Why Do I Have To Do A Self Assessment Tax Return If I M Employed Taxpayers may need to complete a tax return if they are newly self employed and have earned more than 1 000 have multiple sources of income have received any untaxed income for example

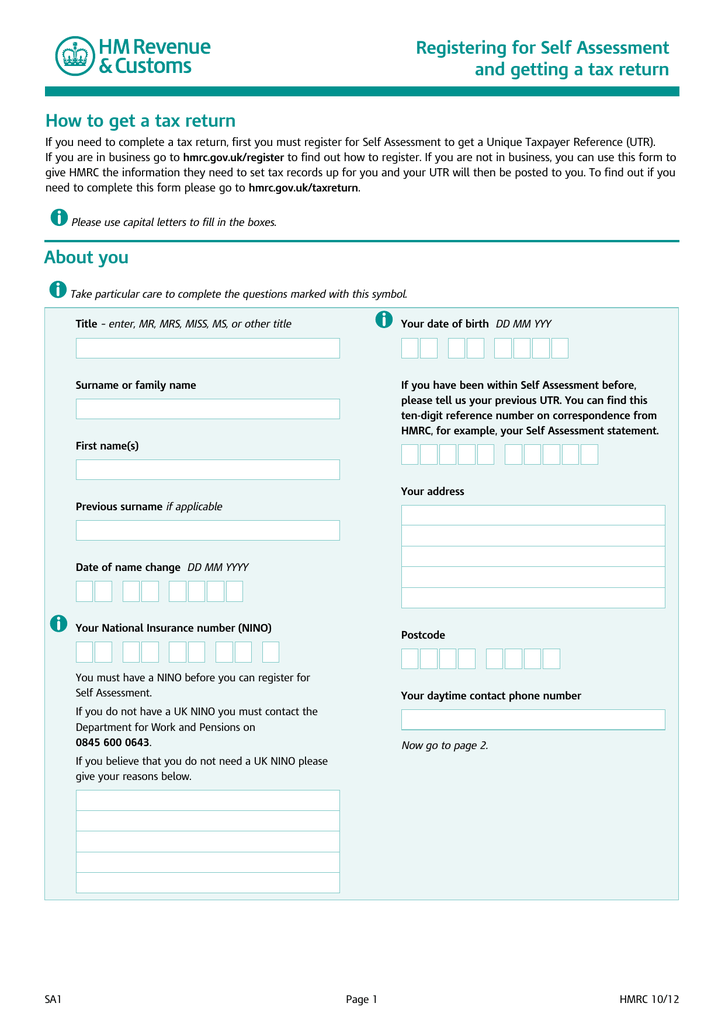

The Self Assessment personal tax return informs HMRC about your taxable income and gains for a tax year and is submitted online or by paper annually You are solely responsible for informing HMRC If you re self employed you ll need to submit a self assessment tax return every year to pay income tax and National Insurance on your profits Other people who need to fill in a tax return

Why Do I Have To Do A Self Assessment Tax Return If I M Employed

Why Do I Have To Do A Self Assessment Tax Return If I M Employed

https://cooperaccounting.co.uk/wp-content/uploads/2020/12/how-do-you-complete-a-self-assessment-tax-return-min.jpg

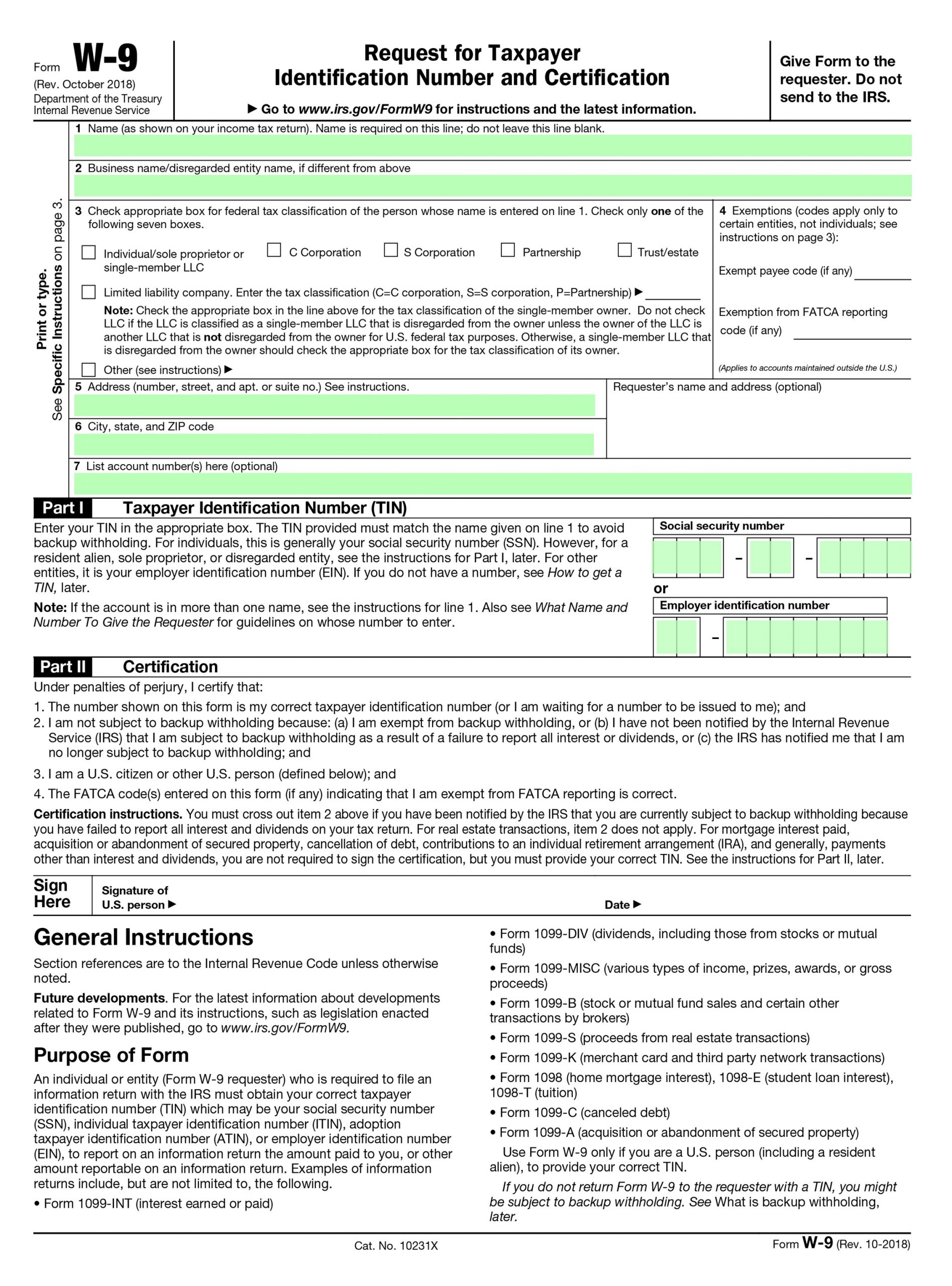

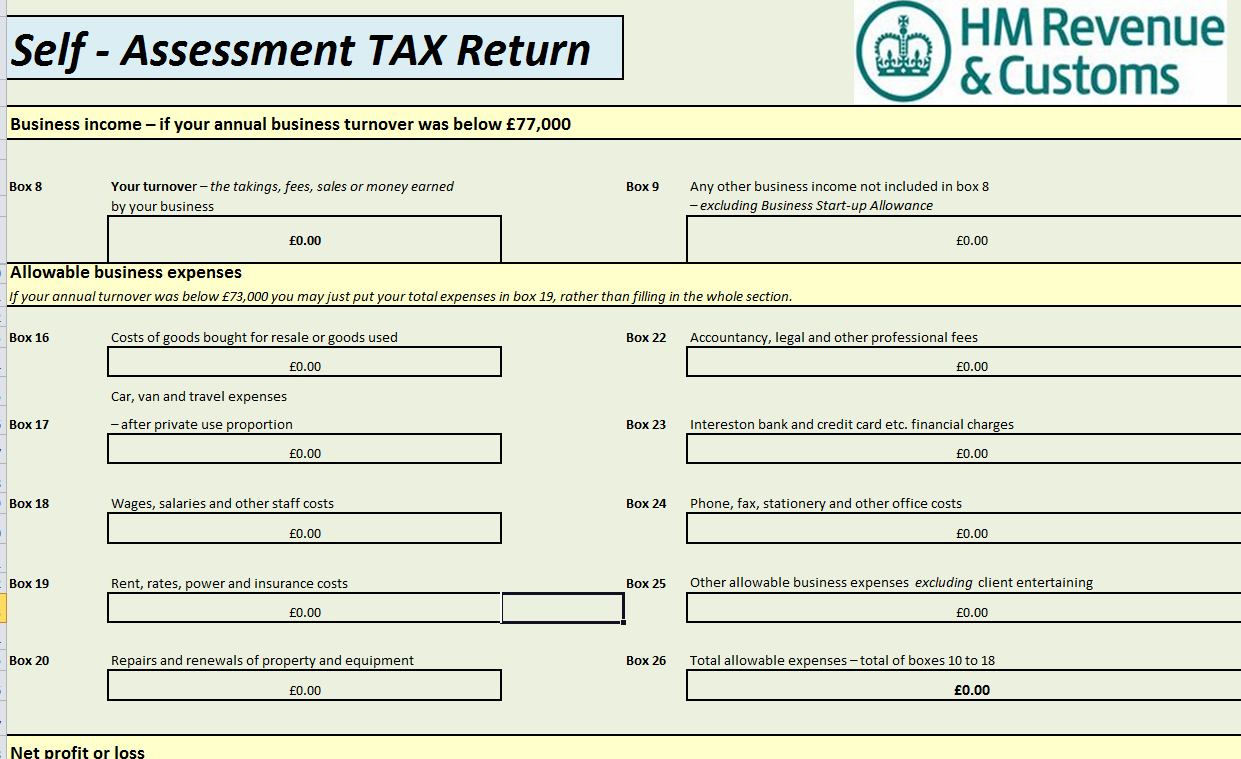

Self Employment Tax Return Form 2022 Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-employment-tax-return-form-2022.jpg

How To File Self Employment Taxes Step By Step Your Guide

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/63586e3826bb5a0e5d20d881_keeper-1099-tax-calculator-results.png

When you ve submitted your Self Assessment tax return you ll be told how much tax and if you re self employed National Insurance contributions you ll need to pay When do If you re one of the millions of taxpayers still to file their online self assessment tax return you ve less than a month until the deadline Here s what you

This may apply to you for example if you started self employment in a tax year When you notify HMRC that you owe tax for a year they may ask you to complete a tax return for that year so you can If you re filing a tax return for the first time this January and worried about getting it wrong you re not alone In November 2022 we surveyed 881 people who will

Download Why Do I Have To Do A Self Assessment Tax Return If I M Employed

More picture related to Why Do I Have To Do A Self Assessment Tax Return If I M Employed

Amazon Flex Take Out Taxes Augustine Register

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e9b83fd4bedd77a0b98f76_form-1040.png

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2020/05/IRS-Tax-Refund-check-shutterstock_1640116444.jpg

Notice Of Assessment Tax Form Federal Notice Of Assessment In Canada

https://turbotax.intuit.ca/tips/images/NOTICE-OF-ASSESSMENT-6.jpg

If you re self employed completing your self assessment tax return can be a real chore But it s crucial you get it right and file on time Here s how to go about it If we do not receive your tax return by the deadlines you ll have to pay a 100 penalty even if you do not owe any tax To find out more about penalties go to

HMRC will not normally withdraw a return if you have been self employed at any time during the tax year even if it was only for a short time and there is no tax owing Do Overview Self Assessment is a system HM Revenue and Customs HMRC uses to collect Income Tax Tax is usually deducted automatically from wages and pensions

All Value Appraisal Service Are Offering Tax Assessment Nursing Home

https://i.pinimg.com/originals/24/df/11/24df1128e7477c0017cf8962d8d3c4e6.gif

How To File Self Employment Taxes Step By Step Your Guide

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/63586e15901b4eedea2eb16c_keeper-1099-tax-calculator.png

https://www.gov.uk/government/news/do-y…

Taxpayers may need to complete a tax return if they are newly self employed and have earned more than 1 000 have multiple sources of income have received any untaxed income for example

https://www.spondoo.co.uk/tips/why-is-hmr…

The Self Assessment personal tax return informs HMRC about your taxable income and gains for a tax year and is submitted online or by paper annually You are solely responsible for informing HMRC

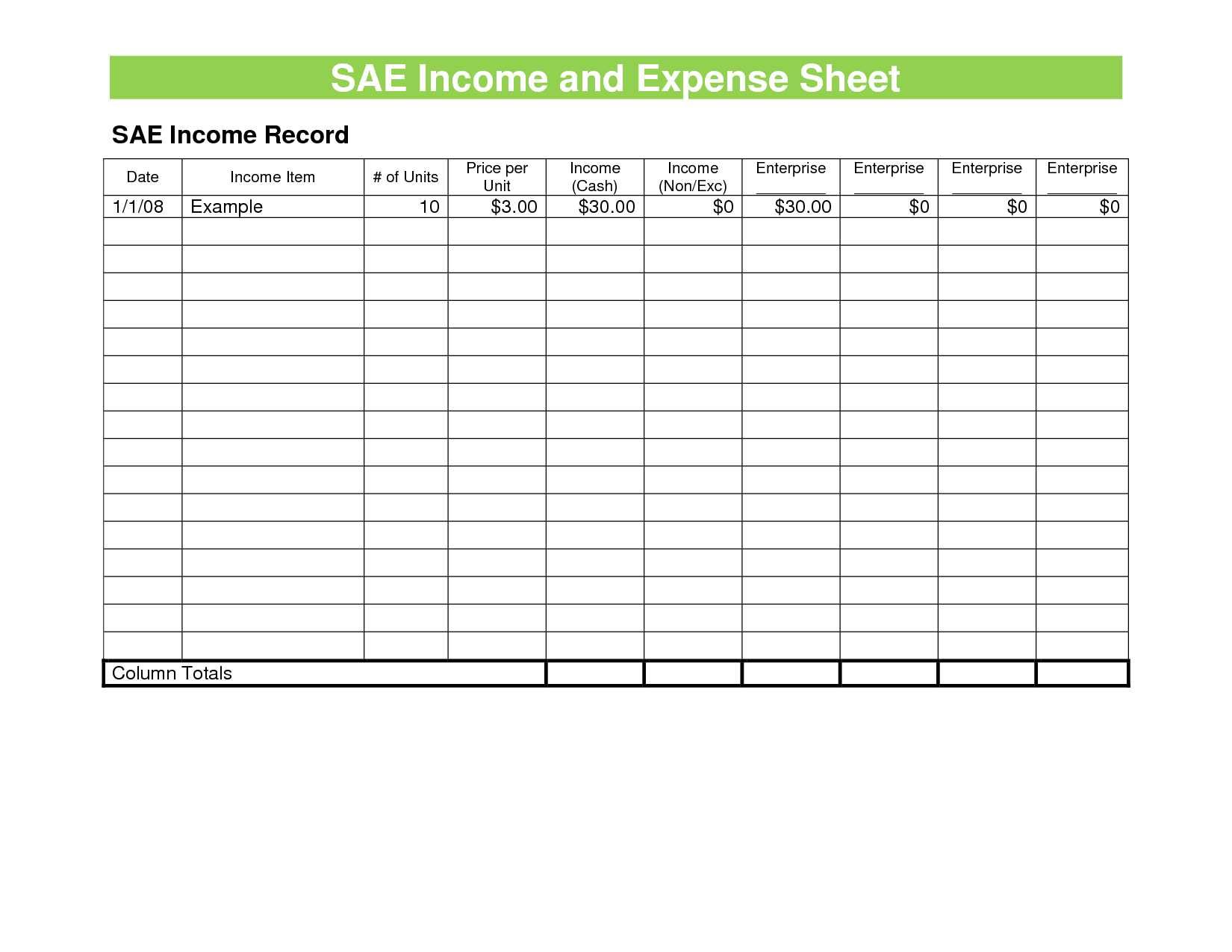

Self Employed Tax Spreadsheet With Self Employed Expense Sheet Sample

All Value Appraisal Service Are Offering Tax Assessment Nursing Home

How To Obtain Your Tax Calculations And Tax Year Overviews

What Is A Self Assessment Tax Return Form Go Self Employed

One Week Left To Register For Self assessment Tax Return HW Fisher

How To Calculate Self Employment Tax YouTube

How To Calculate Self Employment Tax YouTube

Register And File Your Self Assessment Tax Return Tabitomo

End Of Year Accounts Template For Self Employed Small Business No

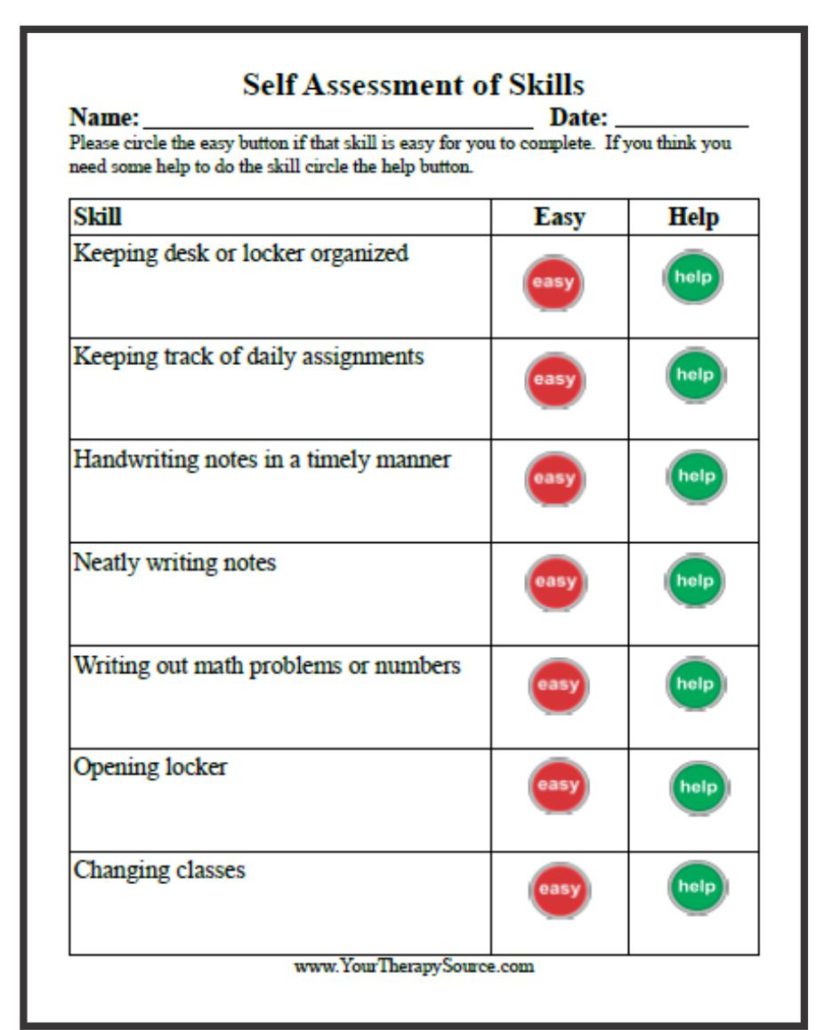

Self Assessment Form Your Therapy Source

Why Do I Have To Do A Self Assessment Tax Return If I M Employed - This may apply to you for example if you started self employment in a tax year When you notify HMRC that you owe tax for a year they may ask you to complete a tax return for that year so you can