2024 New York Homeowner Tax Rebate The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct deposit

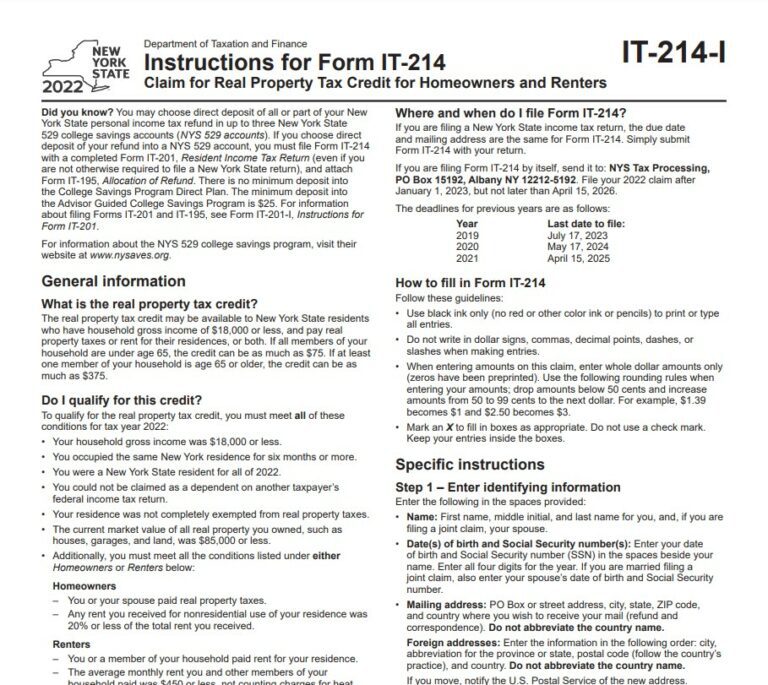

Frequently asked questions 2022 Homeowner Tax Rebate Credit Check Lookup Lost stolen destroyed and uncashed checks Eligibility To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

2024 New York Homeowner Tax Rebate

2024 New York Homeowner Tax Rebate

https://media.wgrz.com/assets/WGRZ/images/a07fcd1f-3754-4e57-bce5-9be83e9634c0/a07fcd1f-3754-4e57-bce5-9be83e9634c0_1140x641.jpg

2024 New York Glitz Wall Calendar Calendar Club

https://calendarclub.com.au/cdn/shop/files/9781664821439_1_700x700.jpg?v=1690696558

2024 NYC Neuromodulation

https://neuromodec.org/nyc-neuromodulation-2024/img/nyc_bg.webp

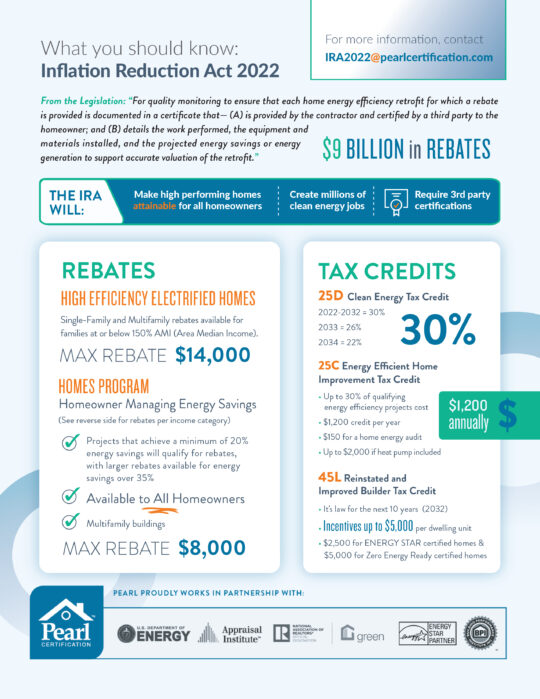

The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most recipients of the School Tax Relief STAR exemption or credit were automatically qualified and have already received their rebates Currently New Yorkers can combine IRA tax credits with New York State incentives and programs helping homeowners cut energy use save more money contribute to a cleaner healthier planet Now is the time to start your clean energy future free from fossil fuels including natural gas oil and propane

May 3 2023 Albany NY Governor Hochul Announces Support for Homeowners Tenants and Public Housing Residents as Part of FY 2024 Budget Adds 391 Million for New York s Emergency Rental Assistance Program to Support Thousands More Tenants and Families Including New York City Housing Authority Residents and Section 8 Voucher Recipients The New York Department of Taxation and Finance will soon begin sending direct financial assistance to 1 75 million New Yorkers who received the Empire State Child Credit and or the Earned Income Credit on their 2021 state tax returns including a gas tax moratorium and a homeowner tax rebate credit Our families have felt the effects of a

Download 2024 New York Homeowner Tax Rebate

More picture related to 2024 New York Homeowner Tax Rebate

Confusion Over When Eligible New Yorkers Will Get Their Homeowner Tax Rebate Check CNYcentral

https://chittenango.com/wp-content/uploads/2022/08/bb776db9-9697-43c3-882f-8577bedc9e89-large16x9_tax_rebate.PNG

The Homeowner s Guide To The Inflation Pearl Certification

https://pearlcertification.com/images/page_headers/_imageBlockMedium/IRA_Infographic-2022-1.jpg

New York State To Mail Out Homeowner Tax Rebate Credit Checks DSJ

https://dsj.us/wp-content/uploads/2022/06/homeowners-tax-rebate-checks.jpg

Strategic Operating Plan In 2024 we re launching a new pilot tax filing service called Direct File If you re eligible and choose to participate file your 2023 federal tax return online for free directly with IRS It will be rolled out in phases and is expected to be more widely available in mid March The property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less The rebate amount will be applied as a credit to your property tax account The City of New York Property Tax Rebates Attn Damaged Review P O Box 5528 Binghamton NY 13902 5528 City of New

NEW YORK New York City Mayor Eric Adams today signed legislation to provide a one time property tax rebate of up to 150 to hundreds of thousands of eligible New York homeowners The bill was passed by the New York City Council earlier this month I grew up on the edge of homelessness so I know the worry and fear that too many low and The amount of the credit is between 250 and 350 and will be available through 2023 To be eligible homeowners must be Eligible for the 2022 School Tax Relief STAR credit or exemption Make less than 250 000 a year based on federal adjusted gross income from tax year 2020 and Have a school tax liability for the 2022 2023 school year

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

https://www.syracuse.com/resizer/d5Fht24Xbm2Z-MQedKvKt1kuy_M=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/QIMGUVTTIFFGFPKEIOPG2ECTTU.jpg

https://www.tax.ny.gov/star/

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive your benefit each year in one of two ways STAR credit If you are registered for the STAR credit the Tax Department will issue your STAR benefit via check or direct deposit

https://www.tax.ny.gov/pit/property/homeowner-tax-rebate-credit.htm

Frequently asked questions 2022 Homeowner Tax Rebate Credit Check Lookup Lost stolen destroyed and uncashed checks Eligibility To be eligible for a homeowner tax rebate credit in 2022 you must have qualified for a 2022 STAR credit or exemption had income that was less than or equal to 250 000 for the 2020 income tax year and

Direct Payments Worth Up To 1 050 Being Sent To Millions Of Americans NOW Are You Eligible

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks Wgrz

NYS 2023 Homeowner Tax Rebate Tax Rebate

New 2023 2024 New York Street Racing Permit Decal ATTENTION NOT I detail

Property Tax Rebate New York State Printable Rebate Form

NYC Homeowners Leave 75M In Tax Rebates Unclaimed

NYC Homeowners Leave 75M In Tax Rebates Unclaimed

2024 Venture Capital World Summit Venture Capital World Summit

Homeowner Tax Rebate Program For People Who Live In Their Home YouTube

Tax Time Already 2022 Tax Deductions For Homeowners A COVID Rebate

2024 New York Homeowner Tax Rebate - SHARE ALBANY N Y WWTI Homeowners in New York should check their mail because the state is mailing out Homeowner Tax Rebate checks The homeowner tax rebate credit is a one year program