2024 Recovery Rebate Credit Worksheet The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021

Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return The Recovery Rebate Credit Worksheet consists of multiple lines each with a specific purpose in the calculation process Here we provide a step by step explanation of how to complete the worksheet Line 1 Enter your 2023 adjusted gross income AGI from your 2024 Form 1040 or 1040 SR Line 2 Enter the number of qualifying children under the

2024 Recovery Rebate Credit Worksheet

2024 Recovery Rebate Credit Worksheet

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

2023 Tax Rebate Credit Tax Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Recovery Rebate Credit Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/04/Recovery-Rebate-Credit-Form-2023.png

Your Recovery Rebate Credit will be included in your tax refund If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit Recovery Rebate Credit Recovery Rebate Credit Worksheet Explained As the IRS indicated they are reconciling refunds with stimulus payments and the Recovery Rebate Credit claimed on your return If you do not know the amounts of your stimulus payment refer to notice 1444 C or visit the IRS website Review your Recovery Rebate Credit Worksheet in your PDF last page

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020 The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no

Download 2024 Recovery Rebate Credit Worksheet

More picture related to 2024 Recovery Rebate Credit Worksheet

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-federal-tax-credits-taxuni.jpg?resize=1024%2C576&ssl=1

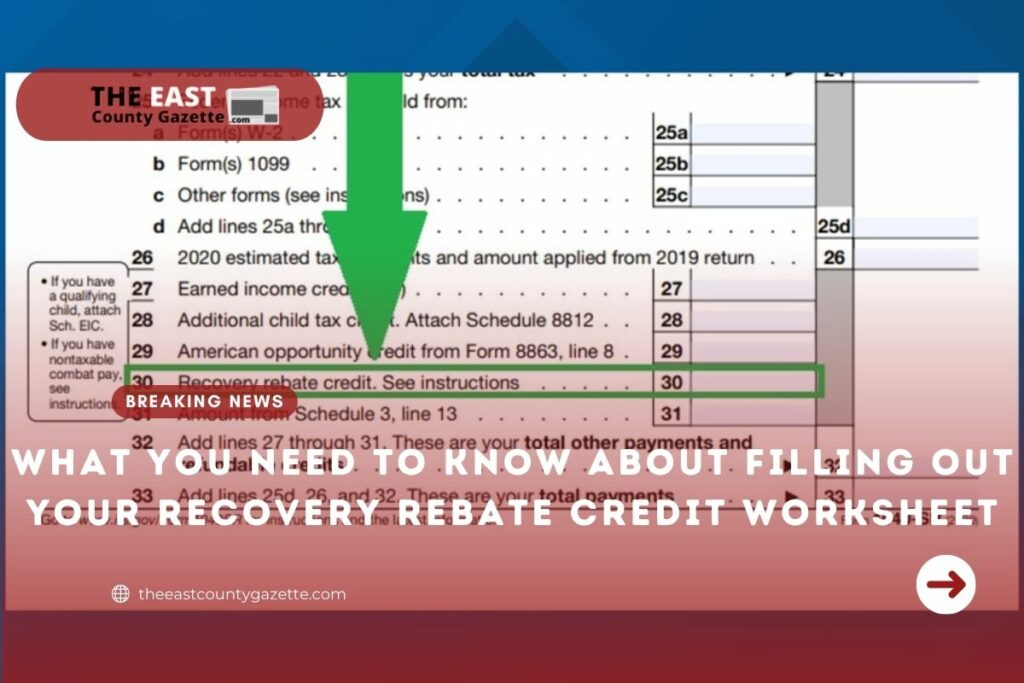

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet The East County

https://theeastcountygazette.com/wp-content/uploads/2022/02/2-20-2-1024x683.jpg

You ll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit This is the case if you received a partial amount less than the If your rebate will be going to a bank account within the U S you have the option to have your rebate directly deposited If you want the Department of Revenue to directly deposit your rebate into your checking or savings account at your bank credit union or other financial institution place an X in the appropriate box on Line 20

The IRS included a Recovery Rebate Credit Worksheet in the instructions for Form 1040 If you are owed money look for the Recovery Rebate Credit that is listed on Line 30 of the 1040 Form for the The Recovery Rebate Credit amount is figured just like the first and second economic impact stimulus payments except that it uses your client s tax year 2020 information to determine eligibility and the amount rather than prior year returns The credit will be reported on Form 1040 line 30 The Recovery Rebate Credit amount if any is

How To Complete Your Recovery Rebate Credit Worksheet For The Stimulus Package The East County

https://theeastcountygazette.com/wp-content/uploads/2022/02/Featured-Image-Templet-2022-02-21T222007.911-2.png

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-federal-tax-credits-taxuni-12.jpg

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021

https://accountants.intuit.com/support/en-us/help-article/tax-credits-deductions/enter-stimulus-payments-figure-recovery-rebate/L2fDNZPKt_US_en_US

Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return

30 Recovery Rebate Credit Recovery Rebate

How To Complete Your Recovery Rebate Credit Worksheet For The Stimulus Package The East County

Recovery Rebate Credit Worksheet Pdf Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit How Does It Work Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

Recovery Rebate Credit 2022 Worksheet Recovery Rebate

Recovery Rebate Credit Worksheet Example Recovery Rebate

2024 Recovery Rebate Credit Worksheet - The Recovery Rebate Credit Worksheet can help determine if you are eligible for the credit If you re eligible for the Recovery Rebate Credit you will need the amount of any Economic Impact Payments you received to calculate your Recovery Rebate Credit amount using the RRC Worksheet Here is a link to a PDF of the worksheet Recovery Rebate