Wi Child Tax Credit 2023 2023 Wisconsin Act 101 expands the current state child and dependent care tax credit from 50 percent of the federal credit to 100 percent beginning with tax year 2024

Here is what you should know about the child tax credit for this year s tax season and whether you qualify The maximum tax credit per qualifying child is 2 000 for children Expanding on the nature of Wisconsin s newly signed child tax credit legislation for those with incomes at or above 43 000 the restructured tax credit offers potential relief up to 2 000 for

Wi Child Tax Credit 2023

Wi Child Tax Credit 2023

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

CHILD TAX CREDIT 2023 AMOUNT Tax Refund 2022 2023 IRS TAX REFUND UPDATE

https://i.ytimg.com/vi/uy_73yxbNpo/maxresdefault.jpg

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

https://taxprocpa.com/images/increased-child-tax-credit.jpg

Beginning with tax year 2023 the governor s budget will increase the percentage of the federal credit that filers with one dependent child may claim from 4 percent to 16 percent and Child and dependent care credit increases Wisconsin Act 101 Effective March 6 2024 and applicable to tax years beginning after December 31 2023 Wisconsin

To receive the Child Tax Credit you have to have earned at least 2 500 in income to be eligible This tax credit directly reduces the amount of income tax you owe and up to 1 500 can be A qualifying child is your child step child grandchild niece nephew sibling or authorized foster child For the EiTC children must be under 19 at the end of 2023 or under 24 if fulltime

Download Wi Child Tax Credit 2023

More picture related to Wi Child Tax Credit 2023

Why The Child Tax Credit Is Lower In 2023 Khou

https://media.khou.com/assets/VERIFY/images/15a040f1-9821-4933-a978-2b8b0a8fc521/15a040f1-9821-4933-a978-2b8b0a8fc521_1140x641.jpg

Maximum Amount Of Child Tax Credit 2023 Texas Breaking News

https://texasbreaking.com/wp-content/uploads/2023/02/child-tax-credit-in-2023-check-eligibility-how-to-claim.jpg

Child Tax Credit 2023 Get Up To 3 600 Per Child

https://biospc.org/wp-content/uploads/2023/08/Child-Tax-Credit-2023-1024x683.png

Under current law Wisconsin filers can receive a state Child and Dependent Care Expenses Credit up to 300 to 525 for one qualifying dependent or up to 600 to 1 050 for two or more The left leaning Center for American Progress said if the child tax credit is expanded 224 000 Wisconsin residents under 17 whose families are not eligible for the full

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit On March 4 Gov Tony Evers signed Assembly Bill 1023 now 2023 Wisconsin Act 101 which expands the current child and dependent care tax credit from 50 percent to

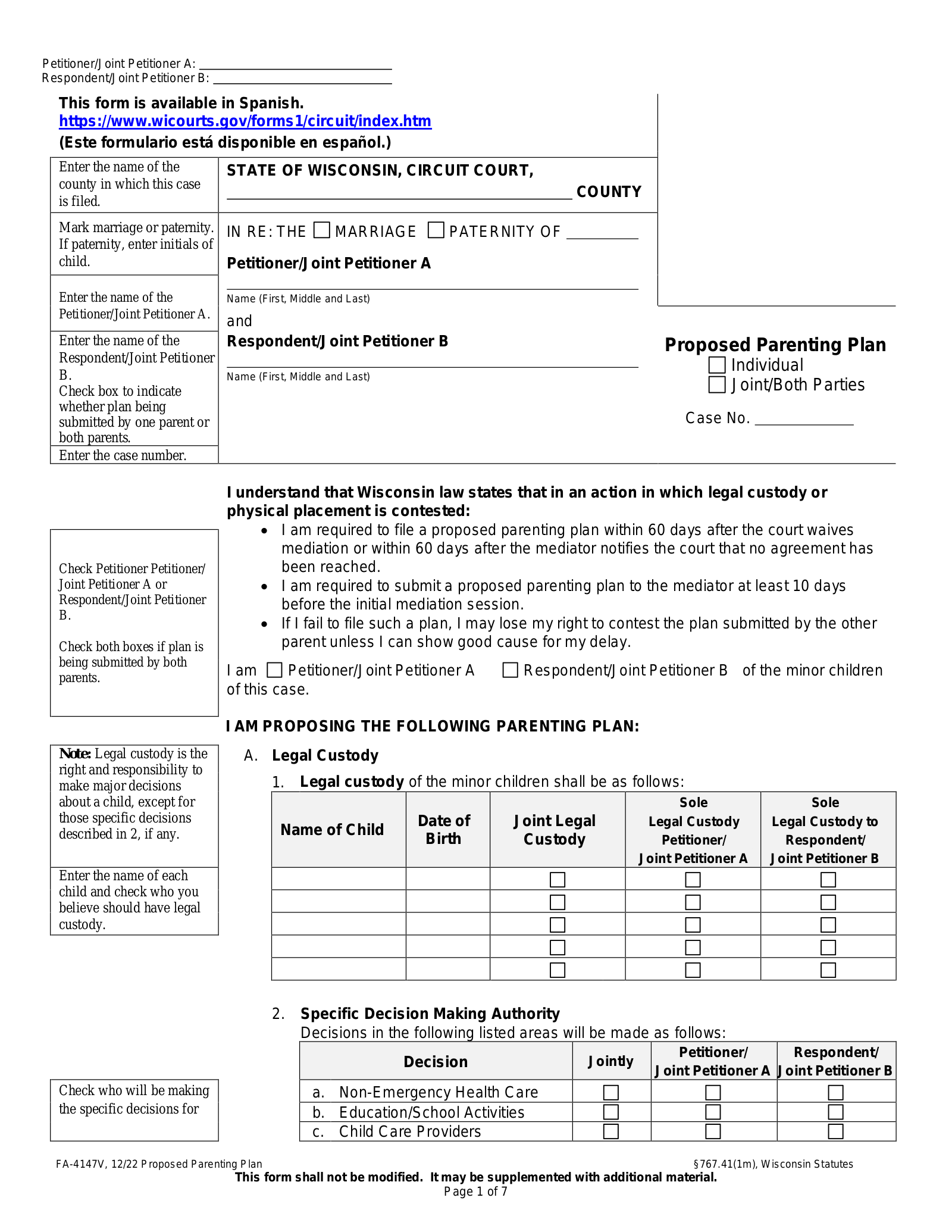

Free Wisconsin Custody Parenting Plan PDF EForms

https://eforms.com/images/2023/04/wisconsin-parenting-plan.png

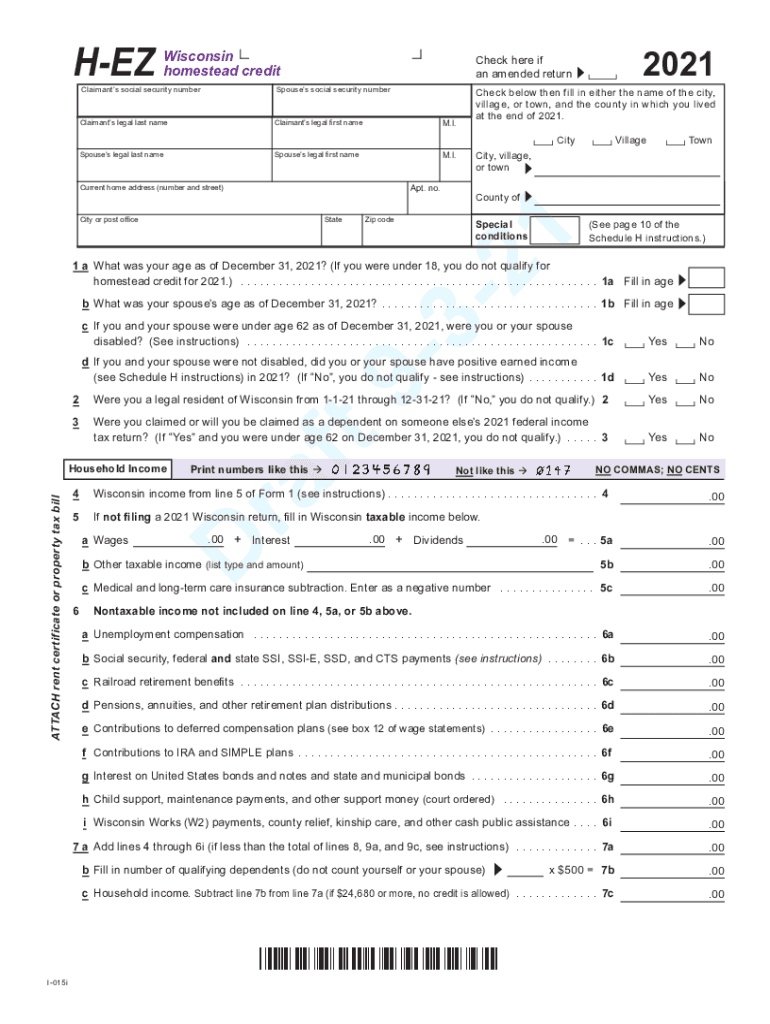

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable

https://www.signnow.com/preview/573/344/573344198/large.png

https://content.govdelivery.com › accounts › WIGOV › bulletins

2023 Wisconsin Act 101 expands the current state child and dependent care tax credit from 50 percent of the federal credit to 100 percent beginning with tax year 2024

https://www.usatoday.com › story › money › taxes

Here is what you should know about the child tax credit for this year s tax season and whether you qualify The maximum tax credit per qualifying child is 2 000 for children

2021 Child Tax Credits Paar Melis Associates P C

Free Wisconsin Custody Parenting Plan PDF EForms

New Child Tax Credit Opens The Door For Old Scams

2022 Education Tax Credits Are You Eligible

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Child Tax Credit Portal Now Open For Non filers How To Claim Up To

Child And Dependent Care Credit 2022 2022 JWG

2022 Child Tax Credit Chart Latest News Update

Wi Child Tax Credit 2023 - Wisconsin policymakers thus far have not followed suit although the state s tax code does provide some specific relief for parents Here we take a closer look at child tax credits as