Wisconsin Diesel Fuel Tax Rate Included in the Gasoline Diesel Kerosene and Compressed Natural Gas rates is a 0 1 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST

Total Non Motor Vehicle Fuel Tax Avgas 0 060 eff 4 1 06 LPG 0 226 eff 4 1 06 CNG 0 247 eff 4 1 06 LNG 0 197 eff 4 1 12 Total Non MVF Tax Total Motor Total Non Motor Vehicle Fuel Tax Avgas 0 060 eff 4 1 06 LPG 0 226 eff 4 1 06 CNG 0 247 eff 4 1 06 LNG 0 197 eff 4 1 12 Total Non MVF Tax Total Motor

Wisconsin Diesel Fuel Tax Rate

Wisconsin Diesel Fuel Tax Rate

https://files.taxfoundation.org/20200729125555/Gas-Tax-July-2020-FV-01.png

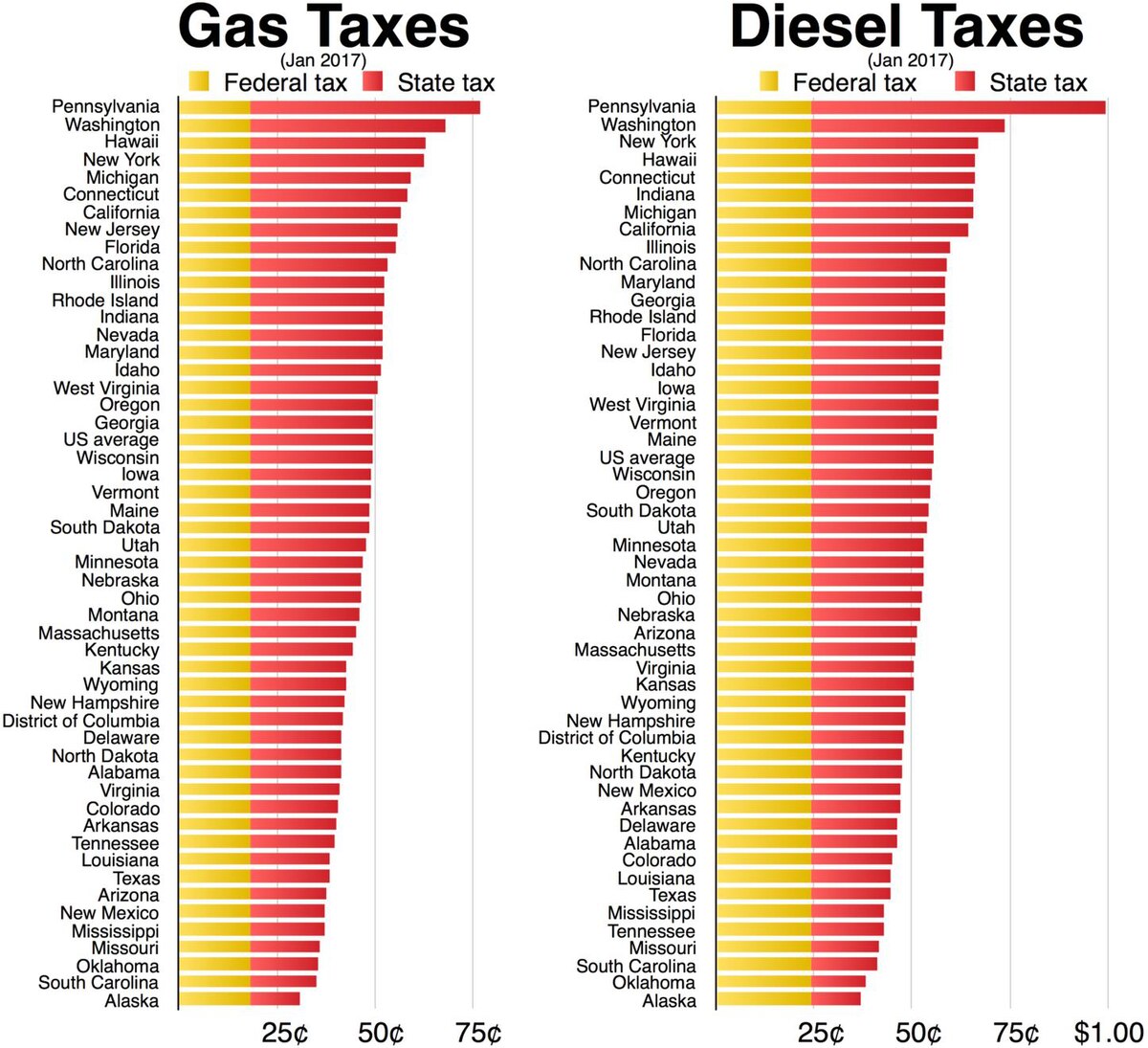

Fuel Taxes In The United States Wikipedia

https://upload.wikimedia.org/wikipedia/commons/thumb/a/a8/Gas_and_Diesel_taxes.pdf/page1-1200px-Gas_and_Diesel_taxes.pdf.jpg

Driving Through Gas Taxes IER

https://www.instituteforenergyresearch.org/wp-content/uploads/2019/05/Diesel.png

Total Non Motor Vehicle Fuel Tax Avgas 0 060 eff 4 1 06 LPG 0 226 eff 4 1 06 CNG 0 247 eff 4 1 06 LNG 0 197 eff 4 1 12 Total Non MVF Tax Total Motor In 2021 22 collections from the tax on gaso line represented 74 4 of total fuel tax collections and the tax on diesel fuel represented 25 2 of collections with 0 4 being

Prior year In 2017 18 collections from the tax on gaso line represented 76 9 of total fuel tax collections and the tax on diesel fuel represented 22 6 of collections with 0 5 The tax rates on alternate fuels are 22 6 per gallon for liquefied propane gas 24 7 per gallon for compressed natural gas and 19 7 per gallon for liquefied natural gas rate

Download Wisconsin Diesel Fuel Tax Rate

More picture related to Wisconsin Diesel Fuel Tax Rate

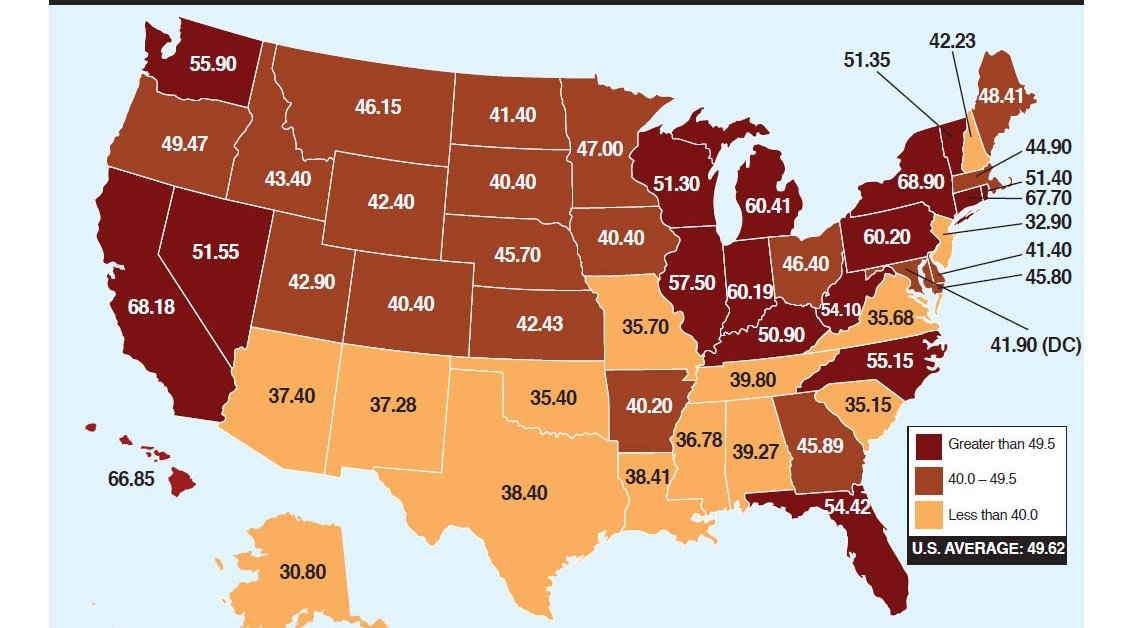

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

https://igentax.com/wp-content/uploads/2022/06/Tobacco-Cigarette-Taxes-by-State-5.png

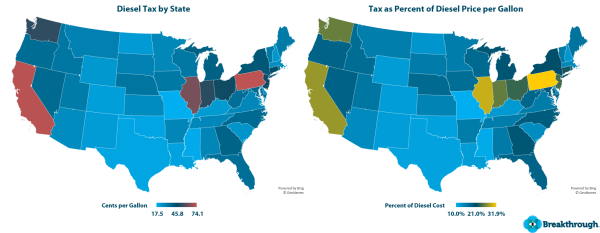

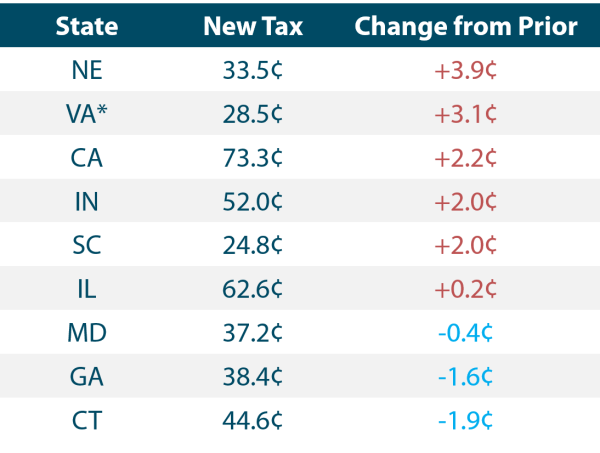

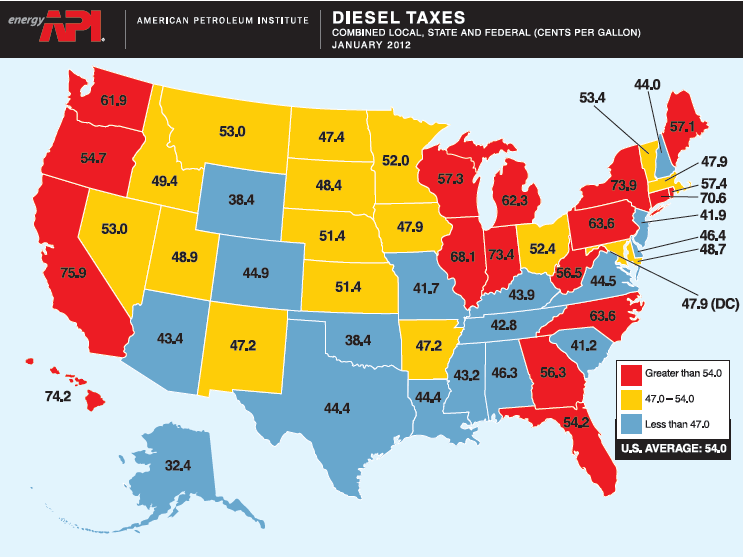

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

https://images.ctfassets.net/ss5iqdlyydqr/wp202001diesel-taxes-mappng/681b4388bf64a8650b460e6ac08703cc/diesel-taxes-map.png?w=600&h=233&q=50

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

https://files.taxfoundation.org/20180808093450/Gas-Tax-July-2018.png

WI INTERNATIONAL FUEL TAX AGREEMENT IFTA INSTRUCTIONS TAX RATES continued Wisconsin Department of Transportation MV2754 12 2020 IFTA TAX This quarter 0 jurisdictions have changed their fuel tax rates Last updated on 2 28 24 by MASSACHUSETTS View the Changes to the Matrix

Gas Taxes The tax rates identified in this map include state and local excise and sales taxes on diesel fuel as well as various fees as calculated by the American Country for consumption use or warehousing The rate of tax is currently 18 3 cents per gallon with higher rates for aviation gasoline diesel fuel and kerosene 8 There is also

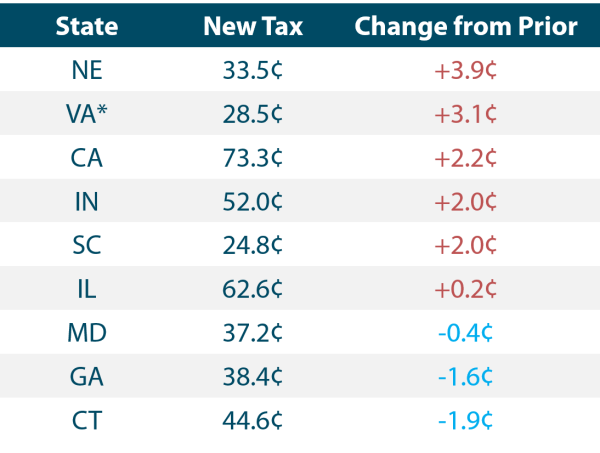

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

https://images.ctfassets.net/ss5iqdlyydqr/wp202001tax-changes-by-statepng/034c267a6f2519bf47d55db186f853f4/tax-changes-by-state.png?w=600&h=453&q=50

State Gasoline Tax Rates As Of July 2019 The Online Tax Guy

https://files.taxfoundation.org/20190730150512/Gas-Tax-July-2019-fv-01.png

https://www.salestaxhandbook.com/wisconsin/gasoline-fuel

Included in the Gasoline Diesel Kerosene and Compressed Natural Gas rates is a 0 1 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST

https://www.revenue.wi.gov/DORReports/fts202305.pdf

Total Non Motor Vehicle Fuel Tax Avgas 0 060 eff 4 1 06 LPG 0 226 eff 4 1 06 CNG 0 247 eff 4 1 06 LNG 0 197 eff 4 1 12 Total Non MVF Tax Total Motor

This Map Shows Where Gas Is Taxed The Most Time

U S Diesel Fuel Taxes By State Impacts On Transportation Costs

Highest Price Ever Of Gasoline In March State by State Gas Price And

Map Of State Gasoline Tax Rates In 2014

Map State Gasoline Tax Rates Tax Foundation

Gas And Diesel Taxes In The United States R coolguides

Gas And Diesel Taxes In The United States R coolguides

What Is The Gas Tax Rate Per Gallon In Your State ITEP

State Motor Fuels Tax Rates 2000 2011 2013 2017 Tax Policy Center

State Motor Fuels Tax Rates Tax Policy Center

Wisconsin Diesel Fuel Tax Rate - Five states charge sales tax on diesel fuel which is calculated as a percentage of the fuel purchase and varies based on the price of fuel The prices below are for diesel taxes