Wv Tax Credits Verkko West Virginia s highest priority is meeting your company s needs Part of the service includes providing aggressive development assistance in the form of tax credits and

Verkko According to West Virginia s income tax booklet quot the Homestead Excess Property Tax Credit provides a refundable credit of up to 1 000 for low income property owners Verkko 1 maalisk 2023 nbsp 0183 32 The West Virginia tax relief plan reduces individual income taxes rebates the car tax and provides business property tax relief Governor Justice tax

Wv Tax Credits

Wv Tax Credits

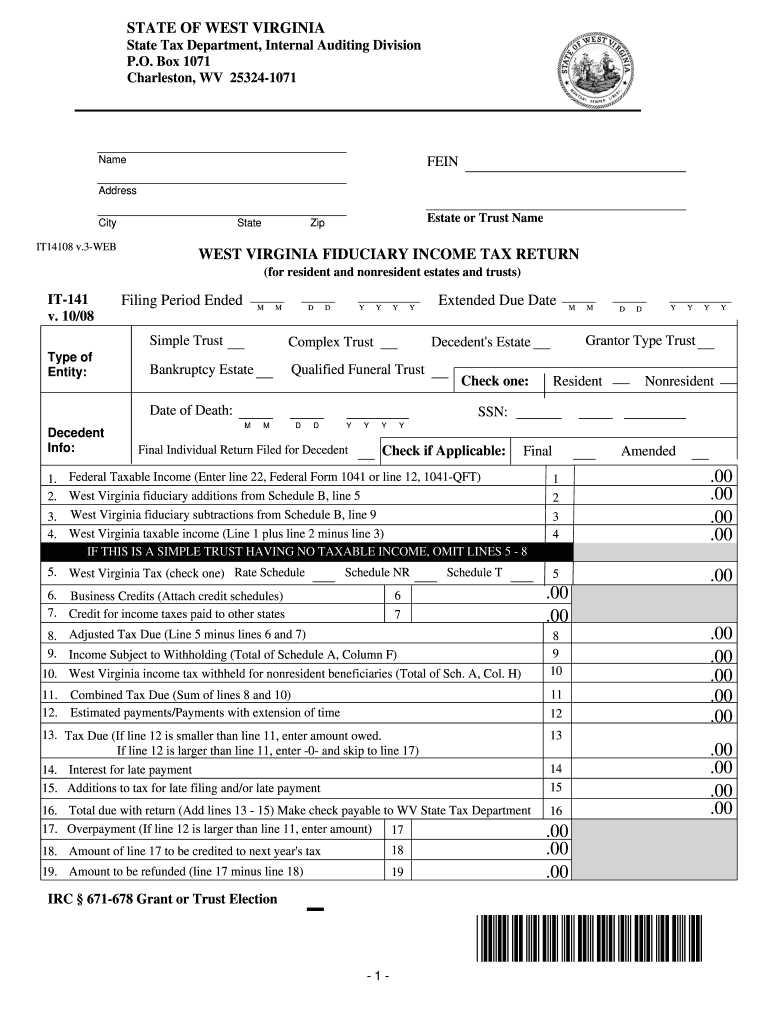

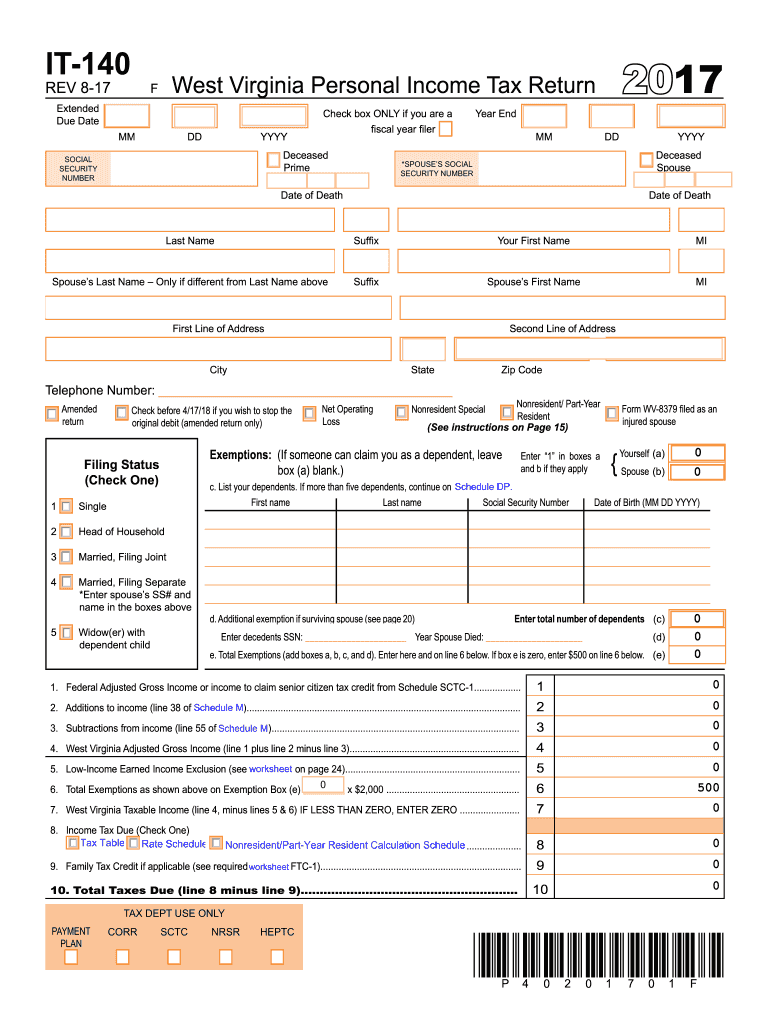

https://www.pdffiller.com/preview/100/112/100112768/large.png

WV State Tax Department Fiduciary Estate Tax Return Forms Fill Out

https://www.signnow.com/preview/11/875/11875584/large.png

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage

https://i.pinimg.com/originals/16/32/aa/1632aa5254885bbfdc75663e9a275641.png

Verkko Learn How to Qualify for the Motor Vehicle Property Tax Credit Still have questions Go to our Income Tax Cut and Property Tax Rebate Page Verkko This summary form and the appropriate credit calculation schedule s or form s must be enclosed with your return to claim a ta x credit Information for these tax credits may

Verkko Credit Schedules AFTC 1 Alternative Fuel Tax Credit for Periods Beginning On or After January 1 2015 Instructions AG 1 Environmental Agricultural Equipment Tax Credit Verkko be claimed Both this summary form and the appropriate credit calculation schedule s or form s MUST BE ENCLOSED with your return in order to claim a tax credit

Download Wv Tax Credits

More picture related to Wv Tax Credits

Free Tax Prep Assistance And Forms At Birmingham Public Library

https://2.bp.blogspot.com/-NEBYWrRxza0/Vo_g07gEvuI/AAAAAAAAOd0/j1QLSwTsyHY/s1600/5512347305_f2008d7527_o.jpg

K 1e Kentucky Form Pdf Essentially cyou 2022

https://www.irs.gov/pub/xml_bc/33485005.gif

What Is A Lifetime Learning Credit Credit RCMTaxServices Learning

https://i.pinimg.com/originals/7e/94/06/7e9406be4e1a00ee943b3d365b4371ac.jpg

Verkko The EITC is a refundable federal income tax credit that provides millions of dollars in assistance to working individuals and families in West Virginia When a return is filed Verkko The Senior Citizen s Tax Credit is available to those homeowners who Participate in the Homestead Exemption program contact your county assessor s office for more

Verkko 20 tammik 2022 nbsp 0183 32 In West Virginia owners of certified historic buildings meaning those listed on the National Register of Historic Places individually or as a contributing Verkko credits may be obtained by visiting our website at tax wv gov or by calling the Taxpayer Services Division at 1 800 982 8297 See additional instructions on page 33 WEST

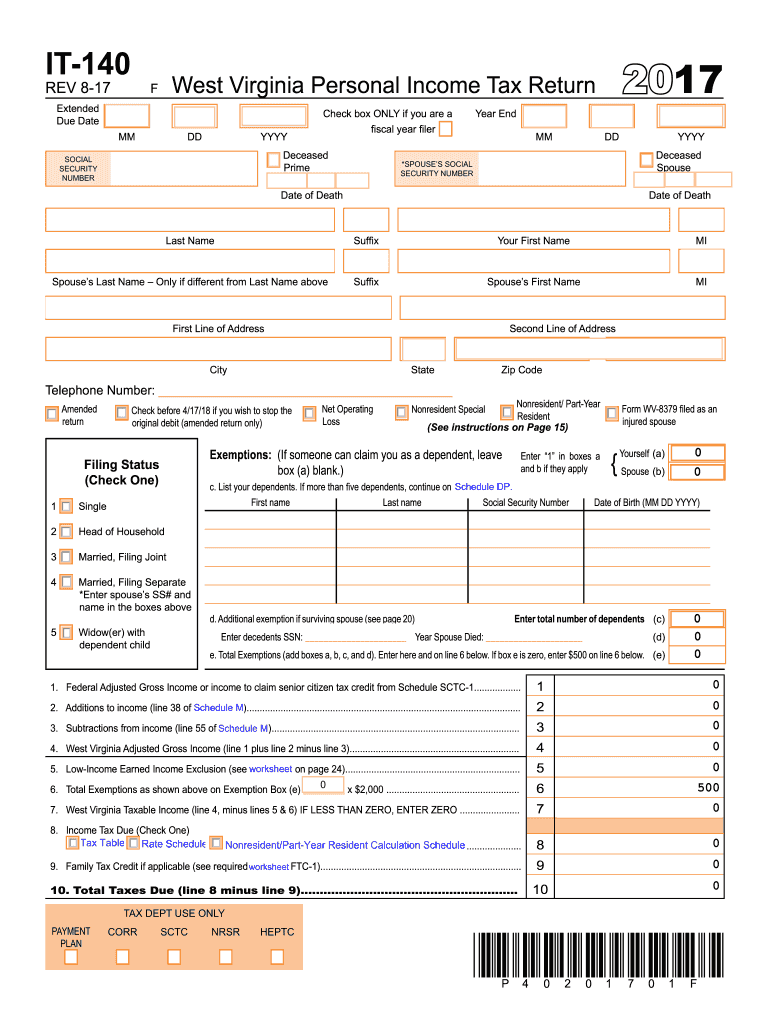

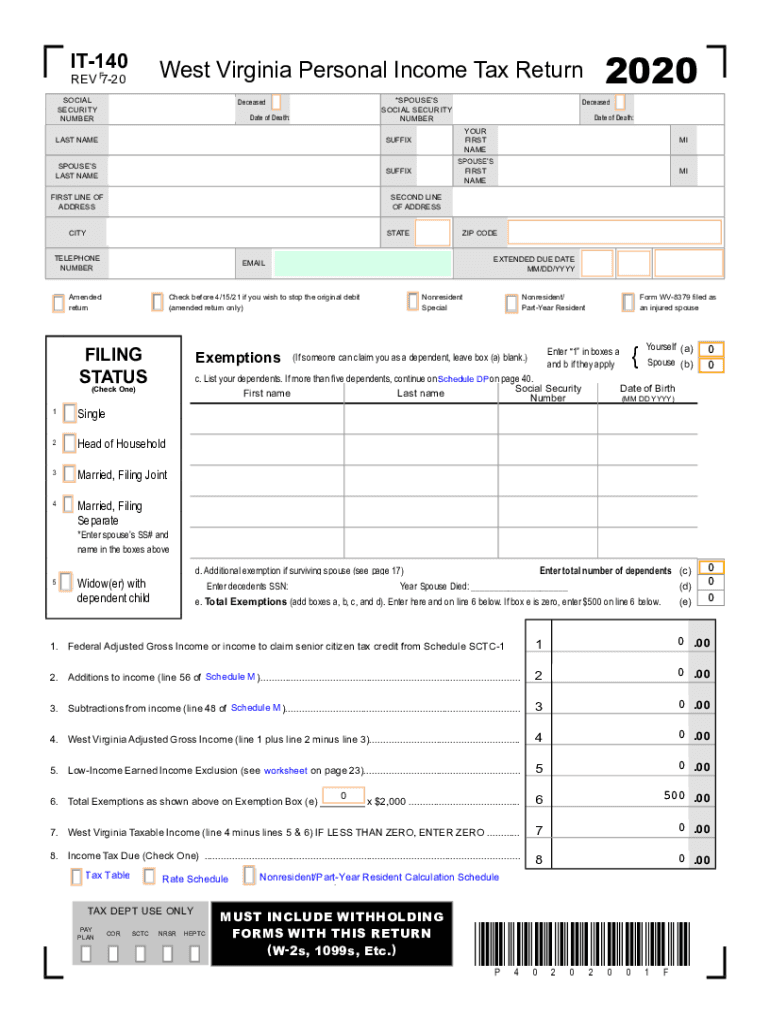

Wv State Tax Forms Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/431/376/431376922/large.png

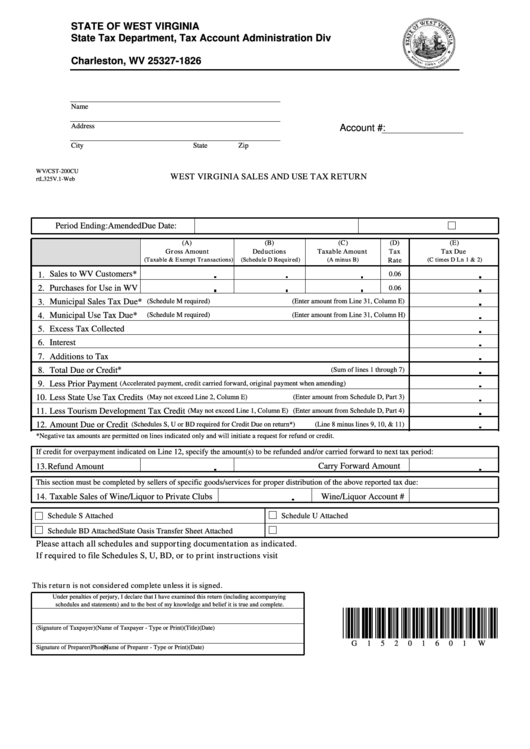

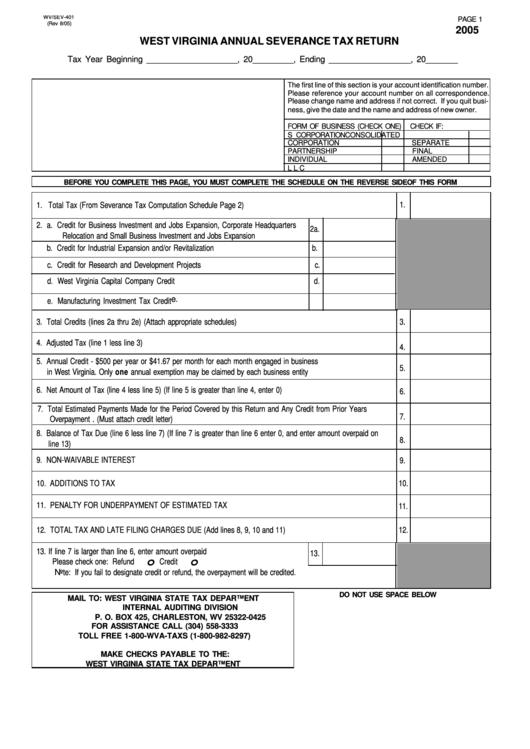

Form Cst 200cu West Virginia Sales And Use Tax Return Printable Pdf

https://data.formsbank.com/pdf_docs_html/315/3152/315226/page_1_thumb_big.png

https://westvirginia.gov/wv-incentives

Verkko West Virginia s highest priority is meeting your company s needs Part of the service includes providing aggressive development assistance in the form of tax credits and

https://support.taxslayer.com/hc/en-us/articles/360015906891-What...

Verkko According to West Virginia s income tax booklet quot the Homestead Excess Property Tax Credit provides a refundable credit of up to 1 000 for low income property owners

Types Of Energy Tax Credits LoveToKnow

Wv State Tax Forms Fill Out Sign Online DocHub

Form Wv sev 401 West Virginia Annual Severance Tax Return 2005

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

OECD Releases Final Plan To Crack Down On International Tax Evasion

GP Accounting Tax Services Hayward CA

GP Accounting Tax Services Hayward CA

Tax Credits Rubber Stamp Stock Vector Illustration Of Bracket 87803935

It 140 Wv Fill Out Sign Online DocHub

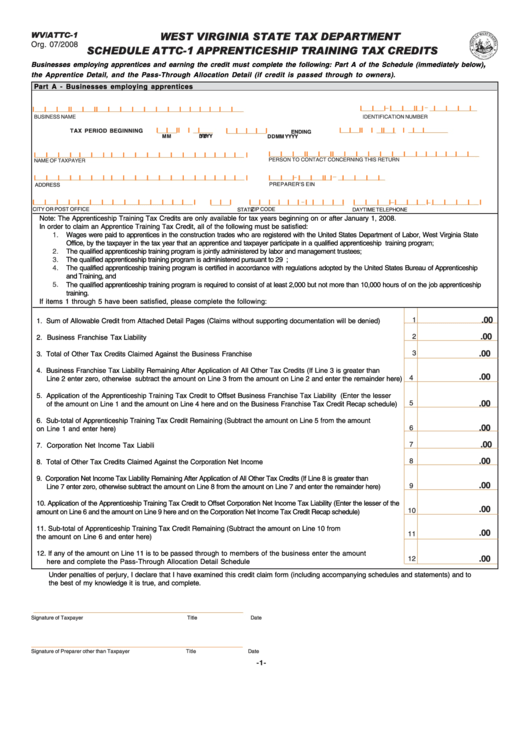

Fillable Form Wv attc 1 West Virginia Schedule Attc 1 Apprenticeship

Wv Tax Credits - Verkko Learn How to Qualify for the Motor Vehicle Property Tax Credit Still have questions Go to our Income Tax Cut and Property Tax Rebate Page