7500 Rebate 2024 What cars qualify for the 7 500 tax credit in 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit The U S Department of the Treasury proposed a rule on Friday that would make it easier for consumers to get a 7 500 tax credit for new electric vehicles and a 4 000 credit for used EVs The

7500 Rebate 2024

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24982304/1532640345.jpg)

7500 Rebate 2024

https://duet-cdn.vox-cdn.com/thumbor/0x0:4928x3280/2400x1600/filters:focal(2464x1640:2465x1641):format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24982304/1532640345.jpg

Honda Jazz 2023 Facelift More Power With The RS Package SASATIMES

https://images.summitmedia-digital.com/topgear/images/2022/08/08/honda-fit-rs-2023-main-1659916085.jpg

Starting 2024 Electric Vehicle Buyers Eligible For Up To 7 500 Instant Rebate On Car Purchases

https://professpost.com/wp-content/uploads/2023/10/Electric-Car-1080x675_copy_1078x674.jpg

Who qualifies You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses The bad news is that fewer vehicles are now eligible for federal tax credits and even fewer are eligible for the maximum 7 500 credit But there s good news too Many electric and plug in

If you re shopping for or researching an electric vehicle in 2024 you ve probably heard that significant changes in the federal tax credit of up to 7 500 for EVs and plug in hybrids took The Inflation Reduction Act offers a tax credit worth up to 7 500 to those who buy new electric vehicles It also offers a 4 000 credit for used EVs New rules for 2024 will allow buyers to

Download 7500 Rebate 2024

More picture related to 7500 Rebate 2024

Point Of Sale Instant Rebate Easier Access To The 7 500 EV Tax Credit In 2024 YouTube

https://i.ytimg.com/vi/_kjzQbOEO7s/maxresdefault.jpg

In 2024 Electrical Automotive Patrons May Get An Instantaneous Rebate Of As Much As 7 500 Idzsn

https://idzsn.com/wp-content/uploads/2023/10/In-2024-electric-car-buyers-could-get-an-instant-rebate.jpg

7 500 One Time Rebate Can Be Claimed This New Year Here s What You Should Know Texas

https://texasbreaking.com/wp-content/uploads/2022/12/106987155-16390657212021-12-09t150838z_104791917_rc23br9mqj5p_rtrmadp_0_global-forex-1024x683.jpeg

The IRS first started handing out tax credits to EV buyers in 2022 after the passing of the Inflation Reduction Act up to 7 500 for new cars The policy was a key part of President Biden s The electric vehicle tax credit also known as the clean vehicle tax credit or 30D if you like IRS code can offer up to 7 500 off the purchase of a new EV The credit was approved

The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential 2024 Tesla Model Y price with 7 500 EV tax credit 38 130 for a rear wheel drive Model Y with an EPA estimated 260 miles of range Tesla s least expensive Model Y configuration Tesla

Mobil One Offical Rebate Printable Form Printable Forms Free Online

https://printablerebateform.net/wp-content/uploads/2021/07/Trifexis-Rebate-Form-2021-768x506.jpg

Lensrebates Alcon Com

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24982304/1532640345.jpg?w=186)

https://www.usatoday.com/story/money/cars/2024/01/03/cars-qualify-ev-tax-credit-2024/72088375007/

What cars qualify for the 7 500 tax credit in 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler

https://www.irs.gov/newsroom/qualifying-clean-energy-vehicle-buyers-are-eligible-for-a-tax-credit-of-up-to-7500

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Mobil One Offical Rebate Printable Form Printable Forms Free Online

Alcon Rebate Form 2023 Printable Rebate Form

Buying An Electric Car You Can Get A 7 500 Tax Credit But It Won t Be Easy NCPR News

Seresto Rebate Form PrintableRebateForm

Printable Alcon Rebate Form 2023 Printable Forms Free Online

Printable Alcon Rebate Form 2023 Printable Forms Free Online

DIAGEN 7500 DIAGEN

New Wearer Rebate Alcon New Wearers Can Save Up To 225 On Your Contact Lens Purchase

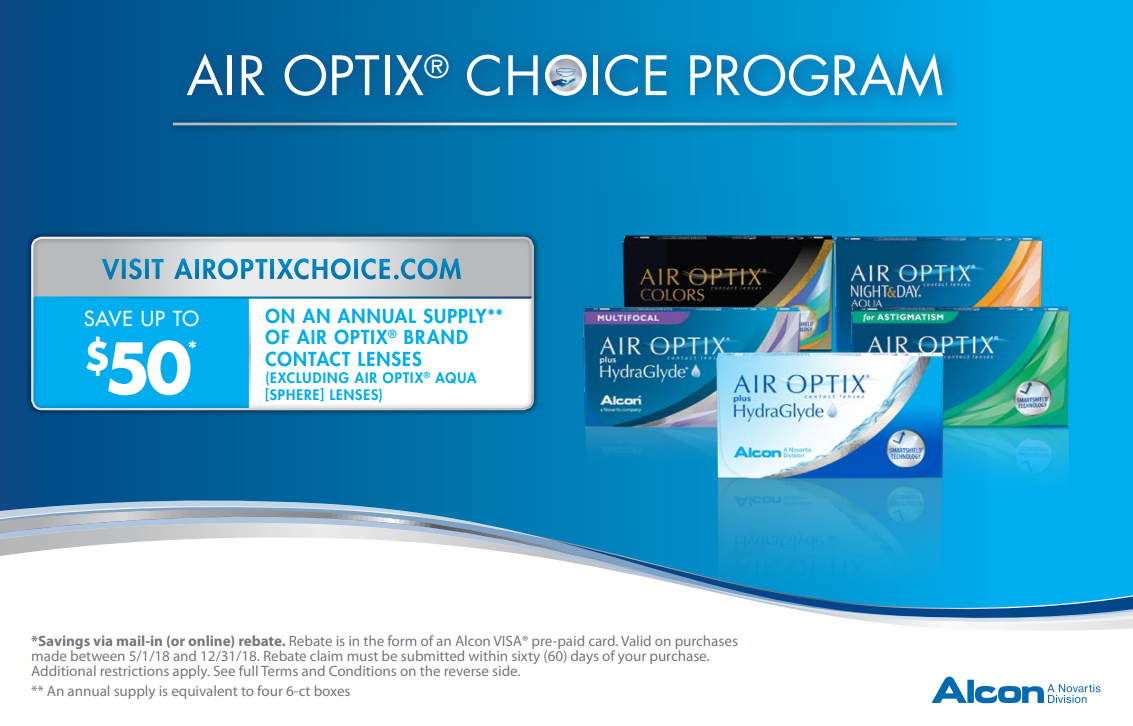

Rebate Air Optix Printable Rebate Form

7500 Rebate 2024 - In 2024 You ll Get Your 7 500 EV Tax Credit Up Front Here s How It Works David Nadelle October 9 2023 at 1 06 PM 3 min read JGalione iStock Car buyers in 2024 will have to mull