Income Tax Rebate On Sb Interest Web 6 mars 2023 nbsp 0183 32 How to calculate income tax on savings bank interest Savings account interest is taxable at your slab rate in case the interest amount exceeds Rs 10 000 in a financial year Interest earned up to

Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is Web Deduction can be claimed only up to Rs 10 000 on the interest earned on the savings bank account However tax will have to be paid on any amount over and above Rs 10 000

Income Tax Rebate On Sb Interest

Income Tax Rebate On Sb Interest

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

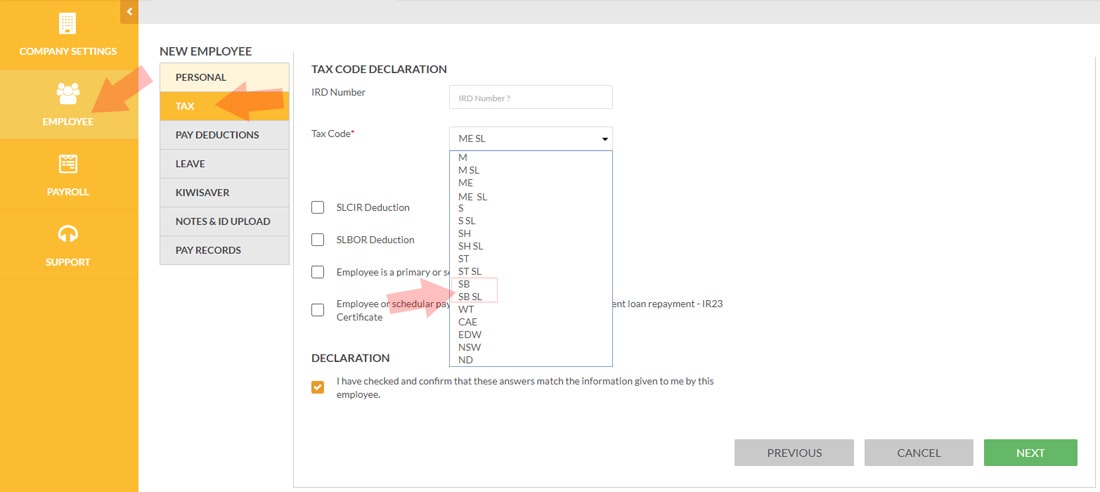

Secondary Tax Codes SB SB SL Your Payroll NZ

https://yourpayroll.co.nz/media/1535/nz-tax-code-sb-sl-min.jpg

Web 22 juil 2019 nbsp 0183 32 Any amount that is credited as interest on the savings bank is income for the taxpayer and needs to be disclosed under his her Income tax return under the head Web 17 ao 251 t 2018 nbsp 0183 32 As per this section interest income from savings bank accounts and fixed deposits is exempt from income tax to the extent of Rs 50 000 per financial year To be eligible for tax benefit under Section

Web 26 juil 2022 nbsp 0183 32 If you opt for the old existing income tax regime while filing ITR for FY 2021 22 AY 2022 23 then you can claim a tax deduction of up to Rs 10 000 on savings Web 14 f 233 vr 2023 nbsp 0183 32 Section 80TTA of the Income Tax Act was introduced in order to allow a deduction of up to INR 10 000 on such interest Who can claim 80TTA deduction

Download Income Tax Rebate On Sb Interest

More picture related to Income Tax Rebate On Sb Interest

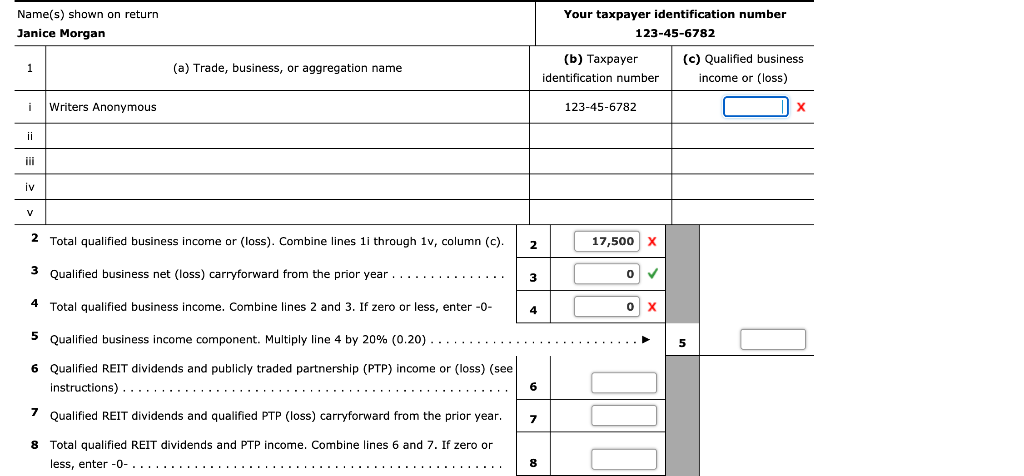

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Web 25 juil 2018 nbsp 0183 32 Section 80TTA is introduced to provide deduction to an individual or a Hindu undivided family in respect of interest received on deposits not being time deposits in a savings account held with banks Web 24 f 233 vr 2022 nbsp 0183 32 Rs 23000 for the period of 1st July to 31st December 2021 Rs 12 000 x 3 6 Rs 6 000 for the period of 1st April 2020 to 31st March 2021 Therefore total interest

Web 3 sept 2023 nbsp 0183 32 Deductions Under Section 80TTA If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a Web 22 oct 2022 nbsp 0183 32 October 22 2022 Interest from savings account is exempt from tax for an amount up to Rs 10 000 during a financial year Rs 10000 limit includes the sum of all

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

https://i.ytimg.com/vi/jZcpVwGx4EE/maxresdefault.jpg

How To Search Income Tax Rebate On Women YouTube

https://i.ytimg.com/vi/AZf97f6TnMU/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYfyBCKCAwDw==&rs=AOn4CLBVuBsHbuO6x_qmXoWcQ4cIESQWMw

https://www.paisabazaar.com/tax/income-ta…

Web 6 mars 2023 nbsp 0183 32 How to calculate income tax on savings bank interest Savings account interest is taxable at your slab rate in case the interest amount exceeds Rs 10 000 in a financial year Interest earned up to

https://tax2win.in/guide/section-80tta

Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Retirement Income Tax Rebate Calculator Greater Good SA

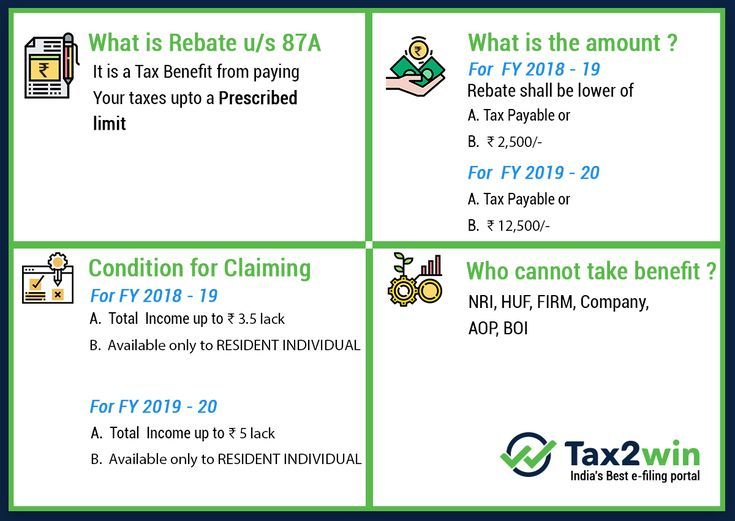

Income Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A Rebates Financial

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

DEDUCTION UNDER SECTION 80C TO 80U PDF

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax Rebate On Sb Interest - Web Interest generated on a savings bank account is tax free up to 10 000 under section 80TTA of the Income Tax Act It makes an account with a balance of less than 10 000