Working Tax Credit Number 0800 Contact HMRC Get contact details if you have a query about Self Assessment tax credits Child Benefit Income Tax including PAYE tax for employers including employers

Child Tax Credit Working Tax Credit If you are unable to claim online you may be able to claim by phone instead Call the Universal Credit Helpline on 0800 328 5644 0800 The Department for Work Pensions DWP used to call from a withheld number but now it will show on your incoming calls as 0800 023 2635 It s worth saving this number in your

Working Tax Credit Number 0800

Working Tax Credit Number 0800

https://www.beavismorgan.com/wp-content/uploads/2021/11/BM-WEB-15-1536x1251.png

Working Tax Credit FAQs That You Wanted

https://www.coreadviz.co.uk/wp-content/uploads/2021/05/Working-Tax-Credit-CoreAdviz.png

Tax Credits Increase Thompson Taraz Rand

https://www.thompsontarazrand.co.uk/wp-content/uploads/2020/04/e26adc0e-d69d-4653-9f65-9450fc0663e2-1.jpg

Working Tax Credits WTC Income Support Universal Credit helpline Telephone 0800 328 5644 Telephone Welsh language 0800 328 1744 You ll be given a 16 Telephone 0345 300 3900 Relay UK 18001 0345 300 3909 You have to renew your claim by 31 July every year If you do not renew it your Working Tax Credit may stop See the

If you re already getting Universal Credit use the Report a change of circumstances tab on your online account or call the Universal Credit helpline Universal Credit helpline How much can you get If you work a certain number of hours a week and have an income below a certain level you could get up to 2 435 working tax credit in

Download Working Tax Credit Number 0800

More picture related to Working Tax Credit Number 0800

Work Opportunity Tax Credit Available To Employers

https://blog.nisbenefits.com/hs-fs/hubfs/work tax credit B.jpg?width=1920&name=work tax credit B.jpg

Working Tax Credit People Learning Academy Ltd

https://peoplelearningacademy.co.uk/wp-content/uploads/elementor/thumbs/Tax-credits-ootlsdvaz7rhfempaqgka0iit3mygfo9usafmqftik.jpg

Difference Between Tax Deduction And Tax Credit

https://www.bestbusinesscenter.org/pics/homepage-image-credits.jpg

There is more information about the HMRC App on the GOV UK website Telephone The main telephone number is the tax credit helpline 0345 300 3900 NGT Call us about Working for Families Enquiry Phone number Current call wait times Individuals 0800 227 773 Sorry you ve called outside our office hours Caregivers in

Call our national phone line You can contact an adviser through our free Help to Claim phone service Advisers are available 8am to 6pm Monday to Friday England 0800 144 Telephone 0800 138 7777 Monday to Friday from 8 am to 6 pm Webchat Launch Monday to Friday from 8 am to 6 pm or Saturday 8 am to 3 pm WhatsApp

PDF How To Complete Your Tax Credits Claim Form Revenue

https://img.pdfslide.net/doc/image/5af189df7f8b9aa9168f33e0/how-to-complete-your-tax-credits-claim-form-revenue-2011-04-04-4-and.jpg

PPT Dial Working Tax Credit Number For Instant Help PowerPoint

https://cdn4.slideserve.com/7165907/dial-working-tax-credit-number-for-instant-help-n.jpg

https://www.gov.uk/contact-hmrc

Contact HMRC Get contact details if you have a query about Self Assessment tax credits Child Benefit Income Tax including PAYE tax for employers including employers

https://contact.org.uk/help-for-families/information-advice-services/benefits...

Child Tax Credit Working Tax Credit If you are unable to claim online you may be able to claim by phone instead Call the Universal Credit Helpline on 0800 328 5644 0800

What Is A Tax Credit DaveRamsey

PDF How To Complete Your Tax Credits Claim Form Revenue

Working Tax Credit Working Tax Credit

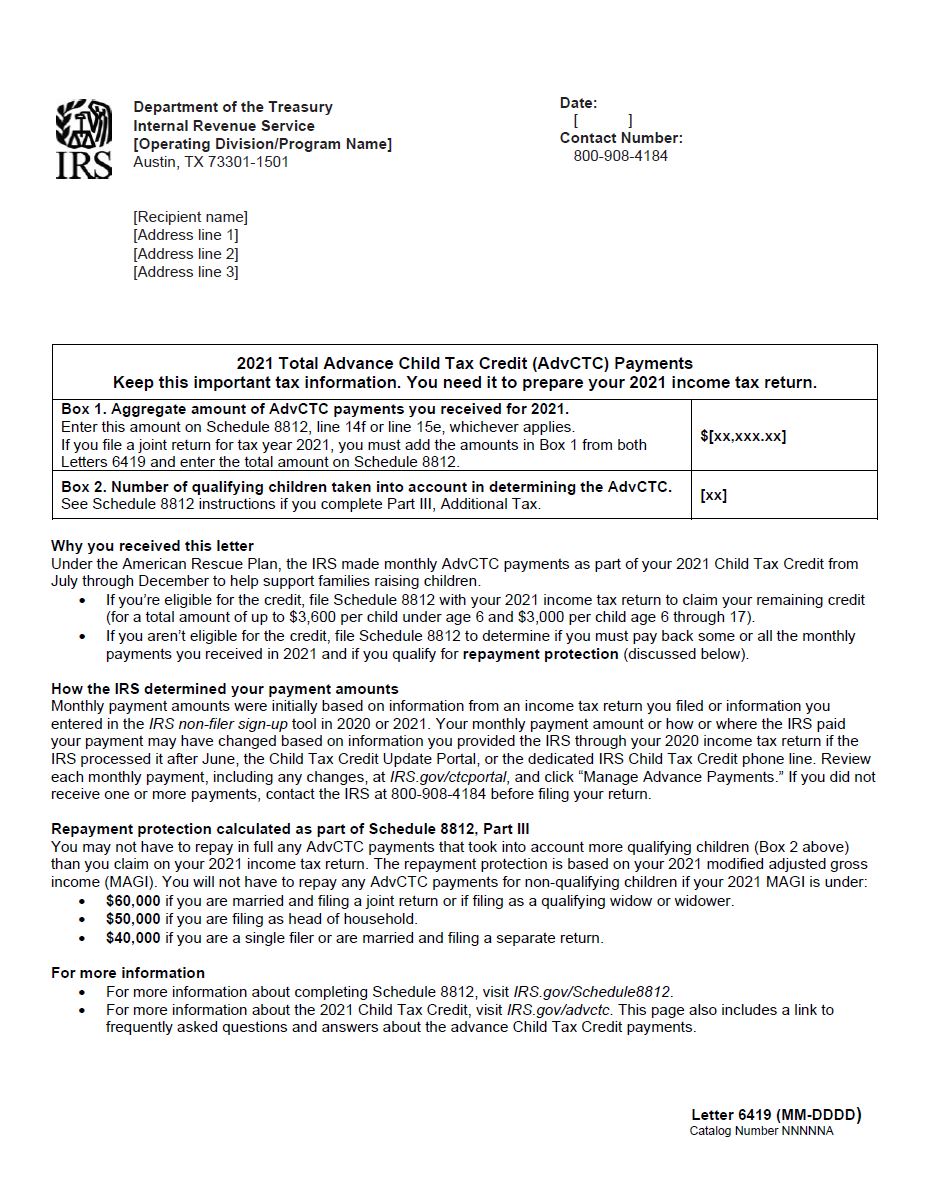

Tax Credit Letters Additional Information

What The Working Tax Credit Changes Mean Channel 4 News

Free Tax Credits Help Advice The Mix

Free Tax Credits Help Advice The Mix

How Tax Credits Work YouTube

Child Tax Credit Number Breanna Bertram

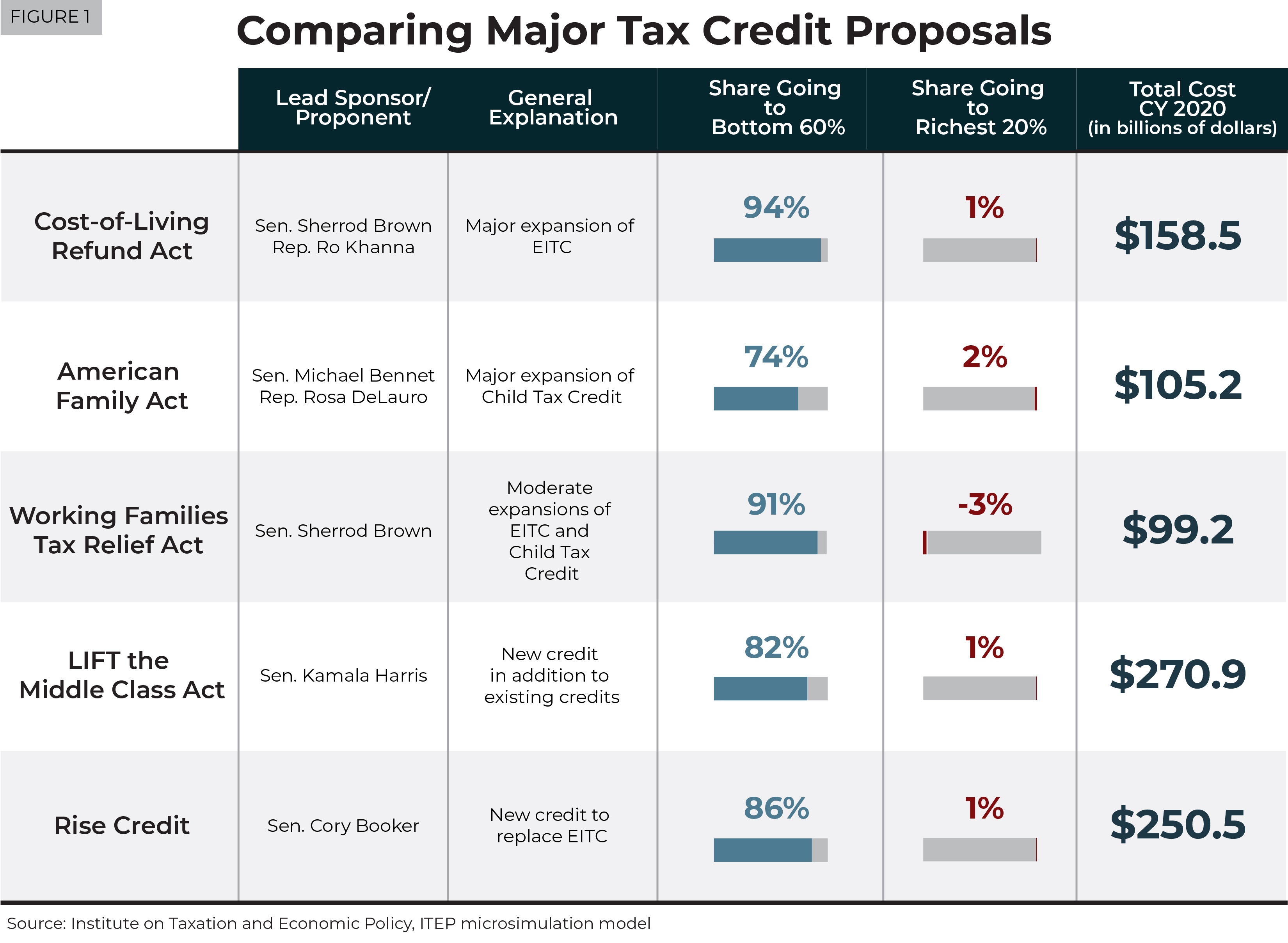

Understanding Five Major Federal Tax Credit Proposals Common Dreams

Working Tax Credit Number 0800 - If you re already getting Universal Credit use the Report a change of circumstances tab on your online account or call the Universal Credit helpline Universal Credit helpline