Wind Energy Tax Incentives The Investment Tax Credit ITC provides a credit for investment costs at the start of a project In August 2022 Congress passed the Inflation Reduction Act IRA which extends the Production Tax Credit PTC and the Investment Tax Credit ITC for

Economics and Incentives for Wind Wind energy projects provide many economic benefits including direct and indirect employment land lease payments local tax revenue and lower electricity rates plus other financial incentives The IRA extends tax credits for wind and solar for the next ten years and allows stand alone energy storage projects to qualify for the first time

Wind Energy Tax Incentives

Wind Energy Tax Incentives

https://grist.org/wp-content/uploads/2013/11/wind-turbine-and-storm-clouds.jpg

U S Manufacturers Sound Call For Clean Energy Tax Incentives

https://www.designnews.com/sites/designnews.com/files/cleanenergy.jpg

FACT SHEET Treasury IRS Open Public Comment Clean Energy Tax

https://tidwellgroup.com/wp-content/uploads/2022/10/Fact-Sheet.jpg

On Aug 16 2022 President Biden signed into law the Inflation Reduction Act of 2022 IRA which includes new and revised tax incentives for clean energy projects The IRA extends and significantly modifies the federal tax credits available for wind energy projects Outlined below are the primary federal incentives for developing and investing in wind power resources for funding wind power and opportunities to partner with DOE and other federal agencies on efforts to move the U S wind industry forward

The timing and magnitude of wind turbine installations in the United States are often driven by tax incentives The U S production tax credit PTC a per kilowatthour kWh credit for electricity generated by eligible renewable sources was first enacted in 1992 and has been extended and modified in the years since To stimulate the deployment of renewable energy technologies including wind energy the federal government provides incentives for private investment including tax credits and financing mechanisms such as tax exempt bonds loan guarantee programs and low interest loans Tax Credits

Download Wind Energy Tax Incentives

More picture related to Wind Energy Tax Incentives

Understanding The Expanded Benefits Of Energy Tax Incentives Under 179D

https://i.ytimg.com/vi/xa4uYU_do88/maxresdefault.jpg

Winds Of Change For Alternative Energy Tax Incentives In 2016

https://s2.studylib.net/store/data/013557212_1-c9e809e295c4bb3b67fd40b44e55be5d-768x994.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Of the 4 billion tax credits 1 5 billion supports projects in historic energy communities These projects will create good paying jobs lower energy costs and support the climate supply chain and energy security goals of the Biden Harris Administration s Investing in America agenda Mass production and technology advances are making turbines cheaper and many governments offer tax incentives to spur wind energy development Drawbacks include complaints from locals that

A qualified small wind energy property uses a wind turbine to generate electricity for use in connection with a home in the United States and used as a residence by the taxpayer Tax credits includes installation costs This large package contains many new tax credits to incentivize taxpayers to go green with energy from renewable resources while simultaneously receiving financial relief It also extends or adds to currently existing

Redirecting

https://heinonline.org/HOL/ViewImageLocal?handle=hein.journals/nre25&div=52&collection=&method=preview&ext=.png&size=3

IRA Energy Grants Tax Incentives That Could Save Healthcare Billions

https://s3-prod.modernhealthcare.com/s3fs-public/climate.png

https://windexchange.energy.gov/projects/incentives

The Investment Tax Credit ITC provides a credit for investment costs at the start of a project In August 2022 Congress passed the Inflation Reduction Act IRA which extends the Production Tax Credit PTC and the Investment Tax Credit ITC for

https://windexchange.energy.gov/projects/economics

Economics and Incentives for Wind Wind energy projects provide many economic benefits including direct and indirect employment land lease payments local tax revenue and lower electricity rates plus other financial incentives

Into The Wind The AWEA Blog A New Way To Visualize The Wind Energy

Redirecting

Speech 12 Illinois And The Wind Energy Production Tax Credit YouTube

Renewable Energy Tax Incentives Global Law Firm Norton Rose Fulbright

Commercial Property Condition Assessments PCA Property Inspection Blog

ACORE Comments To Treasury On Implementing The Inflation Reduction Act

ACORE Comments To Treasury On Implementing The Inflation Reduction Act

September 2022 Kansas Country Living Bluestem Electric Cooperative

Wind Energy Tax Credit Likely Over But Effect May Not Hurt Like Before

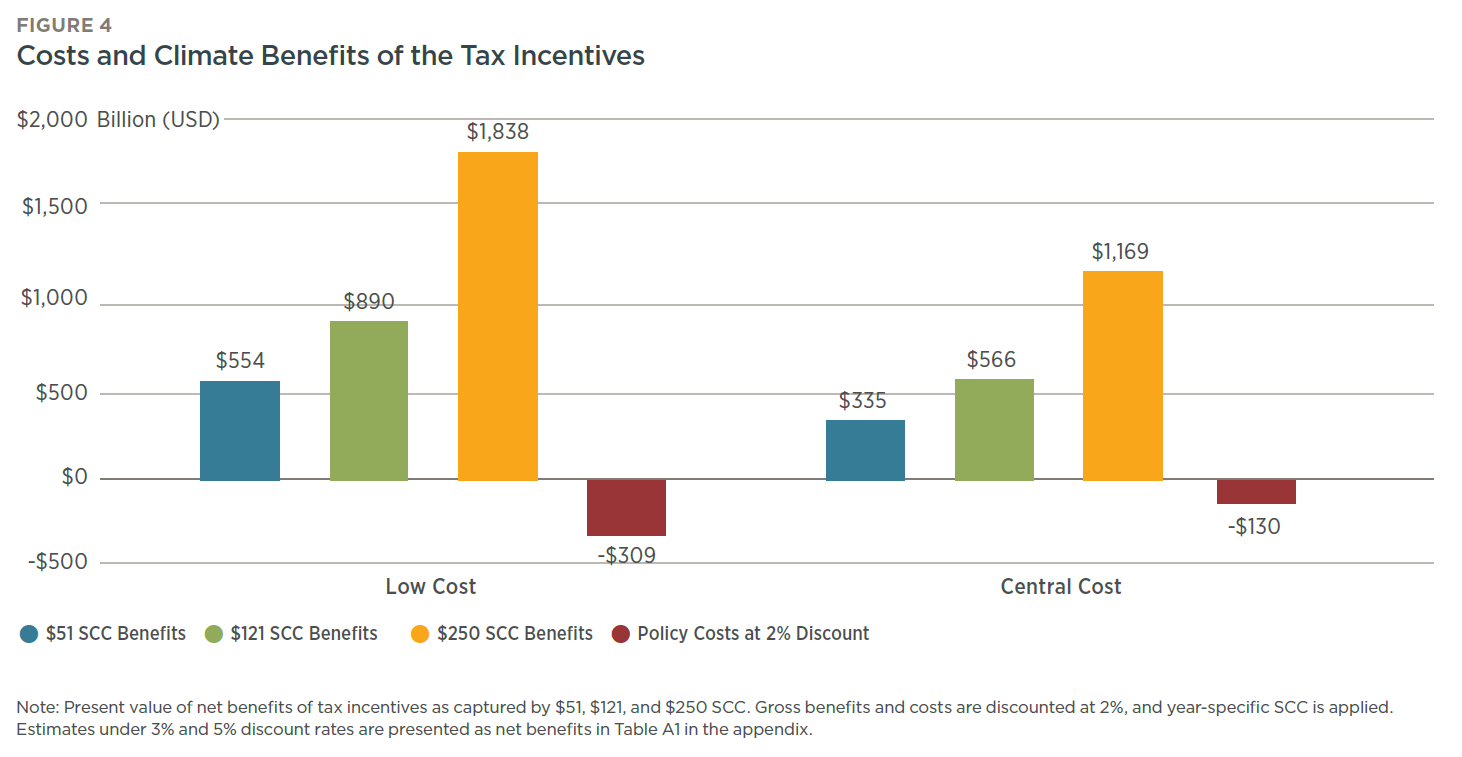

Assessing The Costs And Benefits Of Clean Electricity Tax Credits

Wind Energy Tax Incentives - Wind power tax credit Qualified expenditures on wind energy systems can be eligible for tax credits Accountants should keep clients informed about the eligibility requirements to ensure tax incentives are maximized Biomass tax credit Biomass including biofuels and biomass stoves are recognized by the IRS for tax credits