Will County Il Property Tax Freeze For Seniors Exemptions Disabled Persons Homestead Exemption Senior Citizens Assessment Freeze Homestead Exemption In accordance with Section 15 175 of the Property Tax Code

The Senior Citizens Assessment Freeze Homestead Exemption qualifications for the 2021 tax year for the property taxes you will pay in 2022 are listed below You will be 65 or The Senior Citizens Assessment Freeze Homestead Exemption qualifications for the 2022 tax year for the property taxes you will pay in 2023 are listed below You will be 65 or

Will County Il Property Tax Freeze For Seniors

Will County Il Property Tax Freeze For Seniors

https://i0.wp.com/njtoday.news/wp-content/uploads/2022/09/homeequity_property-tax-reimbursement-1200.jpg?resize=1024%2C649&ssl=1

Ending Delays For senior Freeze Beneficiaries NJ Spotlight News

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2022/06/Chapendra-flickr-copy.jpg

Lisle Township Supervisor Defends Opposition To Proposed Property Tax

https://jnswire.s3.amazonaws.com/jns-media/bb/58/523712/property_tax_3.jpeg

Per Illinois State Statute 35 ILCS 200 15 172 seniors applying for this exemption must complete the enclosed application in its entirety including the property 8 30 AM 4 30 PM Property Tax Exemption Information If you are a homeowner senior citizen veteran disabled veter an or disabled person you might be eligible for a money

The Senior Citizens Assessment Freeze Homestead Exemption qualifications for the 2020 tax year for the property taxes you will pay in 2021 are listed below You will be 65 or The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special

Download Will County Il Property Tax Freeze For Seniors

More picture related to Will County Il Property Tax Freeze For Seniors

Hecht Group Illinois Property Tax Freeze For Seniors

https://img.hechtgroup.com/1663513494646.jpg

Tax Credits Could Replace Senior Freeze Rebates New Jersey Monitor

https://newjerseymonitor.com/wp-content/uploads/2022/09/seniorfreeze-scaled.jpeg

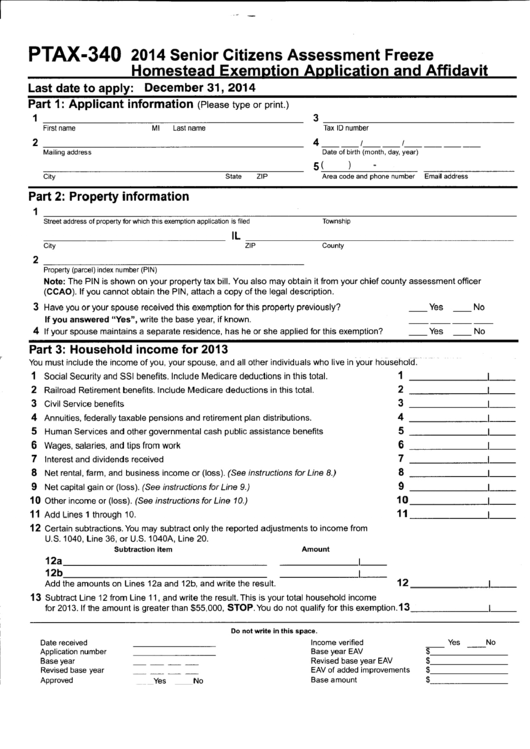

Senior Citizen Assessment Freeze Exemption Cook County Form

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-ptax-340-2014-senior-citizens-assessment-freeze-2.png

In response to the evolving issue of the coronavirus or COVID 19 around the world Rhonda Novak the Will County Supervisor of Assessments has announced a The Senior Citizens Real Estate Tax Deferral Program allows qualified seniors to defer all or part of their property taxes and special assessment payments on

Property Tax Relief Homestead Exemptions PTELL and Senior Citizens Real Estate Tax Deferral Program 35 ILCS 200 15 175 General Homestead Exemption GHE To apply for a property tax freeze seniors usually need to file an application with their local county assessor s office Property tax freezes for seniors provide financial relief

New Property Tax Freeze For Maine Seniors Maine Credit Unions

https://mainecreditunions.org/wp-content/uploads/2022/06/house-gdcdf0adc5_1280-1024x1024.png

New Property Tax Freeze For Maine Seniors Maine Credit Unions

https://mainecreditunions.org/wp-content/uploads/2021/01/financial-4560047_1920-768x495.jpg

https://www.willcountysoa.com/section/exemptions

Exemptions Disabled Persons Homestead Exemption Senior Citizens Assessment Freeze Homestead Exemption In accordance with Section 15 175 of the Property Tax Code

https://www.willcountysoa.com/section/pdf/Senior...

The Senior Citizens Assessment Freeze Homestead Exemption qualifications for the 2021 tax year for the property taxes you will pay in 2022 are listed below You will be 65 or

NJ Senior Freeze Property Tax Reimbursement THE RIDGEWOOD BLOG

New Property Tax Freeze For Maine Seniors Maine Credit Unions

Property Tax Freeze For Seniors Gets Struck Down In St Louis County

Which States Freeze Property Taxes For Seniors TaxesTalk 2022

Hecht Group 3 Ways To Pay Your Will County Illinois Property Taxes

Understanding The Senior Freeze NJMoneyHelp

Understanding The Senior Freeze NJMoneyHelp

Will County Senior Tax Freeze Form CountyForms

Property Tax Freeze Deadline For Seniors Approaches

Hecht Group Illinois Property Tax Freeze For Seniors

Will County Il Property Tax Freeze For Seniors - Per Illinois State Statute 35 ILCS 200 15 172 seniors applying for this exemption must complete the enclosed application in its entirety including the property