80ccd 1 Vs 80ccd 1b Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions available under Section 80CCD 1 provided if they opt for the old tax regime Thus the

There is so much confusion about NPS Tax Benefits after the 2016 Budget Hence in this post let us discuss about NPS Tax Benefits under sections 80CCD 1 80CCD 2 and 80CCD 1B and how to claim additional tax Tax benefits on NPS are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B All the tax benefits annuity restrictions exit and withdrawal rules are applicable to NPS Tier I account only

80ccd 1 Vs 80ccd 1b

80ccd 1 Vs 80ccd 1b

https://i.ytimg.com/vi/Zs4Omr2D7AU/maxresdefault.jpg

20181212 Invest In Nps Equity Funds Comparison Post Tax Section 80ccd

https://www.personalfinanceplan.in/wp-content/uploads/2018/12/20181212-invest-in-nps-equity-funds-comparison-post-tax-section-80ccd1B.png?x91460

NPS Tax Benefits U s 80CCD 1 80CCD 2 And 80CCD 1B

https://financialcontrol.in/wp-content/uploads/2019/05/NPS-tax-benefits-us-80CCD1-80CCD2-and-80CCD1B.png

Section 80CCD 1 allows for a maximum deduction of Rs 1 5 lakh and Section 80CCD 1B allows for an additional Rs 50 000 in deductions Can I divide my NPS payment under U S 80C and 80CCD 1B from my salary Section 80CCD1 allows every tax paying individual in India to get tax deduction benefits from the amount you deposit in your NPS account This tax benefit is open to both employed and self

Key Differences 80CCD 1B vs 80CCD 2 Eligibility Section 80CCD 1B applies to self contributions while Section 80CCD 2 applies only to employer contributions Limits Section What is the difference between 80CCD 1 and 80CCD 2 80CCD 1 covers contributions made by the individual while 80CCD 2 pertains to contributions made by the

Download 80ccd 1 Vs 80ccd 1b

More picture related to 80ccd 1 Vs 80ccd 1b

80CCD 1 80CCD 2 80CCD 1B NPS CONTRIBUTION NEW PENSION SCHEME

https://i.ytimg.com/vi/LO7AMxTrhyw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYfyBHKCowDw==&rs=AOn4CLDfRFVXwN4NeqbGesfWDbGy3ZAZbQ

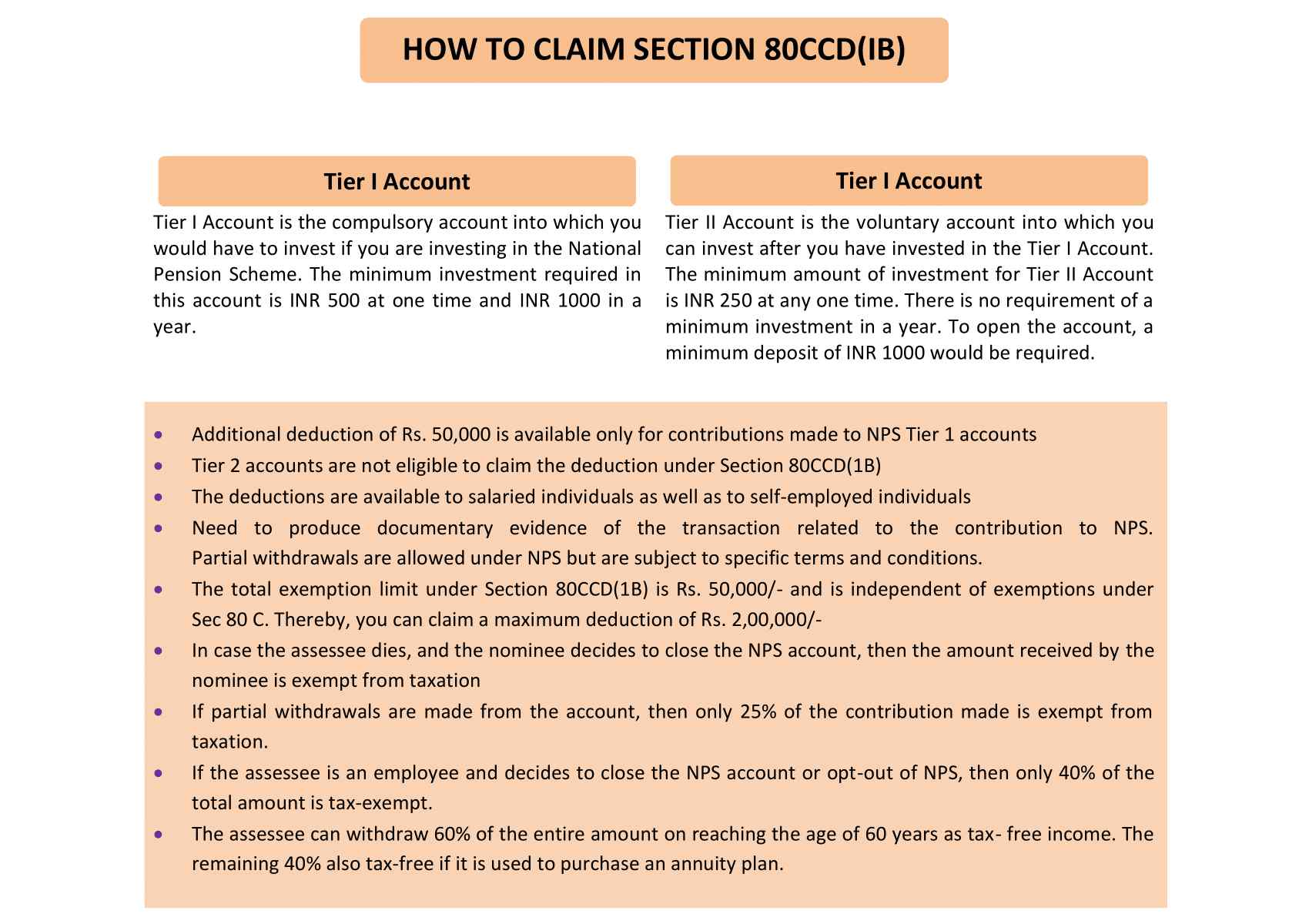

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B-National-Pension-Scheme-600x600.png

NPS Vs Mutual Fund Which Is Better For Retirement NPS Real Tax

https://i.ytimg.com/vi/rtl6fZQabck/maxresdefault.jpg

However the maximum limit of deduction under section 80C 80CCC and 80CCD 1 cannot exceed INR 1 50 Lakhs Further as per section 80CCD 2 the maximum limit is 10 of the salary Additionally maximum Section 80CCD 1 is for individual contributions and is part of the 1 5 lakh Section 80C limit Section 80CCD 1B offers an additional tax saving opportunity of 50 000 Section 80CCD 2

Section 80C of the Income Tax Act 1961 allows a maximum deduction up to 1 50 Lakhs for investments made in specific schemes Section 80CCD allows income tax What is the difference between Section 80CCD 1 and Section 80CCD 1B Section 80CCD 1 allows the deduction for contributions made towards National Pension

NPS 80CCD 1 AND SECTION 80CCD 1B YouTube

https://i.ytimg.com/vi/9zU4iMCWPdM/maxresdefault.jpg

Section 80CCD Deduction Under 80CCD 1 80CCD 1B 80CCD 2

https://cdnlearnblog.etmoney.com/wp-content/uploads/2022/09/3-6.jpg

https://cleartax.in

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions available under Section 80CCD 1 provided if they opt for the old tax regime Thus the

https://www.basunivesh.com

There is so much confusion about NPS Tax Benefits after the 2016 Budget Hence in this post let us discuss about NPS Tax Benefits under sections 80CCD 1 80CCD 2 and 80CCD 1B and how to claim additional tax

Section 80C With Section 80CCC 80CCD 1 80CCD 1B 80CCD 2 YouTube

NPS 80CCD 1 AND SECTION 80CCD 1B YouTube

2 Deductions From GTI Section 80CCD 80CCD 1 80CCD 1B 80CCD 2

National Pension Scheme 80CCD 1B How To Claim Onlineideation

Section 80CCD Deductions NPS APY Section 80CCD 1 1b 2

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

NPS Tax Benefit U s 80ccd1 80ccd2 And 80ccd 1b NPS Tax Benefits

Deduction U s 80CCC To 80CCD 1 80CCD 1B 80CCD 2 II Invest In NPS II

National Pension Scheme 80CCD 1B How To Claim Onlineideation

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

80ccd 1 Vs 80ccd 1b - Section 80CCD 1 allows for a maximum deduction of Rs 1 5 lakh and Section 80CCD 1B allows for an additional Rs 50 000 in deductions Can I divide my NPS payment under U S 80C and 80CCD 1B from my salary