Working At Home Tax Deductions 2022 The fixed rate method for calculating your deduction for working from home expenses is available from 1 July 2022 If you don t use the fixed rate method you need

If your employer pays you an allowance to cover your working from home expenses you must include it as income in your tax return If you re a sole trader or From the current tax year 2022 23 onwards employees who are eligible can still make a claim for tax relief for working from home The claim can be made in self

Working At Home Tax Deductions 2022

Working At Home Tax Deductions 2022

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

2022 Deductions List Name List 2022

https://www.relakhs.com/wp-content/uploads/2020/06/Income-Tax-Deductions-List-FY-2020-21-Latest-Tax-exemptions-for-AY-2021-2022-tax-saving-options-chart-tax-rebate.jpg

5 Tax Deductions Small Business Owners Need To Know

https://www.workinghomeguide.com/wp-content/uploads/2017/12/tax-deductions.jpeg

2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home This method simplifies your claim for home office expenses work space in the home expenses and office supply and phone expenses If you worked more than

HM Revenue and Customs HMRC is accepting tax relief claims for working from home due to coronavirus during 2021 to 2022 More than 550 000 Can you claim work from home tax deductions Who can claim tax deductions when working from home Tax Tip 1 Deduct home office expenses if you only worked for yourself or worked for yourself in

Download Working At Home Tax Deductions 2022

More picture related to Working At Home Tax Deductions 2022

Tax Deductions Master List It Always Helps To Know The Types Of Tax

https://i.pinimg.com/originals/15/a6/2e/15a62e57e3086db232425ae452a797e3.jpg

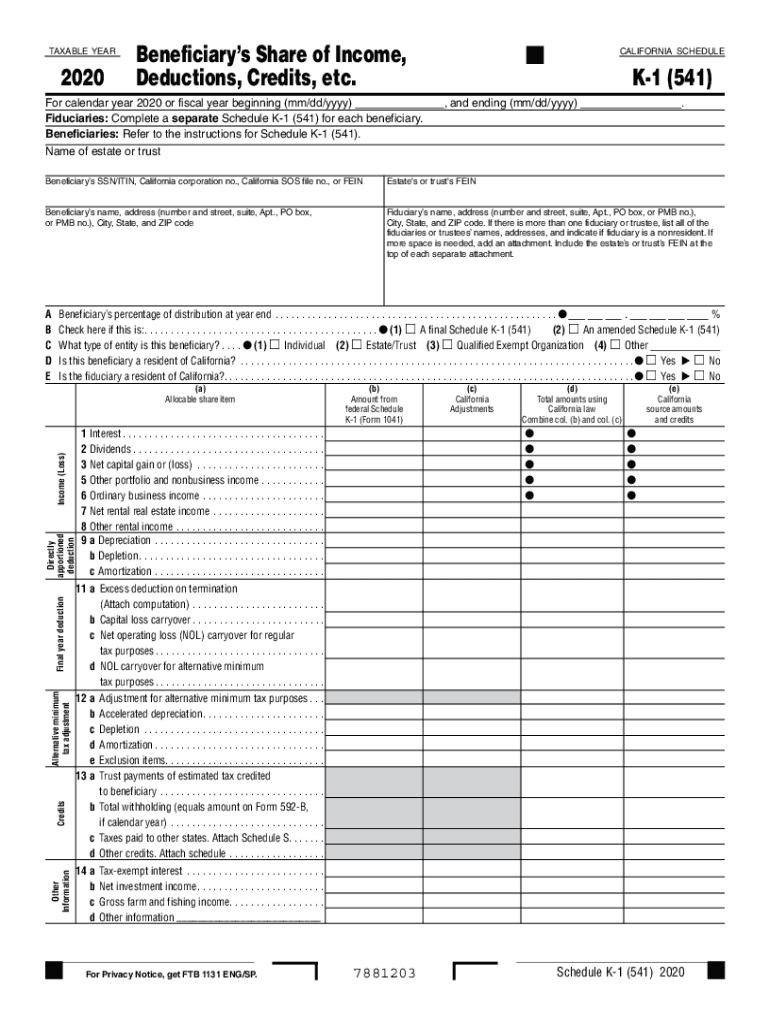

K 1 2020 2023 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/539/908/539908024/large.png

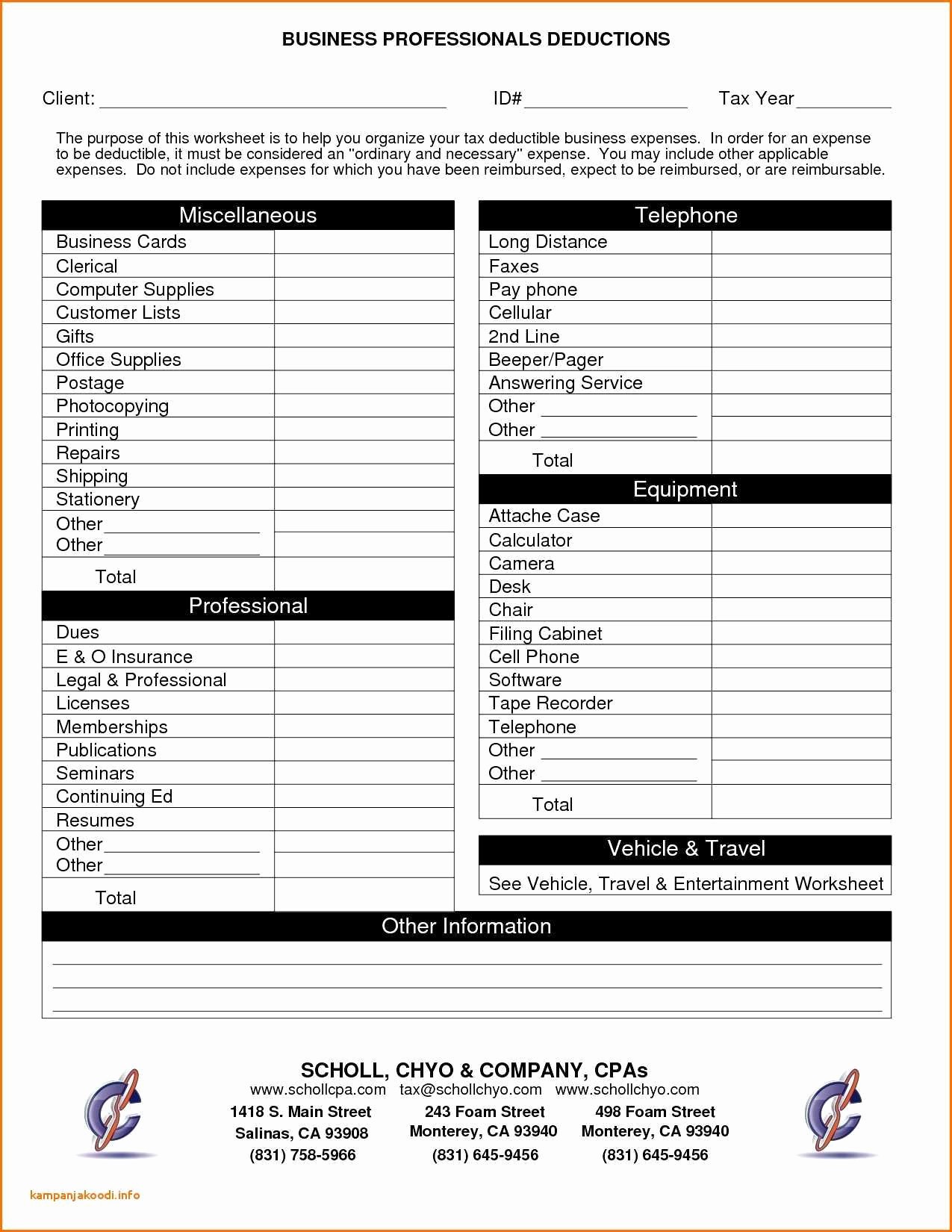

Realtor Tax Deductions Worksheet Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/354/967/354967762/large.png

While you can still claim for the prior two tax years for this tax year the one that started 6 April 2022 and likely for future tax years HMRC says you can t claim tax relief if the only reason you re required to work from Working from home tax relief is a UK government initiative aimed at helping workers offset the increased home related expenses incurred while working remotely during the COVID 19 pandemic Those

So who gets to take work from home tax deductions Well the IRS reserves them for self employed independent contractors In other words if you work This calculator covers the 2013 14 to 2023 24 income years Use either the fixed rate method 67 cents or actual cost method to work out your deduction for work

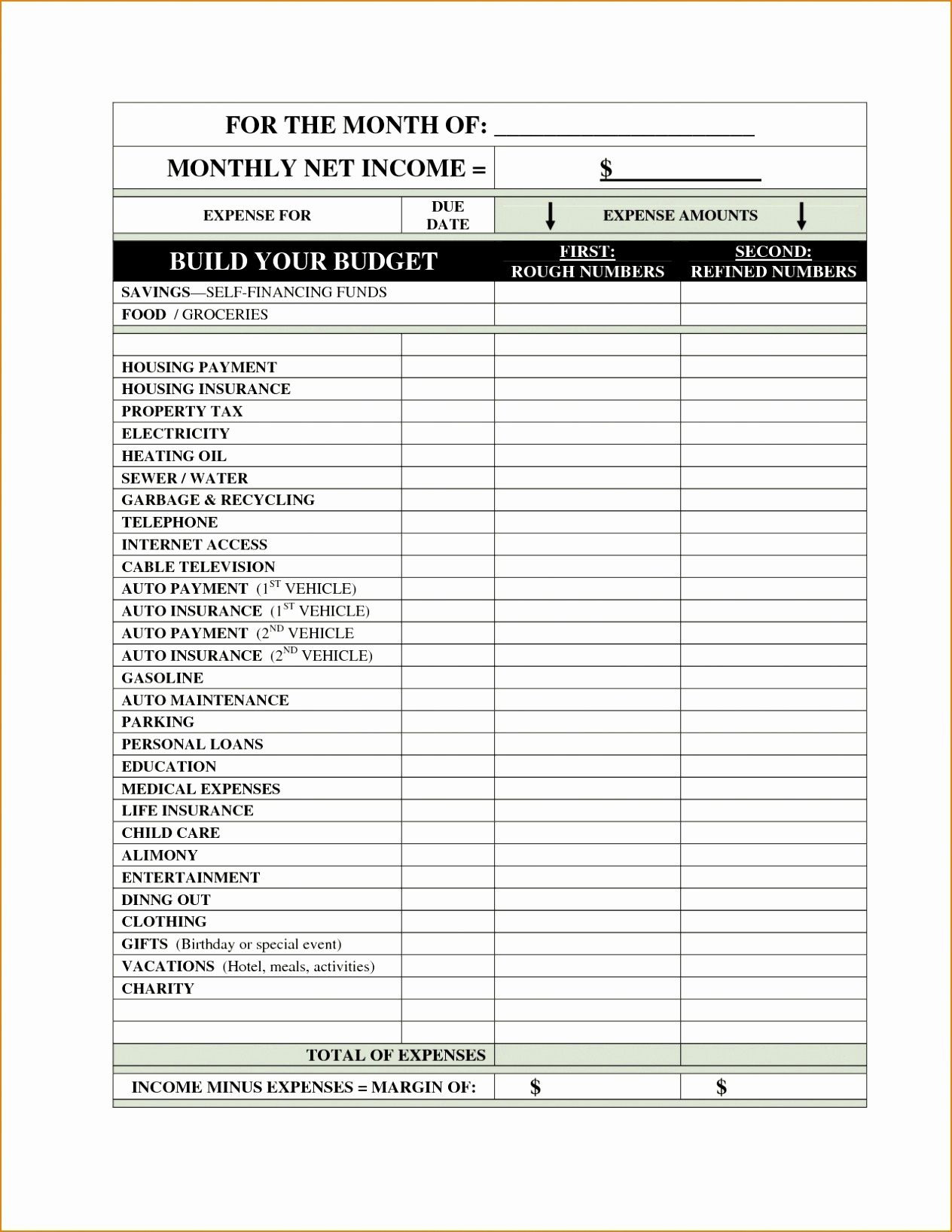

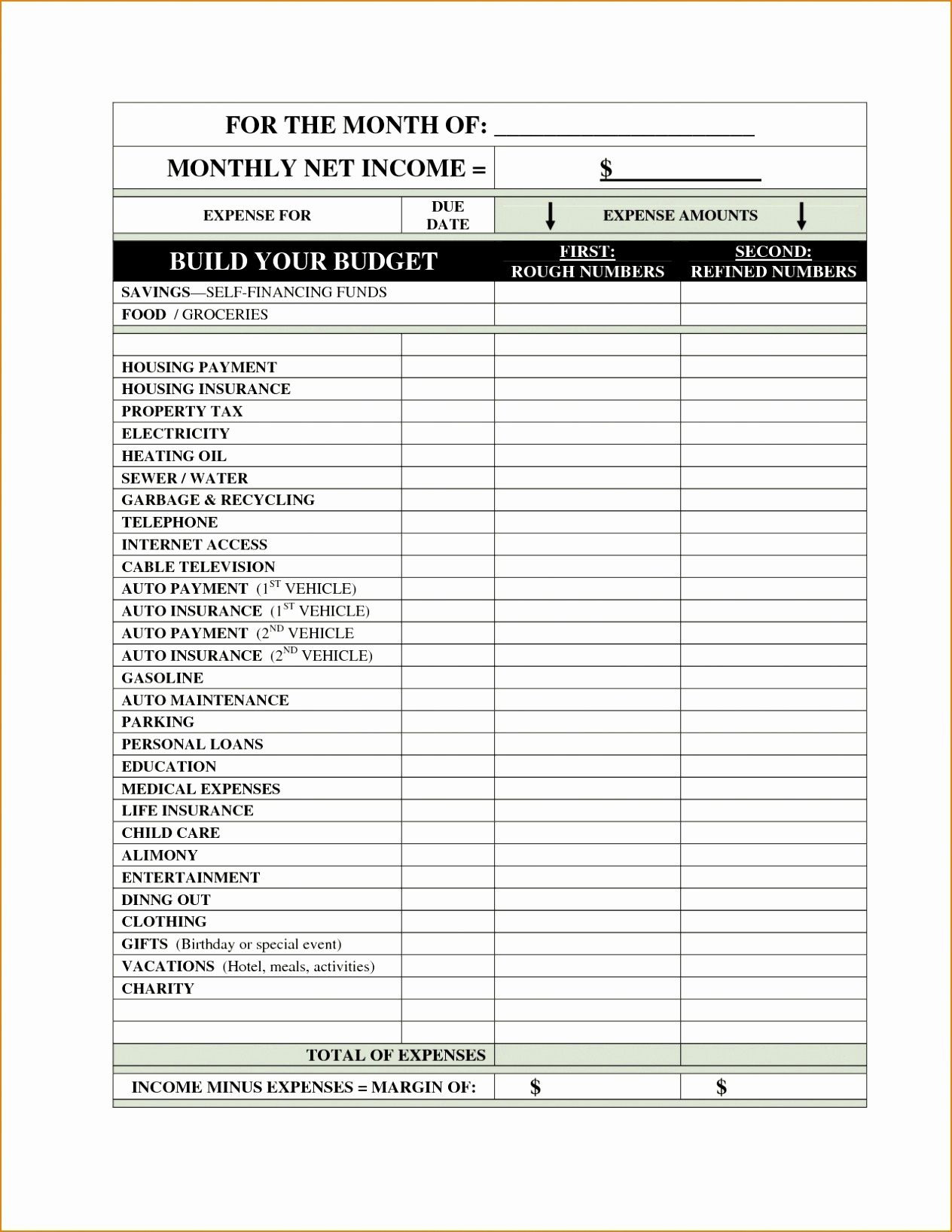

Tax Deduction Spreadsheet Template Business Tax Deductions Small

https://i.pinimg.com/474x/f8/11/74/f811745e7a04c2e4ee08120bad8a1eee.jpg

Tax Deductions For Contract Workers Freelancers And Home Business

https://i.pinimg.com/originals/b1/46/73/b14673837d3f99a152b082d60a59c0f4.jpg

https://www.ato.gov.au/individuals-and-families/...

The fixed rate method for calculating your deduction for working from home expenses is available from 1 July 2022 If you don t use the fixed rate method you need

https://www.ato.gov.au/.../working-from-home-expenses

If your employer pays you an allowance to cover your working from home expenses you must include it as income in your tax return If you re a sole trader or

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax

Tax Deduction Spreadsheet Template Business Tax Deductions Small

2022 Deductions List Name List 2022

Small Business Deductions Worksheet Petermcfarland us

Http www anchor tax service financial tools deductions medical

Itemized Donation List Printable Printable World Holiday

Itemized Donation List Printable Printable World Holiday

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

Brilliant Tax Write Off Template Stores Inventory Excel Format

Income Tax Deductions For The FY 2019 20 ComparePolicy

Working At Home Tax Deductions 2022 - 2023 and 2024 Work From Home Tax Deductions Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home