80ccd 2 And 80ccd 1 Section 80CCD 1 and 80CCD 2 are related to the deductions available to individuals for the contributions made to the NPS and APY Get to know its features conditions and more on

Section 80CCD of the Income Tax Act Discover the key aspects of deductions under Section 80CCD 1 and 80CCD 2 of the Income Tax Act Learn about eligibility how to A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government to NPS of

80ccd 2 And 80ccd 1

80ccd 2 And 80ccd 1

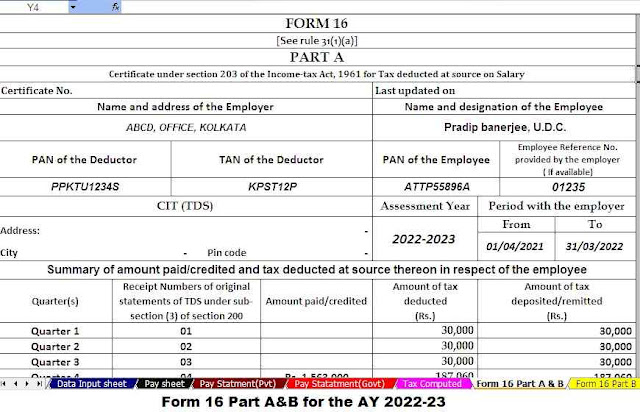

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgJhROVEdcD10HOXa4gEBhn7fQZj_KZCXnJLsU1uKvMIaVAJWGxNvX170jNqfHDKS6a-v6ZI_45Dcj4cEcevt3bUwQdh8HUZrVU4_U2OYWRoV0Qc85mh1zCzA0uBzXogq7AE0OfCBBpGxzTL8UgdhegrUx8dg58lJsBzQNI-MKAwGT0GYgJuaVPxvbT/w640-h412/Form 16 Part A and B.jpg

NPS Tier 1 Benefits 80CCD 1 80CCD 1B 80CCD 2 NPS Tax

https://i.ytimg.com/vi/GT73sBLn6A0/maxresdefault.jpg

Section 80 CCD 80CCD 1 80CCD IB 80CCD 2 80CCE 80CCF

https://i.ytimg.com/vi/E_xOfPkGWfs/maxresdefault.jpg

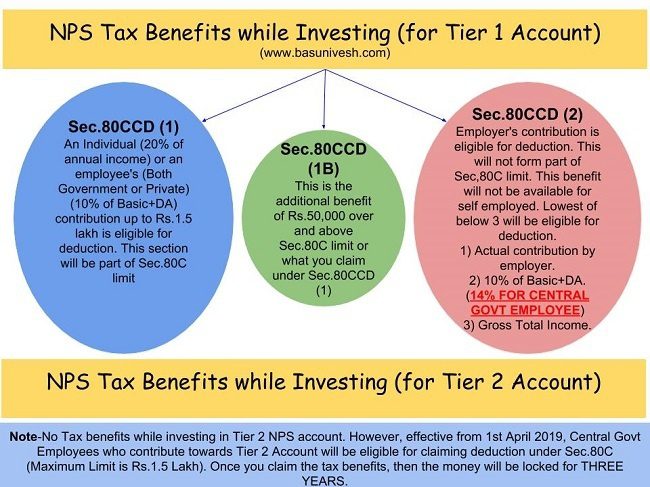

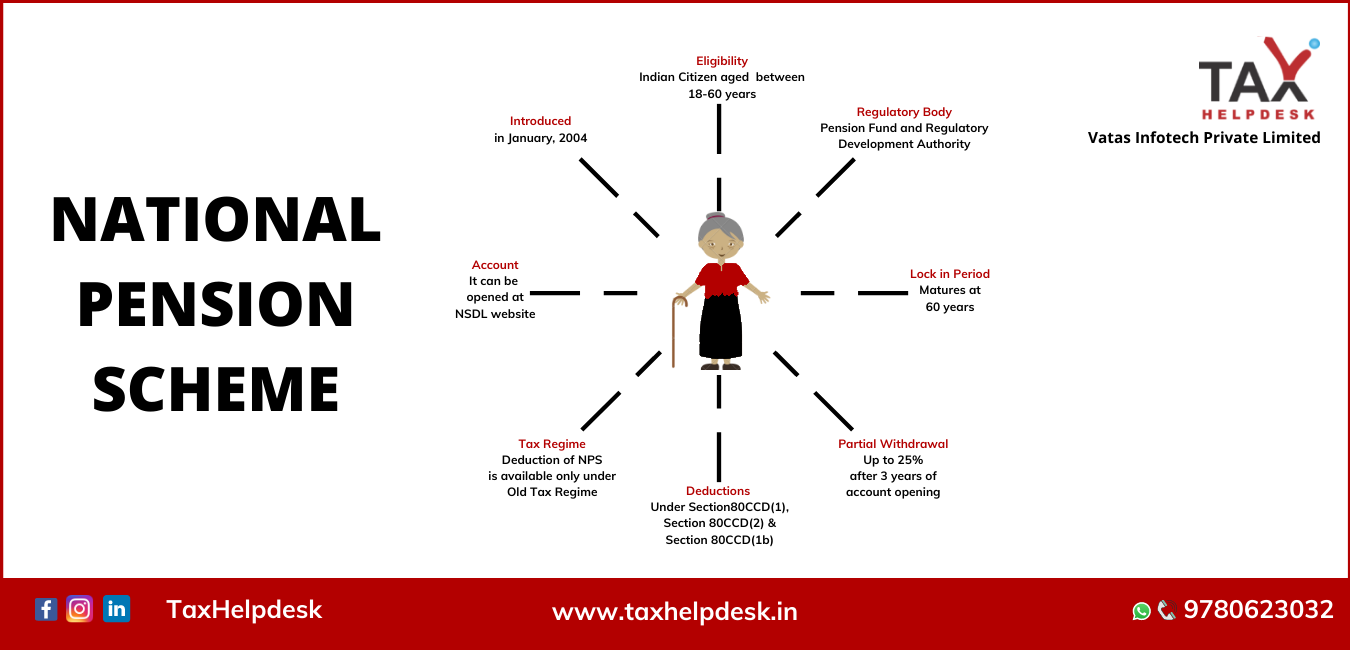

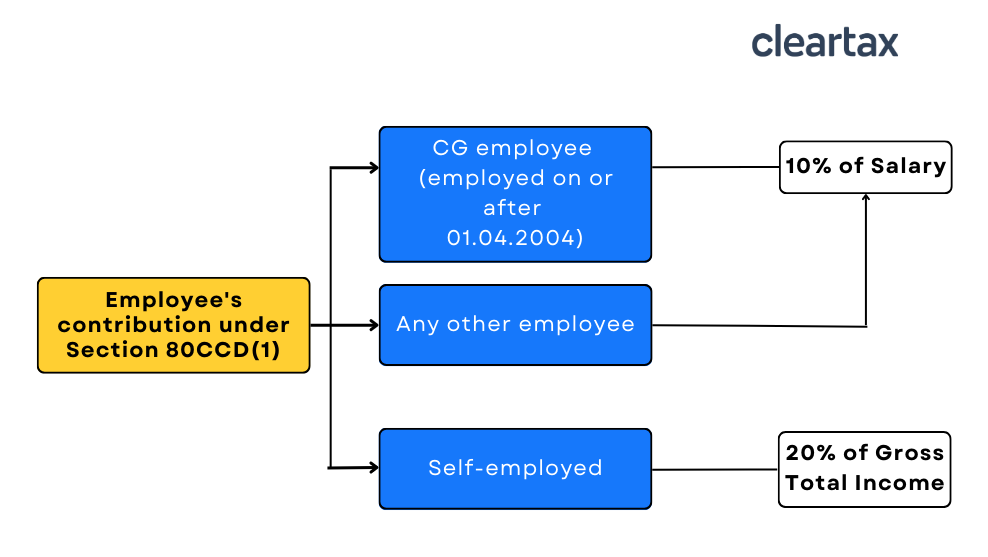

Under 80CCD and its subsections you can receive annual tax savings of up to Rs 2 lakh by investments made into retirement plans National Pension Scheme NPS and Atal Pension Yojana APY Read on to know the key features of Section 80CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of deduction of 80C and 80CCD 1 cannot exceed Rs 1 50 lakhs in

80CCD 2 relates to the deduction of employer s contribution to New Pension Scheme NPS This contribution is firstly added in salary income and later allowed as Let us discuss the types of NPS Tax Benefits or deductions available in Sec 80CCD 1 80CCD 2 and 80CCD 1B How to claim additional NPS tax benefits

Download 80ccd 2 And 80ccd 1

More picture related to 80ccd 2 And 80ccd 1

NPS Tax Benefits 2020 Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B.jpg?lossy=1&strip=1&webp=1

NPS 80CCD 1 AND SECTION 80CCD 1B YouTube

https://i.ytimg.com/vi/9zU4iMCWPdM/maxresdefault.jpg

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

https://i.ytimg.com/vi/PbIdrmlETqQ/maxresdefault.jpg

Tax benefits on NPS are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B All the tax benefits annuity restrictions exit and withdrawal rules are applicable The investments up to 1 50 000 qualify for tax deduction under 80CCD 1 and 80CCD 2 combined of the Income Tax Act Furthermore an additional investment of

Under Section 80CCD NPS donations are eligible for tax deductions of up to 2 00 000 Tier I and Tier II are two different accounts to which NPS contributions can be made Section 80CCD 2 is a provision under the Income Tax Act in India that allows employees to claim tax deductions for contributions made by their employer towards their

Section 80CCD Deduction Under 80CCD 1 80CCD 1B 80CCD 2

https://cdnlearnblog.etmoney.com/wp-content/uploads/2022/09/3-6.jpg

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

https://assets-news.housing.com/news/wp-content/uploads/2021/12/28201150/Section-80-Deduction-All-about-Income-Tax-Act-Section-80C-80CCC-and-80CCD.jpg

https://groww.in/p/tax/section-80ccd

Section 80CCD 1 and 80CCD 2 are related to the deductions available to individuals for the contributions made to the NPS and APY Get to know its features conditions and more on

https://tax2win.in/guide/section-80ccd

Section 80CCD of the Income Tax Act Discover the key aspects of deductions under Section 80CCD 1 and 80CCD 2 of the Income Tax Act Learn about eligibility how to

Deduction Under Section 80CCC 80CCD 80CCE

Section 80CCD Deduction Under 80CCD 1 80CCD 1B 80CCD 2

What Is Dcps In Salary Deduction Login Pages Info

FAQs On Deductions Under Section 80C 80CCC 80CCD And 80D

Can I Split NPS Deduction Into 80CCD 1B 80CCD 1 How To Get

Deduction Under Section 80C 80CCC 80CCD And 80D And 80CCD 1 80CCD

Deduction Under Section 80C 80CCC 80CCD And 80D And 80CCD 1 80CCD

Section 80C 80CCC 80CCD 80CCE Deductions In Computing Total Income

All About The National Pension Scheme In India TaxHelpdesk

Deductions Under Section 80CCD Of Income Tax

80ccd 2 And 80ccd 1 - Let us discuss the types of NPS Tax Benefits or deductions available in Sec 80CCD 1 80CCD 2 and 80CCD 1B How to claim additional NPS tax benefits