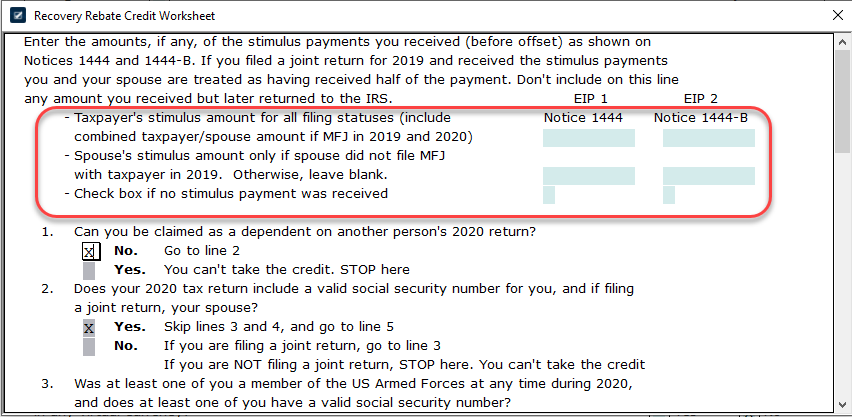

2020 Recovery Rebate Credit Eligibility When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR Instructions can help you determine if you may be eligible to claim a

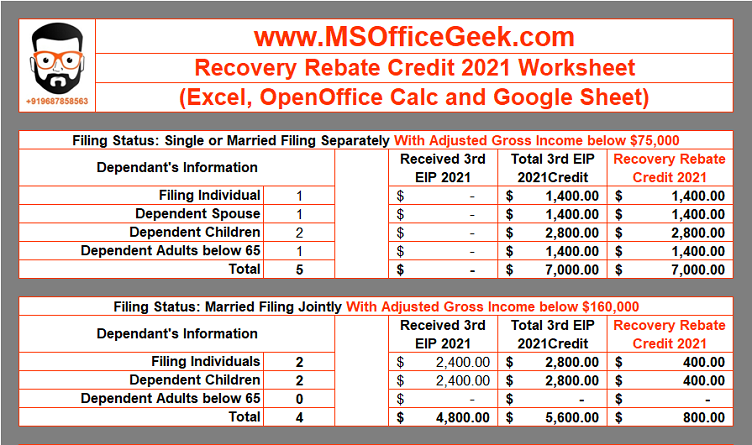

If you didn t get a first and second Economic Impact Payment or got less than the full amounts you may be eligible to claim the 2020 Recovery Rebate Credit by filing a 2020 tax return if you have not filed yet or by amending your 2020 tax return if it s already been processed The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying

2020 Recovery Rebate Credit Eligibility

2020 Recovery Rebate Credit Eligibility

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Menards 5879 Printable Rebate Forms RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-5879-printable-rebate-forms.jpg?resize=1024%2C876&ssl=1

The IRS estimates that almost 940 000 of the nation s taxpayers have unclaimed refunds totaling more than 1 billion for tax year 2020 and encourages eligible non filers in 2020 to claim their Recovery Rebate Credit before the May 17 deadline To be eligible for the credit you must have Been a U S citizen or U S resident alien in 2020 and or 2021 Not have been a dependent of another taxpayer for tax years 2020 and or 2021

The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim the RRC on your 2020 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Tax Return for Seniors The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if Your EIP 2 was less than 600 1 200 if married filing jointly plus 600 for each qualifying child you had in 2020

Download 2020 Recovery Rebate Credit Eligibility

More picture related to 2020 Recovery Rebate Credit Eligibility

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

Menards Printable Rebate Form MenardsRebate Form

https://www.menardsrebate-form.com/wp-content/uploads/2022/09/menards-printable-rebate-form.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Eligible people must file a 2020 tax return by May 17 2024 to cash in on the recovery rebate tax credit potentially worth thousands of dollars If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return

If you didn t get the full first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit by filing a new or amended 2020 tax return If you didn t get the full third Economic Impact Payment see Questions and Answers About the Third Economic Impact Payment Topic H Reconciling on Your Individuals who were eligible for an economic impact payment but did not receive one or were eligible for a larger payment than they received may be able to claim a recovery rebate credit when they file their income tax return for 2020

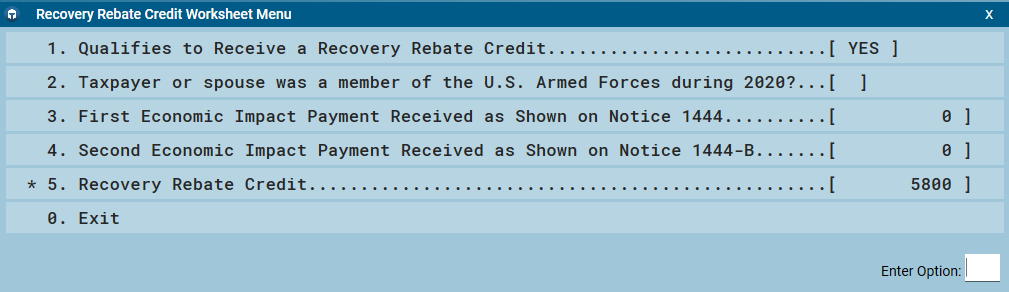

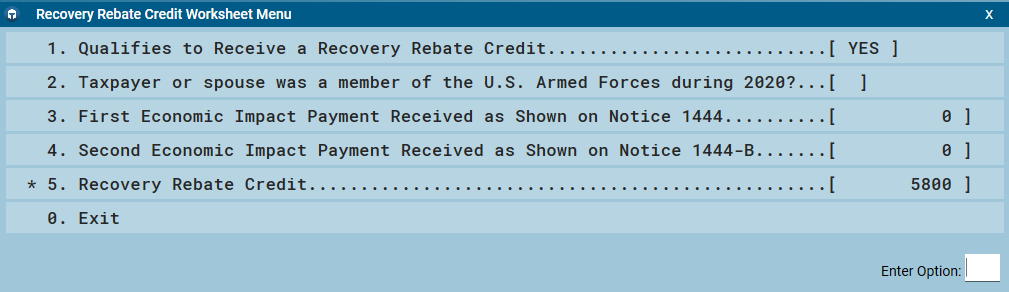

Desktop 2020 Recovery Rebate Credit Support

https://support.taxslayerpro.com/hc/article_attachments/4409936810778/rrcmenu.png

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

https://www.irs.gov/newsroom/2020-recovery-rebate...

When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR Instructions can help you determine if you may be eligible to claim a

https://www.irs.gov/newsroom/recovery-rebate-credit

If you didn t get a first and second Economic Impact Payment or got less than the full amounts you may be eligible to claim the 2020 Recovery Rebate Credit by filing a 2020 tax return if you have not filed yet or by amending your 2020 tax return if it s already been processed

How To File Recovery Rebate Credit Turbotax Recovery Rebate

Desktop 2020 Recovery Rebate Credit Support

2020 Recovery Rebate Credit FAQs Updated Again Elmbrook Tax Accounting

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2020 Calculator KwameDawson Recovery Rebate

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

2020 Recovery Rebate Credit Eligibility - To be eligible for the credit you must have Been a U S citizen or U S resident alien in 2020 and or 2021 Not have been a dependent of another taxpayer for tax years 2020 and or 2021