80c And 80ccd 2 Section 80CCD has been further divided into two subsections 80CCD 1 Contributions made by the employee self salaried or self

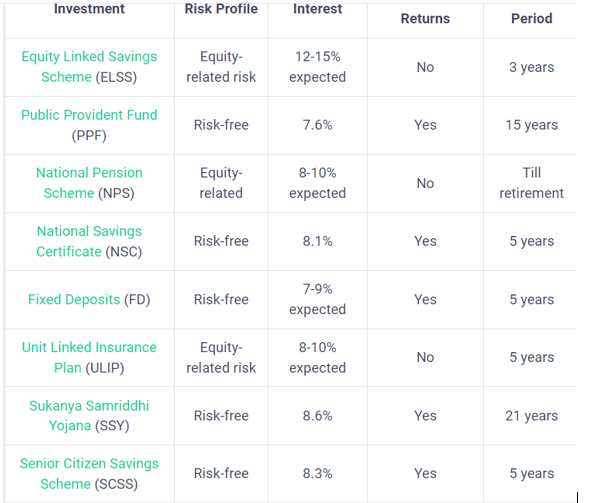

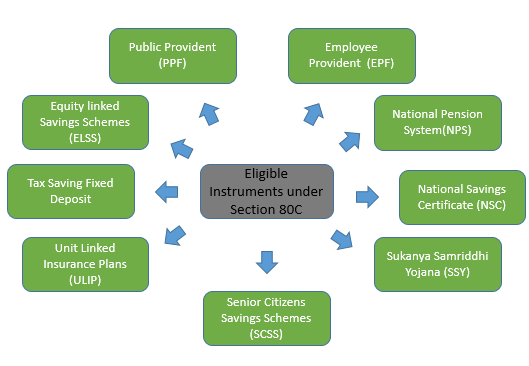

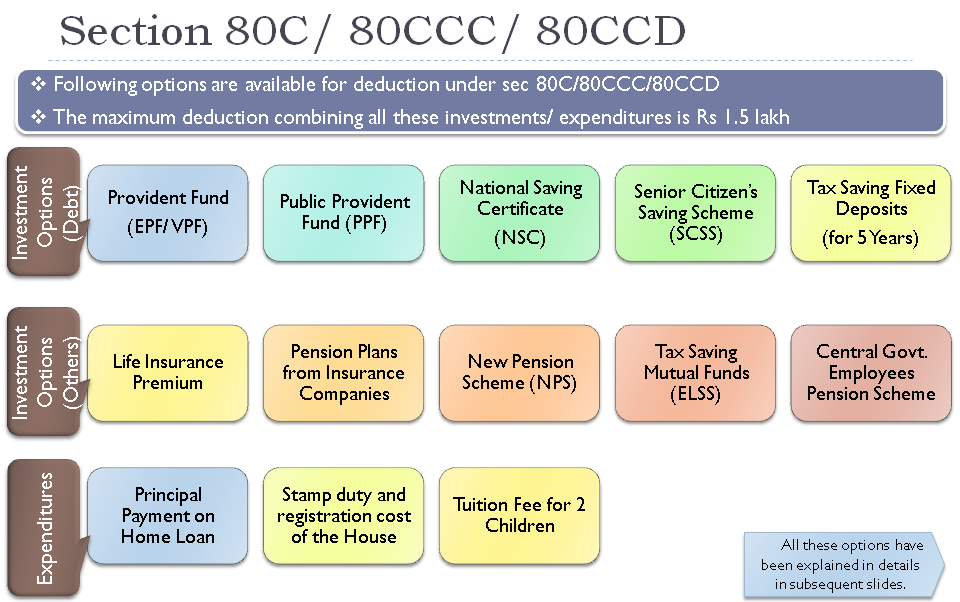

You can claim deductions under both sections 80C and 80D of the Income Tax Act 1961 Under section 80C you can claim a deduction of 1 5lakhs by investing in PPF ELSS etc Also you can claim a deduction for medical insurance If we Claim 1 5Lakh under Sec 80C with Insurance PF and Mutual Fund and 50k under 80CCD 1B then where can we claim the amount contributed towards 80CCD 2 And what is the limit of 80CCD 2 alone

80c And 80ccd 2

80c And 80ccd 2

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

FAQs On Deductions Under Section 80C 80CCC 80CCD And 80D

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c-768x702.jpg

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Section 80CCD 1 is for individual contributions and is part of the 1 5 lakh Section 80C limit Section 80CCD 1B offers an additional tax saving opportunity of 50 000 Section 80CCD 2 Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits

Section 80CCD 2 of the Income Tax Act provides an excellent opportunity for salaried individuals to save on taxes while securing their retirement through contributions to the National Pension Section 80CCD of the Income Tax Act provides tax benefits for contributions to central government pension schemes It includes Section 80CCD 1 Deals with individual

Download 80c And 80ccd 2

More picture related to 80c And 80ccd 2

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Section 80C 80CCC 80CCD 80CCE Deductions In Computing Total Income

https://i.ytimg.com/vi/GI9JwWO0QU4/maxresdefault.jpg

Deduction From Gross Total Income Section 80C To 80U Graphical Table

https://incometaxmanagement.com/Images/Graphical-ITAX/Deduction-from-GTI/Section-80C.jpg

Section 80 CCD 1 allows taxpayers to claim tax benefits on the amount deposited in the central government pension schemes Section 80 CCD 2 allows tax deduction benefits to the As per Sec 80CCE aggregate deduction u s 80C 80CCC and 80CCD 1 is restricted to maximum of Rs 1 50 000 Therefore in current regime Rs 90 000 is allowed u s

What is Section 80CCD 1 and 80CCD 2 Section 80CCD 1 and Section 80CCD 2 help individuals claim deductions on contributions to their retirement plans and permit employers to avail deductions for contributions made on Under Section 80 of the Income Tax Act 1961 an individual can avail exemptions and deductions that lowers their tax liability Under Section 80CCD personal and employer

Section 80C 80CCC 80CCD And 80D Deduction Complete Guide

https://www.legalraasta.com/blog/wp-content/uploads/2021/04/Section-80C.png

Income Tax Deductions While Filling ITR In India RJA

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

https://cleartax.in

Section 80CCD has been further divided into two subsections 80CCD 1 Contributions made by the employee self salaried or self

https://cleartax.in

You can claim deductions under both sections 80C and 80D of the Income Tax Act 1961 Under section 80C you can claim a deduction of 1 5lakhs by investing in PPF ELSS etc Also you can claim a deduction for medical insurance

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

Section 80C 80CCC 80CCD And 80D Deduction Complete Guide

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

How To Prepare Trading Account YouTube

A Complete Guide On Income Tax Deductions Under Section 80C 80CCC

Deduction Under Section 80C A Complete List BasuNivesh

Deduction Under Section 80C A Complete List BasuNivesh

Investment Options To Avail Tax Deduction Under Section 80C

TAX DEDUCTION UNDER SECTION 80C

Budget 2014 Impact On Money Taxes And Savings

80c And 80ccd 2 - Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits