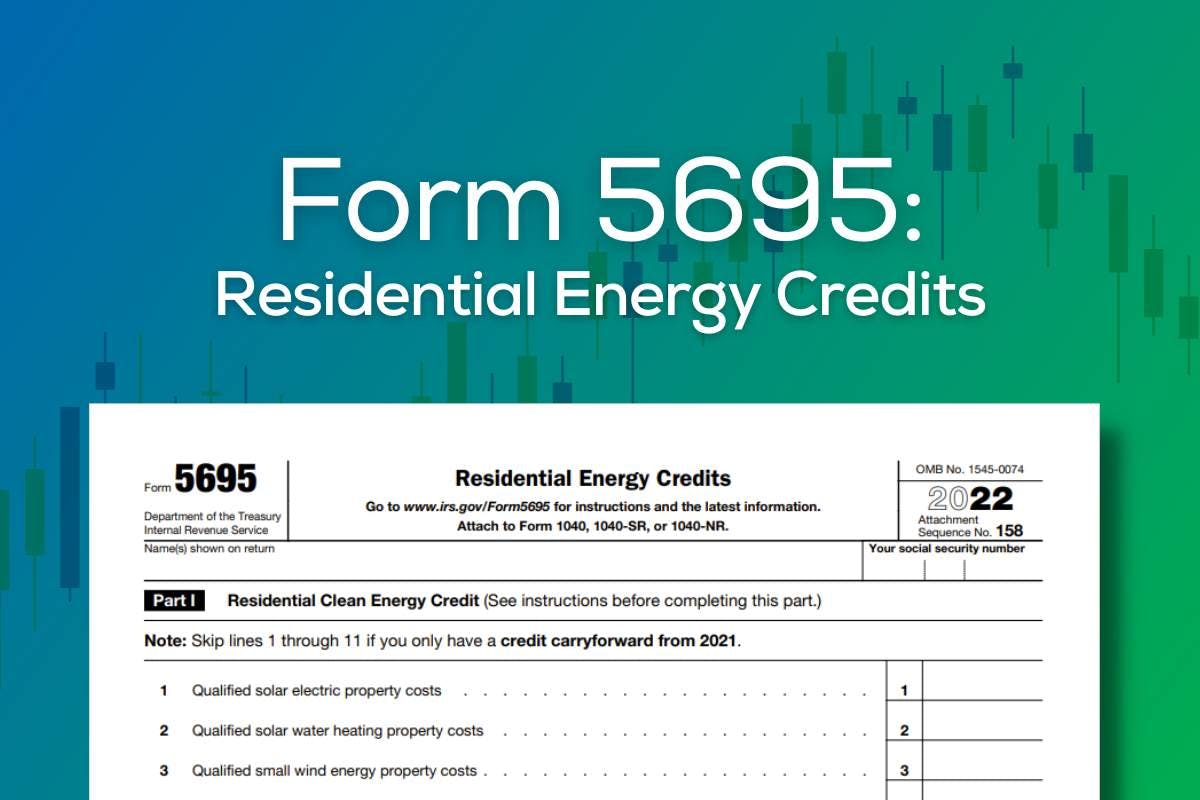

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming

Who Qualifies For The Solar Tax Credit

Who Qualifies For The Solar Tax Credit

https://skylinesmartenergy.com/wp-content/uploads/2023/05/Hero-Locations.jpg

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Who qualifies for the solar tax credit In order to qualify for the solar tax credit your project and property will need to meet certain eligibility criteria Am I eligible to claim the federal solar tax credit You might be eligible for this tax credit if you meet all of the following criteria Your solar PV system was installed between January 1

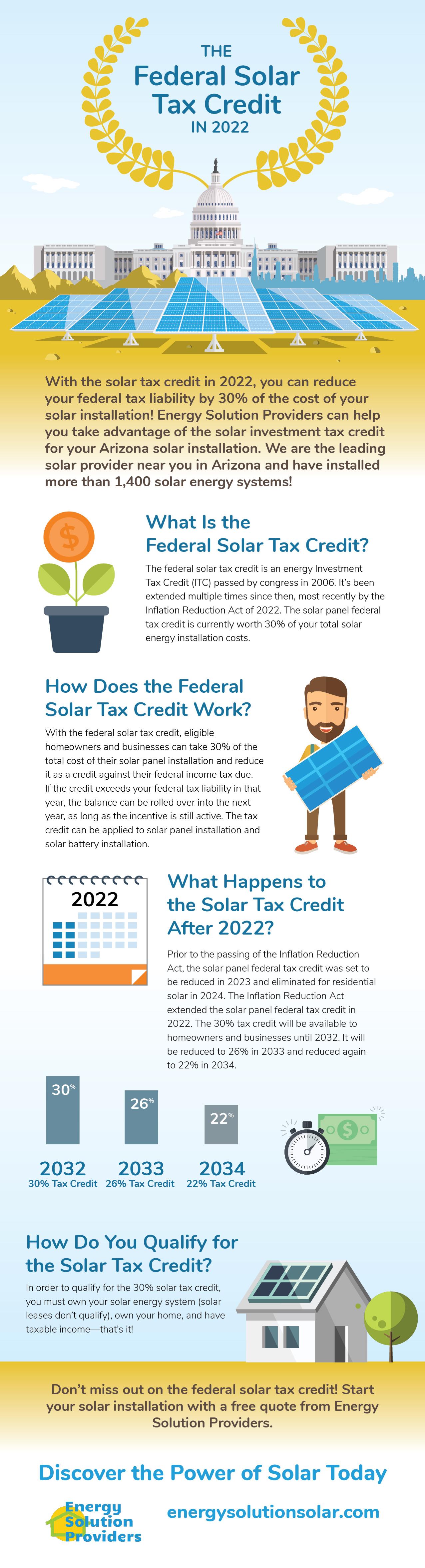

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your The federal solar tax credit lowers your tax liability for qualifying solar system expenses The federal solar tax credit can be claimed anytime between 2022 through 2034

Download Who Qualifies For The Solar Tax Credit

More picture related to Who Qualifies For The Solar Tax Credit

The Solar Tax Credit How To Claim It Bright Solar IO

https://brightsolarpower.io/wp-content/uploads/2020/01/How-To-Claim-The-Solar-Tax-Credit.png

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2021-01.jpg?itok=SJbBX9lJ

The Federal Solar Tax Credit What You Need To Know 2022

https://sandbarsc.com/wp-content/uploads/2017/07/solar-tax-credit.jpg

The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before reducing to Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar The only requirements to use this incentive are You own the system by going solar via cash or a solar loan lease or PPA financing cannot claim the tax credit You have

YouTube

https://i.ytimg.com/vi/tH1zgdp9UQo/maxresdefault.jpg

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit

https://images.prismic.io/palmettoblog/283c592c-9e38-4b57-a6d0-f70cf6ce54f4_form-5695.jpg?auto=compress

https://www.energy.gov › eere › solar › …

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

https://www.nerdwallet.com › ... › taxe…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

Federal Investment Solar Tax Credit Guide Learn How To Claim The

YouTube

How To Claim Solar Tax Credit Solar Panels Network USA

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

How To Claim Your Solar Tax Credit ITC

The Solar Tax Credit 9 Key Points

The Solar Tax Credit 9 Key Points

A Guide To The 30 Solar Tax Credit Green Ridge Solar

FL Residents Solar Federal Tax Credit Guide SunVena Solar

Federal Solar Tax Credit Energy Solution Providers Arizona

Who Qualifies For The Solar Tax Credit - Am I eligible to claim the federal solar tax credit You might be eligible for this tax credit if you meet all of the following criteria Your solar PV system was installed between January 1