Is Interest Income Tax Deductible Web 23 Dez 2023 nbsp 0183 32 Mortgage interest is only deductible against income from the property i e not deductible for privately used property Standard deductions A lump sum special expense deduction totalling EUR 36 for a single person or EUR 72 for married couples is provided without need for proof Furthermore there are also a number of other specific

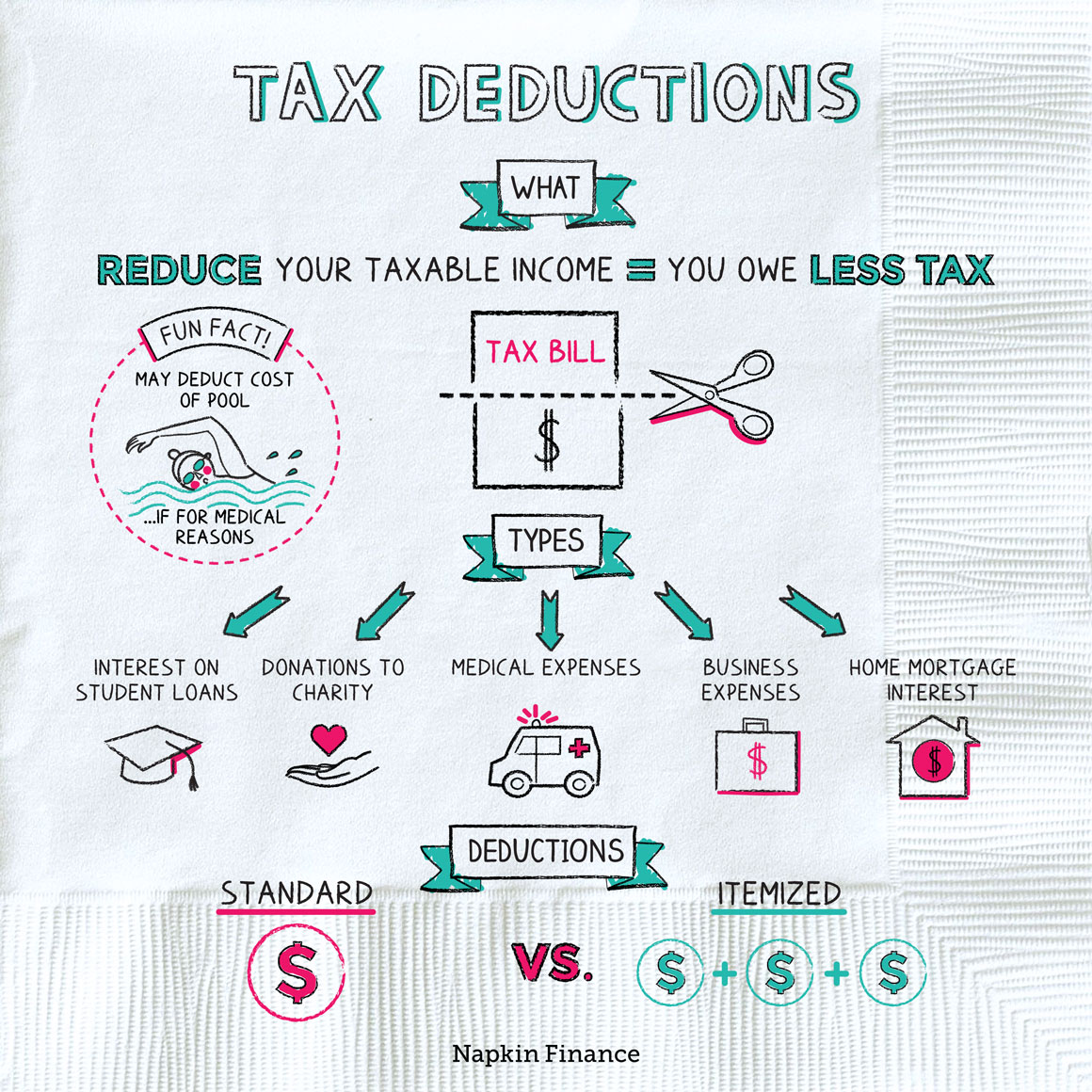

Web 17 Jan 2023 nbsp 0183 32 Tax deductible interest is the interest you ve paid for various purposes that can be used to reduce your taxable income Not all interest is tax deductible In general tax deductible interest is interest you pay on your mortgage student loans and some investments Web to claim interest deductions in the respective YAs IRB will review confirm the deductibility of the interest expense then amend the assessment for each YA to allow the claim Summary Generally interest income is subject to tax only when it is received but interest expense is deductible when it is incurred and which may not be paid

Is Interest Income Tax Deductible

Is Interest Income Tax Deductible

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

https://www.investopedia.com/thmb/u2wJjKORNGwYIkLIUBgzZkTPInY=/1500x1000/filters:fill(auto,1)/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg

Web 15 Dez 2017 nbsp 0183 32 Topic No 505 Interest Expense Interest is an amount you pay for the use of borrowed money Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction Web The Internal Revenue Service IRS allows you to deduct several different types of interest expense including home mortgage interest and interest related to the production of income But it does not allow deductions for consumer interest expense

Web 31 Dez 2022 nbsp 0183 32 Annual net interest expense the excess of interest paid over that received is only deductible at up to 30 of EBITDA for corporation and trade tax purposes The 30 limitation applies to all interest whether the debt is granted by a shareholder related party or a third party Web 9 Nov 2020 nbsp 0183 32 Interest payments for a mortgage on a rental property can also be subtracted from the cost of operating the rental Interest deductions are allowed primarily to encourage home ownership and

Download Is Interest Income Tax Deductible

More picture related to Is Interest Income Tax Deductible

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

2021 Federal Tax Brackets Withholding Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2020-income-tax-brackets-pasivinco.png

Web 14 Dez 2023 nbsp 0183 32 Because Mary is a tax savvy investor she was able to reduce her taxable income from the original 150 000 to 127 000 That 10 000 investment interest expenses deduction resulted in 2 220 of tax savings assuming an ordinary tax rate of 24 and a long term capital gains tax rate of 15 Note The election to treat qualified dividends as Web Vor 4 Tagen nbsp 0183 32 The standard deduction is the amount taxpayers can subtract from income if they don t list deductions separately When it comes to filing your taxes one of the first big decisions to make is

Web 4 Mai 2017 nbsp 0183 32 Under the current U S income tax system most interest paid is deductible and interest received is usually taxable The ideal one might imagine is to tally up everyone s income with interest receipts counting as positive income and interest payments to others counting as negative income Web 30 Apr 2023 nbsp 0183 32 Tax Deduction A tax deduction is a reduction in tax obligation from a taxpayer s gross income Tax deductions can be the result of a variety of events that the taxpayer experiences over the

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

Income Tax Interest How Is Interest Income Taxed Calculate Income

https://img.etimg.com/thumb/msid-65355989,width-1070,height-580,imgsize-94405,overlay-etwealth/photo.jpg

https://taxsummaries.pwc.com/germany/individual/deductions

Web 23 Dez 2023 nbsp 0183 32 Mortgage interest is only deductible against income from the property i e not deductible for privately used property Standard deductions A lump sum special expense deduction totalling EUR 36 for a single person or EUR 72 for married couples is provided without need for proof Furthermore there are also a number of other specific

https://www.thebalancemoney.com/what-is-tax-deductible-interest-5206…

Web 17 Jan 2023 nbsp 0183 32 Tax deductible interest is the interest you ve paid for various purposes that can be used to reduce your taxable income Not all interest is tax deductible In general tax deductible interest is interest you pay on your mortgage student loans and some investments

Interest Income Formula And Calculation

Investment Expenses What s Tax Deductible Charles Schwab

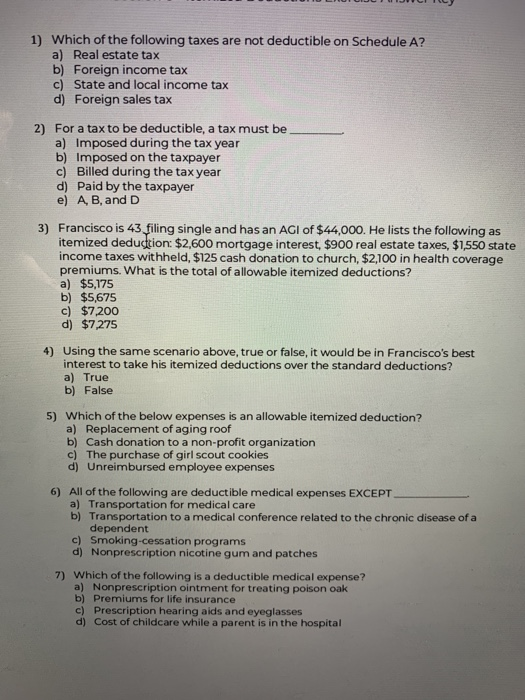

Solved 1 Which Of The Following Taxes Are Not Deductible On Chegg

Five Types Of Interest Expense Three Sets Of New Rules

Accrued Income Definition Accounting Treatment Accountant Skills

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

Find Your WHY 2 Easy Ways To Discover Your Life s Purpose

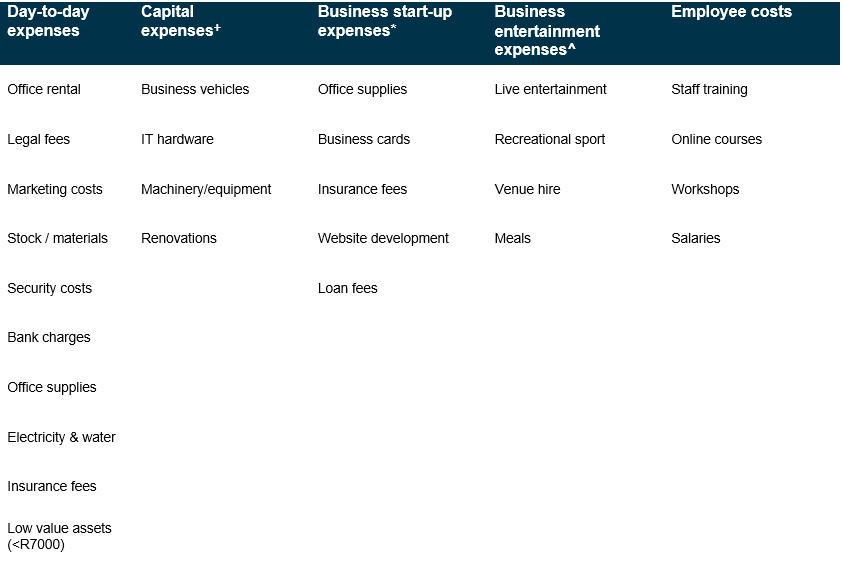

Tax deductible Expenses For Small Businesses Sage Advice South Africa

What Is A Tax Deduction Ramsey

Is Interest Income Tax Deductible - Web 18 Juli 2023 nbsp 0183 32 The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions States that assess an income tax also may allow