Ev Tax Rebate Income Limit Web 7 janv 2023 nbsp 0183 32 The new climate law also added income limits for the tax credit a maximum of 300 000 for a household 150 000 for an individual or 225 000 for a head of

Web 5 sept 2023 nbsp 0183 32 You won t qualify for the EV tax credit if you are single and your modified adjusted gross income exceeds 150 000 The EV tax credit income limit for married Web 27 ao 251 t 2022 nbsp 0183 32 The tax benefit which was recently modified by the Inflation Reduction Act for years 2023 through 2032 allows for a maximum credit of 7 500 for new EVs and up

Ev Tax Rebate Income Limit

Ev Tax Rebate Income Limit

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/california-income-based-electric-vehicle-rebate-program-expected-to-4.jpg

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

https://paultan.org/image/2022/02/2022-EV-LKM-road-tax-rebate.jpg

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

Web 2 sept 2022 nbsp 0183 32 Single tax filers are eligible if their income is below 150 000 For heads of households that income cap rises to 225 000 Joint filers are eligible for the EV tax Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

Web 31 mars 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Download Ev Tax Rebate Income Limit

More picture related to Ev Tax Rebate Income Limit

Recovery Rebate Income Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-q-a-about-recovery-rebates-student-loans-health-care-4.png

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

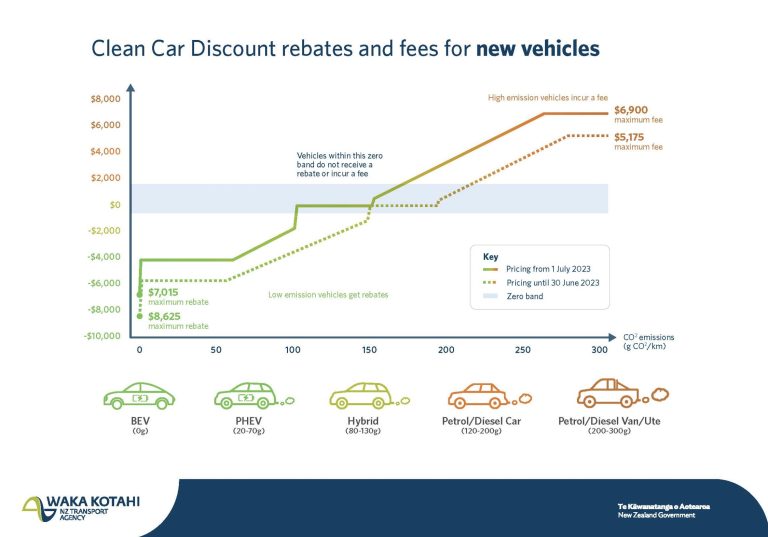

Tesla Income From NZ EV Rebates Trace At Potential IRA Advantages Feature

https://www.teslarati.com/wp-content/uploads/2023/06/Tesla-new-zealand-rebates-768x537.jpg

Web 25 janv 2023 nbsp 0183 32 Here s how to get a faster tax refund When to expect key forms for filing your tax return Electric vehicle tax credits will be harder to get Consumers who are in Web Il y a 21 heures nbsp 0183 32 Lower income buyers could get up to 12 000 California is eliminating its popular electric car rebate program which often runs out of money and has long

Web 18 avr 2023 nbsp 0183 32 Since you have a MAGI of 145 000 below the 150 000 threshold your income qualifies for the tax credit 6 Are the income limits talking about gross income Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Economic Recovery Rebate Income Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/2021-income-limits-released-by-hud-view-them-now.png?fit=2048%2C526&ssl=1

BUDGET 2023 Income Tax Slabs In New Tax Regime Income Limit For

https://i.ytimg.com/vi/WaRI4GEcHcQ/maxresdefault.jpg

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 The new climate law also added income limits for the tax credit a maximum of 300 000 for a household 150 000 for an individual or 225 000 for a head of

https://www.kiplinger.com/taxes/ev-tax-credit

Web 5 sept 2023 nbsp 0183 32 You won t qualify for the EV tax credit if you are single and your modified adjusted gross income exceeds 150 000 The EV tax credit income limit for married

Budget 2023 Sitharaman Proposes Change In Tax Structure Income Tax

Economic Recovery Rebate Income Limits Recovery Rebate

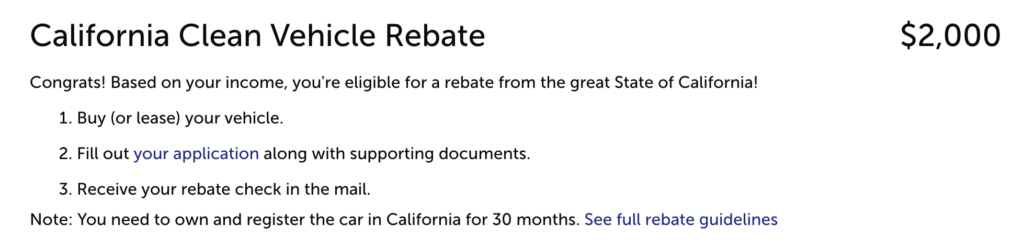

California EV Rebate Income Limit How To Claim The EV Rebate

California EV Rebate Income Limit How To Claim The EV Rebate

Ca Electric Car Rebate Income Limit 2022 Carrebate

Ev Tax Credit 2022 Retroactive Shemika Wheatley

Ev Tax Credit 2022 Retroactive Shemika Wheatley

California EV Rebate Income Limit How To Claim The EV Rebate

Income Tax Rebate Under Section 87A

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Ev Tax Rebate Income Limit - Web 31 mars 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 167 30D of the Internal Revenue Code Code for qualified plug in electric