Working Tax Credit Number Change Of Circumstances Anyone who is no longer eligible for Working Tax Credit due to a change in their circumstances may be able to apply for other UK Government support including

Check if a change affects your tax credits This advice applies to England See advice for Northern Ireland Scotland Wales You must tell HM Revenue and Customs HMRC How to deal with HMRC Tax Credits How to notify changes Changes can be reported to HMRC in three ways Online HMRC s digital channel allows claimants to check claim

Working Tax Credit Number Change Of Circumstances

Working Tax Credit Number Change Of Circumstances

https://ivainformation.com/wp-content/uploads/2017/03/IVAI-Change-of.jpeg

Tax Credit Calculator 2013 CALCULATORSA

https://i2.wp.com/www.rivercitybenefits.com/wp-content/uploads/2013/06/tax-credit-based-on-federal-poverty-guidlines-chart.jpg

Working Tax Credit Number

https://image.slidesharecdn.com/workingtaxcreditnumber-150328060154-conversion-gate01/95/working-tax-credit-number-1-1024.jpg?cb=1427522543

Working Tax Credit is designed to top up your earnings if you work and are on a low income But it s being replaced and most people now have to claim Universal Credit A change of circumstances may affect your Working Tax Credits Almost all changes in family and work life during the year e g a change of job will affect your award for tax

05 Apr 2024 Working tax credit explained Discover whether you re eligible to claim working tax credit and how much you could receive in 2024 25 Marianne Calnan Tax Credits Changes that must be reported to HMRC Certain changes of circumstances must be notified to HMRC within a specified time period This section explains the

Download Working Tax Credit Number Change Of Circumstances

More picture related to Working Tax Credit Number Change Of Circumstances

Working Tax Credit In 2022 Everything You Need To Know

https://www.your-benefits.co.uk/wp-content/uploads/2022/03/pexels-kindel-media-8301230-comp-1536x1024.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

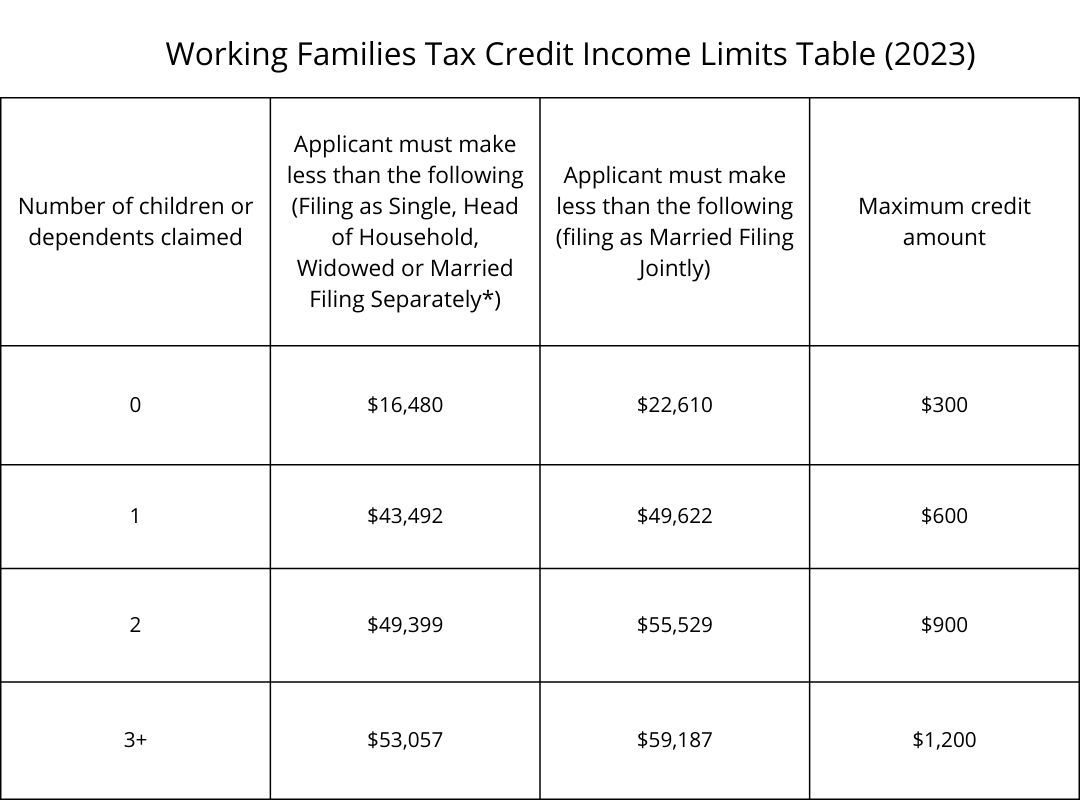

FAQ WA Tax Credit

https://www.wataxcredit.org/wp-content/uploads/2023/01/WFTC-Income-Table-.jpg

Tax Credits changes of circumstances Changes in your circumstances to do with your work income other benefits children childcare and partner must be reported to HMRC Page 1 Help If you have any questions or would like more details contact the HMRC office shown on the letter you got with this form Change of circumstances You must tell us

Change of circumstances Working Tax Credit is paid on a year by year basis but it is very important to tell HMRC about changes during the year which could affect the Check whether any details are wrong because your circumstances have changed since the time HMRC sent your renewal pack You should also check if a change affects your

Working Tax Credit FAQs That You Wanted

https://www.coreadviz.co.uk/wp-content/uploads/2021/05/Working-Tax-Credit-CoreAdviz.png

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

https://www.gov.uk/government/news/working-tax...

Anyone who is no longer eligible for Working Tax Credit due to a change in their circumstances may be able to apply for other UK Government support including

https://www.citizensadvice.org.uk/benefits/help-if...

Check if a change affects your tax credits This advice applies to England See advice for Northern Ireland Scotland Wales You must tell HM Revenue and Customs HMRC

Margit Kincaid

Working Tax Credit FAQs That You Wanted

Working Tax Credit People Learning Academy Ltd

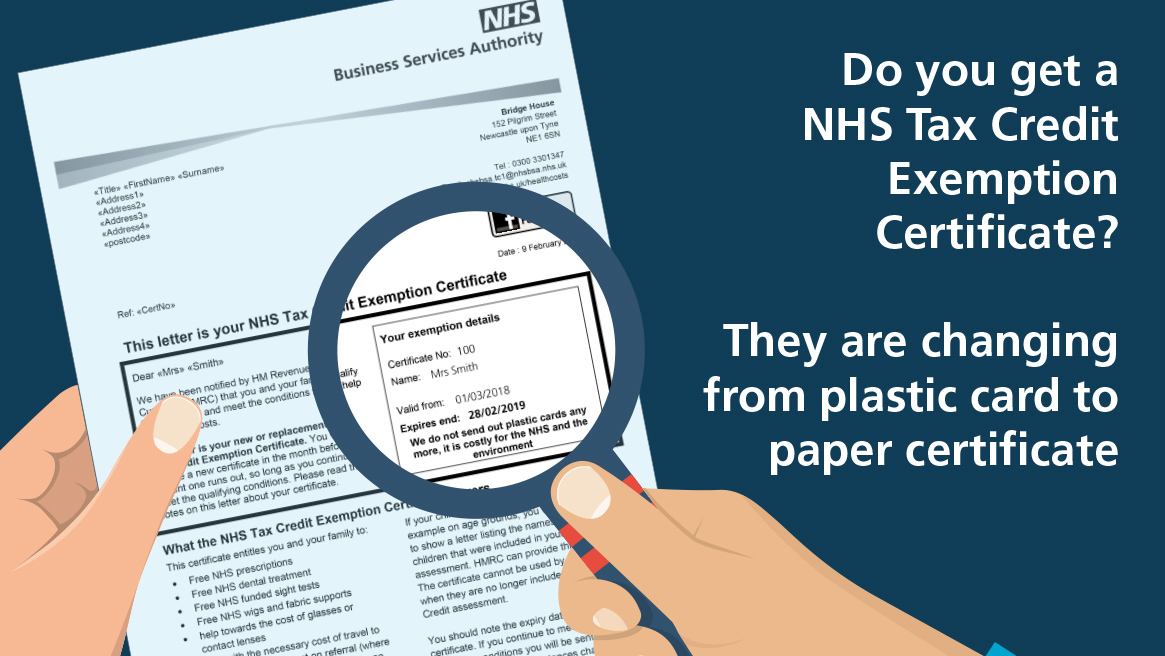

Changes To Proof Of Exemption NHSBSA

Working Tax Credit WCHG

Tax Credits Increase Eyre Co Accountants

Tax Credits Increase Eyre Co Accountants

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

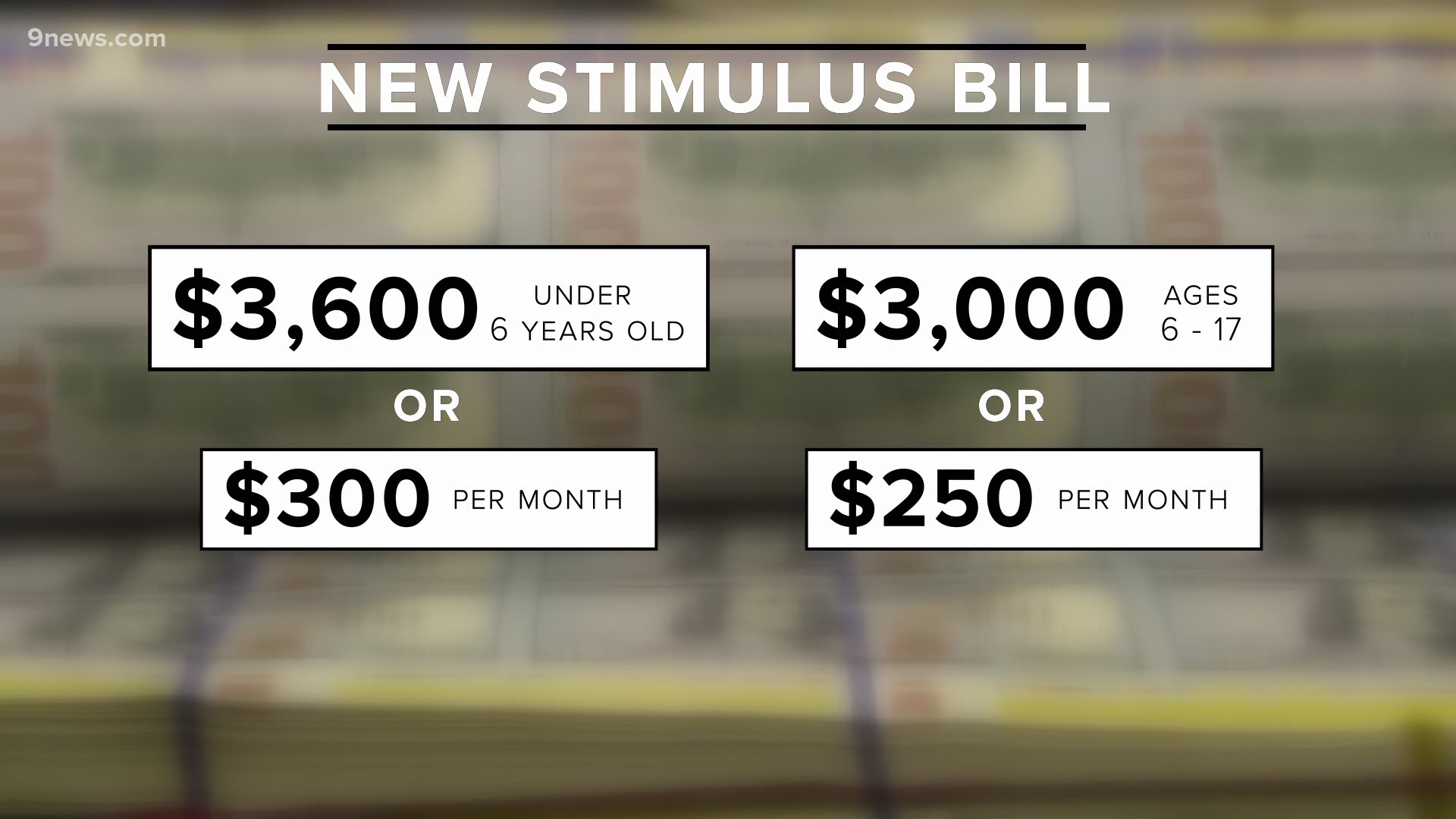

New Child Tax Credit Explained When Will Monthly Payments Start

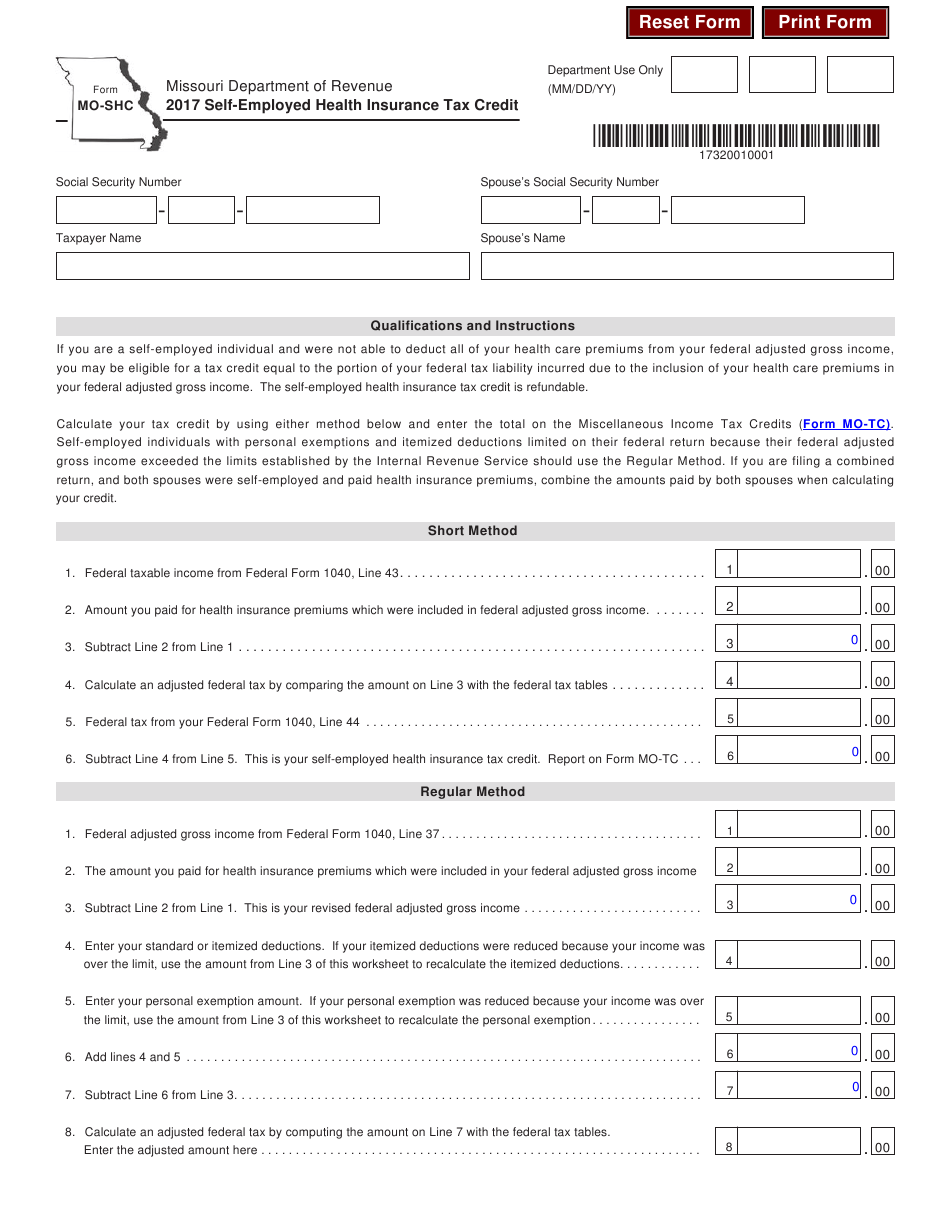

Working Tax Credits Self Employed Form Employment Form

Working Tax Credit Number Change Of Circumstances - 05 Apr 2024 Working tax credit explained Discover whether you re eligible to claim working tax credit and how much you could receive in 2024 25 Marianne Calnan