2023 California Child Tax Credit Use our EITC calculator or review the 2024 CalEITC credit table to calculate how much you may get when you file your tax year 2024 return These related cash back credits include CalEITC

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Young Child Tax Credit YCTC Provides tax credit per eligible tax return for tax year 2023 Must have a qualifying child under 6 years old at the end of the tax year and qualify for CalEITC

2023 California Child Tax Credit

2023 California Child Tax Credit

https://i.ytimg.com/vi/nu5UJCdU-so/maxresdefault.jpg

New Bill Could Expand The Child Tax Credit Here s What To Know For

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA14Uw4L.img?w=2385&h=1072&m=4&q=75

Child Tax Credit Expansion In New Bipartisan Deal Has Battle In House

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18 You may qualify to claim the 2023 credit for child and dependent care expenses if you and your spouse RDP paid someone in California to care for your child or other qualifying person while

If you qualify for CalEITC and have a child under the age of 6 you may also qualify for a refundable tax credit of up to 1 154 through the Young Child Tax Credit If you qualify you may see a reduced tax bill or a bigger refund California families who qualify for the Young Child Tax Credit YCTC can get up to 1 117 per tax return either as cash back or reduced taxes You must have an eligible child

Download 2023 California Child Tax Credit

More picture related to 2023 California Child Tax Credit

Child Tax Credit When Will The IRS Start Refunding Your Credit Money

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18r4vk.img?w=1920&h=1080&m=4&q=75

Your State s Stance On Child Tax Credits In 2024 A Comprehensive Overview

https://www.publishedreporter.com/wp-content/uploads/2024/01/CTC-3-scaled.jpg

3rd Round Of Child Tax Credit Payments Go Out This Week The Daily World

https://www.thedailyworld.com/wp-content/uploads/2021/09/26463542_web1_ChildTaxCredit-ADW-210914-TreasuryCheck_1.jpg

The Child Tax Credit is a tax credit for taxpayers who have children and meet certain requirements This year it s worth 2 000 for each qualifying child Coming soon Updated information and filing limits for 2025 If you paid someone in California to care for your child dependent while you were working or looking for employment you may qualify to take a credit on your tax return Nonresidents must

Learn how California s refundable income tax credits provide critical financial support to low income families and individuals EITC and Child Tax Credit CTC have provided hundreds Two Democratic state lawmakers want to expand California s earned income tax credit and young child tax credit in a year of budget deficits

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

https://www.ftb.ca.gov › about-ftb › newsroom › caleitc › ...

Use our EITC calculator or review the 2024 CalEITC credit table to calculate how much you may get when you file your tax year 2024 return These related cash back credits include CalEITC

https://www.irs.gov › credits-deductions › individuals › child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812

Calculate Californians Benefit From The CalEITC And Young Child Tax

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Watch CBS Mornings Child Tax Credit Set To Expire Full Show On

House Passes Child Tax Credit Expansion NPR Tmg News

IRS Releases Website To Manage Child Tax Credit Deposits Payne

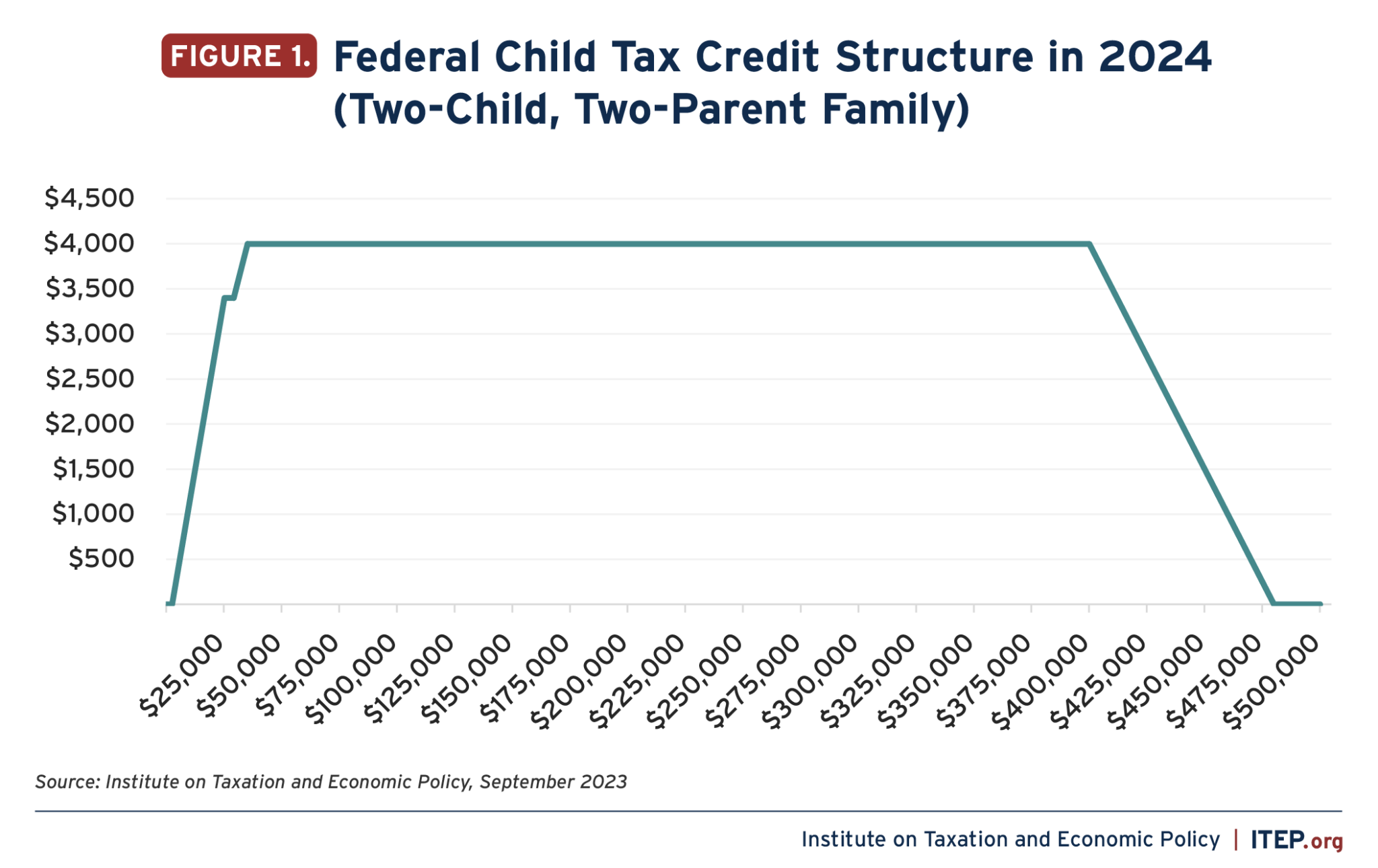

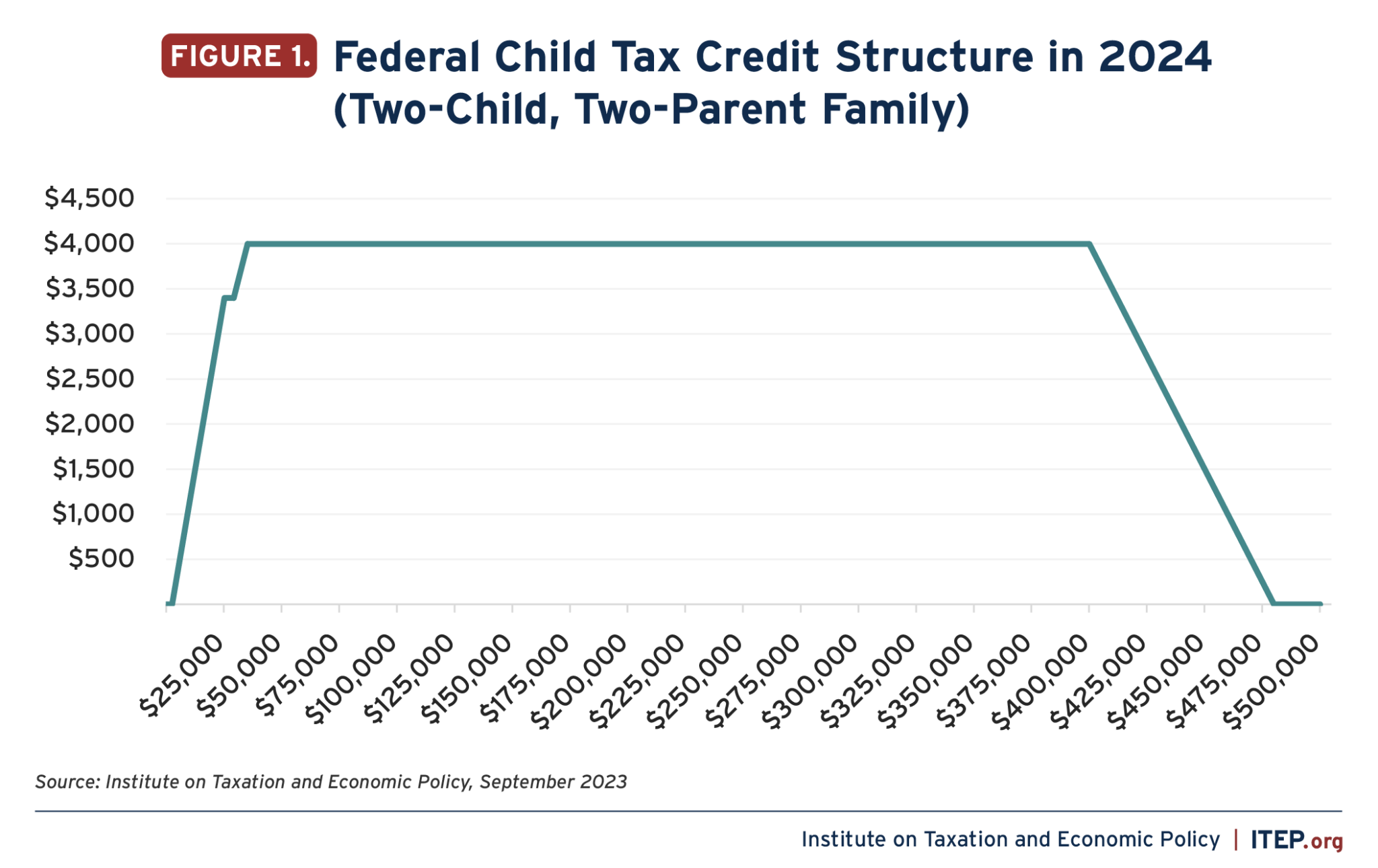

States Are Boosting Economic Security With Child Tax Credits In 2023 ITEP

States Are Boosting Economic Security With Child Tax Credits In 2023 ITEP

One Republican Eyes More Direct Payments Amid Rising Childcare Costs

Child Tax Credit How Much Is It For 2024

Child Tax Credit 2023 Update

2023 California Child Tax Credit - The Child Tax Credit is a tax benefit to help families who are raising children Nearly all families with kids will qualify Couples making less than 150 000 and single parents also called Head