Why Did I Receive A State Tax Refund The timeline varies from state to state Why did I not receive a state tax refund There are several reasons you may not have received your state tax refund including There was an error You owe past debts You got taken advantage of by a tax scammer if the IRS needs to contact you they will almost always do so by mail

You should begin checking the status of your tax refund 4 weeks after you mail a paper tax return To track your e filed tax refund First check your e file status to see if your refund was accepted by the IRS One tax expert says it could be the result of an error in completing the return so the IRS corrected it and sent a refund Another expert says there could be another reason so be

Why Did I Receive A State Tax Refund

Why Did I Receive A State Tax Refund

https://i.ytimg.com/vi/wnz3jZk6Zwc/maxresdefault.jpg

No New La Income Tax Refund Cards As Of Friday

https://www.gannett-cdn.com/-mm-/a481916a9da4934da6f90fc763e8898a9ede1f3d/c=0-248-4928-3032/local/-/media/2015/09/18/LAGroup/Alexandria/635781757453782915-GettyImages-160770016.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

How To Find Out If You Owe State Taxes Rowwhole3

https://www.bankrate.com/2017/07/27113408/united-states-treasury-tax-refund-check-and-tax-form-mst.jpg

If you are receiving a tax refund check its status using the IRS Where s My Refund tool You can view the status of your refund for the past 3 tax years If you owe money or are receiving a refund you can check your return status by signing in to view your IRS online account information Key Takeaways If you file your income tax return electronically and opt for direct deposit you ll usually get your refund within 21 days It can take longer to get your refund if you file a

It s possible to check on your individual state income tax refund by visiting this Refund Status page and selecting Where s My Refund Much like with other states you will need to enter your SSN and the amount of your refund in whole dollars before you can see a status States sometimes process returns faster than the IRS Generally rule you can expect your state tax refund within 30 days of the electronic filing date or postmark date You can check on

Download Why Did I Receive A State Tax Refund

More picture related to Why Did I Receive A State Tax Refund

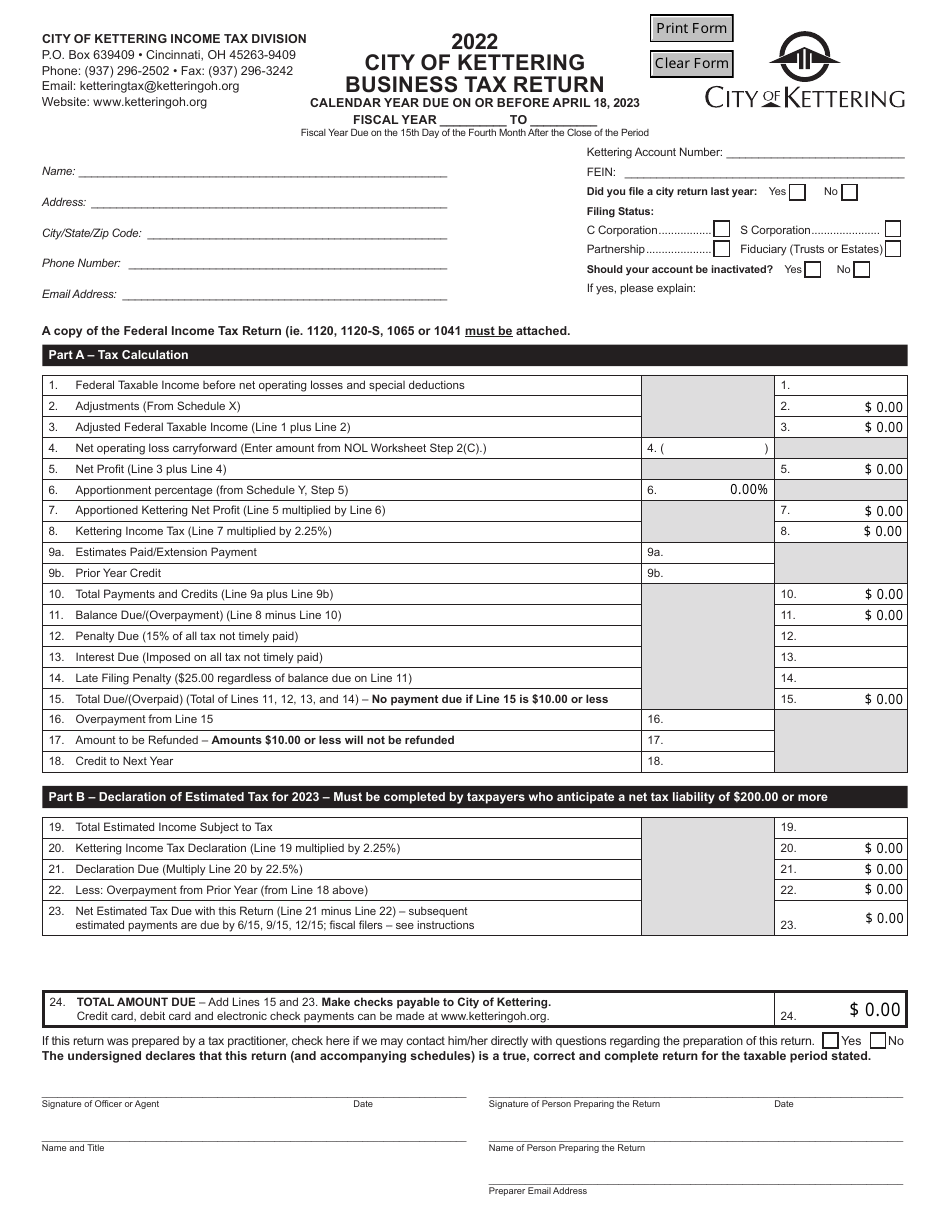

Form KBR 1040 2022 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2580/25802/2580256/form-kbr-1040-business-tax-return-city-of-kettering-ohio_print_big.png

How Long To Get Colorado Tax Refund Coots Nathan

https://i.pinimg.com/originals/25/84/14/258414a9ba63687de99d431af3bce628.png

NY State Tax Refund Status Can Now Be Checked Online

https://townsquare.media/site/10/files/2018/02/RS2410_180093932.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

Generally refunds of state taxes paid by individuals are only federally taxable to the extent a federal benefit was claimed for paying state taxes The Georgia General Assembly recently passed and Governor Kemp signed legislation allowing for an additional refund of income taxes from 2020 because the state has experienced a revenue

Why did i receive a check from Green Dot Bank After I sent my return i got a check from green dot bank saying we were unable to complete a deposit of your 24 tax refund using the designated account information and as a result they sent the check This seems like a scam TurboTax Deluxe Online posted Undelivered and unclaimed tax refund checks Every year millions of federal and state tax refunds go undelivered or unclaimed Learn how to claim your refund if you did not file a return or if your check never got to you Check the status of your tax refund

How Long Does It Take To Get State Tax Refund BMTS Corp

https://www.bmtscorp.com/wp-content/uploads/2023/07/how-long-does-it-take-to-get-state-tax-refund-768x461.png

Ohio To Stop Mailing Tax refund Tax Form

https://www.gannett-cdn.com/authoring/2018/02/02/NCOD/ghows-OH-643d6605-c998-3d9e-e053-0100007fbd6a-bbb0d03e.jpeg?crop=1199,677,x0,y61&width=1199&height=677&format=pjpg&auto=webp

https://blog.taxact.com/wheres-my-state-refund...

The timeline varies from state to state Why did I not receive a state tax refund There are several reasons you may not have received your state tax refund including There was an error You owe past debts You got taken advantage of by a tax scammer if the IRS needs to contact you they will almost always do so by mail

https://ttlc.intuit.com/community/after-you-file/...

You should begin checking the status of your tax refund 4 weeks after you mail a paper tax return To track your e filed tax refund First check your e file status to see if your refund was accepted by the IRS

Q A If Someone Receives A State Tax Refund Can They Still

How Long Does It Take To Get State Tax Refund BMTS Corp

Where s My State Tax Refund

Received Issuer Declined MCC Message Here s What It Means

5 Ways To Make Your Tax Refund Bigger The Motley Fool

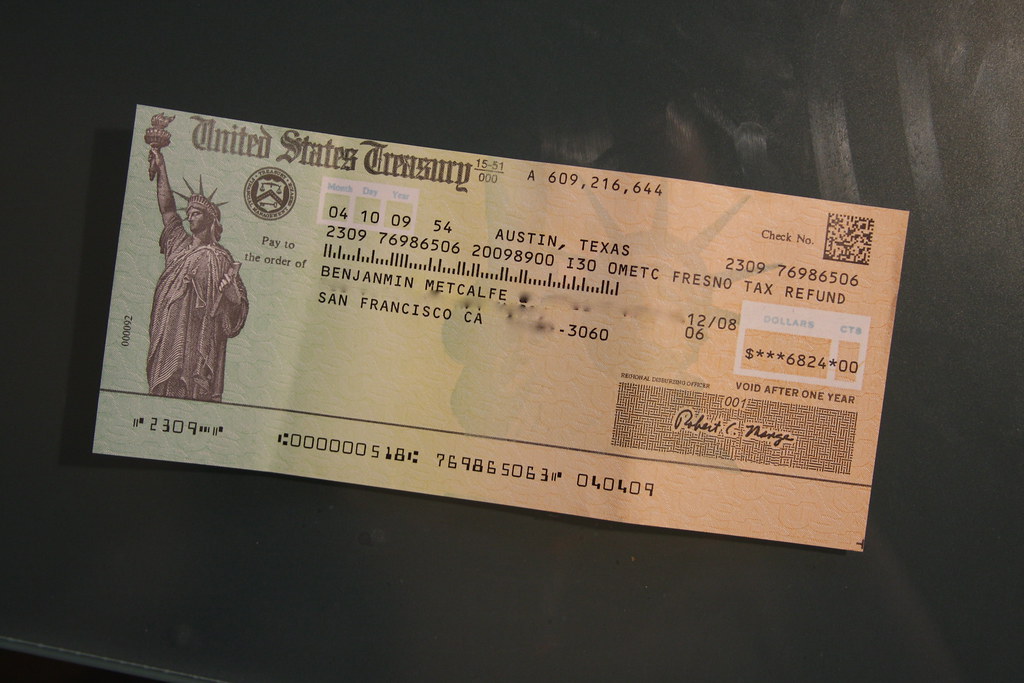

A Refund Check From The IRS Here s Why You Might Have Gotten One

A Refund Check From The IRS Here s Why You Might Have Gotten One

How To Find Out When I Get My Tax Return Theatrecouple12

Tax Refund Check Wow The US Treasury Opened Up It s Vice Flickr

Average Tax Refund In Every U S State Vivid Maps

Why Did I Receive A State Tax Refund - How to track the status of your federal tax refund and state tax refund in 2024 plus tips about timing