2023 First Time Home Buyer Tax Credit Act The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation over the next five years here s how big the tax credit can get 2024 Maximum tax credit of 15 000

Repayment of first time homebuyer credit Generally you must repay any credit you claimed for a home you bought if you bought the home in 2008 See Form 5405 and its instructions for details and for exceptions to the repayment rule Home equity loan interest The U S federal government offered a tax credit program to first time homebuyers including those who hadn t owned a home in three years from 2008 2010 In his 2024 State of the Union

2023 First Time Home Buyer Tax Credit Act

2023 First Time Home Buyer Tax Credit Act

https://kcrar.com/wp-content/uploads/2022/08/GettyImages-623869344-scaled.jpg

5 Tips For First Time Home Buyers In 2023

https://selfi.com/wp-content/uploads/2023/01/First-time-home-buyer-1050x675.png

First Time Home Buyers Tax Credit HBTC Loans Canada

https://loanscanada.ca/wp-content/uploads/2021/02/First-Time-Home-Buyers-Tax-Credit.png

March 13 2024 Whitehouse Heinrich Panetta Blumenauer Unveil First Time Homebuyer Tax Credit to Bring Homeownership Within Reach for More Families Bicameral legislation would address dramatic increase in housing costs that is preventing families from getting a foothold in the middle class The 2023 plan is part of the DASH Decent Affordable Safe Housing for All Act which is officially U S Senate Bill 680 Under the proposal First time home buyers would get a tax credit of 20 of a home s purchase price with a maximum of 15 000

First time homebuyers would qualify for an annual tax credit of 5 000 per year for two years for a total of 10 000 The one year tax credit for current homeowners would be available Introduced in the House of Representatives in April by Rep Earl Blumenauer and Rep Jimmy Panetta the First Time Homebuyer Act would establish a refundable tax credit of 10 of a home s

Download 2023 First Time Home Buyer Tax Credit Act

More picture related to 2023 First Time Home Buyer Tax Credit Act

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

https://www.pmrloans.com/wp-content/uploads/2022/02/How-the-Proposed-15000-First-Time-Home-Buyer-Tax-Credit-Works.jpg

First Time Home Buyer Benefits In 2023 Programs And Perks

https://assets.themortgagereports.com/wp-content/uploads/2022/12/First-Time-Home-Buyer-Benefits.jpg

Tips For Homebuyers 2023 First Time Home Buyer Tips Buying A Home

https://i.ytimg.com/vi/EKM9VbP1QN4/maxresdefault.jpg

The First Time Homebuyer Act of 2024 commonly called the 15 000 First Time Home Buyer Tax Credit gives first time home buyers a tax credit that can be applied toward down payment and closing costs at settlement or issued as a cash payment from the U S Treasury The program s minimum eligibility standards include Eligible first time home buyers would receive a refundable tax credit equal to 10 of the property s purchase price The credit amounts would max out at 15 000 for homes

1 Determine Your Eligibility You received a First Time Homebuyer Credit 2 Gather Your Information Social Security number or your IRS Individual Taxpayer Identification Number Date of birth Street address ZIP Code 3 Check Your Account Go to our First Time Homebuyer Credit Account Look up to receive The First Time Homebuyer Act of 2021 would create a federal refundable tax credit for up to 10 of the purchase price of a primary residence up to 15 000 There are several other federal programs available for first time homebuyers including FHA and VA loans Who May Qualify as a First Time Homebuyer

Biden s 25 000 First Time Home Buyer Tax Credit Downpayment Toward

https://i.ytimg.com/vi/1zeab8s0hkM/maxresdefault.jpg

First Time Home Buyer Tax Credit USDA LOANS USDA Home Loan USDA

https://www.usdaloansdirect.com/wp-content/uploads/2017/05/JI-5250745_home-buying_s4x3.jpg.rend_.hgtvcom.1280.9601.jpg

https://homebuyer.com/learn/15000-first-time-home...

The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation over the next five years here s how big the tax credit can get 2024 Maximum tax credit of 15 000

https://www.irs.gov/publications/p530

Repayment of first time homebuyer credit Generally you must repay any credit you claimed for a home you bought if you bought the home in 2008 See Form 5405 and its instructions for details and for exceptions to the repayment rule Home equity loan interest

Halftime Pt 2 Homebuilder Housing Double Dip Fears Overblown

Biden s 25 000 First Time Home Buyer Tax Credit Downpayment Toward

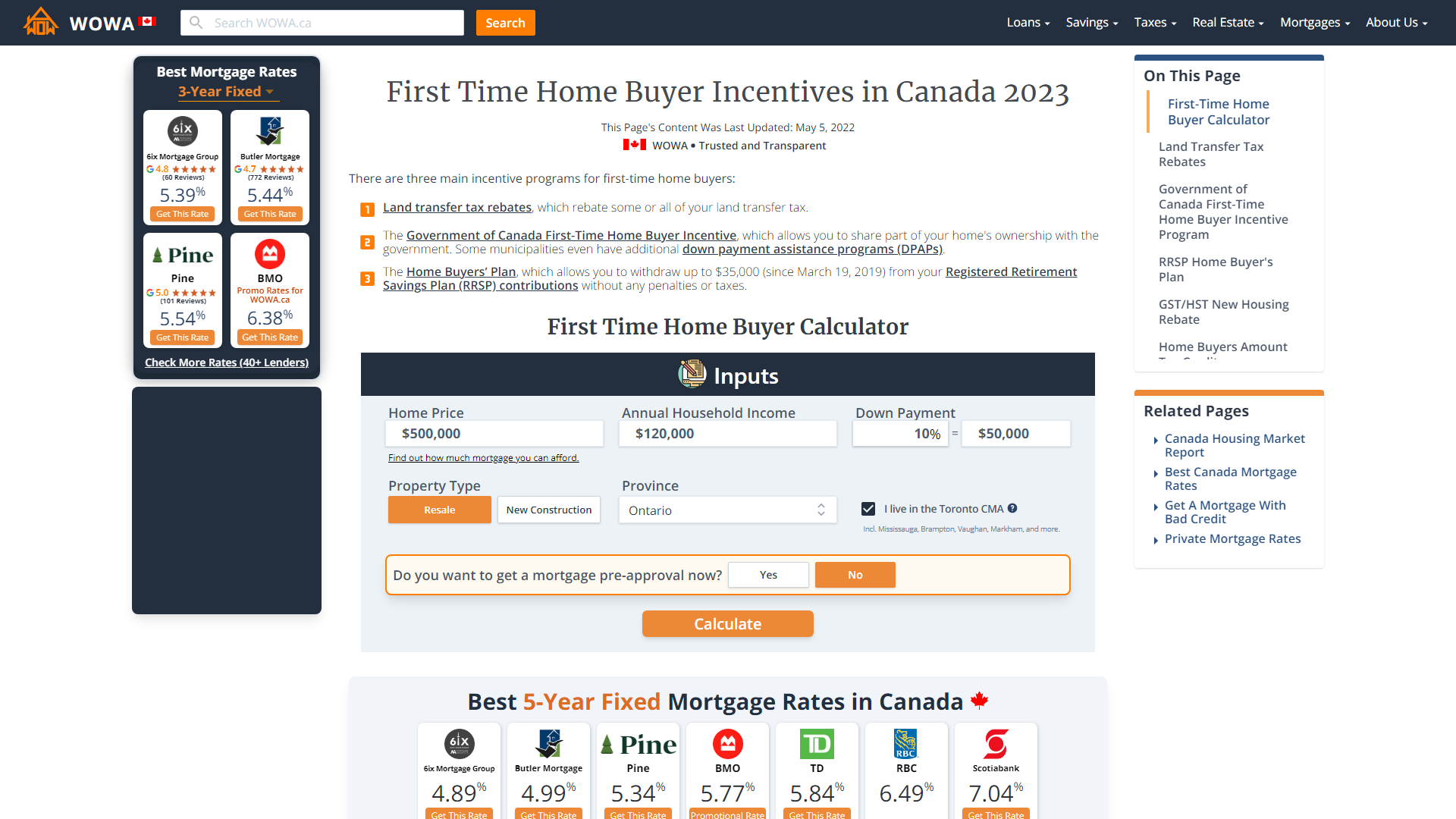

First Time Home Buyers Incentives Canada 2023 WOWA ca

First Time Home Buyer Tax Credit So Many Opinions What To Do About It

Choosing A Mortgage Company A First time Home Buyer s Guide Moreira

Tips For Building Equity When Buying Your First Home Mortgage

Tips For Building Equity When Buying Your First Home Mortgage

First Time Home Buyer Tax Credit 2009 Highlights HomesMSP Real

Who Qualifies For Biden s 15 000 First Time Home Buyer Tax Credit

Tips For Buying Your First House With Low Credit Mortgage Solutions

2023 First Time Home Buyer Tax Credit Act - May 18th 2023 Share If you re thinking about buying a new home congressional democrats and Joe Biden have an act in motion that could provide you with some stimulus The 15 000 First Time Home Buyer Credit was proposed in 2021 and aims to give first time buyers of a specific income refundable tax credits after purchasing their first home