2023 Home Tax Deduction You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425 paid in 2024 for 2023 You

The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money If you worked remotely in 2023 you may be curious about the home office deduction Here s who qualifies for the tax break this season according to experts

2023 Home Tax Deduction

2023 Home Tax Deduction

https://www.worksheeto.com/postpic/2011/01/tax-deduction-worksheet_472300.png

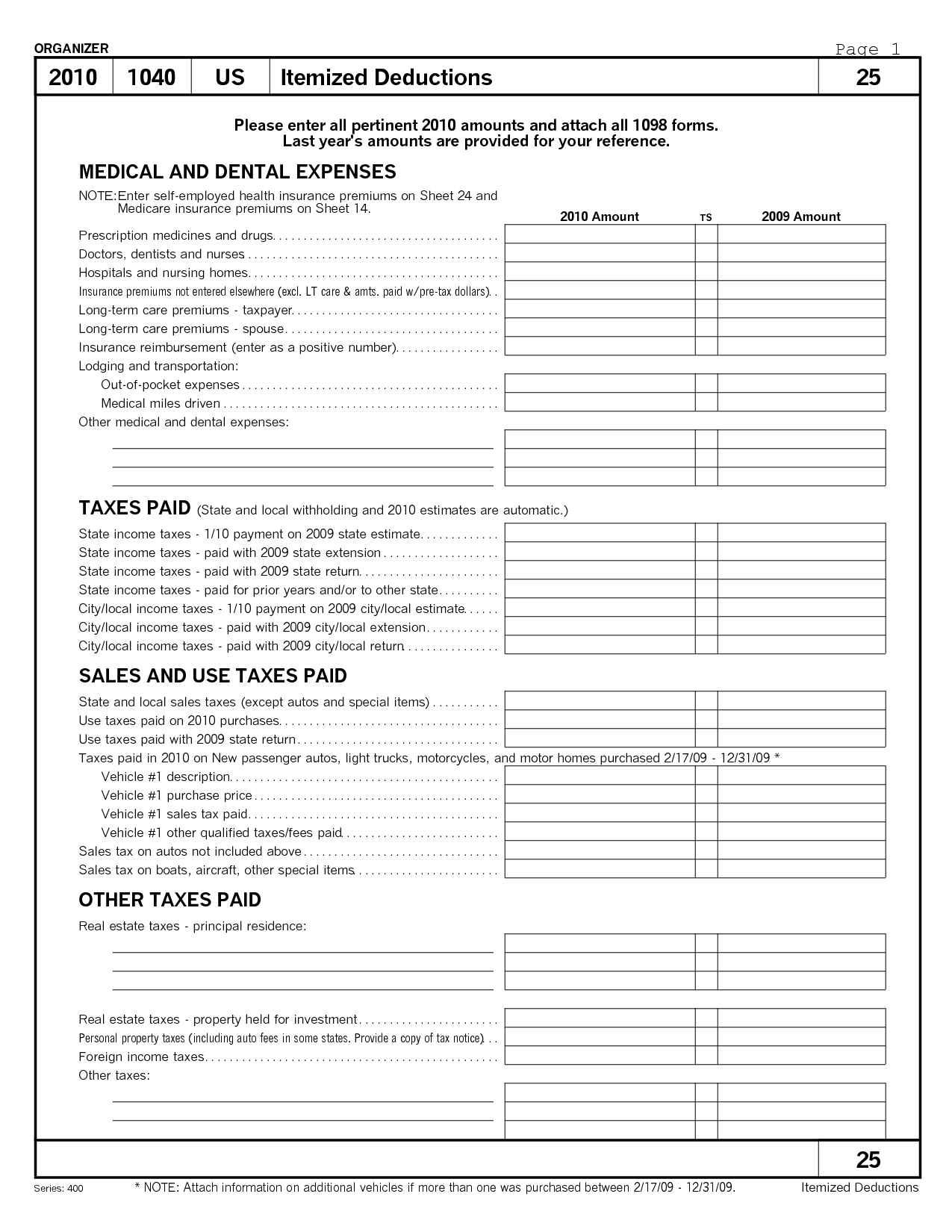

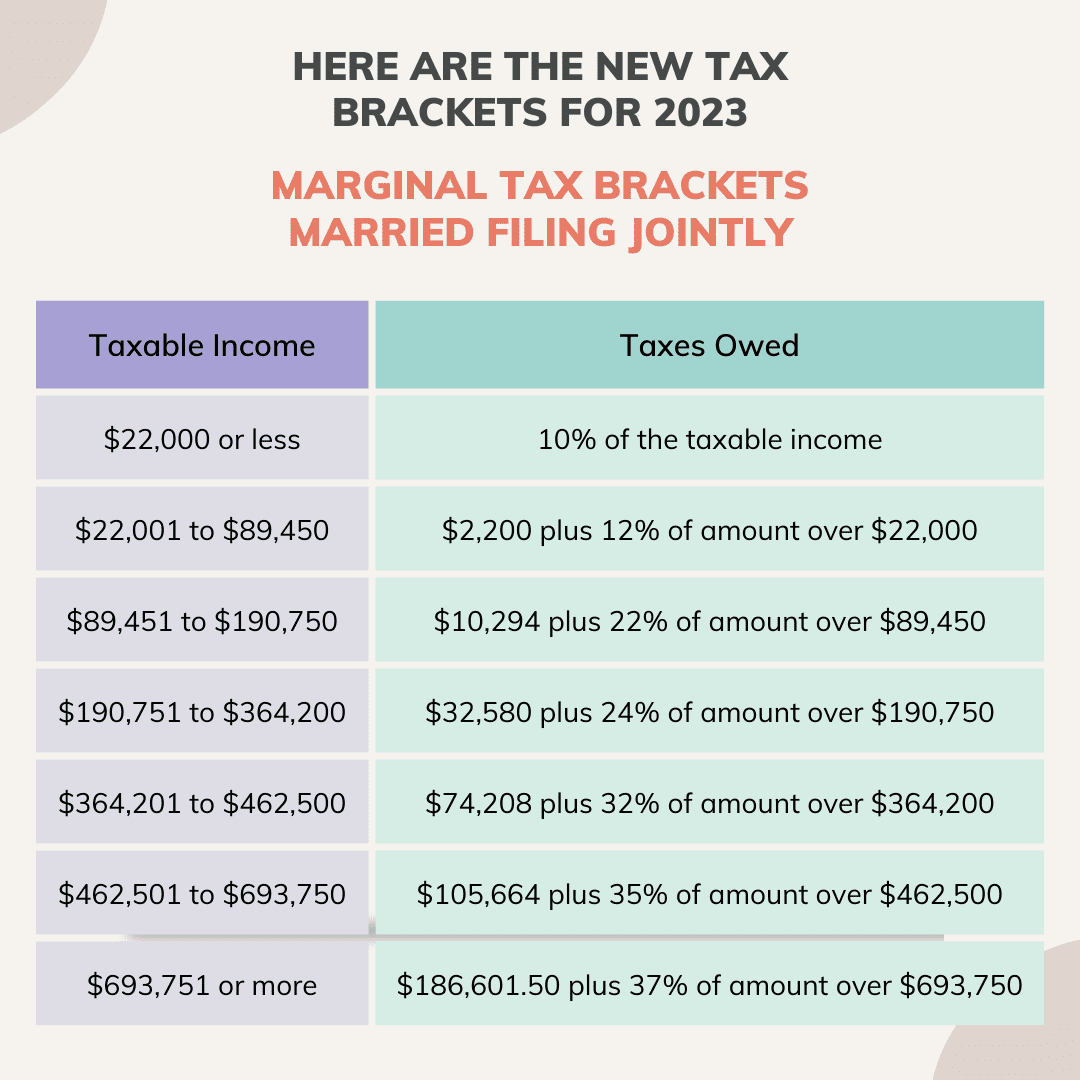

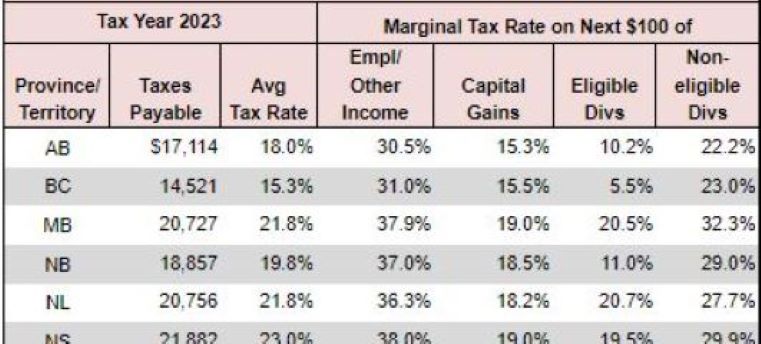

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/2.png

Income Tax Excel Spreadsheet Spreadsheet Downloa Income Tax Excel Sheet

http://db-excel.com/wp-content/uploads/2019/01/income-tax-excel-spreadsheet-throughout-income-tax-worksheets-sample-state-and-local-worksheet-2017-for.jpg

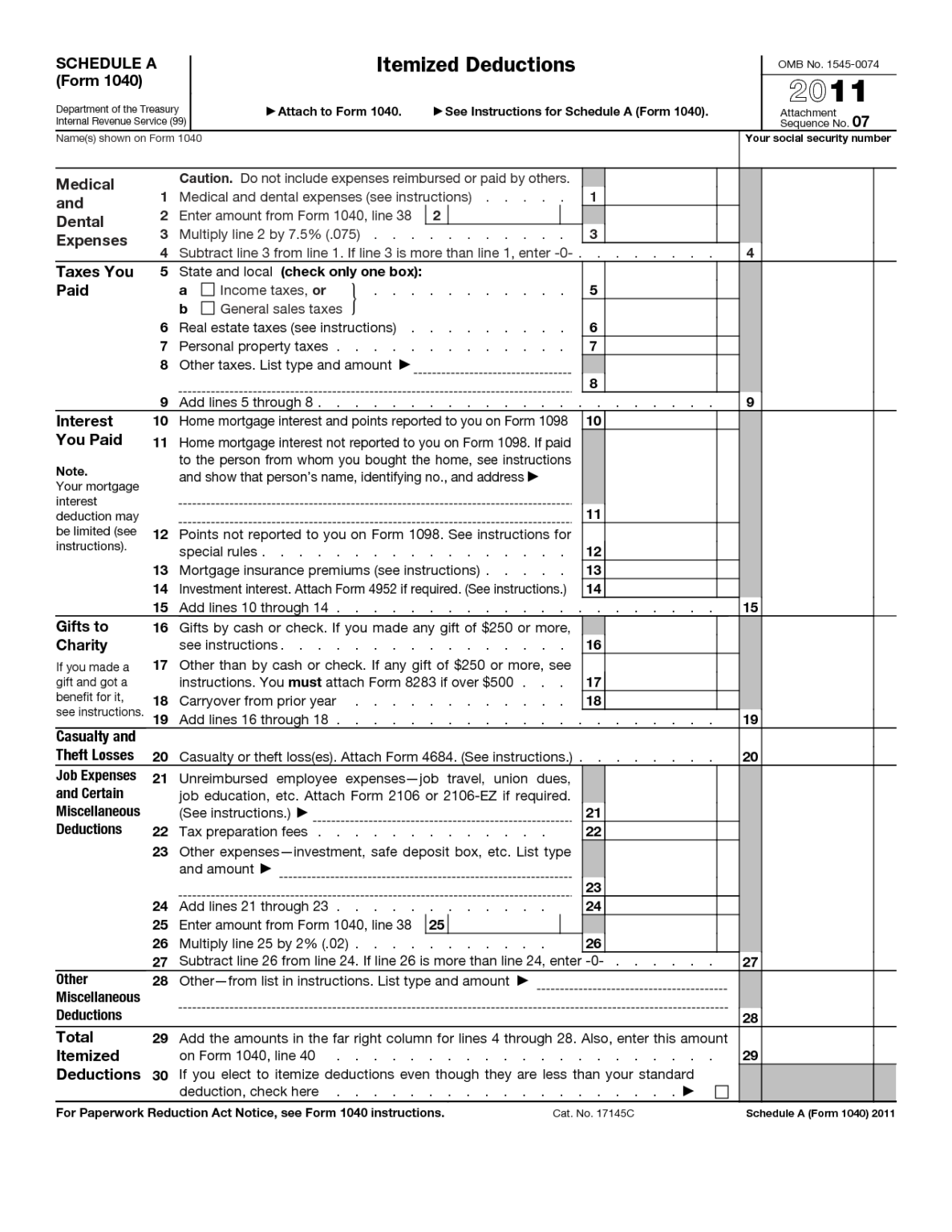

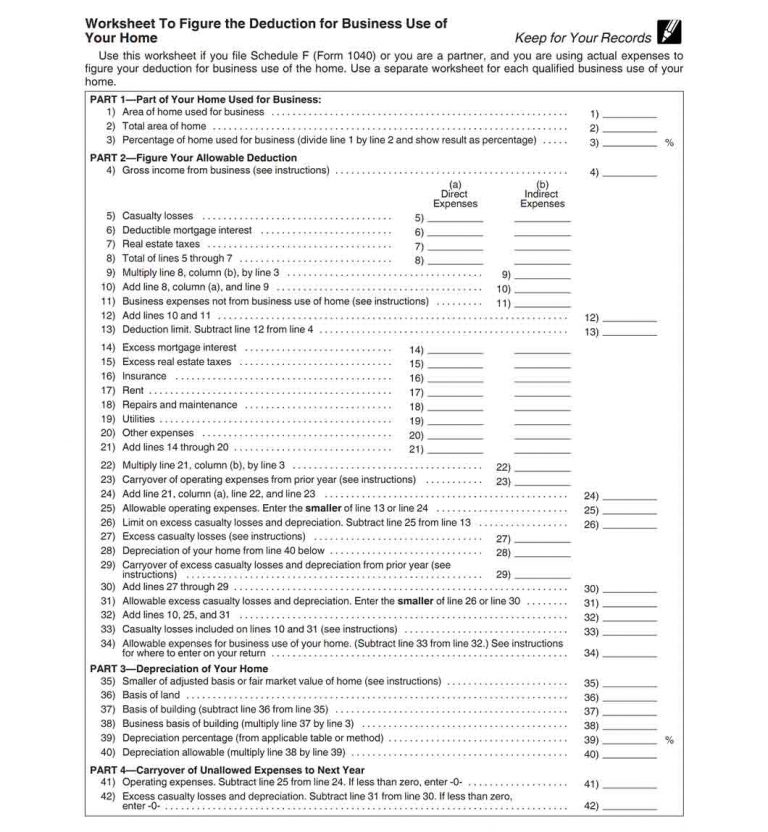

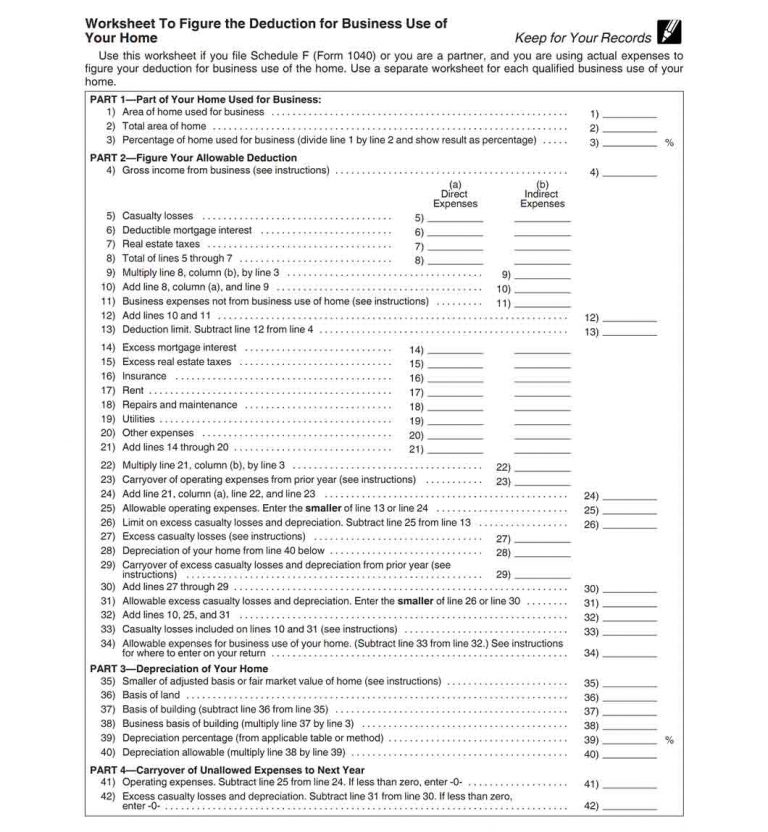

There are two ways to calculate the home office deduction the simplified option and the regular method according to the IRS The simplified option uses a In 2023 the standard deduction breaks down like this For single and married individuals filing taxes separately the standard deduction is 13 850 For married couples filing jointly the standard

Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

Download 2023 Home Tax Deduction

More picture related to 2023 Home Tax Deduction

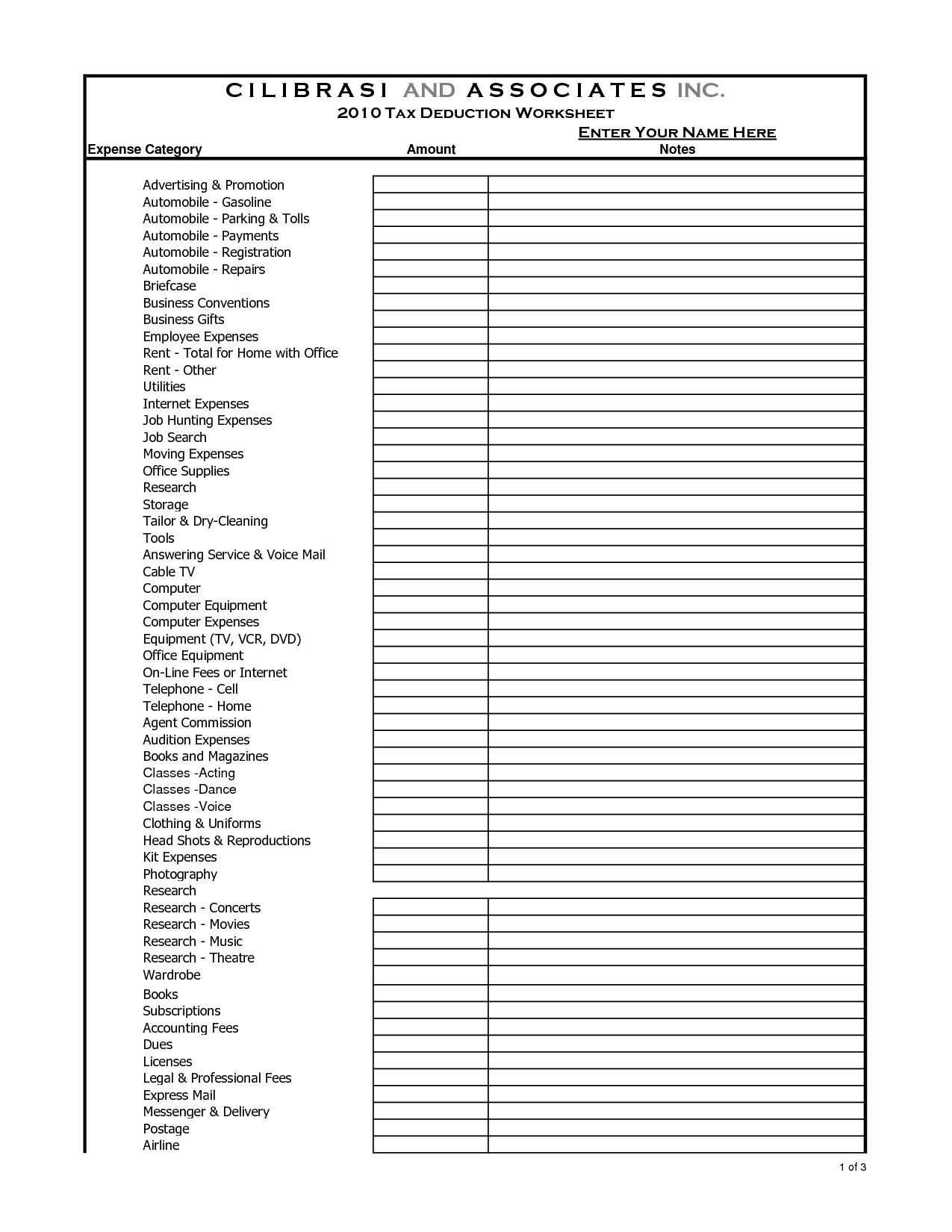

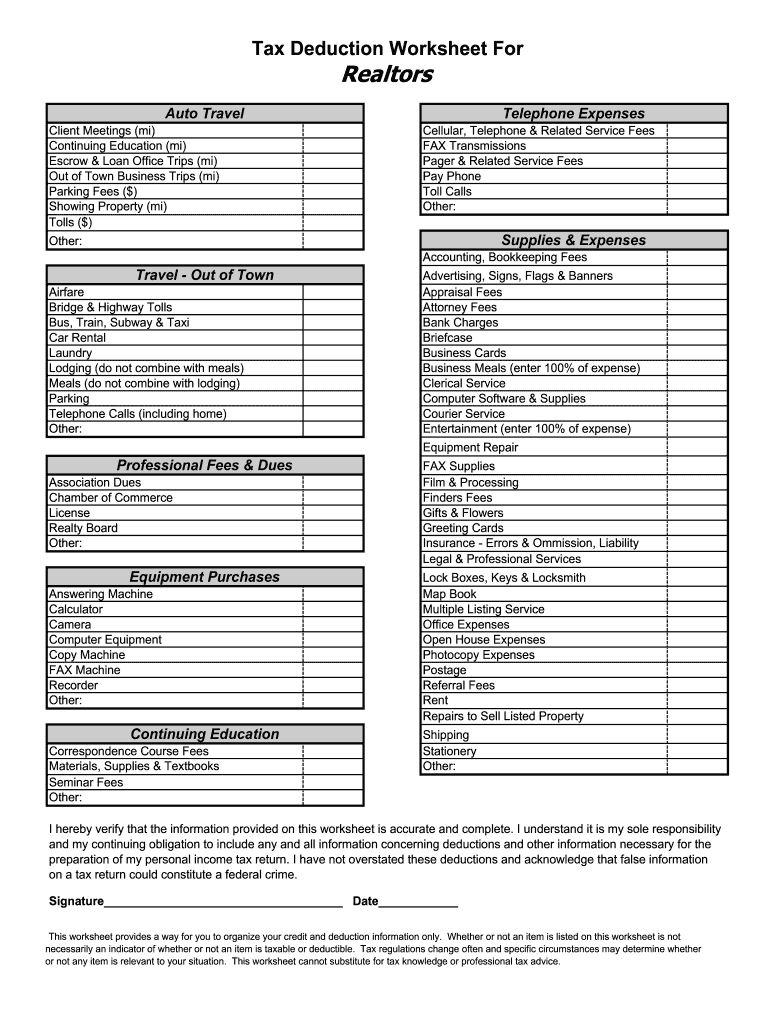

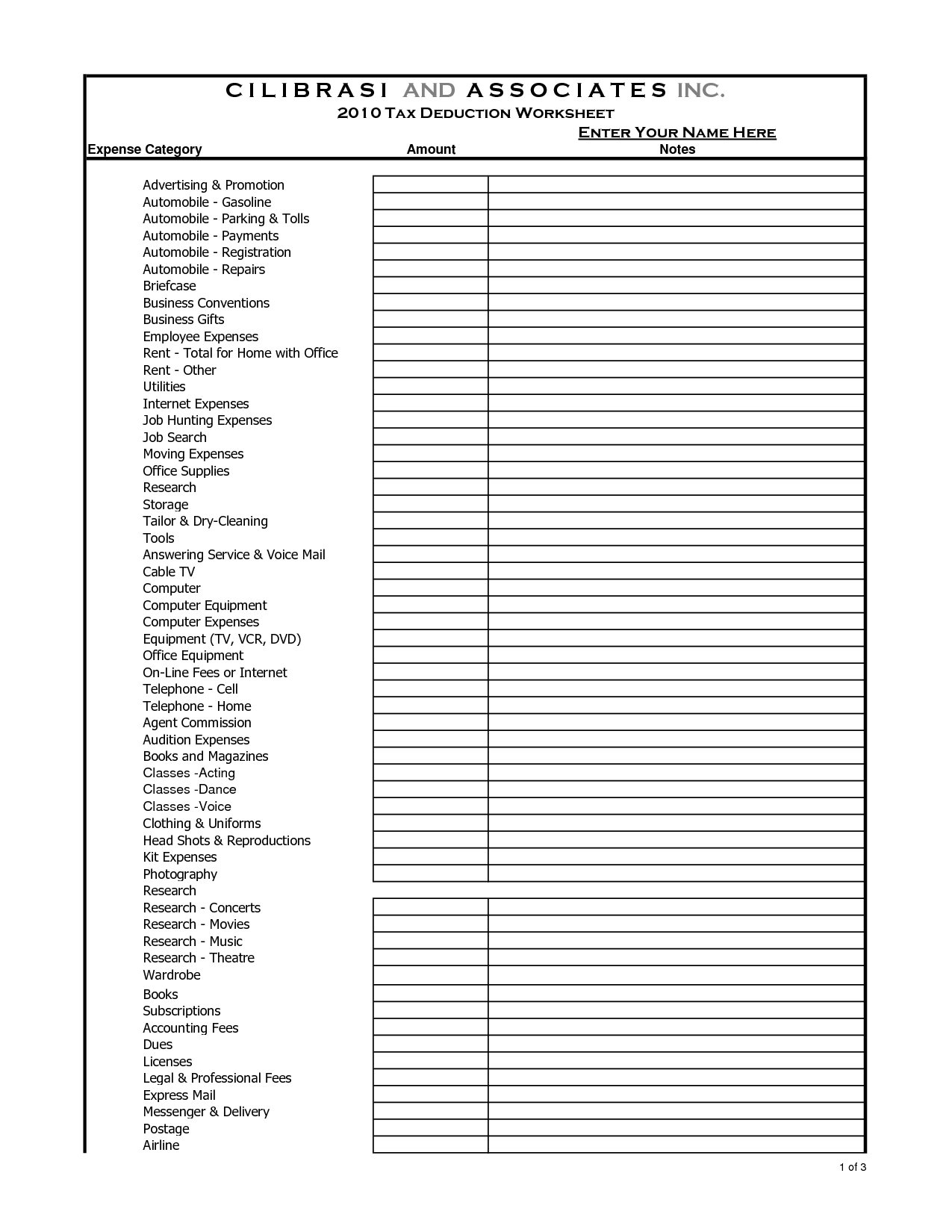

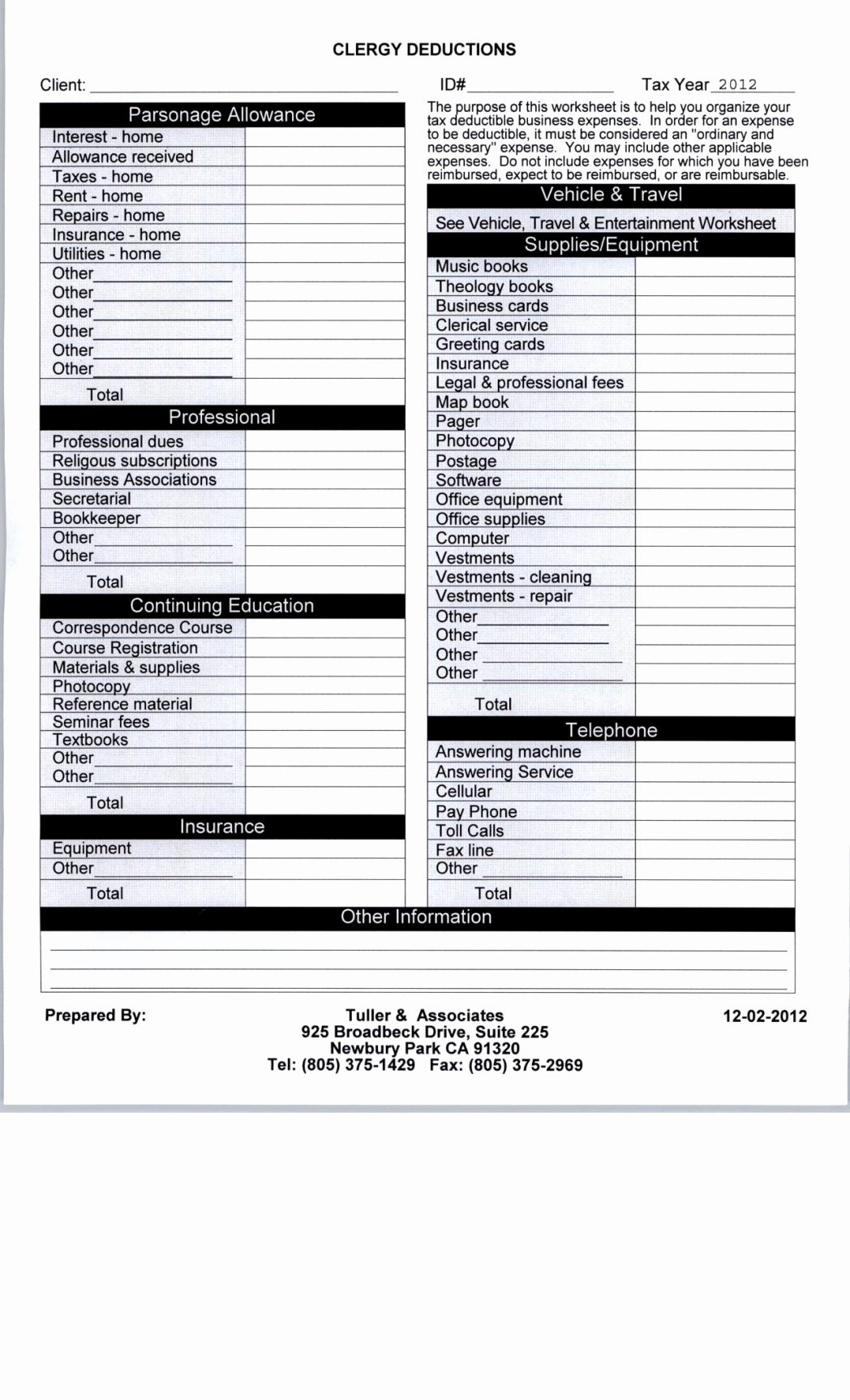

Printable Real Estate Agent Tax Deductions Worksheet

https://www.signnow.com/preview/354/967/354967762/large.png

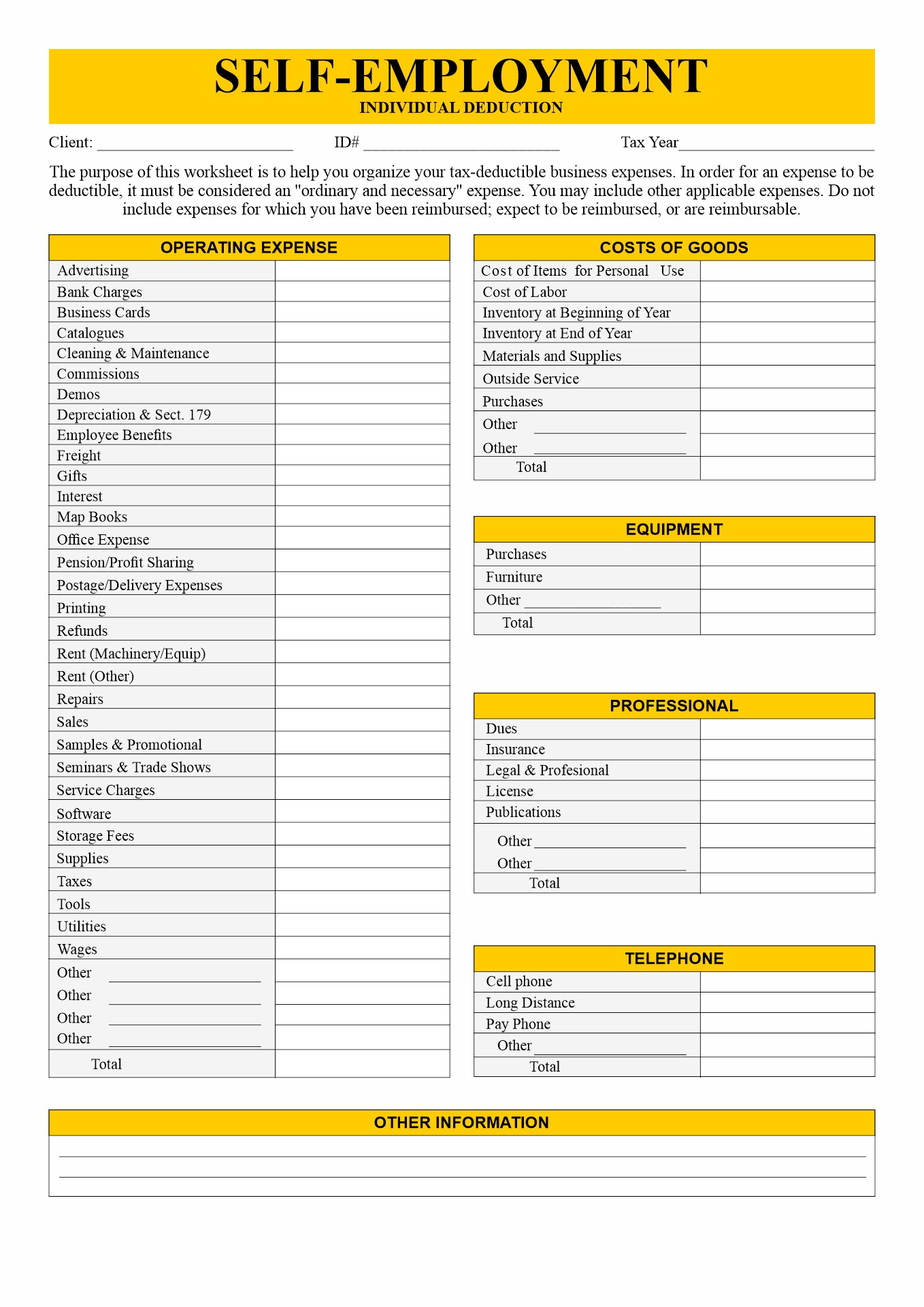

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/04/self-employed-tax-deductions-worksheet.jpg

Standard Deduction Worksheet Line 40 Form Fill And Sign Printable

https://www.pdffiller.com/preview/100/101/100101588/large.png

The home office deduction is a type of small business tax deduction that allows entrepreneurs to deduct expenses if they run their business from home If you are one of those entrepreneurs you likely What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t

Homeowners can write off mortgage interest and points property taxes sustainable and accessible home improvements and losses from a federal disaster on The simplified option uses a standard deduction of 5 per square foot of the portion of your home used for business capped at 300 square feet or 1 500

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

https://www.irs.gov/publications/p530

You owned the home in 2023 for 243 days May 3 to December 31 so you can take a tax deduction on your 2024 return of 946 243 365 1 425 paid in 2024 for 2023 You

https://www.nerdwallet.com/.../propert…

The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

Your First Look At 2023 Tax Brackets Deductions And Credits 3

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Printable Itemized Deductions Worksheet Printable World Holiday

Home Office Tax Deduction What To Know Fast Capital 360

Home Office Tax Deduction What To Know Fast Capital 360

TaxTips ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

20 Self Motivation Worksheet Free PDF At Worksheeto

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

2023 Home Tax Deduction - If you worked remotely in 2023 you may be wondering if you can get a tax break for doing so The IRS has strict rules for claiming a home office though Here s