2024 Tax Rebate Illinois Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season Illinois Department of Revenue Announces Start to 2024 Income Tax Season

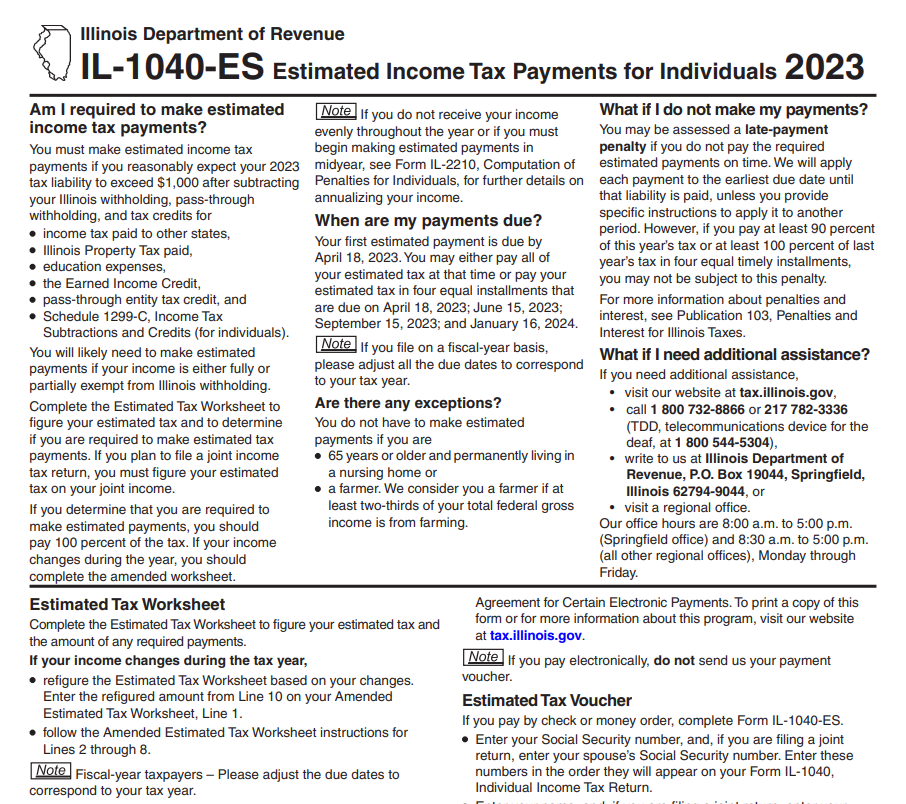

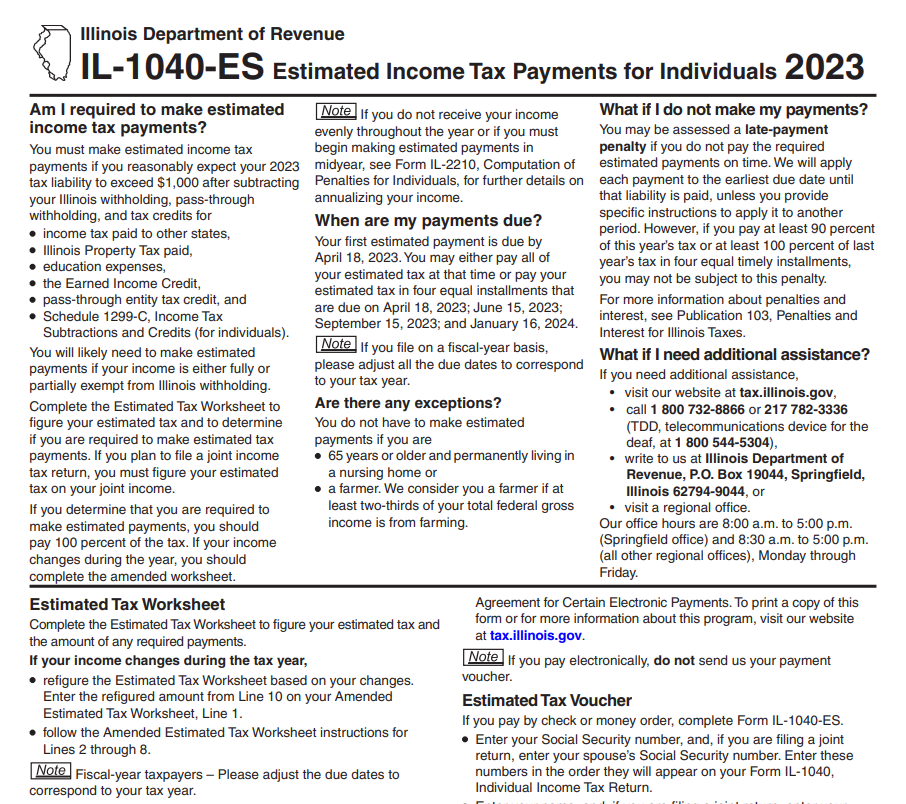

ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January 29th 2024 That is also the same IDOR s taxpayer assistance numbers are available for tax related inquiries and include automated menus allowing taxpayers to check the status of a refund identify an IL PIN or receive estimated payment information without having to wait for an agent To receive assistance taxpayers may call 1 800 732 8866 or 217 782 3336

2024 Tax Rebate Illinois

2024 Tax Rebate Illinois

https://printablerebateform.net/wp-content/uploads/2023/04/Nebraska-Tax-Rebate-2023-768x678.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

https://m.media-amazon.com/images/I/81J20wwDaLL.jpg

2024 This bulletin is written to inform you of recent changes it does not replace statutes rules and regulations or court decisions For information or forms Visit our website at tax illinois gov Register and file your return online at mytax illinois gov For registration questions call or email us at 217 785 3707 REV CentReg illinois gov The Illinois Earned Income Tax Credit EITC was increased this year to 20 of the Federal EITC and expanded to include taxpayers 18 years of age or older with or without qualifying child those 65 years of age or older without qualifying child and those with an IRS issued Individual Taxpayer Identification Number ITIN

The deadline to file 2023 federal and Illinois tax returns or an extension is April 15 2024 The IRS recommends visiting IRS gov for common questions They also state that the fastest and easiest way to file and receive a refund is to file electronically with direct deposit The amount of the credit is determined by your eligibility for the federal EITC For tax years 2022 and earlier filed by April 2023 the Illinois Earned Income Tax Credit is 18 of the federal credit amount For tax years 2023 and beyond filed in 2024 the Illinois EITC rises to 20 To find out if you qualify for benefits check the IRS

Download 2024 Tax Rebate Illinois

More picture related to 2024 Tax Rebate Illinois

NWC Tryouts 2023 2024 NWC Alliance

https://nwcalliancesoccer.demosphere-secure.com/_files/tryouts-2023-2024/NWC 2023-2024.JPG

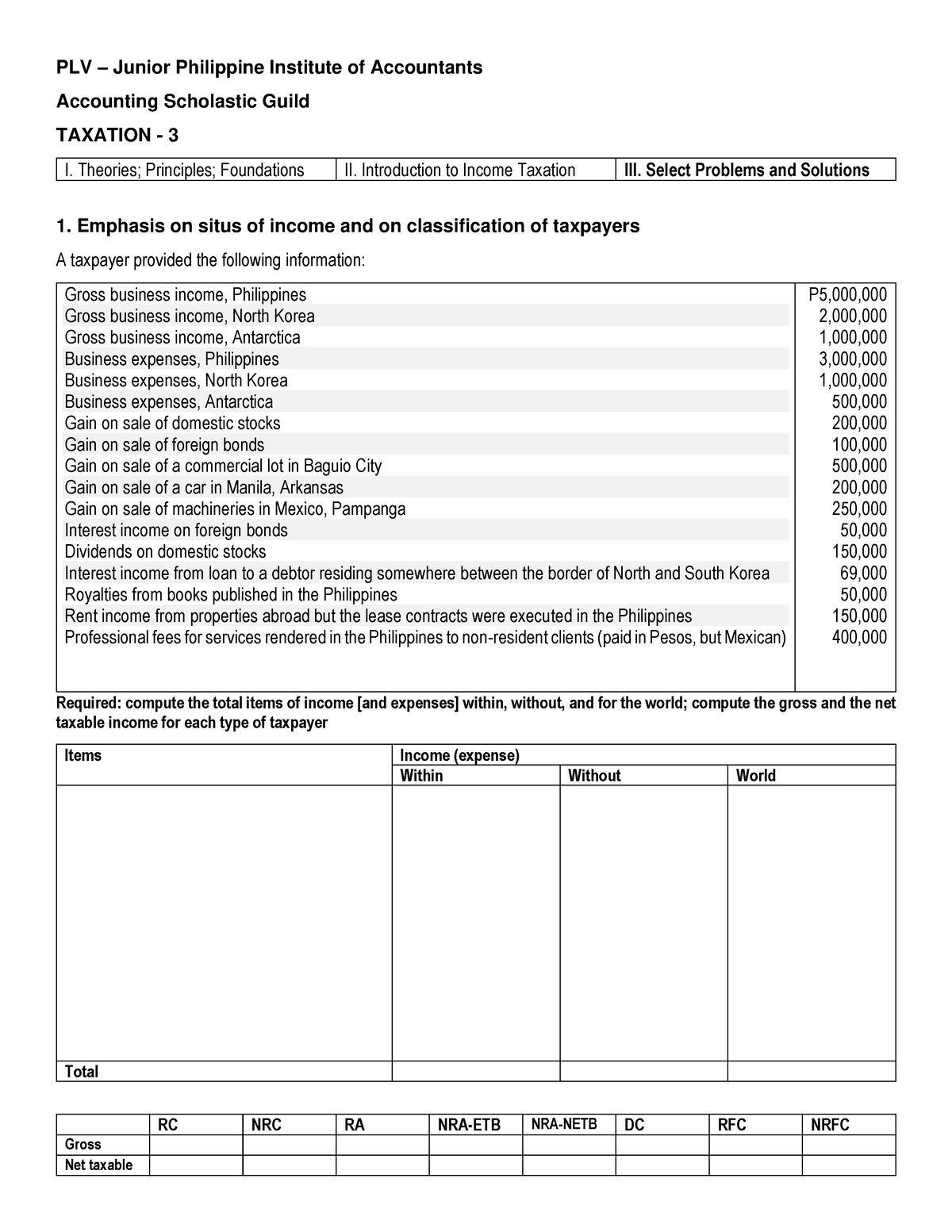

AKS 2023 2024 TAX 1 DAY 3 PLV Junior Philippine Institute Of Accountants Accounting

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1915a686ff08737254bddc16840f8378/thumb_1200_1553.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

First and foremost to be eligible you must have filed taxes In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross In regard to the Individual Income Tax Rebate a person qualifies if they were an Illinois resident in 2021 and their adjusted gross income was under 400 000 if filing jointly or 200 000 if

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue Illinois federal income tax season 2024 opens Monday Dave Dawson Assistant editor Jan 26 2024 The Illinois Department of Revenue is providing taxpayers with tips and alerting them to

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=969%2C649&ssl=1

Tolminator 2024

https://tolminator.mojekarte.si/design/tolminator/img-tolminator/logo-2024-1.png

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

Mission Vision and Value FY 2024 18 What s New for Illinois Income Taxes FY 2024 15 New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees Illinois Department of Revenue Announces Start to 2024 Income Tax Season Illinois Department of Revenue Announces Start to 2024 Income Tax Season

https://www.mystateline.com/news/local-news/illinois-announces-start-of-2024-tax-season-heres-when-refunds-will-be-sent-out/

ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January 29th 2024 That is also the same

Income Tax Rebate Under Section 87A

Tax Rates For The 2024 Year Of Assessment Just One Lap

Illinois Tax Rebate 2022 Cray Kaiser

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Illinois Income Tax Rebate 2023 Tax Rebate

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And Strategies To Maximize Your

State Withholding Tax Form 2023 Printable Forms Free Online

2023 Taxes Clarus Wealth

2024 Tax Rebate Illinois - The deadline to file 2023 federal and Illinois tax returns or an extension is April 15 2024 The IRS recommends visiting IRS gov for common questions They also state that the fastest and easiest way to file and receive a refund is to file electronically with direct deposit