2024 Mn Tax Rebate In the application of the Minnesota EV Tax Rebate Program an Electric Vehicle is defined as a motor vehicle that is able to be powered by an electric motor drawing current from rechargeable storage batteries fuel cells or other portable sources of electrical current and meets or exceeds applicable regulations in Code of Federal Regulations title 49 part 571 and successor requirements

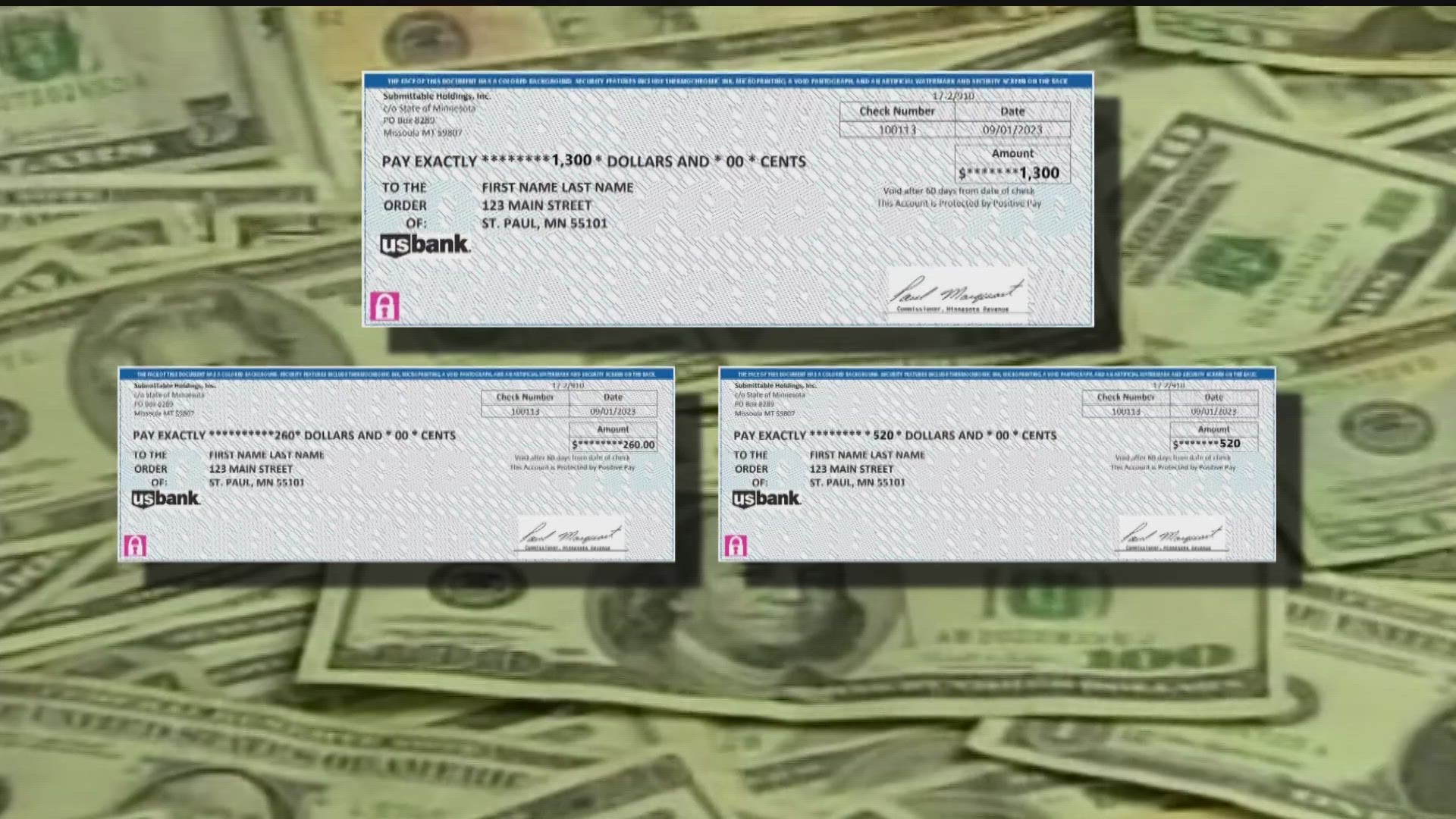

The one time rebate law provided payments of up to 1 300 for eligible taxpayers including 520 for married couples filing a joint return with adjusted gross income of 150 000 or less 260 for all other individuals with adjusted gross income of 75 000 or less Another 260 for each dependent claimed on your return up to three dependents 780 The 2023 legislative session resulted in a number of changes to Minnesota s tax code including some that affect previous tax years At this time you should not amend any Minnesota returns solely to account for these changes Major changes are summarized below

2024 Mn Tax Rebate

2024 Mn Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1bDWWD.img

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

Stimulus Check Update 1300 Payment Sent Today MN Tax Rebate Details YouTube

https://i.ytimg.com/vi/RInym0B1FDE/maxresdefault.jpg

Those making 75 000 or less received 260 couples making 150 000 or less got 520 and parents in those income brackets got another 260 per child for up to three kids with the maximum Depending on Minnesotans income and the size of their rebate check the federal tax could take between 26 and 286 of the rebate The Minnesota Department of Revenue says it will be sending a

The State of Minnesota has limited funds for the EV rebate When the program launches on February 1 2024 completed applications will be reviewed on a first come first served basis For new electric vehicles owners lessees may receive a rebate up to 2 500 For used electric vehicles owners may receive a rebate up to 600 260 for individuals with adjusted gross income of 75 000 or less 520 for married couples who filed a joint return with an adjusted gross income of 150 000 or less An additional 260 added for each dependent filed on the tax return with a maximum of three dependents totaling 780

Download 2024 Mn Tax Rebate

More picture related to 2024 Mn Tax Rebate

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

MN Tax Rebate Check Proof DocumentCloud

https://s3.documentcloud.org/documents/23911077/pages/mn-tax-rebate-check-proof-p1-normal.gif?ts=1692207775832

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Michael J Bologna Minnesota taxpayers who banked nearly 1 billion in rebate checks earlier this year are required to pay federal income taxes on the payments in 2024 the state Department of Revenue confirmed Wednesday Revenue officials had hoped the rebates sent to 2 4 million taxpayers would enjoy tax free treatment at the federal level The bill also extends sunset date of the credit from tax year 2024 to tax year 2031 or a property tax refund return under Minnesota Statutes chapter 290A based on property taxes payable in 2022 or rent constituting property taxes paid in 2021 by December 31 2022 4 had AGI for taxable years beginning in 2021 greater than a

Minnesota Solar Incentives Tax Credits And Rebates Of 2024 By Timothy Moore Contributor Fact Checked Lexie Pelchen Editor Published Sep 18 2023 12 00pm We earn a commission from partner January 12 2024 2 22 PM Gov Tim Walz announces details of the rebate program providing up to 1 300 for Minnesota families during a press conference at the State Capitol in St Paul on Aug

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Alconchoice Com Printable Rebate Form Printable Word Searches

https://handypdf.com/resources/formfile/images/10000/renters-rebate-sample-form-page1.png

https://www.jeffbelzer.com/blogs/2740/ev/2024-minnesota-electric-vehicle-tax-rebate-program-information-eligibility-news/

In the application of the Minnesota EV Tax Rebate Program an Electric Vehicle is defined as a motor vehicle that is able to be powered by an electric motor drawing current from rechargeable storage batteries fuel cells or other portable sources of electrical current and meets or exceeds applicable regulations in Code of Federal Regulations title 49 part 571 and successor requirements

https://www.revenue.state.mn.us/direct-tax-rebate-2021

The one time rebate law provided payments of up to 1 300 for eligible taxpayers including 520 for married couples filing a joint return with adjusted gross income of 150 000 or less 260 for all other individuals with adjusted gross income of 75 000 or less Another 260 for each dependent claimed on your return up to three dependents 780

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Renters Rebate Form Printable Rebate Form

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Minnesota Tax Rebate 2023 Your Comprehensive Guide PrintableRebateForm

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Missouri State Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

2024 Mn Tax Rebate - MINNESOTA 2024 2026 REBATE SUMMARY MINNESOTA RESIDENTIAL ENERGY EFFICIENCY PROGRAMS Effective January 1 2024 Equipment Minimum Qualifications Rebate Amount Key Central air conditioners 13 4 SEER2 w Quality Installation 150 15 2 SEER2 12 0 EER2 w Quality Installation 450