Withholding Tax Us Dividends Canada Web 13 Dez 2023 nbsp 0183 32 The Canadian government imposes a 15 withholding tax on dividends paid to out of country investors which can be claimed as a tax credit with the IRS and is waived when Canadian stocks are held in US retirement accounts

Web The U S withholding tax rate charged to foreign investors on U S dividends is 30 but this amount is generally reduced to 15 for taxable Canadian investors by a tax treaty between the U S and Canada The withholding tax Web 8 Aug 2023 nbsp 0183 32 Corporate Withholding taxes Last reviewed 08 August 2023 Under US domestic tax laws a

Withholding Tax Us Dividends Canada

Withholding Tax Us Dividends Canada

https://eeltd.ca/wp-content/uploads/2023/05/Understanding-tax-on-dividends-in-canada-3-1024x681.jpg

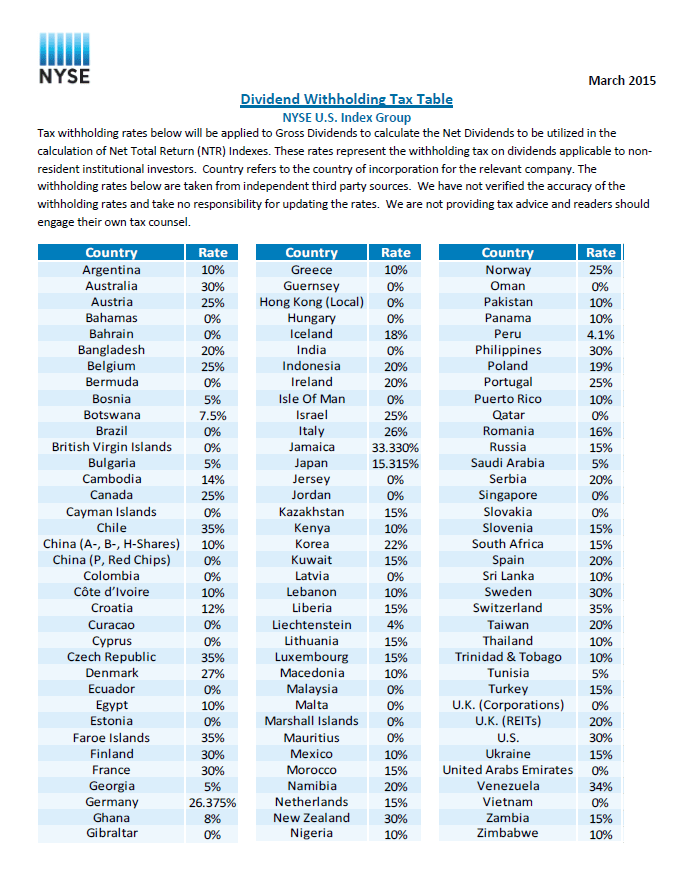

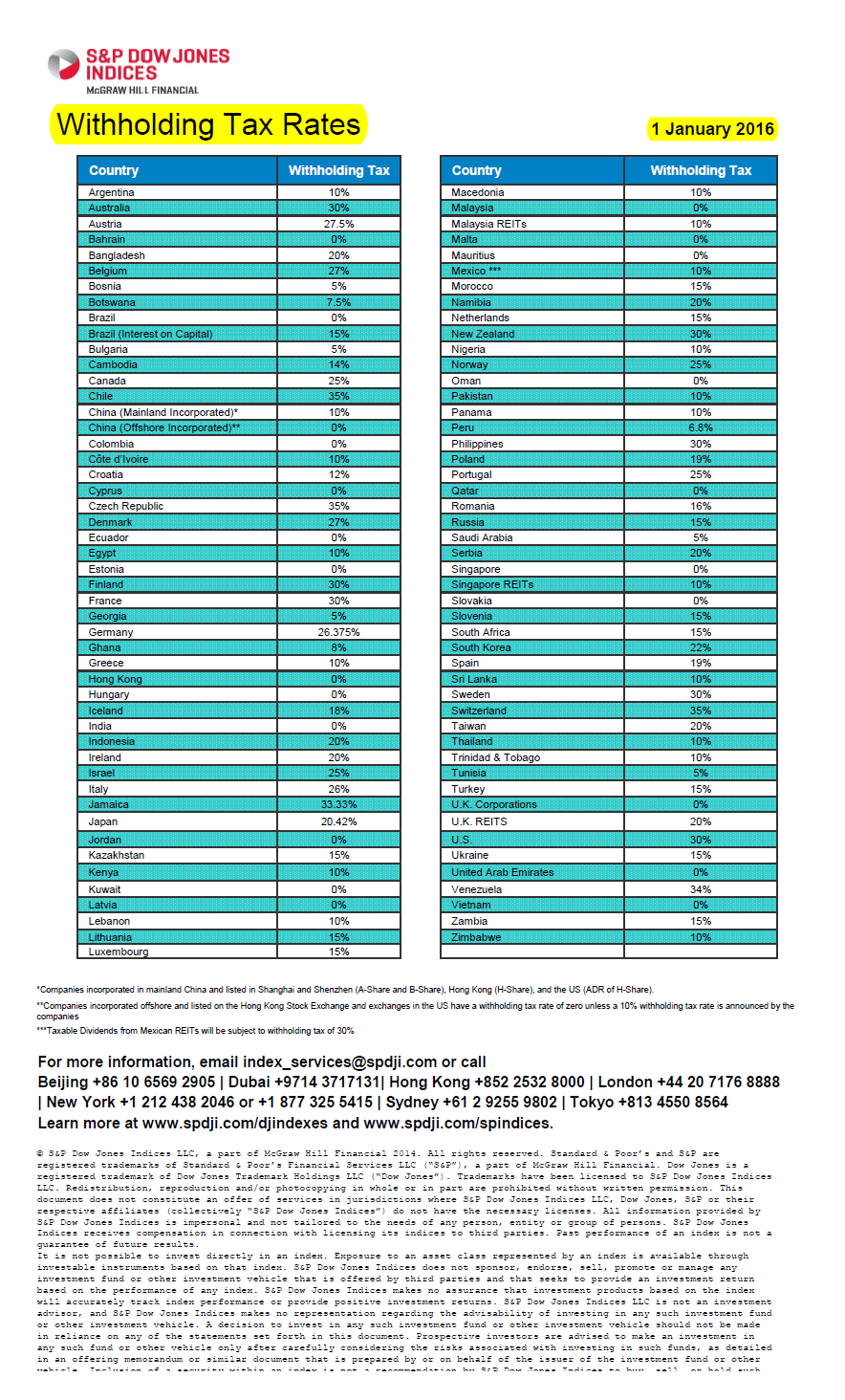

Dividend Withholding Tax Rates By Country 2015 TopForeignStocks

http://topforeignstocks.com/wp-content/uploads/2015/09/Dividend-withholding-taxe-rates-2015.png

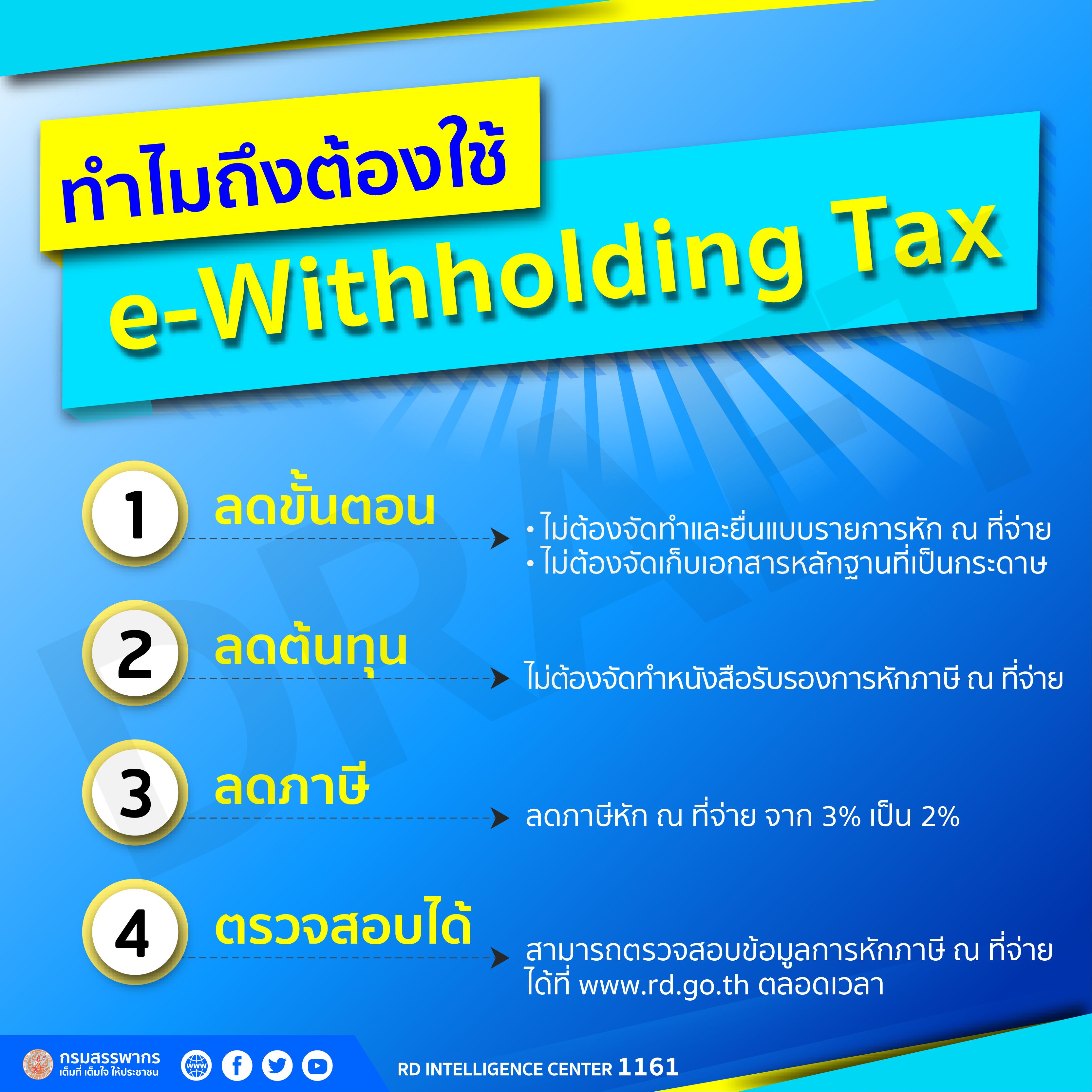

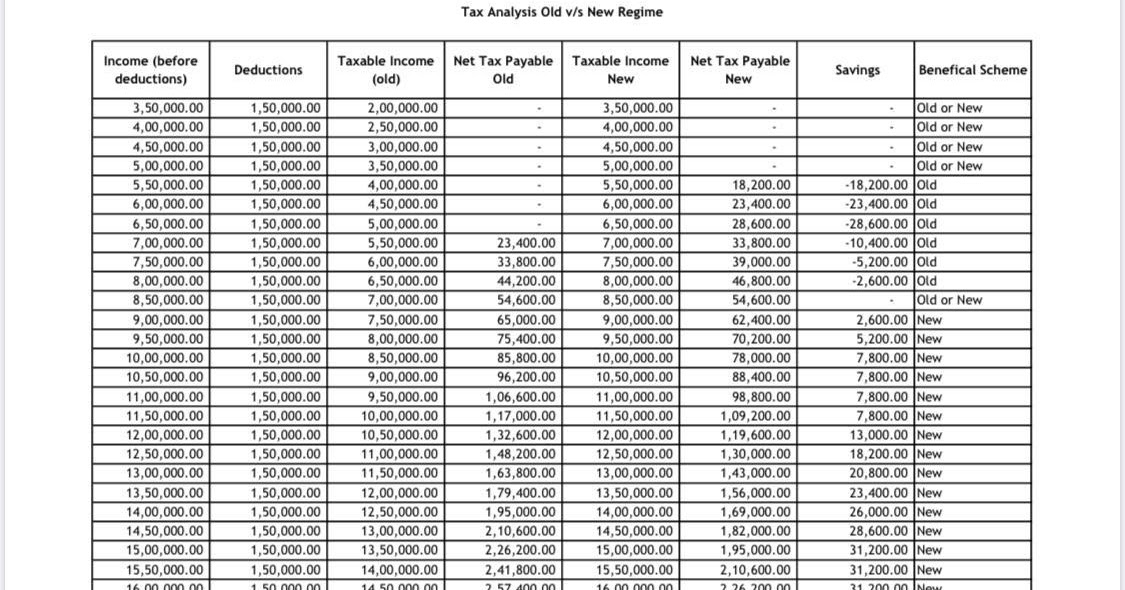

E Withholding Tax 2

https://allmylike.com/images/EWITHHOLDING.jpg

Web 7 Feb 2017 nbsp 0183 32 At 100 000 of income the Canadian dividend tax rate range is 15 to 29 versus 36 to 46 for U S dividends It is also important to note that registered accounts like RRSPs have an Web The treaty withholding tax rate on the foreign dividend is 15 The following table compares the overall tax impact if the actual foreign withholding tax was 25 instead of 15

Web Dividends received from U S stocks may be subject to withholding tax and that dividend would be paid to you net of withholding taxes The CRA allows Canadians to avoid double taxation and thus if a 15 U S withholding tax was applied to the dividends received a foreign tax credit can be claimed for 15 Web 7 Juli 2015 nbsp 0183 32 One should ensure that the maximum tax withheld on U S dividends is 15 in accordance with the Canada U S Tax Treaty When reporting the foreign income and foreign tax withheld one should convert these amounts to Canadian dollars using the Bank of Canada exchange rate in effect on the transaction date

Download Withholding Tax Us Dividends Canada

More picture related to Withholding Tax Us Dividends Canada

TaxTips ca Canadian Dividends No Tax

https://www.taxtips.ca/dtc/eligible-dividends/canadian-dividends-before-regular-tax.jpg

Underused Housing Tax Effisca

https://www.effisca.com/wp-content/uploads/2023/02/2-2048x1390.jpg

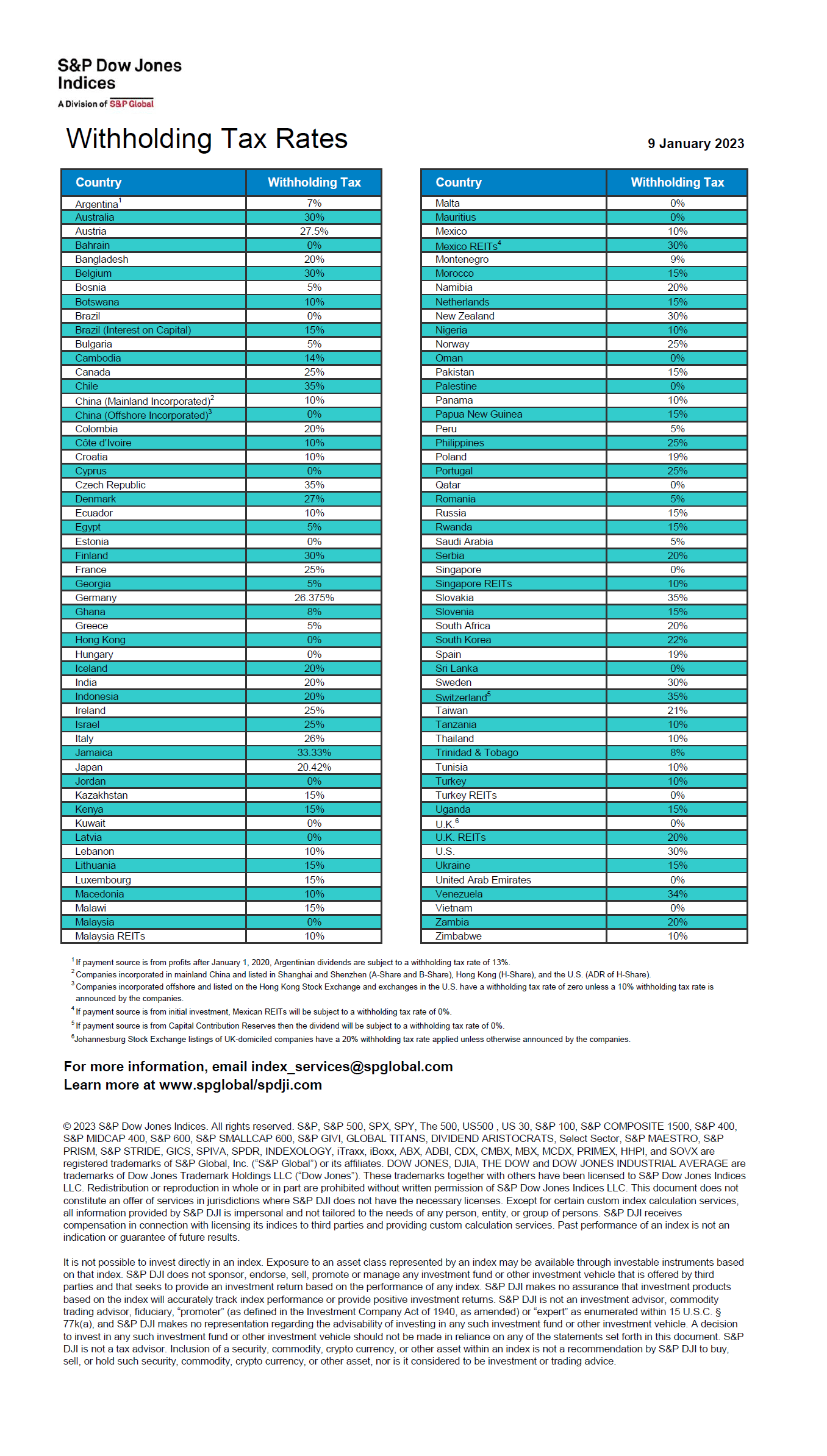

Dividend Withholding Tax Rates By Country For 2023 TopForeignStocks

https://topforeignstocks.com/wp-content/uploads/2023/01/Dividend-withholding-taxes-by-Country-Jan-2023.png

Web United States on the dividend income 15 rather than 30 and Canada generally allows you to deduct the U S withholding tax from your Canadian tax on that income However you still need to file a U S income tax return and report your worldwide income and pay any residual tax to the United States to the extent it exceeds Web 22 Dez 2023 nbsp 0183 32 CRA was asked to confirm the Canadian withholding tax applicable to dividends paid by Canco to US LLC on or after February 1 2009 i e date of application of look through rule under Article IV 6 to dividend payments In responding to this question CRA assumed that all of the conditions for the application of Article IV 6 of the Treaty

Web US individual entitled to 15 dividend withholding tax rate per Article IV 6 US individual not entitled to the 15 Treaty rate on dividends per Article IV 7 a U S Individual Canco US LLC Ontario LP 27 Fiscally Transparent Entities Examples 28 Paragraph 7 b operates to deny Treaty benefits to owners of certain hybrid entities Targeted at among Web 19 Sept 2023 nbsp 0183 32 Canada 25 China Mainland 10 France 25 Germany 26 Ireland 25 Japan 20 Mexico 10 Netherlands 15 Switzerland 35 U K 0 U S 30 for nonresidents S amp P Dow Jones Indices maintains a list of

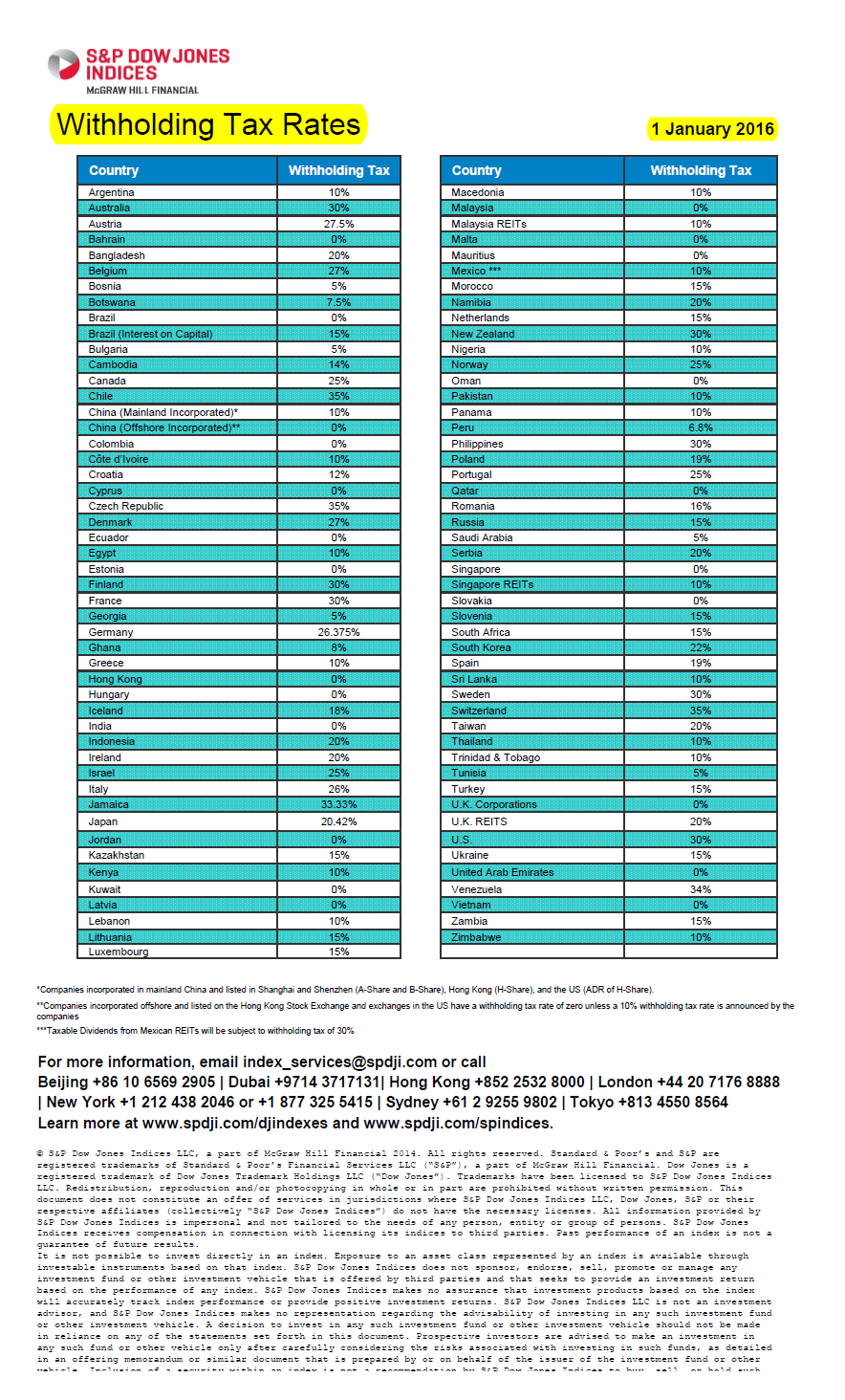

Dividend Withholding Tax Rates By Country 2016 TopForeignStocks

https://topforeignstocks.com/wp-content/uploads/2016/03/Dividend-Withholding-Tax-Rates-for-2016.png

Understanding The Taxes On Dividends In Canada Duggal Professional

https://taxcounting.com/mt-content/uploads/2021/08/picture2_611a4ee8cfea2.png

https://www.suredividend.com/canadian-taxes-us-investors

Web 13 Dez 2023 nbsp 0183 32 The Canadian government imposes a 15 withholding tax on dividends paid to out of country investors which can be claimed as a tax credit with the IRS and is waived when Canadian stocks are held in US retirement accounts

https://www.blackrock.com/.../withholding-tax-reference-guid…

Web The U S withholding tax rate charged to foreign investors on U S dividends is 30 but this amount is generally reduced to 15 for taxable Canadian investors by a tax treaty between the U S and Canada The withholding tax

BIR Imposes 1 Withholding Tax On Online Merchants

Dividend Withholding Tax Rates By Country 2016 TopForeignStocks

Dividends Explained Joanna Bookkeeping

Weekly Tax Calculator 2021 Tax Withholding Estimator 2021

Guide To Foreign Tax Withholding On Dividends For U S Investors

How Dividends Are Taxed In Canada YouTube

How Dividends Are Taxed In Canada YouTube

See Link In Bio For More Details We Are Ready To Handle Your Tax Needs

Historical Income Tax Rates Chart SexiezPicz Web Porn

Business Withholding Guide Income Tax Shattering The Myths Dr Reality

Withholding Tax Us Dividends Canada - Web 7 Feb 2017 nbsp 0183 32 At 100 000 of income the Canadian dividend tax rate range is 15 to 29 versus 36 to 46 for U S dividends It is also important to note that registered accounts like RRSPs have an