Why Is My State Tax Refund Higher Than Federal This year many people are receiving much smaller refunds for the Federal or even owing because employers used new tax tables published by the IRS as a result of the new tax laws Those tables caused many taxpayers to not have enough withheld from their paychecks so now their refunds are much lower than expected

Knowing why your state tax is more than your federal tax is the first step to becoming an educated taxpayer with a Tax resolution specialist consultant Knowing the difference between state and federal taxes helps you make better financial choices and prepare for state tax changes Federal income taxes are collected by the federal government while state income taxes are collected by the individual state s where a taxpayer lives and earns income

Why Is My State Tax Refund Higher Than Federal

Why Is My State Tax Refund Higher Than Federal

https://3.bp.blogspot.com/-5LC4btlHXuc/Uy2MJt4Y8UI/AAAAAAAAAMQ/uz65tHlEZPM/s1600/By-The-Book-Taxes-CT-2.jpg

11 How To Check My State Refund Status Trending Hutomo

https://i2.wp.com/images.ctfassets.net/ifu905unnj2g/1zITcbI6WTwwhYkzrV0MSr/5a215aad2a09fdf03c52d0d9c4ab6a1e/image_4.png

Why Is My State Tax Refund 0 4 Possible Reasons

https://ik.imagekit.io/e8n0zowbu/wp-content/uploads/2023/11/why-is-my-state-tax-refund-0-1160x559.jpg

It is possible for that to happen depending on the kind of income you entered on your tax return and on the amount you had withheld from your income for federal and state taxes It is also possible that some of your forms are not ready and you should not trust the calculations at this point WASHINGTON The IRS today provided guidance PDF on the federal tax status of refunds of state or local taxes and certain other payments made by state or local governments to individuals

Federal taxes are generally higher than state taxes because revenue received from federal income tax rates make up the primary funding source for the federal government Conversely state tax rates are lower because property taxes sales tax and local taxes like sewer maintenance and sanitation services are paid by residents throughout the year Federal tax rates are typically higher than state tax rates States can have different credits and deductions States also tax people whether they are a resident or nonresident Gyles says

Download Why Is My State Tax Refund Higher Than Federal

More picture related to Why Is My State Tax Refund Higher Than Federal

Is My State Tax Refund Taxable Intuit TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2022/03/Untitled-design4.png?w=411&h=600&crop=1

Why Is My State Tax Higher Than Federal Exploring Differences

https://lytaxadvisors.com/wp-content/uploads/2023/09/Why-Is-My-State-Tax-Higher-Than-Federal.png

5 Ways To Make Your Tax Refund Bigger The Motley Fool

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

If your state refund is taking longer to arrive than your federal refund remember that each state has its own processing protocols and security measures some of which may require more time than the federal process Want to check on the status of your state refund Go to your state s government website to find more information Why is my refund different than the amount on the tax return I filed updated December 22 2023 All or part of your refund may be offset to pay off past due federal tax state income tax state unemployment compensation debts child support spousal support or other federal nontax debts such as student loans

If you paid too much in taxes during the year through payroll withholdings then you may get a refund If you paid too little in withholding then you may owe additional tax If you live in a state that assesses income tax then you ll need to file a state return along with your federal return Why is my state refund so high A state refund can be high as a result of too much withholding It means that more tax was withheld all year from your paychecks than what was necessary to cover what you owe

How Long To Get Colorado Tax Refund Coots Nathan

https://i.pinimg.com/originals/25/84/14/258414a9ba63687de99d431af3bce628.png

Here s The No 1 Thing Americans Do With Their Tax Refund GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2020/05/IRS-Tax-Refund-check-shutterstock_1640116444-1024x576.jpg

https://ttlc.intuit.com/community/taxes/discussion/...

This year many people are receiving much smaller refunds for the Federal or even owing because employers used new tax tables published by the IRS as a result of the new tax laws Those tables caused many taxpayers to not have enough withheld from their paychecks so now their refunds are much lower than expected

https://lytaxadvisors.com/blog/why-is-my-state-tax...

Knowing why your state tax is more than your federal tax is the first step to becoming an educated taxpayer with a Tax resolution specialist consultant Knowing the difference between state and federal taxes helps you make better financial choices and prepare for state tax changes

Where s My State Tax Refund

How Long To Get Colorado Tax Refund Coots Nathan

Understanding Your Forms W 2 Wage Tax Statement

IRS Refund Schedule When To Expect Your Tax Refund

Your Tax Refund Is The Key To Homeownership The All Star Team

Why Do I Owe State Taxes This Year Why So Much 2022 Guide 2023

Why Do I Owe State Taxes This Year Why So Much 2022 Guide 2023

TAX HACKS The 9 States With No Income Tax and The Hidden Catch In Each

Average Tax Refund In Every U S State Vivid Maps

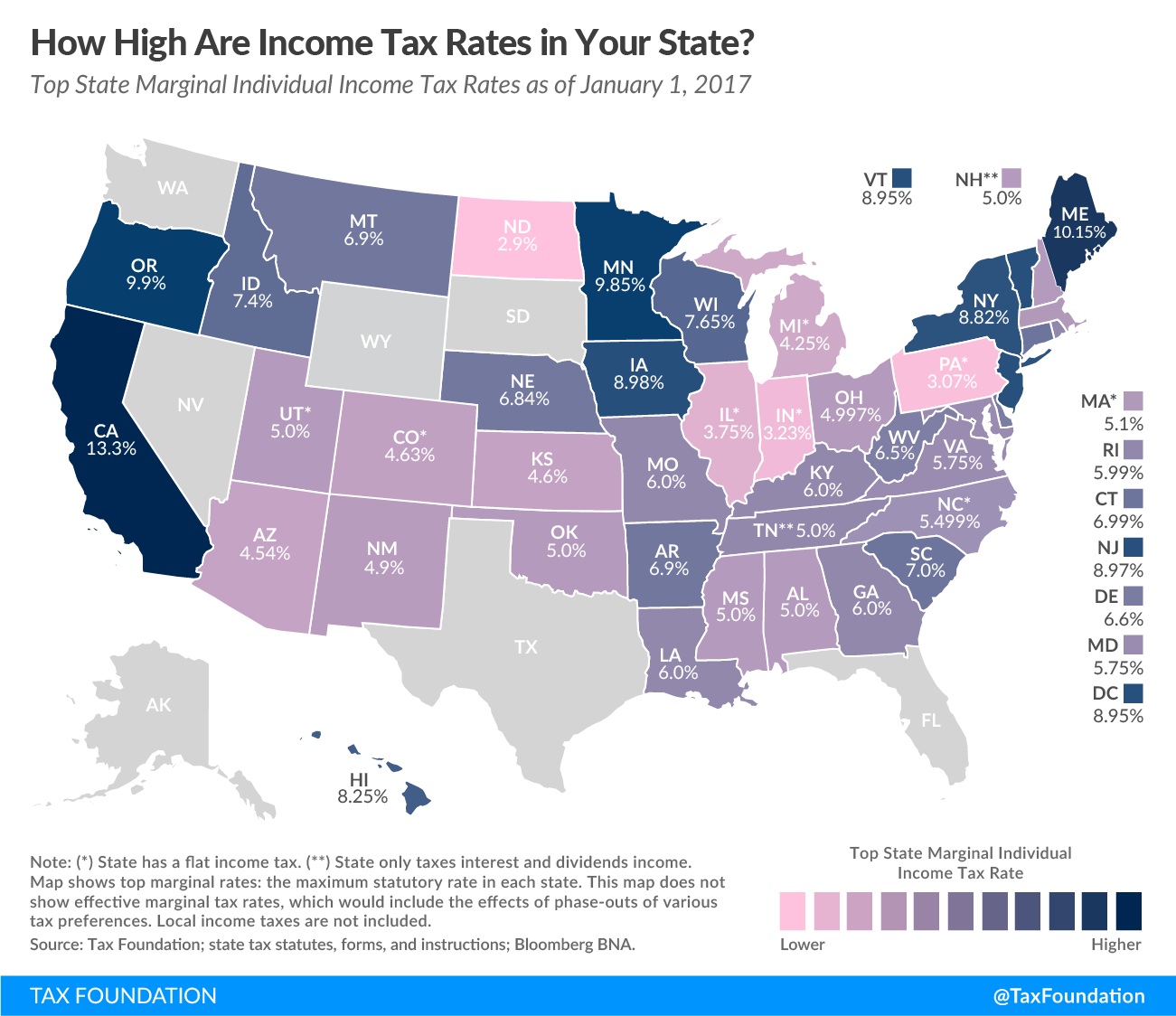

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

Why Is My State Tax Refund Higher Than Federal - WASHINGTON The IRS today provided guidance PDF on the federal tax status of refunds of state or local taxes and certain other payments made by state or local governments to individuals