Why Is Jersey Considered A Tax Haven In recent years facing considerable external pressure and adverse publicity Jersey s authorities have committed to automatic exchange of tax information under the Common Reporting Standard

JERSEY is not a tax haven and there are no grounds to include the Island on a tax blacklist the head of Jersey Finance has said Well of course he has That s Jersey is fiscally independent from the UK UK public money is not ordinarily spent in the island and Jersey residents do not pay tax or national insurance contributions to HMRC As the UK is responsible for Jersey s defence and international representation the cost of Jersey to the British taxpayer could be seen at around 55 million though this is a notional cost it is unlikely that if Jersey were independent that money would be saved on costs to the armed forces The State

Why Is Jersey Considered A Tax Haven

Why Is Jersey Considered A Tax Haven

https://factstherapy.com/wp-content/uploads/2021/11/tax-haven.jpeg

Portrait Of A Tax Haven Jersey Tax Justice Network

https://taxjustice.net/wp-content/uploads/2020/07/37003610891_e77748c0ec_k-1.jpg

What Is Tax Haven And How It Works Kuvera

https://kuvera.in/blog/wp-content/uploads/2022/11/What-Is-Tax-Haven.png

Jersey was higher than Guernsey because of a larger volume of foreign direct investment A new list of corporate tax havens has named Jersey as the seventh most aggressive in the Jersey a British Crown Dependency and Channel Island has long been associated with the term tax haven The island maintains a unique tax structure that attracts wealthy

But regardless of whether one thinks that is high or low it s low how Jersey taxes its citizens actually has little bearing on its regard as a tax haven The goal Jersey has been variously given the title of a tax haven since the 1920s when wealthy Brits began to move or move their wealth into the island to avoid wealth and

Download Why Is Jersey Considered A Tax Haven

More picture related to Why Is Jersey Considered A Tax Haven

The Fall Of Jersey How A Tax Haven Goes Bust Jersey The Guardian

https://i.guim.co.uk/img/media/ff0066cea8e1d1f77cd252c688defa1c0086f8a2/0_33_4256_2553/master/4256.jpg?width=1200&height=630&quality=85&auto=format&fit=crop&overlay-align=bottom%2Cleft&overlay-width=100p&overlay-base64=L2ltZy9zdGF0aWMvb3ZlcmxheXMvdGctZGVmYXVsdC5wbmc&enable=upscale&s=08072ed154e231de4a9e0699f8222e44

What Are Tax Havens And What Is Their Relationship To Housing

https://www.manuelgabarre.com/wp-content/uploads/2021/12/tax-haven-768x576.jpg

.jpg)

Inilah Daftar Negara Tax Haven

https://ddtc-cdn1.sgp1.digitaloceanspaces.com/ori/-Infografis_Daftar-Negara-Tax-Haven (1).jpg

Is Jersey a Tax Haven Yes It does not matter how much regulation is in place the mega rich and large multi national always find a loophole Jersey as a tax neutral jurisdiction does not support tax evasion aggressive tax avoidance or unfair tax competition It is a criminal offence to facilitate or engage in tax evasion in Jersey It has been this

Jersey operates a zero ten regime introduced in June 2008 in Jersey to comply with the EU Code of Conduct for Business Taxation and to promote equal tax treatment Jersey one of the Channel Islands between England and France has had a reputation as a tax haven since wealthy Brits started moving there and transferring their

/GettyImages-1176530219-bd6698eef9d7459183e70a9db1cb3234.jpg)

Why Is The Bahamas Considered A Tax Haven

https://www.investopedia.com/thmb/eJk_dhBdGBDCbr-UVN-KnGz8sjA=/2000x1500/filters:fill(auto,1)/GettyImages-1176530219-bd6698eef9d7459183e70a9db1cb3234.jpg

Law And International Taxation Understanding Tax Havens

https://1.bp.blogspot.com/-5PlAVNgffi4/VUiHP9co4fI/AAAAAAAACY4/ilvTL04KLQE/s1600/tax-haven-a.jpg

https://taxjustice.net/.../portrait-tax-haven-j…

In recent years facing considerable external pressure and adverse publicity Jersey s authorities have committed to automatic exchange of tax information under the Common Reporting Standard

https://www.taxresearch.org.uk/Blog/2021/01/28/...

JERSEY is not a tax haven and there are no grounds to include the Island on a tax blacklist the head of Jersey Finance has said Well of course he has That s

Wealth Protection Tax Avoidance Real Estate And A Tax Haven In USA

/GettyImages-1176530219-bd6698eef9d7459183e70a9db1cb3234.jpg)

Why Is The Bahamas Considered A Tax Haven

Randalieren Gans Einfach Zu Bedienen Jersey Map Nackt Lippen Leeds

Superannuation As A Legitimate Tax Haven By Tomvon Reckers Issuu

The UK A Tax Haven

/monacomontecarlo-5bfc317146e0fb00511ac101.jpg)

Why Is Monaco Considered A Tax Haven

/monacomontecarlo-5bfc317146e0fb00511ac101.jpg)

Why Is Monaco Considered A Tax Haven

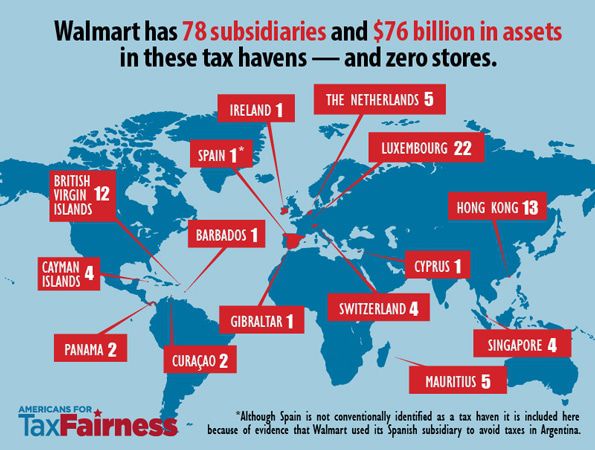

Progressive Charlestown The Walmart Web

Now We Have Evidence That UK Could Become A Tax Haven After Brexit

The Tax System For Companies In Ireland AccountsIreland

Why Is Jersey Considered A Tax Haven - A new article in the Guardian Long Reads series entitled The fall of Jersey how a tax haven goes bust Not as dramatic as this one but still The article heavily features